Crypto leads in record-breaking year for Aussie ETF growth, while unlisted funds sink

Pic: Getty Images

- BetaShares Crypto Innovators ETF (ASX:CRYP) surges 214% to be top 2023 ETF performer

- Aussie ETF industry records its highest annual funds under management increase in 2023

- 2023 marks worst year on record for Australian managed funds with net outflows of -$36.9 billion

The Australian ETF industry’s final figures for 2023 are in with BetaShares Crypto Innovators ETF (ASX:CRYP) the top performer followed by the Global X 21Shares Bitcoin ETF (CBOE:EBTC).

Crypto made a strong comeback according to the BetaShares Australian ETF Review for 2023, with CRYP rising 214.5%, followed by EBTC, which rose 150.9%.

The Global X 21Shares Ethereum ETF (CBOE: EETH) also had a good year in 2023, rising more than 90%. Launched in May 2022, EBTC and EETH are Australia’s only spot cryptocurrency ETFS tracking performance of the price of Bitcoin and Ethereum respectively in Aussie dollars.

The US Securities and Exchange Commission’s (SEC) only last week approved spot bitcoin ETFs from a range of fund managers, including financial titans BlackRock and Fidelity.

After the winter of 2022, crypto had a much better year in 2023. Bitcoin, the world’s most renowned cryptocurrency, rose 154.37% last year.

Also on the top performers ETF list for 2023 were those with other technology exposures including the Global X Fang+ ETF (ASX:FANG) and Global X Semiconductor ETF (ASX:SEMI).

The FANG stocks, which include Alphabet, Amazon, Apple, Meta, Microsoft, NVIDIA, and Tesla had a strong performance in 2023 driven by excitement in artificial intelligence (AI).

The US NASDAQ index, the bellwether for the global tech sector, rallied by more than 44%.

Record year for ETF growth, not so good for unlisted funds

The Australian ETF industry recorded its highest annual funds under management (FUM) increase in 2023, ending the year with $177.5 billion (ASX+CBOE), representing 33% yoy growth.

BetaShares chief commercial officer Ilan Israelstam says the industry grew $43.7 billion in 2023 – an industry record in terms of dollar annual growth.

“Two thirds of this growth coming from market appreciation with the remainder deriving from investor inflows and unlisted fund conversion activity,” he says.

In total, the Australian ETF industry received $15 billion of net inflows, in a year where the unlisted funds industry sustained net outflows of -$36.9 billion, marking the worst year on record for Australian managed funds.

Israelstam says with the exception of 2021, ETFs have now received higher flows than unlisted funds in four of the past five years.

“Most strikingly of all, looking across a longer period – since the launch of the Australian ETF industry in 2001 – Australian unlisted managed funds industry are now negative,” he says.

“This clear investor preference for ETFs, plus the increasing conversion activity we’re seeing of unlisted managed funds into active ETFs, represents a significant changing of the guard in the Australian asset management industry.”

