The Year in Crypto: 2020, the year that Bitcoin came of age

Coinhead

Coinhead

Digital currencies came into their own this year as the market matured, their appeal broadened into the mainstream, and large investors and institutions climbed on board the phenomenon.

The story of cryptocurrencies this year can be told through the price action of super crypto, Bitcoin, the original and most influential of them all.

Starting out in January, Bitcoin’s price in Australian currency was at $10,200 and it advanced to $15,000 in February before cratering in March to $6,200.

From there it was a long, slow recovery up to $16,000 in August, and then another correction took the price down to $13,000 where it traded into October.

A key moment this year for Bitcoin occurred in October and involved a pivotal decision by US digital payments platform PayPal.

This was when PayPal decided to allow its users to pay for goods and services in cryptocurrencies.

eToro cryptoasset expert, Simon Peters, said this move would “introduce a massive user base to crypto, with PayPal boasting 346 million active accounts, all of whom will be able to hold and shop using Bitcoin, Ethereum and Litecoin once the service has been rolled out”.

Paypal president and chief executive Dan Schulman said at the time: “The shift to digital forms of currencies is inevitable, bringing with it clear advantages in terms of financial inclusion and access; efficiency, speed and resilience of the payments system; and the ability for governments to disburse funds to citizens quickly.”

In late November, Bitcoin suffered a slight sell off triggered by long-term holders, or ‘hodlers’ as they are known in crypto circles, closing out for profit.

Trading data from trading platform eToro showed a significant number of long position holders of Bitcoin had taken advantage of the November price rally to sell and lock-in profits.

“Of all the Bitcoin positions opened on eToro at the time of the bull run in December 2017, 19 per cent of those that remain in November 2020 have been closed this month – which suggests that clients have been eagerly awaiting a change to recoup their initial investments,” said eToro crypto analyst Peters.

“This week, it seems, many have done so, creating a price slide in the process,” he said.

After that, Bitcoin took off and climbed to nearly $27,000 by December, and at the time of writing is trading at $37,500.

“Three years on, the crypto industry has consolidated, matured and is seeing real traction with institutional investors,” said eToro’s Peters.

“Institutional investors are using Bitcoin as an inflationary hedge to combat the prospect of continued government stimulus.

“The real question is, when do they stop buying?”

Another highlight for cryptocurrency this year, and a popular story on Stockhead, came in November and involved a fish farming company.

This was West Coast Aquaculture Group and the company made history when it became the first in Australia to raise capital in cryptocurrency after its IPO on fintech platform STAX for $5m.

“The successful WCA capital raise and IPO paves the way for the future of capital markets in Australia,” said STAX chief executive, Kenny Lee.

An interesting trend for cryptocurrency in 2020 was that it started to decouple from other financial markets, including shares and currencies.

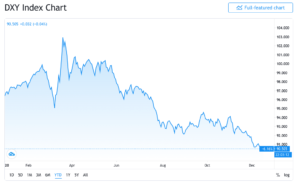

Another dimension to crypto prices is the US dollar’s slide in value this year, down 12.5 per cent from its March 2020 high.

Investors may be exiting holdings of the world’s save haven currency and moving into inflation-proof assets as the value of the US dollar goes down.

Surveys show that Millennials are more open-minded to cryptocurrencies than older generations and less trusting of traditional financial institutions.

This difference in attitude and outlook on financial markets was highlighted in one of the largest surveys undertaken on cryptocurrency.

Millennials, broadly people aged below 40, are known as early adopters of new technology as it rolls out through society.

Close to 60 per cent of this age group expect Bitcoin will be in common use in the 2020s, and they are more trusting of the cryptocurrency.

One thing is for sure, and that is central banks including Australia’s are developing their own version of digital currency, as cash loses popularity.

Cash is used in only one quarter of transactions, and its use has been declining over the past decade.

The rise of Bitcoin and other cryptocurrencies during 2020 has stirred some debate over its merits as an asset class relative to others, notably gold.

The debate centres around the store of value aspect of Bitcoin and cryptocurrencies versus gold, and gold’s reputation has rested on its safe haven status.

“Bitcoin is on track to mature as part of a new asset class, with in-built deflationary attributes,” Caroline Bowler, CEO of Australian cryptocurrency and digital asset exchange BTC Markets told Stockhead.

“I’m not an investment advisor but this characteristic alone burnishes its safe haven reputation.”

However, Bowler cautioned investors to weigh the two assets against their own portfolio requirements.

“Gold and Bitcoin differ primarily on the technical aspects – storage, distribution, transaction speed for example,” she said.

“These may be increasingly relevant as we move deeper into the digital age of investment.”

On the opposite side of the table sits gold, which its supporters say has qualities not seen in cryptocurrency.

“Part of gold’s allure is in its physical qualities – lustre and lack of tarnish which make it attractive for jewellery which tends to align with the notion that it must be valuable, none of those apply to bitcoin,” Hedley Widdup, investment manager at Lion Selection Group, said.

Decentralised finance or Defi became an industry buzzword in 2020, and is shorthand for financial contracts operating on blockchain technology.

Imagine any type of financial contract ranging from loans, to insurance, share trades and savings, being readily accessible through a smart phone.

Ethereum is an example of a digital contract running on a blockchain, albeit for cryptocurrency, that users can access through a decentralised App.

There are other types of cryptocurrency and each is slightly different with its own distinct features. They include Litecoin and XRP as examples.

XRP has grabbed some headlines on reports that US regulator, the Securities and Exchange Commission has opened a legal case over its precise status under US securities law.

The SEC is seeking answers from XRP’s promoter, San Francisco-based fintech firm Ripple Labs, and said XRP may be considered a financial security.

As a security XRP would need to be registered with regulators including the SEC.

In the meantime, digital currency platform Coinbase has taken the step of temporarily halting trading in XRP from mid-January while the case plays out.

A few ASX stocks have business linked to cryptocurrency markets or allow investment in the digital asset.

Millennial-focused investing app Raiz Invest’s (ASX:RZI) offerings include an investment portfolio with exposure to Bitcoin.

Meanwhile, DigitalX (ASX:DCC) launched a crypto fund last November.

Fatfish Blockchain (ASX:FFG) has a venture capital arm that includes investments in crypto mining.

Payments processing system operator Fintech Chain (ASX:FTC) makes the list too because its system handles cryptocurrency payments.