Central bank digital currency could be Australia’s monetary future

Pic: GettyImages

Australians are choosing digital payments over cash. The shift is enabled by advancements in financial technology.

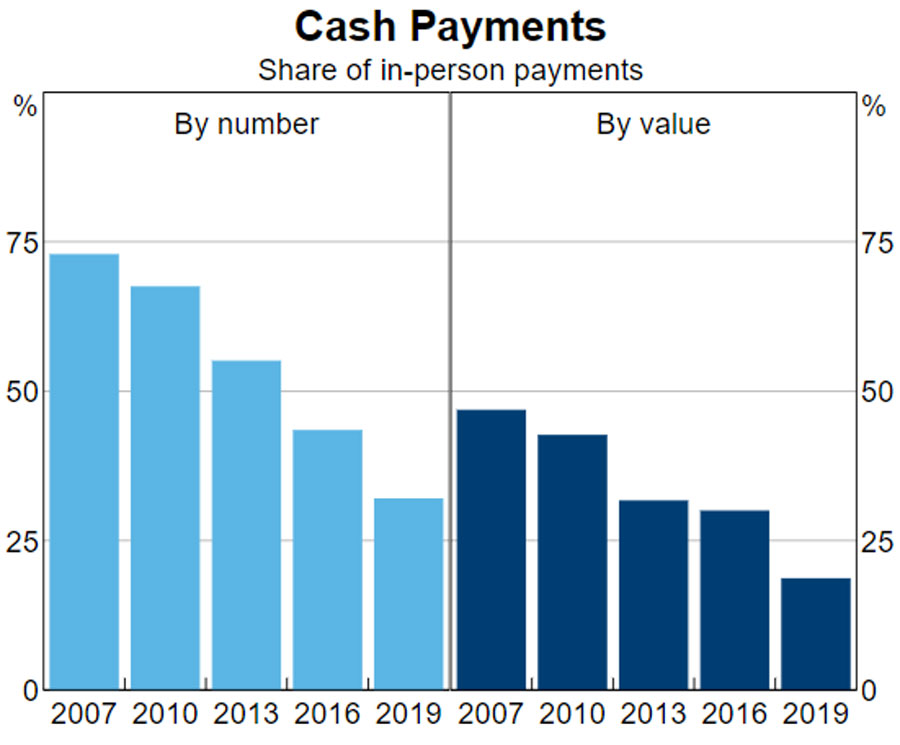

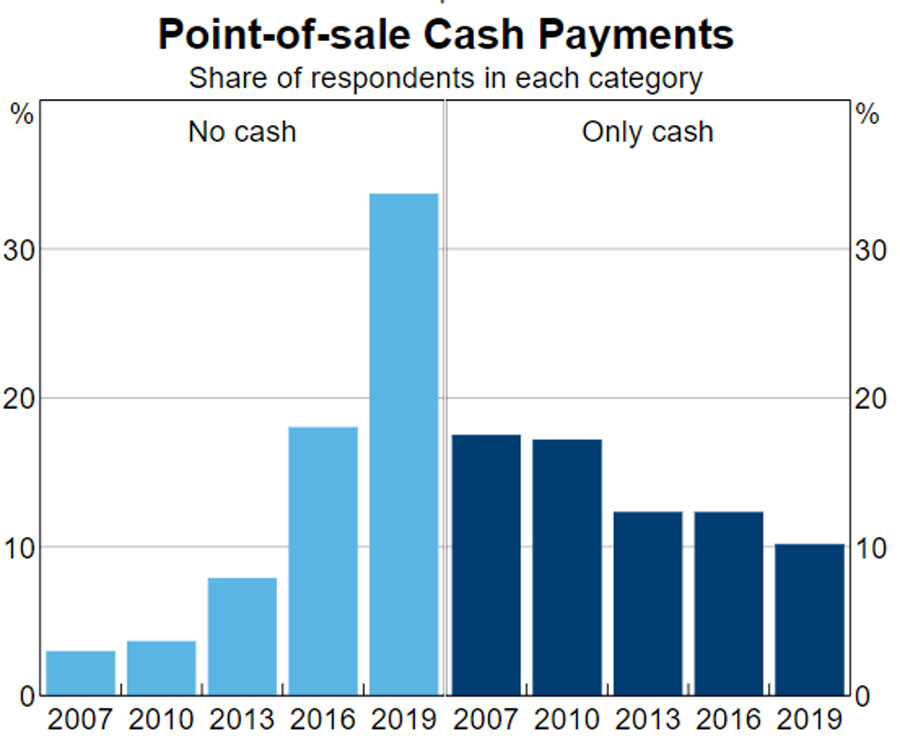

Reserve Bank of Australia (RBA) statistics highlight the decline. In 2007, almost 75 per cent of payments were made with cash. In 2019, that figure was just 27 per cent. Further RBA data shows exponential growth of cashless payments since 2007.

Australia could become cashless in the future. Central banks govern a nation’s momentary system. Therefore, it is central banks that could innovate to create a comprehensive cashless system.

Stablecoins are an option to explore. They’re cryptocurrencies designed to maintain price stability, by pegging their value to an external reference asset. Reference assets could be fiat currencies like the US Dollar.

Tether is one example of a stablecoin. Valued at AU$21.6 billion, it’s the largest stablecoin by market capitalisation. Its price is pegged to the US Dollar. One Tether must always equal one US Dollar.

Stablecoins are borderless. They have no governing body. However, central banks have an opportunity to innovate to keep pace with the changes in digital finance.

Central bank digital currencies (CBDC) are a potential solution.

What are CBDCs?

CBDCs are digital forms of fiat money. They’ve been compared to cryptocurrencies like Bitcoin. However, there are differences between the two.

Bitcoin has no central authority. It is a borderless digital currency. CBDCs are governed by a country’s central bank.

While Bitcoin’s blockchain network is publicly available – anyone can access its complete transaction history — a CBDC’s network is private.

Bitcoin is based on blockchain technology. A CBDC’s network can be built with non-blockchain systems.

See where are we going here?

Current CBDC projects

CBDCs are currently in a conceptual and testing phase in several countries. A 2019 study by the Bank of International Settlements (BIS) highlights worldwide CBDC interest. It reported that 80 per cent of central banks were engaged in CBDC work.

The RBA has conducted its own research. It states, “there is currently no strong public policy case to introduce a CBDC.”