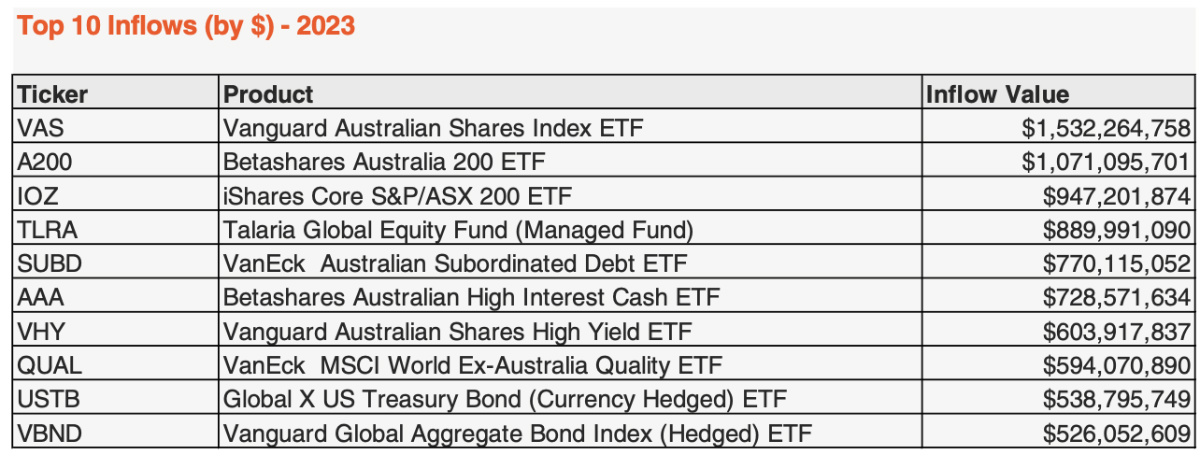

Top inflows and outflows for 2023

Israelstam says strong inflows along with robust performance saw the BetaShares NASDAQ 100 ETF (ASX:NDQ) to enter the top 10 largest products this year.

Other new entrants into the top 10 were BetaShares Australia 200 ETF (ASX:A200) and, due to converting itself into an active ETF this year, Dimensional’s Australian Core Equity Trust (DACE).

Israelstam says given market volatility investors retreated to core allocations in 2023 with the biggest flows going to the three largest broad Australian Equity ETFs.

Fixed income products also experienced strong inflows, with four of the largest 10 products for inflows being in the cash and fixed income category.

“The table of largest outflows at a product level provides a stark illustration of the demand for passive rather than active ETFs by investors over the course of 2023,” Israelstam says.

“Notably, seven of the top 10 funds for net outflows were active ETFs, with Magellan’s MGOC fund receiving net redemptions every month of the year for a total of $2.5 billion as well as meaningful outflows in their other active ETFs.”

