Traders’ Diary: Everything you need to get ready for the week ahead

News

Gold.

Spot prices kept smacking into new all-time highs during the week, driven by rattled market sentiment, safe haven and central bank fervour haven as well as the lurid rumour pushed by both Gregor and Costco of bullion stacks for sale in the isles, alongside 44-gallon tubs of black olives and wheelie bins of peanut butter – all aimed at helping punters ride out even the worstest of any various oncoming apocalypsii.

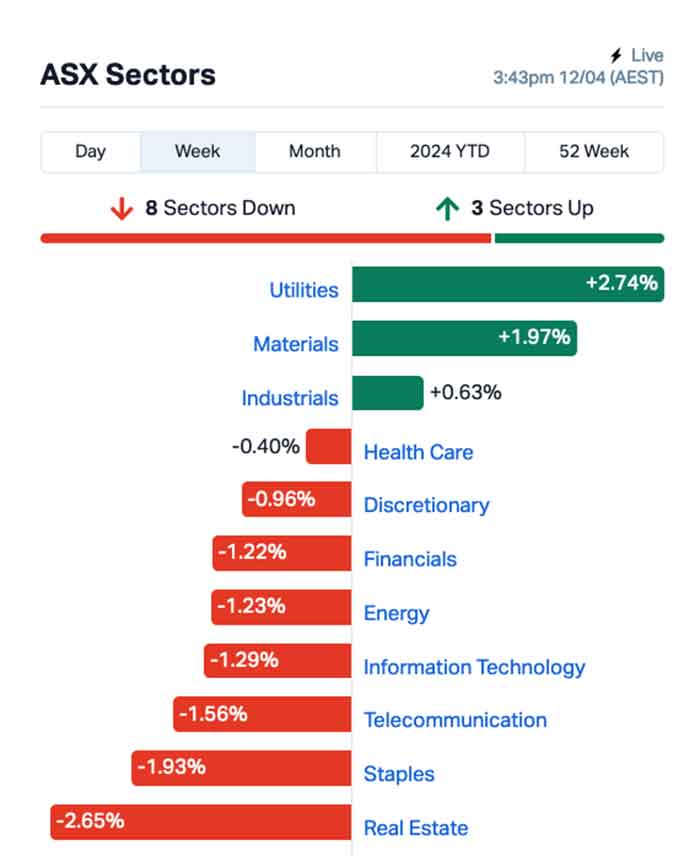

And thus it was that on the ASX last week, investors rotated in earnest out of the toppy Financial sector and over to the other biggie, the Materials sector. Although the Utilities Sector caught the best of the action, (+2.5%) higher, and the shiny crown for the week belonged to punchy big and little ASX Goldies alike, revelling in renewed interest in the precious metal.

