What the ETF: You’ll never guess which ETF was the top performer in July

CRYP is scoring a comeback in 2023. Pic: Getty Images

- Rising oil prices following production cuts boosted the BetaShares Crude Oil Index ETF

- July sees a new entrant into the Top 10 largest ETFs as industry reaches a new record high

- But the winner is…

The crypto winter which plagued much of 2022 and into 2023 looks like it might finally be thawing and there are even positive signs of green shoots starting to spring up.

Betashares Crypto Innovators ETF – CRYP (ASX:CRYP) was the top performing ETF, returning ~22% for July as investors continued their enthusiasm for crypto and Bitcoin related exposures, according to the latest Betashares monthly Australian ETF industry report.

Upon its ASX listing on November 4, 2021, CRYP shattered records in the realm of ETFs, amassing more than $8 million in a mere 45-minute span.

However, its fortunes took a downturn in 2022, marking it as the most significant under-performer among Australian ETFs, with its performance plunging by ~82%.

The drop was attributed to numerous companies within the CRYP portfolio closely tied to cryptocurrency prices, which experienced a substantial decline throughout the year.

The value of widely recognised cryptocurrencies such as Bitcoin and Ethereum sharply declined due to a sequence of unfortunate noteworthy incidents, including the failure of several stablecoins such as TerraUSD and Luna, along with the implosion of global crypto exchange FTX.

A possible tighter cryptocurrency regulatory environment and broader macroeconomic challenges put further pressure on the sector.

However, CRYP has been experiencing a resurgence and is up more than 140% YTD, while the key bellwether for the cryptocurrency market, Bitcoin, is also experiencing an uptick of around 66% in 2023 according to Bitcoinmonthlyreturn.com

“In terms of performance, our Crypto Innovators ETF was the best performing exposure in July, and continues its bounce back from its lows at the end of last year,” Betashares investment strategist Tom Wickenden says.

Top performing ETFs July 2023

Oil ETF rises in line with oil prices

Rising oil prices have also seen BetaShares Crude Oil Index ETF Currency Hedged (Synthetic) (ASX:OOO) return ~16% for July.

Increased oil prices have been supported by reduced supply due to production cuts by OPEC and its allied countries (collectively known as OPEC+), coupled with growing worldwide demand for oil.

“The global uptick in oil prices also supported our Crude Oil Index ETF into second place after returning 16.1% for the month,” Wickenden says.

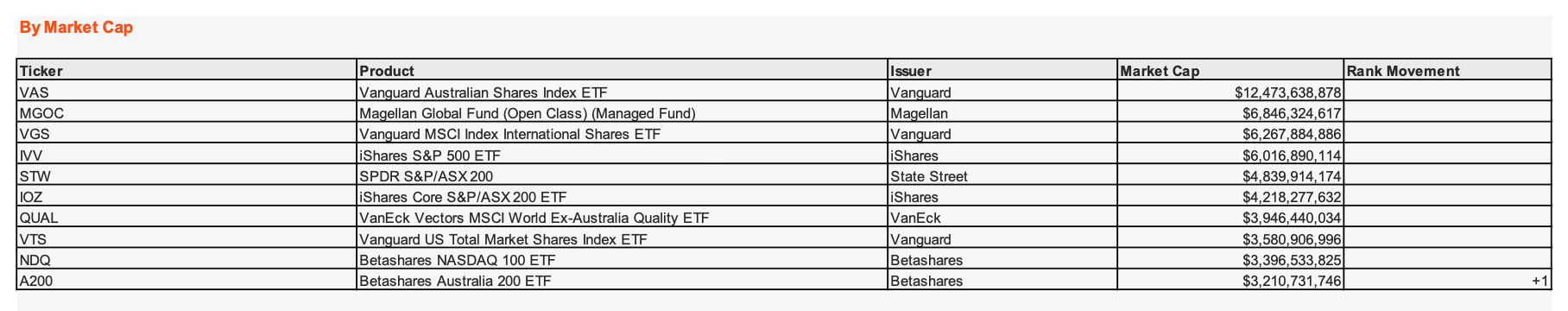

VAS number 1 by AUM as A200 in top 10

Vanguard Australian Shares Index ETF (ASX:VAS) was the number one ETF in terms of Assets Under Management (AUM). VAS now has $12.473 billion AUM.

July also saw a rare new entrant into the Top 10 largest ETFs with BetaShares Australia 200 ETF (ASX:A200), making its debut as it exceeded $3 billion in AUM.

BlackRock cut the rate on its popular iShares Core S&P/ASX 200 ETF (ASX:IOZ), tracking the performance of the S&P/ASX 200 Accumulation Index, from 0.09% to 0.05% per annum.

It was followed by Betashares reducing the fee on its equivalent A200 ETF from 0.07% to 0.04% as Australia’s big ETF providers have been working to increase their market share.

The Aussie ETF industry grew by 2.4% month-on-month in July, for a total monthly market cap increase of $3.5 billion. The industry ended July at $153.5 billion in AUM, a new record high.

Growth & megatrends attract interest

Wickenden says for most of 2022 investors have been focusing on core broad market building block exposures, with particular interest in the fixed income component of portfolios.

“However, in the last month we’ve perhaps detected the beginnings of a shift in sentiment as investors seek out more growth-oriented exposures,” he says.

In line with that shift during July the ETF provider saw strong flows into its BetaShares NASDAQ 100 ETF (ASX:NDQ).

Wickenden says at the more satellite end of investor portfolios, July saw a continuation of two dominant themes of 2023.

“The first being interest in artificial intelligence as megacap tech companies commence plans to monetise the emerging technology, while others look to embed its use within operations to improve efficiency,” he says.

As a result, BetaShares saw continued flows into its BetaShares Global Robotics and Artificial Intelligence ETF (ASX:RBTZ).

“The other recurring theme has been the global energy transition and alternative energy,” he says.

Wickenden says the BetaShares Energy Transition Metals ETF (ASX:XMET) saw an uptick in interest last month from investors seeking exposure to metals which will power the move towards a net zero economy, while the BetaShares Global Uranium ETF (ASX:URNM) saw interest from investors seeking out exposure to alternative energy sources.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.