UBS says now is the time to place a bet against the debased Star Entertainment share price

News

News

The Star Entertainment Group (ASX: SGR) share price is back on the Highway to Sell.

And that’s got analysts at UBS sounding frisky.

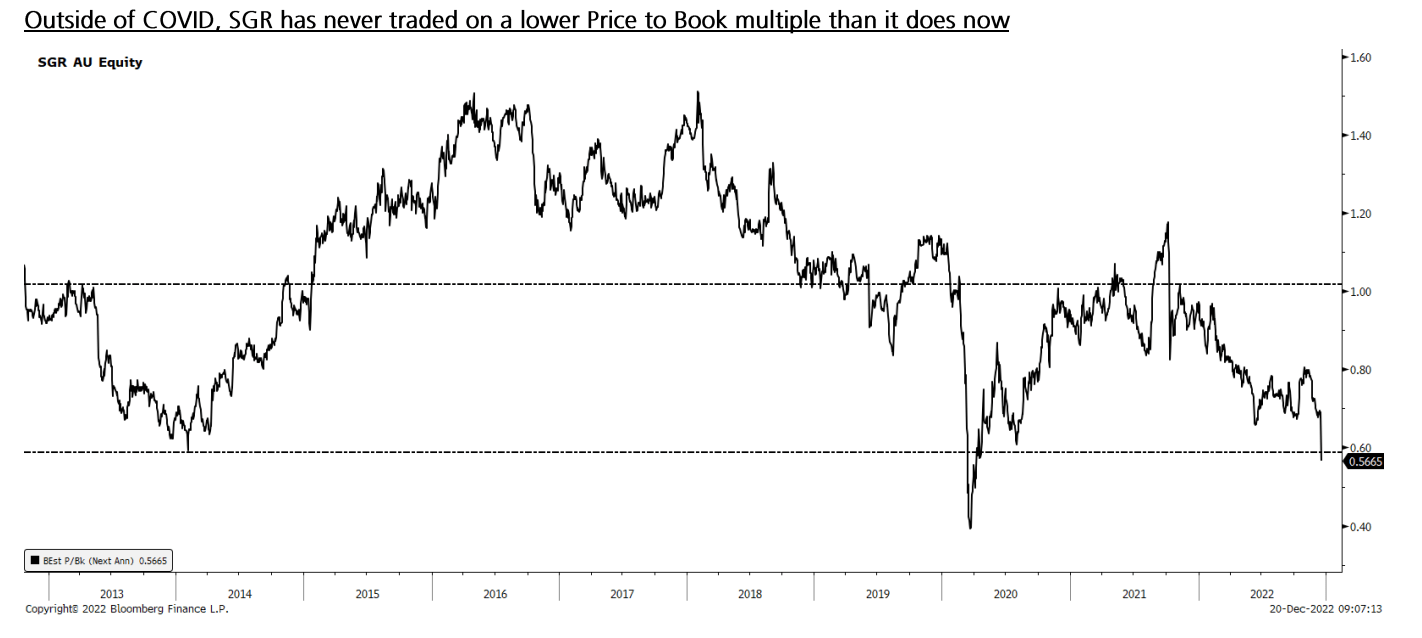

“Outside of COVID, SGR has never traded on a lower Price to Book multiple than it does now,” the investment bank says, placing a Buy rating with a price target to $3.75.

SGR last closed at $1.92, so that’s quite a lot of upside if the bank is playing the right cards.

The lower a company’s price-to-book (P/B) ratio is, the better value it offers. The price-to-book ratio (or multiple) looks at the market’s valuation of a company relative to its book value. (And the market value is typically higher than the book value).

This is especially good if a stock’s book value is less than one, meaning that it trades for less than the value of its assets.

After its latest waterboarding at the hands of the bourse, and according to UBS, Star’s P/B right now is wallowing around an all time low of about 0.56.

This is it. A quiet Saturday press release from the NSW Treasurer:

The Star’s CEO has naturally taken a cranky broadside at the NSW Gov for its opportunistic approach to broadening the tax base by digger deeper into the casino.

“We are not sure how the government modelled its financials nor the basis for suggesting The Star does not pay its fair share of taxes,” says Cooke.

“Specifically, in addition to state gaming taxes, The Star also pays millions in corporate taxes, with total taxes paid as a percentage of The Star’s profits being around 70 per cent, and as high as 80 per cent in the last five years when all the tax regimes are considered.”

Star Casino shares crashed some 11% on the news.

There’s not too much wriggle room for Star, considering the hideous taste that’s been left in NSW public’s mouth following the PR disasters of the last few years…

The play by the government, however opportunistic, won’t break many hearts across an electorate that’s fed up with a sector that’s been exposed as mercenary at the least.

The reforms should achieve tax equality with Electronic Gaming Machines (EGMs) which are littered across NSW pubs and clubs.

Star Sydney’s current gaming tax rates – local tables at a meek 29% and local Electronic Gaming Machines at 32-34% incl. GST – are governed by an ancient contract deal made back in 2020.

NSW clubs pay 26.55%. NSW hotels pay 50%

The intention, according to the NSW Treasurer, is to “bring NSW into line with Victoria” since the Victorians hiked their casino tax rate in May this year from 21.25% to a mighty (but gradual) scale up to ~60% on EGMs.

If implemented, targeted additional casino gaming tax ($121m every year) represents a 37% increase over the pre-COVID (FY19) local gaming tax paid of around $325mn.

According to UBS analysts, the vast majority (more than $100mn) of this uplift would be achieved by shifting to the new Victoria EGM tax rates which now “range between 47-61% depending on turnover.”

If the reform progresses, there’s a decent enough legal question for Star to unleash the lawyers and hit the state up over whether a little compensation might be in order for SGR. That’s one of the reasons Cooke has come out swinging about not being informed.

Moreover UBS points out that the long-term gaming tax agreement agreed to by both parties in 2020 was put down on paper so that SGR and the state could come to some stability and “achieve regulatory certainty to FY41.”

That was a deal the bank says” included financial compensation provisions.”

But there’s an important new element which could put a pin in that – like its disgraced nemesis Crown Resorts – any compensation claims could be tricky to sue for in the wake of systematic shennanigans revealed in the salacious Royal Commission findings and the current independent management that’s been put in place.

Significantly, the bank says in a note, “there does not appear to be a window to pass the legislation ahead of the March ’23 state election.”

Whether the Government intends to lift the rates on pubs and clubs remains unclear but UBS is staking that it would likely face stiff lobbying opposition ahead of the election.

“All other things being equal, higher gaming tax could reduce market consensus FY23 EBITDA by around 20% – 25%”

If SGR meets the UBS target it will return approximately 77% (excluding dividends, fees and charges).

The brokers at Credit Suisse are less enthralled and retain a Neutral rating, but with a still toppy price target of $2.90

The current consensus price target is $3.23, suggesting upside of circa 51% (ex-div).

UBS forecasts a full year FY23 EPS of 13.00 cents.

At the last closing share price the stock’s estimated Price to Earnings Ratio (PER) is 16.31.

UBS Recommendation: Buy / Price Target $3.75

CS Recommendation: Neutral / Price Target $2.90

Consensus Recommendation: Buy / Price Target $3.23