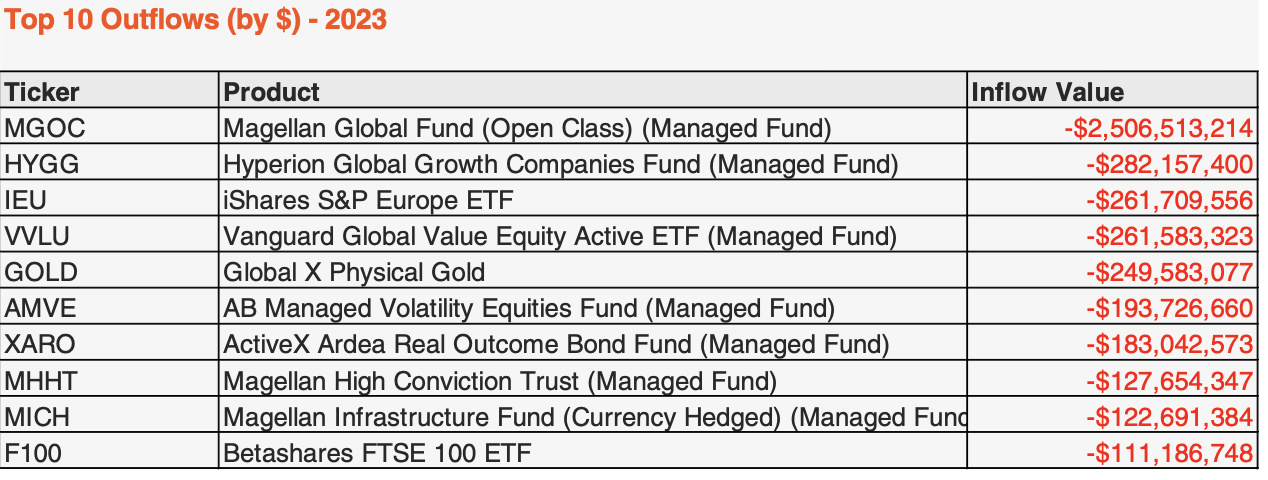

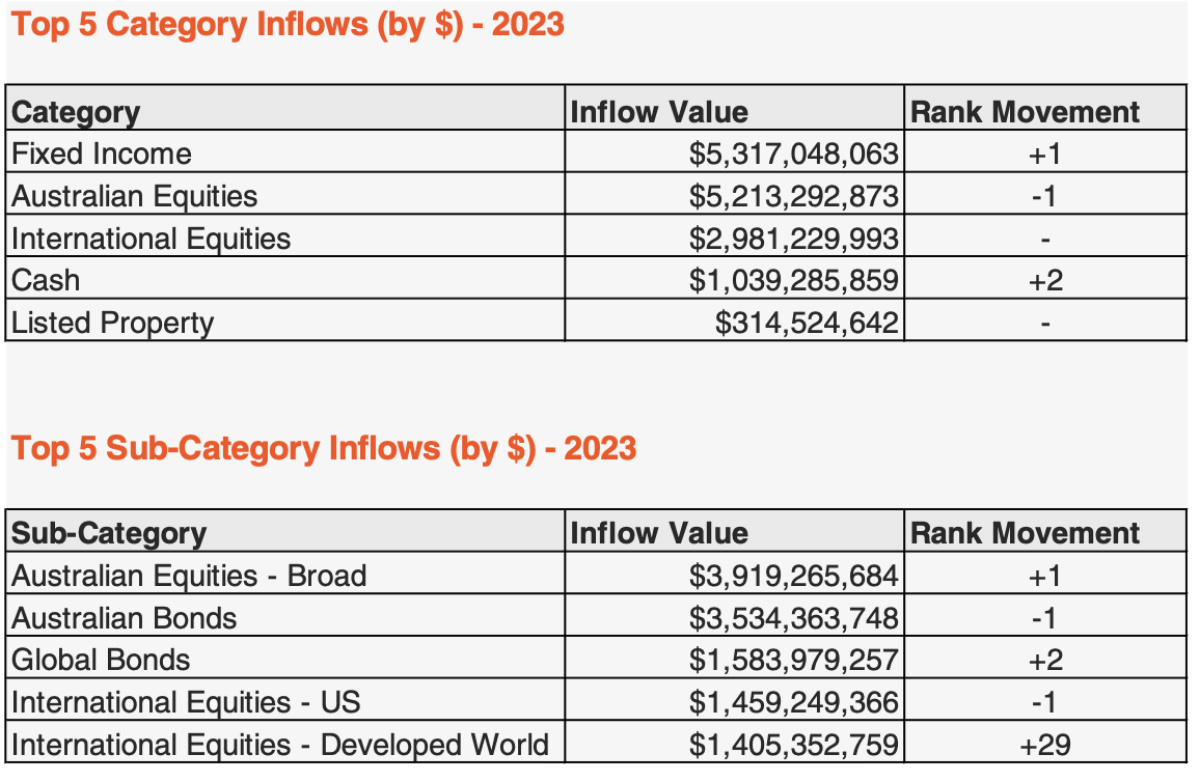

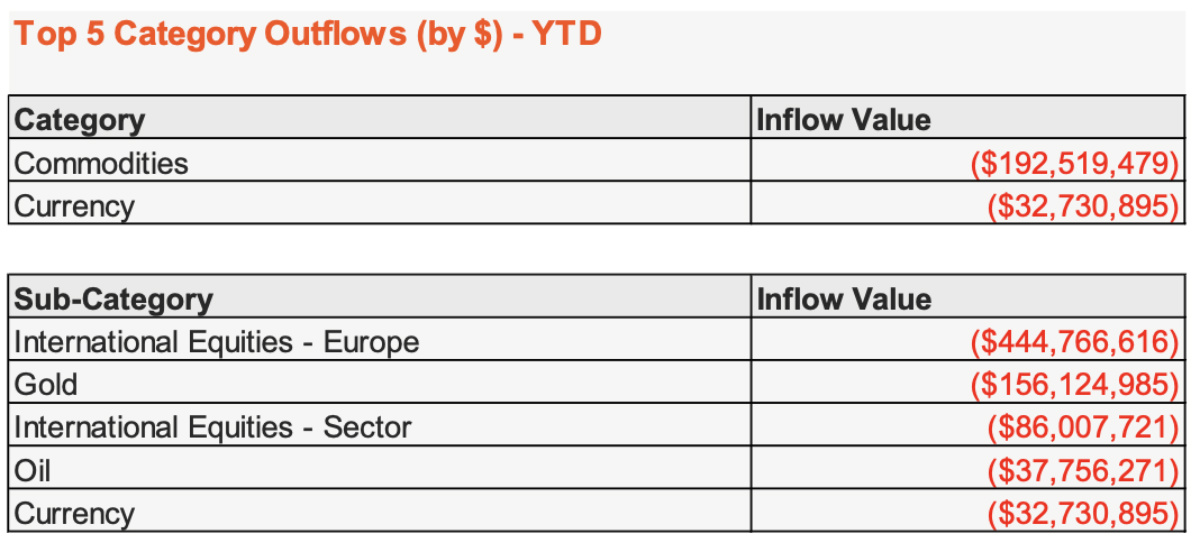

Fixed income popular as investors sought defences stance

Israelstam says with investors seeking out a more defensive stance in their asset allocations, together with elevated income/yield opportunities, fixed Income ETFs were the number one broad category for inflows in 2023.

Australian Shares ETFs were the second most popular category with international equities taking third place, as it did in 2022.

“We expect this to change in 2024 as the rate environment becomes more accomodative, and we would fully expect investors to adopt more meaningfully growth oriented exposures typically found in global equities ETFs going forward,” Israelstam says.

There were very limited outflows at a category level – with gold and European equities the categories with the highest level of outflows in 2023.

Biggest year on record for product launches

As the number of Aussie ETF investors grows, so too has the number of ETF products. 2023 marked a record year, with 56 new ETFs introduced on the ASX and CBOE while during the same period there were eight closures.

This compared to 52 launches and 13 closures 2022. There are now 367 exchange traded products trading on the ASX & CBOE.

“In what is certainly an accelerating trend, a large proportion of the new launches in 2023 were Active ETFs (46% or 26 funds), with the majority of these launches being via the creation of traded classes of existing unlisted funds, which we call conversions,” Israelstam says.

He says there are now 94 active ETFs trading on Australian exchanges with a total of ~$35 billion of FUM, however the vast majority of these assets comes from existing FUM that has been converted to the exchange via the open class structure.

