You might be interested in

Mining

Prospect Resources to acquire remaining 60pc interest in Omaruru lithium project for just US$75,000

Mining

Like nimble gazelles, ASX juniors are waltzing into Africa's virgin territory for critical minerals

Mining

Mining

A third-generation Zimbabwean with extensive experience in the delivery of large-scale mining, power and port projects to market and their operation, the Arcadia lithium project was seemingly made for the leadership of Prospect Resources’ Sam Hosack.

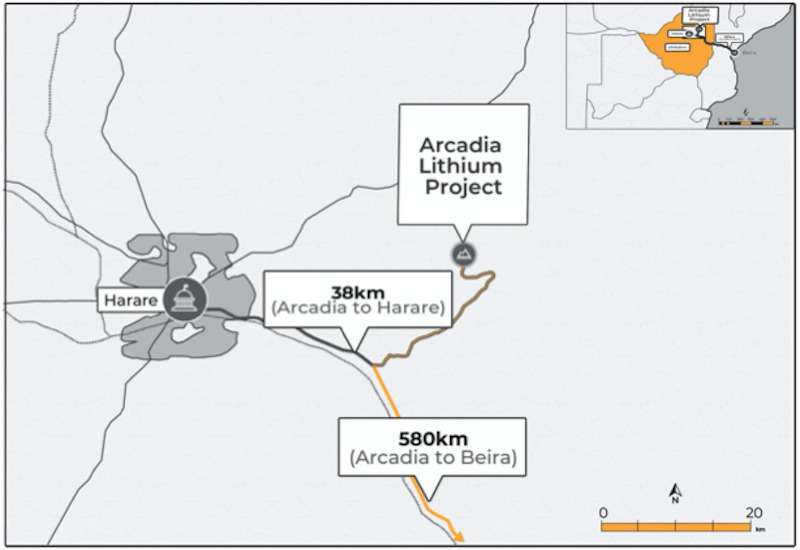

A hard rock lithium project just outside the capital of Harare in Hosack’s native land, Arcadia boasts an ore reserve of 37.4 million tonnes at 1.22% lithium oxide and 121 parts per million tantalum pentoxide for 457,000t of lithium oxide and 10 million pounds of tantalum pentoxide.

The project, 70% owned by Prospect (ASX:PSC) with an opportunity to grow to 87% is advanced. Funding conversations are ongoing and an optimised feasibility study is underway to assess a staged development plan of a 1.2 million tonne per annum output later broadening to the 2.4Mtpa outlined in an earlier study.

That study, being undertaken by Lycopodium, is the result of a strategic review designed to clear a pathway to the company’s goal of near-term production.

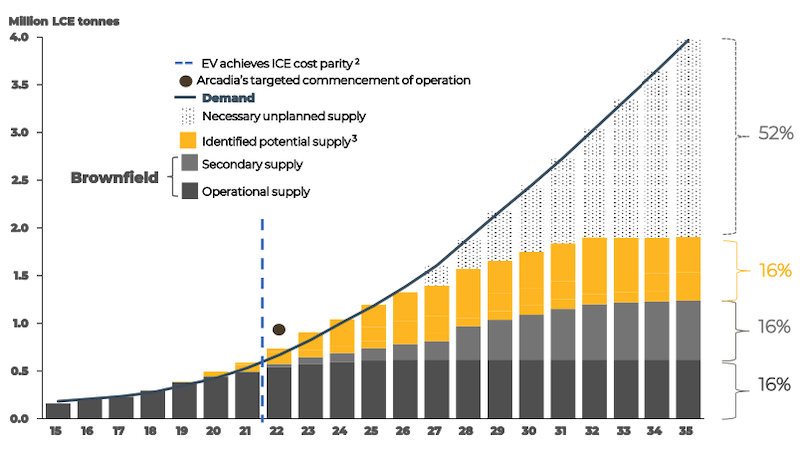

Put near-term production and lithium in the same sentence at the moment and there’s a good chance you’ll see investor heads turn. Here’s why:

“I am very focused and have been for a number of years on the battery minerals complex – this project is right in the sweet spot, being lithium,” Prospect managing director Hosack said.

“I’ve also spent my career developing mining businesses in the lowest cost quartile and looking at Arcadia, I think that’s a huge attraction too. This project sits firmly in the bottom quartile.

“Lastly there’s the historical element. I am a Zimbabwean, and there’s a lot of history I have with the country which makes me feel it is an easy jurisdiction to develop a project in. That’s been backed up by huge support from the government.

“We are very comfortable with the jurisdiction, and our goal is to get this thing into production.”

Prospect’s goal of production is not too far off. Hosack said the company was eyeing a ramp up of its pilot plant.

“We have publicly stated that we will produce first product before June 30 from our pilot plant – that is well underway,” he said.

“We have also stated that in the third quarter we will be able to publish the results of the independent optimised feasibility study also well underway.

“Lastly, we intend to go through to a final investment decision for project funding at the end of this year. On the basis we can achieve all of those I think it’s clear that we are indeed urgently tracking this thing towards production.”

Project economics at Arcadia are compelling, with the existing 2.4Mtpa feasibility study delivering a solid set of numbers.

To its nameplate capacity, Arcadia would deliver the following:

The project’s cash costs are kept low courtesy of a few key factors, according to Hosack, including its near-surface orebody and a strip ratio of 3:1.

Meanwhile, the cost of production is impacted both by a short logistics path to be free on board – around half of what the company’s Pilbara peers are likely to contend with, according to Hosack – as well as the locational benefits of being in an African nation and near a major city.

“We’re only 38km outside Harare, so it’s an easy locality to source quality labour,” he said.

“We don’t require man camps, or airplanes and runways or power stations, and we have overhead powerline energy connection capabilities.

“From an infrastructure perspective we’re in a very strong position, which reduces the amount of non-process infrastructure you need to commit capex to and makes the project more attractive.”

Support is strong in Zimbabwe for Prospect’s lithium ambitions. Arcadia was granted National Project Status in 2017, allowing it to progress quickly through the ranks to its current status as Africa’s most advanced lithium project.

“We were able to get into the position in a relatively short period where we were fully permitted,” Hosack said.

“That’s really been a function of the government of Zimbabwe – the huge support has come on the basis that Arcadia is fundamental to their 2030 Middle Income Economy goals.”

This article was developed in collaboration with Prospect Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.