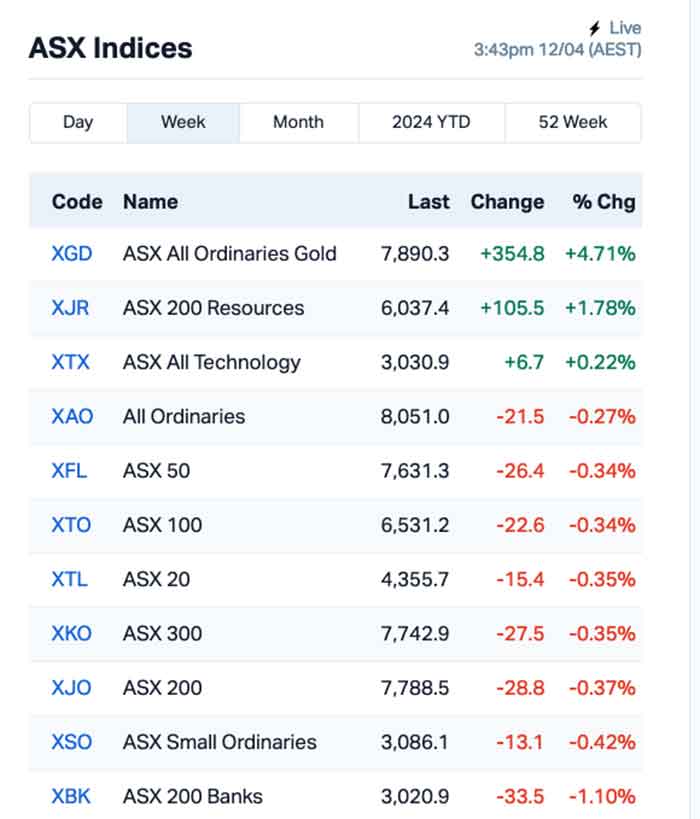

In any case, the All Ordinaries (XGD) Gold Index is larfing all the way to the banks’ faces.

The XGD ended almost 5% higher last week.

As per the Bank of America last week:

“Gold remains one of our favorite (sick) metals and we expect prices to average US$2,500/oz by the fourth quarter, potentially hitting US$3,000/oz by 2025.

“Notably, demand from central banks and China’s retail buyers has been strong. If Western investors join the party on rate cuts, the yellow metal will move a leg higher; this may also be necessary, if sentiment in China improves, and less investment flows into gold.”

It’s not an insubstantial event.

Aussie rock holds around 18% of the world’s known gold resources and we make up almost 10% of global production.

The breakaway republic of Western Australia produces almost 70% of our gold. Something, surely, must be done before that mad dog WA Labor Premier Roger Hugh Cook sniffs an opportunity.

Now, for the first time (today) – here’s the top ASX goldie-gainers, regardless of market cap or funny names – in descending order over the last 12 months.

The XJR Resources index also did good last week, up 1.8% after a number of commodities lifted through the week.

Materials was in the hunt as well, popping close to 2.0%, while Industrials climbed a shade over 0.6%.

Outside of goldies, it was the uranium comeback kids once more, including Bannerman Energy (ASX:BMN) (+6.72%), Deep Yellow (ASX:DYL) (+6.67%) and Paladin Energy (ASX:PDN) (+4.15%).

The biggest losers included City Chic Collective (ASX:CCX) (-9.3%), Star Entertainment Group (ASX:SGR) (-9.1%), Domino’s Pizza Enterprises (ASX:DMP) (-7.5%) and Lake Resources (ASX:LKE) (-4.6%).

The benchmark slunk higher last week despite only three sectors finding the green.

The Typhoon class Resources Sector did comparatively well for a nice change and the displacement of so much weight allowed the local market to rise 0.2%.

Sunken like so many other rate sensitive businesses – the ilk of the Property Sector led local declines.

In this week’s episode of a podcast Peter and Reuben don’t do, probably called What Were They Thinking, the boys didn’t dwell on some of the tough choices investors had to weigh up. Peter didn’t analyse the very conflicting news flow on the US inflation front – strong CPI on Wednesday vs hopes for a three-rate cut Christmas – before Reuben failed to highlight how a a tame PPI then soothed peaky US traders and their inflation concerns.

All the while in the background, slumbering like a tranq’d rhino in a cot, Reuben’s prizewinning 6.7kg sweet potato soothed to stupor by the endless dovish commentary from last week’s absurd infestation of Fed officials, both past and present.

The podcast, recorded naked in a language entirely their own, would almost certainly be sponsored by Peter’s Golden Apple cider…

Perhaps the week’s most arse-shuddering market and bowel moving event, has been the wonderfully unhinghed vow of a few hours ago (at the time of writing, late Sunday in Sydenham) from Israel’s Prime Minister or Bust Benjamin Netanyahu who just pledged the life of his grandmother on Israel’s total and utter victory after the US ally’s bristling military claimed to have blown away some 300 drones and missiles launched over the weekend by Tehran as Iran finally retaliates to constant Israeli needling.

It is a step change escalation and expansion of the current Middle East conflict from a backyard spring clean into a suburb-wide renovation.

On Wall Street, the three major indices wobbled on Friday in anticipation of the weekend escalation.