However, this may change in the future as Australia’s monetary situation evolves.

Europe, along with the US, UK, Canada, and Japan are all studying CBDCs. You can be sure major economies are paying attention to their monetary future.

It’s crucial for any technology system or software to be able to exchange and make use of information with other products or systems.

It’s called interoperability. In practise, it ensures future CBDCs can connect with existing systems.

Unless CBDCs are internationally compatible, inherent opportunities will be lost.

China’s Digital Currency Electronic Payment (DC/EP)

China has made significant progress with CBDCs. Its interoperable DC/EP system is arguably the world’s most developed.

The People’s Bank of China (PBOC) is currently leading large-scale testing of the DC/EP. They have announced trials are underway in four major cities – Shenzhen, Suzhou, Xiong’an, and Chengdu. Approximate combined population? About twice as much as Australia’s.

The DC/EP is being tested by seven major Chinese banks and may also be trialled at the 2022 Beijing Winter Olympic games. However, many details of the DC/EP are, as yet, unpublished.

Sweden’s e-Krona

Like China, Sweden’s central bank, the Riksbank, is currently testing its own interoperable CBDC.

Sweden is of particular interest, as it could be the world’s first cashless society due to the Nordic nation’s declining cash usage.

According to research by The Block, “6 per cent of total household payments were made with cash in 2018”.

Better – 94 per cent of total household payments weren’t made with cash in 2018. Two whole years ago.

Another study showed half of Swedish retailers won’t accept cash past 2025.

In 2017, the Riksbank initiated a three-phase CBDC project. They are now in the final phase, which includes testing of payments, deposits, and transfer capabilities. Unlike China, Sweden’s CBDC may use blockchain technology.

How they design their CBDC is critical. If launched, others will observe its effectiveness.

China and Sweden are leading important research on CBDCs. While Australia states no current use for an e-AUD, the launch of a successful CBDC may offer a glimpse of the cashless future.

This article was developed in collaboration with BTC Markets, a Stockhead advertiser at the time of publishing.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.