What the ETF? Aussie industry sets new FuM record of $146bn in April as CRYP makes comeback

News

News

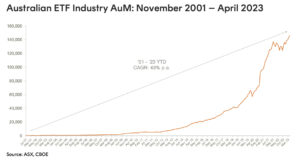

In a very similar pattern to March, a strong rise in global sharemarkets together with continued positive investor flows saw the Australian ETF industry once again set a new all- time high in funds under management (FuM) in April.

According to the latest BetaShares monthly Australian ETF industry report, the Aussie ETF Industry’s FuM grew by 2.4% month-on-month, for a total monthly market cap increase of $3.4 billion.

Industry funds under management ended the month at $146 billion, a new record high.

BetaShares chief commercial officer Ilan Israelstam said like March the growth in April came primarily from asset value appreciation, although investor flows remained positive, at $800 million or 24% of the monthly growth.

Traditionally, the Easter break and holiday period in April, sees ASX ETF trading value drop dramatically and it did so this year.

According to the latest read, trading value fell well over 40% compared to March – to a total value of $6.5 billion – that’s the lowest level recorded since January 2021.

The Aussie ETF industry has grown by 9.4% year on year, or $12.5 billion over the past 12 months.

In April two new products were launched both from Global X. The Global X USD Corporate Bond ETF (Currency Hedged) (ASX:USIG) provides exposure to investment grade, USD denominated corporate bonds to offer investors a tool to generate yield from a fixed income asset class.

Global X said the USIG seeks to deliver investment results that correspond generally to the price and yield performance, before fees and expenses, of the Bloomberg USD Liquid Investment Grade Corporate Hedged to AUD Index by investing in the Xtrackers USD Corporate Bond UCITS ETF (the Underlying Fund), which is managed by global asset manager DWS Group (DWS).

The Global X Australia ex Financials & Resources ETF (ASX: OZXX) aims to deliver portfolio diversification by investing in Australia’s top 100 companies, excluding those in the financial (including REITs), basic material and energy sectors.

Global X said OZXX seeks to provide investment results that correspond generally to the price and yield, before fees and expenses, of the Solactive Australia Ex Financials Materials and Energy Capped Index.

There are now 329 exchange traded products trading on the ASX.

The Global X Physical Platinum (ASX:ETPMPT) and BetaShares Crypto Innovators ETF (ASX:CRYP) were top performers in April.

Global X Australia Head of Investment Strategy Blair Hannon told Stockhead the platinum market is moving from a decade-long surplus into an extended deficit.

Hannon said on the industrial side, deficits are coming with supply flat in South Africa, which accounts for 80% of supply and no mine growth.

He said South African power outages are just getting worse with miners’ backup plans only going so far.

“If things continue, platinum refineries will be shut down and miners will hold platinum as a backlog of concentrate while awaiting refineries to reopen,” he said.

“This creates tighter supply.”

Furthermore, he said car catalyst demand is growing in China thanks to new regulations around air pollution.

“China’s emissions standards phase 6 policies are requiring diesel cars to have better catalysts, which require more platinum.

“This has led to a 12% growth in car catalyst demand for platinum.”

CRYP broke and ETF record when it listed on the ASX on November 4, 2021, attracting more than $8 million within 45 minutes.

However, it was the biggest ETF loser in Australia 2022, with its performance falling ~82% in CY2022 with many of the companies in the CRYP leveraged to crypto prices which tanked during the year.

However, CRYP has been rebounding this year as crypto prices recover and is now up more than 81% year to date. Bitcoin, which is the crypto that the market tends to judge all others by for overall health, is still up by about 65% so far in 2023.

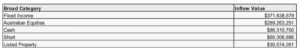

April was a repeat of March with income exposures leading inflows and global equities exposures leading outflows. l

“Broad Australian equities products also continued to receive flows, as has been the case for the year more broadly,” Israelstam said.

“As we remarked last month, global equities ETFs have had a particularly slow start to the year, compared to previous years, with very little inflows recorded in the year to date in what is typically the most popular category in the industry.”