What the ETF? Comeback for Australian ETF industry, achieving record monthly dollar AUM growth in October

News

News

As global and the local share markets staged a comeback in October, so too did the Aussie ETF industry, growing significantly.

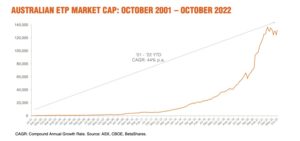

According to the latest BetaShares monthly Australian ETF industry report, assets under management (AUM) grew 5.9% in October, for a total market cap increase of $7.3 billion, the largest industry monthly dollar AUM growth on record.

The industry ended the month at $131.7bn, which was still some $5 billion off the peak level of $136.9 billion recorded in December 2021.

October marked an impressive turnaround from September, when the Australian ETF industry declined in value following sharp sharemarket declines.

The share market rise contributed the bulk of the industry growth this month, with 20% of the growth attributable to net flows (net new money), which were relatively robust at $1.5bn.

ASX ETF trading value increased 17% month on month for a total of $10.7bn. In a further positive sign for the sector, industry growth over the last 12 months has returned to being positive, with an increase of 3.7% year on year, or $4.8bn.

October was a big month for new product development, with eight new products launched, including BetaShares Energy Transition Metals ETF (ASX: XMET) and Nasdaq 100 Yield Maximiser Fund (ASX: QMAX).

The Global X Green Metals Miners (ASX:GMTL) and VanEck Global Carbon Credits ETF (Synthetic) (ASX:XCO2) were also launched last month.

As Stockhead’s Reuben Adams recently reported energy transition metal ETFs offer a way for retail investors to get exposure to a variety of future-facing metals and stocks

Three new actively managed ETF issuers also joined the Aussie industry. These include:

The Hejaz funds are Shariah compliant.

As the crypto 2022 winter continues, Cosmos Asset Management delisted its Cosmos Global Digital Miners Access ETF (CBOE:DIGA) in October, which invests in companies associated with crypto mining.

The company has also applied to delist its two pure cryptocurrency ETFs, the Cosmos Purpose Bitcoin Access ETF (CBOE:CBTC) and Cosmos Purpose Ethereum Access ETF (CBOE:CPET).

With sharemarkets rallying strongly, BetaShares Geared US Equity Fund (GGUS) topped the charts for performance this month, returning 18.8%, followed by BetaShares Global Energy Companies ETF (FUEL) at 14.4%.

Interestingly the CPET, which is to delist, was also a top performer for October.

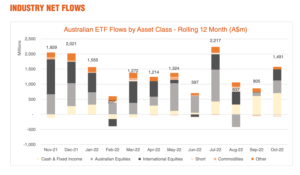

The BetaShares report noted net inflows were recorded in all major asset classes, with the composition of the flows being quite balanced.

Australian Equities was the category with the highest flows at $417m, but we saw strong flows into cash, global equities and fixed income as well ($396m, $369m and $308m respectively).

Overall net flows at a category level were muted, and largely confined to selling in short exposures, particularly the short Nasdaq 100 fund.

The net flows have been changing throughout the 12 months with 2022 volatile amid a changing global economy including rising inflation and interest rates plus geopolitical tensions and ongoing Covid-19 challenges.

BetaShares chief commercial officer Ilan Israelstam said the ASX ETF industry in October surged back to a growth footing thanks to a rally in global sharemarkets and strong new flows from investors.

“In fact, October saw the largest monthly growth in assets under management with an increase of $7.3 billion,” he said.

He said investors continue to see value in domestic exposures, with Australian equities taking in highest level of flows last month.

“This story has played out for most of the year as geopolitical uncertainty, inflation and interest rates has brought investors back home,” he said.

“For BetaShares, we’ve seen consistent interest in our Australia 200 ETF (ASX: A200) from these investors.”

“Pleasingly, the ETF industry continues to innovate with a strong pipeline of new offerings for investors to consider for their portfolios,” he said.