FREE WHELAN: It’s a Festivus for the rest of us… who chose to bathe in appropriate attire

Experts

Experts

Ahhh November, that joyous time of the year.

Melbourne Cup is well and truly behind us and Christmas is right ahead.

I myself decide to double up my stress levels by hosting a Thanksgiving lunch on the last Sunday of November. It’s by no means a tribute to the pilgrims of America, more a chance to eat turkey, watch to college ball and drink some American beers.

I don’t get to host anything for Christmas so this is a good chance to get people together before the usual holiday diaspora takes over.

I’ve had 17 positive responses plus my own tribe so 21 all up in my house. That’s a lot of required turkey and more chairs than I have. Like the opposite of there never being enough exits when there’s a fire.

Speaking of heading for the exits…

The FTX thing of the last week is another one of those things that you see as the tide goes out. You discover not only have some folks been swimming naked but they also don’t have legs and didn’t exist at all.

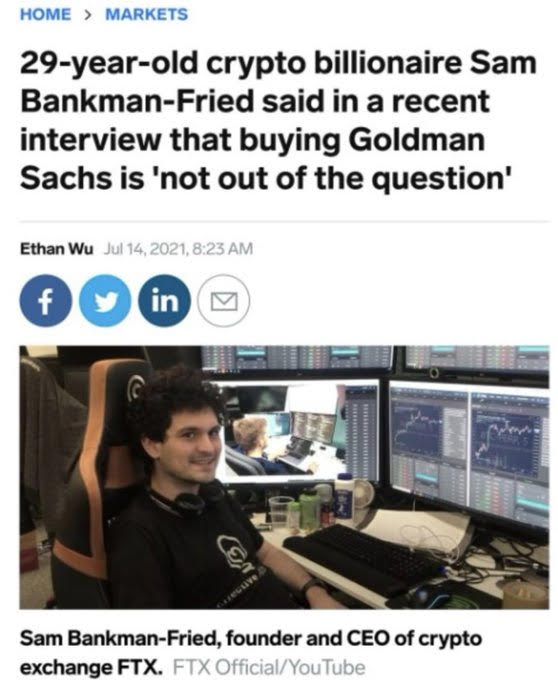

The money is gone and it’s not coming back. All the celebrities and endorsements count for nothing. Sam Bankman-Fried (which legitimately sounds like the name you’d invent if you were writing a book and needed a placeholder name for a fraudulent character – “Bank man”? C’mon seriously?) had investments pouring in from places that really should have had more due diligence in place.

They invested because he was on the cover of Fortune. People need to be sacked. Or in jail. Or both.

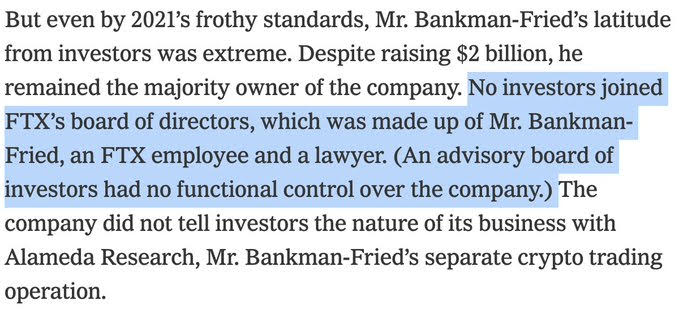

We’re getting numerous stories of FTX and just how much they managed to get from investors, we’re talking professional Venture Capital Rulers of the Galaxy type guys, with little to no checks and balances in place.

Example:

They just handed over a stack of people’s cash to invest in this thing with no accountability or influence in the company.

Disgrace All because of the celebrity status of the head guy Sam. He’d been on the cover of Forbes and Fortune and lunched with the FT and all the usual places successful frauds go.

Something I like to remind people of is that there’s a reason the First Commandment is top of the list. Regardless of your views on religion, either a supreme being or a concerned group of elders had to knock the nonsense on the head once and for all:

“You shall have no other gods before Me”

It’s easy to interpret that as meaning “steer clear of the other religions” but in actuality “other gods” is more likely regarding possessions, money, people with status. How many times do a people need to blow up their life savings following some loud-talking con artist before someone steps in and makes it a law not to prioritise them first?

Think of who in recent history we’ve done this to?

Musk, Wood, Cramer? Chamath?

But enough of this theological pontification. More headlines…

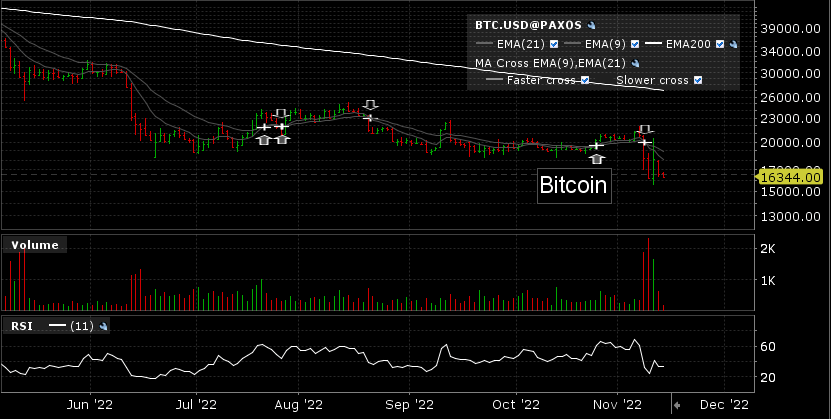

We’re tracking the FTX fall for any contagion and quite frankly I’m a little shocked there isn’t more. Some funds had dollars there and there’s rumours some investment companies had their holdings in the FTX token but the market seems to be shaking that off. Probably because of the below.

Last week saw a brilliant move in markets on the back of weaker than expected US CPI numbers. Funny story is they’re the same numbers that crashed the market back in February.

7.7% CPI was a disaster back then, now it’s a reason to celebrate.

Speaking of Cramer…

On top of that China has relaxed some Covid regs so we’re following that. Chinese stocks have come back from the dead.

I still very much support the idea that a more prudent way to invest in China is via derivatives OF China growth and not physical Chinese companies. Have a look at copper if you want that sort of access. But I’ve said that before.

Beware the casual attitude of some market participants. The Fed needs to see three readings of declining inflation to make sure they’re not going to have to go back around again tightening. It’s not over yet, but it’s looking good.

We opened a small position in gold miners last week and I’m going to add to it where appropriate. Gold had a substantial rally last week and I have been waiting for a time to re-enter the miners. This week is as good as any.

My preferred access is MNRS, Betashares hedged ETF investing in ex-Australian miners.

Today we are seeing the largest daily change in 2-year yield since the Global Financial Crisis.

To be clear:

That was the bottom for gold, not the overall equity market. pic.twitter.com/CTcAEtUtgQ

— Otavio (Tavi) Costa (@TaviCosta) November 10, 2022

Keep it simple.

All the best and stay safe,

James

P.S. I’m looking for turkey recipes. Please send.

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.