It was another uncertain week of great uncertainty after the illuminated runway to a softest of landings, punctuated by generous US Fed Reserve rate cuts became obscured once again by a triple whammy of crap US bank earnings, iffy inflation and the ever gurgling volcano of 2024 geopolitical tensions.

The key Wall St Q1 earnings ahead include Messrs Goldman Sachs, Bank of America, Morgan Stanley, Netflix, Procter and Gamble, Johnson and Johnson and American Express.

On the economic front the Americans face down retail sales data for March and a further cacophony of Fedspeak.

Bond yields rose in the US, UK and Australia but fell in Europe.

Oil prices dipped slightly despite fears about an escalation in the war around Israel to directly include Iran, the copper price rose to new cyclical highs and iron ore prices also rose.

The week ahead brings the Minutes of the RBA Board’s March meeting. The post‑meeting Statement shifted to a neutral tone, and we would expect that to come through as well in the Minutes.

In the UK, investors anticipate updates on the unemployment rate, wage growth, inflation rate, and retail sales, providing crucial insights following positive signs of economic recovery revealed in recent monthly GDP figures.

It will be a light week in Europe in terms of economic data.

In China the rubber-stamped GDP figure will almost definitely explain how the beleaguered economy grew at around Beijing’s reaffirmed target of 5%. No one will be astonished. Other China market moving releases include data on industrial production, retail sales, house prices for March and some Q1 credit data.

Beijing’s back releasing unemployment data, now that the Bureau of Stats has been suitably purged of decent mathematicians.

According to Tony Sycamore from IG, the highlight of this week’s data calendar will be Thursday’s Labour Force report, proving we should all probably get out a little bit more.

“This month, the market expects the economy to lose 40k jobs and for the unemployment rate to rebound to 4% from 3.7%,” Tony says.

“As the seasonal noise around the holiday period begins to subside, we expect to see further evidence of cooling within the labour market and reiterate our call for the RBA to cut rates by 25bp in August before a second cut in November, which will see the cash rate end the year at 3.85%.”

MONDAY

Indonesia, Thailand Market Holiday

Japan Machinery Orders (Feb)

India WPI (Mar)

India Trade (Mar)

China (Mainland) 1-Year MLF Announcement

Turkey Unemployment (Feb)

Eurozone Industrial Production (Feb)

United States Retail Sales (Mar)

United States Business Inventories (Feb)

United States NAHB Housing Market (Apr)

TUESDAY

Thailand Market Holiday

China (Mainland) GDP (Q1)

China (Mainland) Industrial Production, Retail Sales, Fixed

Asset Investment (Mar)

China (Mainland) Unemployment (Mar)

Indonesia Trade (Mar)

Germany Wholesale Prices (Mar)

United Kingdom Labour Market Report (Mar)

Italy Inflation (Mar, final)

Eurozone Trade Balance (Feb)

Eurozone ZEW Economic Sentiment (Apr)

Germany ZEW Economic Sentiment (Apr)

Canada Inflation (Mar)

United States Building Permits, Housing Starts (Mar)

United States Industrial Production (Mar)

WEDNESDAY

India Market Holiday

New Zealand Inflation (Q1)

Japan Trade (Mar)

Singapore Non-oil Domestic Exports (Mar)

United Kingdom Inflation (Mar)

South Africa Inflation (Mar)

Eurozone Inflation (Mar, final)

Brazil Business Confidence (Apr)

United States Net Long-term TIC Flows (Feb)

THURSDAY

Australia Employment (Mar)

Australia Unemployment Rate (Mar)

Switzerland Trade Balance (Mar)

United States Existing Home Sales (Mar)

FRIDAY

Japan Inflation (Mar)

Malaysia GDP (Q1, prelim)

Germany PPI (Mar)

United Kingdom Retail Sales (Mar)

France Business Confidence (Apr)

Spain Balance of Trade (Feb)

India RBI Meeting Minutes

All sources: IG Markets, S&P Global Market Intelligence, CommSec