Millennials are leading the charge on crypto investing

Pic: Stevica Mrdja / EyeEm / EyeEm via Getty Images

Special Report: The coming decades will see the greatest wealth transfer in history, with younger Australians braced for a total of $3.5 trillion from generation before them. Stockhead explores what this means for the future of crypto investing in Australia.

A growing swathe of Australian investors are seeking to diversify their holdings away from traditional ASX-listed blue chip companies in favour of alternate assets. These include digital currencies, which can give their portfolios an important avenue for diversification when global markets are faced with uncertainty.

Underpinning this newfound appetite for alternate assets is a significant transfer of wealth. It’s no secret that Generation X and Millennials in Australia are set to benefit the most, inheriting around $3.5 trillion from the Baby Boomer generation. As it stands, Bitcoin is one emerging asset that may capture its share of investments. Kraken Intelligence’s March 2020 report looked primarily at how upcoming wealth transfers between generations in the U.S. can expect to impact Bitcoin’s value proposition.

Millennials are moving to Bitcoin

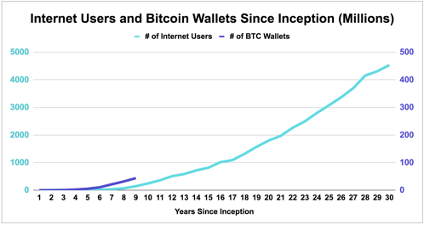

One metric that suggests a broader impact is the number of Bitcoin wallets globally. This metric is tracking strongly with the growth rate of Internet users in the 1990s, suggesting that, as the understanding of Bitcoin is evolving, so too is the amount of users flocking to invest.

Blockchain Capital, in a survey conducted in 2019, looked at the tendency for purchasing Bitcoin between different age groups in the U.S.

The analysis found that the 18-34 age group were “very” or “somewhat” likely to buy Bitcoin in the next 5 years, a figure that grew meaningfully in less than two years’ time.

The graph below shows the same statistic for other age groups.

Bitcoin vs. legacy markets

Today, Bitcoin is trading at roughly $AUD 13,968, which is up roughly 107% since September last year. By comparison, the S&P/ASX 200 is down 10% YTD.

This negative change in the stock market is leading to further rounds of fiscal and monetary stimulus from governments around the world. In Australia, two separate stimulus packages amounting to $AUD 8.8 billion were put into effect to help the economy – Job Keeper and Job Seeker – to eligible recipients.

Furthermore, the Reserve Bank of Australia has stated that the recovery is moving slower than anticipated, particularly since unemployment rates are expected to increase from 7.5% to 10% by Christmas.

While fiat currencies are being devalued, there have been many benefits of investing into an asset like Bitcoin.

For perspective, if you had invested the $750 sum given to you by the government on March 31, you would have $1,237 today. If you had invested the second $750 sum on July 13, you would have $AUD 966.

This means that your $AUD 1,500 could be valued at $AUD 2,203 today, or a 47% return on your investment in five months!

Millennials are losing trust in big financial institutions

A growing number of Generation X and Millennials have expressed a collective distrust in banks and corporations after growing up during the tech bubble in the early 2000s, the Global Financial Crisis in 2008 and the 2017 Royal Commission into Banking and Financial Services. The latter laid bare a culture of systemic misconduct by Australia’s largest incumbent financial institutions who were culpable in matters concerning money laundering, terrorism financing and remuneration-based incentives for trailing product commissions in Australia’s wealth management sector.

Importantly, the younger generations are starting to understand the notion of scarcity, particularly with regards to digital goods, and why it is so appealing. A scarce asset, like gold traditionally, can only appreciate in value as more users invest in it because the demand exceeds the amount in circulation. This is one of Bitcoin’s main selling points, and why generations like Gen Xers and Millennials are starting to heavily invest in it.

The Bottom Line

Bitcoin has gone from a relatively underground financial experiment in response to the Global Financial Crisis to one of the most significant financial and technological innovations since 2009.

Never before have we been able to freely store, send and receive our wealth from or to anyone around the world, at any time, for next to nothing and without reliance on a third party. This, paired with the relative ease of investing in it, it regularly outperforming market indices, and being seen as a better alternative to gold makes Bitcoin a seductive asset to invest in.

Since Kraken’s launch of AUD funding in June 2020, there has been a growing number of investors coming from Australia and millennials are at the forefront of this shift to investing in crypto markets.

This article was developed in collaboration with Kraken, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.