“Actual FUM of Active ETFs currently being held on CHESS, which gives us the best view on the extent to which investors are using the listed version of the product, is ~$9.5 billion,” Israelstam says.

“This CHESS FUM is very concentrated with the largest 10 products representing >70% of this figure.”

“We expect continued growth of this category but to date we haven’t seen true widespread adoption on exchange of Active ETFs,” Israelstam says.

He says there are currently 47 issuers of ETFs in Australia, with eight new issuers joining the market in 2023, all of which were active managers.

Popularity of ETFs continues to climb

Israelstam says consistent with the positive net flow activity, there continues to be solid growth in the number of Aussie ETF investors.

There are now more than 2 million Australians investing in ETFs, representing investor growth of 7% on the the year before.

Annual ASX ETF trading value remained stable after a record year in 2022 of $117 billion with in total $115 billion of ETF value traded on the ASX in 2023.

What BetaShares got right in 2023 and forecasts for 2024

Heading into 2023 Israelstam forecast that market conditions would continue to act as a hinderance to industry growth but expected net inflows to remain consistently positive and ultimately that the industry would return to a growth footing.

As such, BetaShares forecast total industry FuM at end 2023 to exceed $150 billion in assets.

“While I was correct regarding positive inflows, I did not predict that ultimately market conditions would be nearly as positive as they were and thus underestimated by quite some margin, total industry size,” he says.

“In terms of 2024, we believe that the industry will continue to benefit from increased investor adoption and inflows combined with positive markets.

“As such, we forecast total industry FuM at end 2024 to exceed $200 billion and could reach as high as $220 billion depending on market conditions.”

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.