Who’s behind this epic $830 million selldown, ‘the single largest trade in Australian ETF history’?

News

News

It’s a special edition of What the ETF in August, with an ~$830 million outflow in iShares Core S&P/ASX 200 ETF (ASX:IOZ) thought to be the biggest single trade in Australian ETF history.

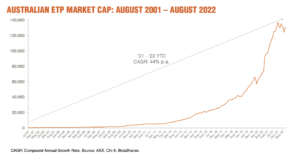

Industry assets under management (AuM) fell 0.2% (-$0.3 billion) month on month, ending August at $130 billion, but BetaShares said the figures were distorted by a “particularly large outflow in a single Australian Shares ETF”.

“The month’s figures were impacted significantly by very large outflows in a broad Australian ETF from iShares, which recorded net outflows of >$1B for the month,” the report noted.

“It appears as though the vast majority of these outflows came from a single institutional client in what we believe to be the single largest trade in Australian ETF history.

“Notably, and as testimony to the liquidity of ETFs more generally, this trade occurred seamlessly and without causing any material market impact.”

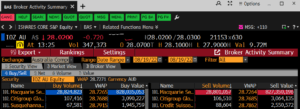

The sale was for ~29 million units totalling ~$830 million in IOZ on August 19. iShares ETFs is managed by one of the world’s biggest fund managers BlackRock, which declined to comment on the trade.

Just who was behind the big sell and their reasoning has not been divulged, although it looks like Macquarie might have been the broker or transition manager for the transaction.

With more than 30 years experience working in financial markets – including State Street Global Advisors, Goldman Sachs, JB Were, Australian banks and now consulting for large financial institutions – Mark Wills has some thoughts.

“Given ongoing consolidation within the superannuation market, for example Sunsuper and QSuper merged earlier this year to create Australian Retirement Trust with more than $200 billion in retirement savings under management, the size and scale of trades in Australia’s equity ETFs is likely to get bigger,” he said.

“The size of this trade suggests it’s probably held by a super fund and not an asset manager and so the destination for proceeds from that redemption could be anything from a panel of Australian long-only active managers or another asset class.”

While the ASX has plummeted more than 10% year to date and is now in correction territory, online investment management service Six Park co-founder and CEO Patrick Garrett said it is anyone’s guess as to what drove the trade in iShares Core.

“It’s unlikely but possible a large institution has down weighted exposure to the Australian shares asset class based on their market views,” Garrett said.

“One of the lowest cost ETFs from one of the largest fund managers in the world is not likely a switch to a competing ETF, so it’s possible a large institution has made an asset allocation change.

“But investors would be jumping at shadows trying to unpack exactly what this trade means not knowing the who or the why.

“The main thing that actually jumps out to me is the trade demonstrates how well liquidity works with these established ETFs.”

Garrett said during times of market volatility investors should remain calm and patient and focus on prudent asset class diversification.

“History has shown this approach generally produces the best investment outcomes and so while big trades like this are interesting they really shouldn’t influence investors’ long-term decisions for their own portfolios.”

The August report also provided some mixed news for embattled Magellan Financial Group (ASX:MFG). There was more than $322 million in outflows from the flagship Magellan Global Fund ETF, the biggest outflow after the iShares core ETF.

Best performing products this month were Magellan Core ESG Fund (ASX:MCSE) (managed fund) which returned 16.7%, followed by BetaShares Global Uranium ETF (ASX: URNM) which returned 13.8%.

ASX ETF trading value increased 22% month on month and at $10.3bn was the sixth largest month in history for value trading. Industry growth over the last 12 months has been 4%, or a total of $4.9bn.

The Australian ETF industry experienced its strongest net inflows in nine months in July, and despite continued market volatility with economic and geopolitical pressures weighing on global markets throughout 2022, ETFs remain a popular investment choice.

The Australian ETF industry has not had a single month of negative outflows over the last 10 years and continue to remain positive for 2022, albeit at a muted level of $0.6bn for August.

New products launched in August include Australia’s first Metaverse-focused ETF, the BetaShares Metaverse ETF (ASX: MTAV).

iShares joined forces with NAB Private Wealth to launch two multi-asset ETFs and a first of its kind “megatrends” thematic ETF in August.

The company said the listing of iShares Balanced ESG ETF (IBAL) (ASX:IBAL), iShares High Growth ESG ETF IGRO (ASX:IGRO) and the iShares Future Tech Innovators ETF ITEK (ASX:ITEK) offer “a low-cost, well-diversified investment solution to help Australians achieve their long-term financial and sustainable investment goals”.

iShares also launched the iShares Global Aggregate Bond ESG AUD Hedged ETF (AESG) in August to give “Australian investors a simple, low-cost way to access a globally diversified basket of over 21,000 fixed income securities including government, government-related, corporate, securitised and green bonds”.

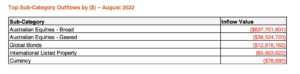

In terms of category flows, the industry flows remained focused on equities, with international equities, followed by fixed income receiving the highest level of flows.

Australian equities as a category received net outflows, which BetaShares noted was unsurprising given the very large institutional trade mentioned in August.

BetaShares chief commercial officer Ilan Israelstam told Stockhead the Australian ETF industry continues to show commendable resilience in the face of ongoing market volatility.

“This resilience is a result of the fact that, in general, ETF investors are not only holding their nerve but are also continuing to allocate more capital to their investment portfolio as they seek to progress on their long-term financial goals,” he said.

“Investors are continuing to show a high degree of sophistication when it comes to portfolio construction.”

He said international equities exposures like the BetaShares Nasdaq 100 ETF (ASX: NDQ) as well as fixed income exposures like BetaShares Australian Composite Bond ETF (ASX: OZBD) found favour with investors over the past month.

“On the other side of the ledger, the Australian equities category saw outflows thanks to a large redemption in another issuer’s broad market ETF – that being said, the BetaShares Australia 200 ETF (ASX: A200) actually saw strong inflows over the month of August,” he said.

“Again, ETFs continue to prove themselves as the vehicle of choice for an increasing number of Australian investors thanks their inherent qualities as a convenient, cost-effective and transparent investment solution.”