What the ETF? Australian ETF sector bounces back in July, boosted by mid-year rally

News

News

The Australian ETF industry experienced its strongest net inflows in nine months in July, returning to its growth trajectory assisted by mid-year market rallies.

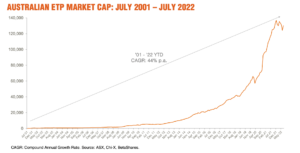

According to BetaShares latest monthly report industry, assets under management (AUM) grew 4.8% ($5.9 billion) month on month, ending July at $130.2 billion.

Betashares said 40% of the industry growth came from strong net inflows of $2.2bn, the highest level of the last nine months. Market cap growth for the last 12 months is 9.7% or $11.5 billion.

Despite all the recent volatility, ETFs remain a popular investment of choice and notably the Australian ETF Industry has not had a single month of net outflows over the last 10 years.

ASX ETF trading value decreased 19% month of month after a very significant month of trading in June (the third highest on record). The July report comes as a significant turnaround from June, where heavy selloffs hit the Aussie ETF industry, with AUM dropping $6 billion.

BetaShares chief commercial officer Ilan Israelstam told Stockhead it’s welcome to see ETF investors are continuing to take a long-term view on their portfolios despite market volatility.

“The data shows that ETF investors are continuing to allocate to their portfolio across a range of broad market and tactical exposures in the face of prevailing market conditions – demonstrating their commitment to building long-term wealth for some of life’s biggest moments including retirement, house deposit or other key milestones,” he said.

“Even more pleasing is the fact that July saw another strong surge of flows – following the trend of previous years – as more investors elect to reinvest the gains from the previous 12 months via a Distribution Reinvestment Plan (DRP).

“A DRP is a convenient way for investors to top up their portfolio and take full advantage of the power of compounding within their portfolio.”

Two new products were launched in July by ETF Securities, the first pure play exposure to US Treasuries available in Australia. The new funds are ETFS US Treasury Bond (Currency Hedged) ETF (ASX Code: USTB) and ETFS USD High Yield Bond (Currency Hedged) ETF (ASX Code: USHY).

“The high yield segment has been the big mover [in the US bond market] over recent weeks with USHY returning close to 7% since inception on July 1,” ETF Securities head of product Evan Metcalf told Stockhead.

“The man driver here has been credit spreads across the lower-rated segments, which have come off sharply since equity markets bottomed in mid-June.

“Treasuries, on the other hand, have been under pressure as longer-dated yields have started to fall as expectations of a near-term peak in the current tightening cycle firm up.”

In July, troubled Magellan Financial Group (ASX:MFG) closed its future pay FPAY retirement-oriented product, which just launched in June 2021. Magellan elected to close the fund, which failed to obtain a meaningful level investor interest, with only $20m in assets at the time of its de-listing.

According to Magellan’s website the “innovative, new, listed, actively-managed fund … aims to deliver investors: a predictable monthly income that grows with inflation, driven by returns and capital growth, with a focus on downside protection.”

July also saw Vanguard close its Global Active Multi-Factor ETF, which had ~$30m in assets. The ETF sought to provide long-term capital appreciation through an active management approach and aimed to outperform the FTSE Developed All Cap Index.

Crypto related exposures bounced significantly after months of large falls. BetaShares Crypto Innovators ETF (ASX: CRYP) returned 40% for July. Stockhead’s Rob Badman recently wrote about Telstra Venture’s pretty upbeat report on the crypto sector, which has been volatile to say the least in 2022.

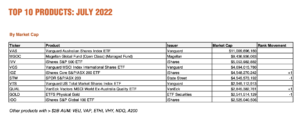

ETF industry flows remained focused on equities, and with Australian equities in particular, which took in ~$1 billion of net flow, followed by international equities.

Outflows were subdued in almost all categories this month, with gold exposures receiving the highest amount of net outflows. The price of the precious metal dipped during July starting the month at US$1811.18 an ounce and closing at US$1766.22. As Stockhead’s Barry Fitzgerald noted, even ASX listed resources stocks which have made some impressive gold discoveries are on sale at big discounts.

“Overall, the Australian ETF industry is going from strength-to-strength as investors continue to allocate to the convenient, cost-effective and transparent investment solution,” Israelstam said.

“In fact, Australia’s ETF Industry has not had a single month of net outflows over the last 10 years – a significant milestone for the industry as fund managers like BetaShares continue to help investors from all walks of life progress on their financial goals.”