The good gas on a bad war: Our Wartime Consiglieres’ potential ASX energy plays

News

News

It was hard to miss Monday’s stunner of an IPO by Top End Energy (ASX:TEE), after the Northern-focussed gassy’s landed on the ASX at 40 cents, double its initial public offering of 20 cents. A 100% premium to the issue price.

And with a new round of sanctions against Moscow already on the cards form the US and the EU, the sector is holding its breath to see whether the EU will cross a red line and tinker with a ban on gas imports from Russia – a massive challenge for Russian-gas dependant states like Germany, despite growing pressure from its Western allies.

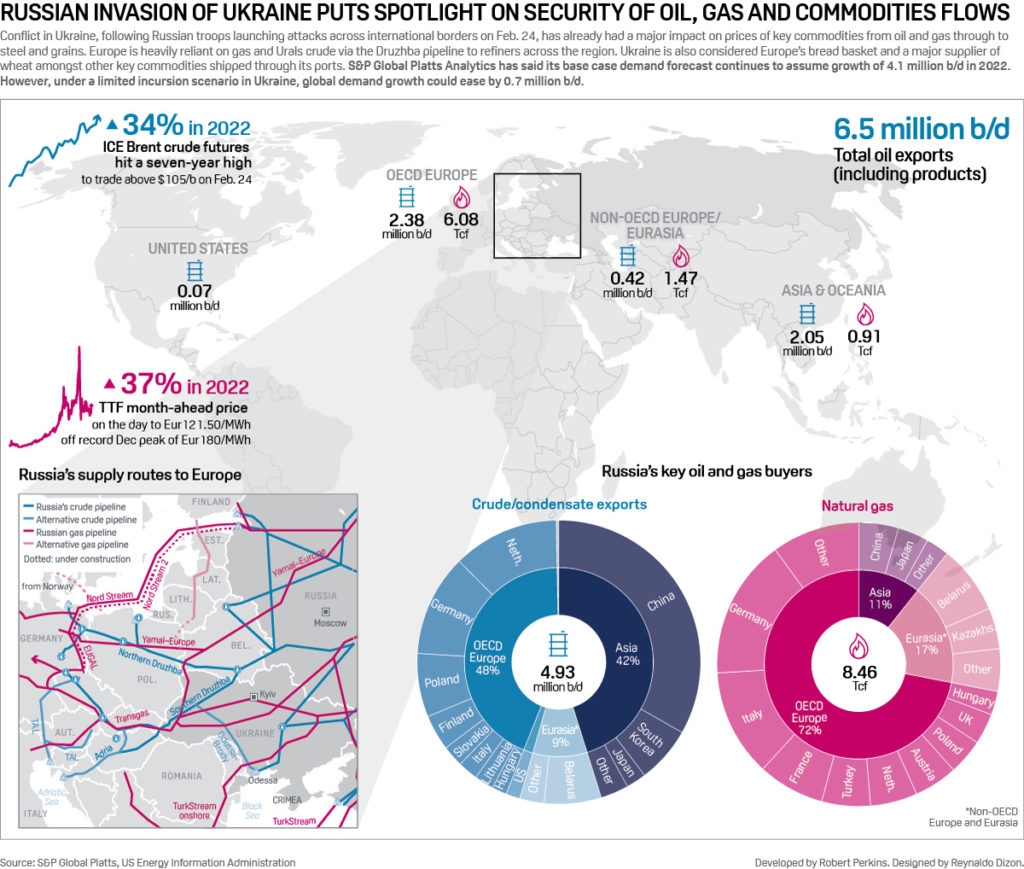

To set the scene, here’s a very handy visual from S&P:

Yet, energy prices were on the move well before the Russia/Ukraine conflict, with strong bump in 2021 year-end demand figures and horribly constrained supply – including OPEC underperforming stated targets and US producers adhering hard to capex discipline, says Galilee Energy (ASX:GLL) Managing Director David Casey.

And here at home? Well, the east coast gas market is facing huge, structural supply issues in the uncertain near term, and that’s why small caps like GLL are accelerating into the winter.

With turmoil striking local and global energy markets, the Queensland-focused coal seam gas developer just extended the closing date of a Share Purchase Plan (SPP), looking to give eligible shareholders the chance to grab another piece of its portfolio.

In a sign of the pressures and opportunities building across the market, Galilee’s SPP has been extended until 5.00pm (Sydney time) this Monday, (11 April), giving eligible shareholders another crack at up to $30,000 worth of shares at the same price – $0.32 – as the February placement, sans any brokerage costs, commission or other fees.

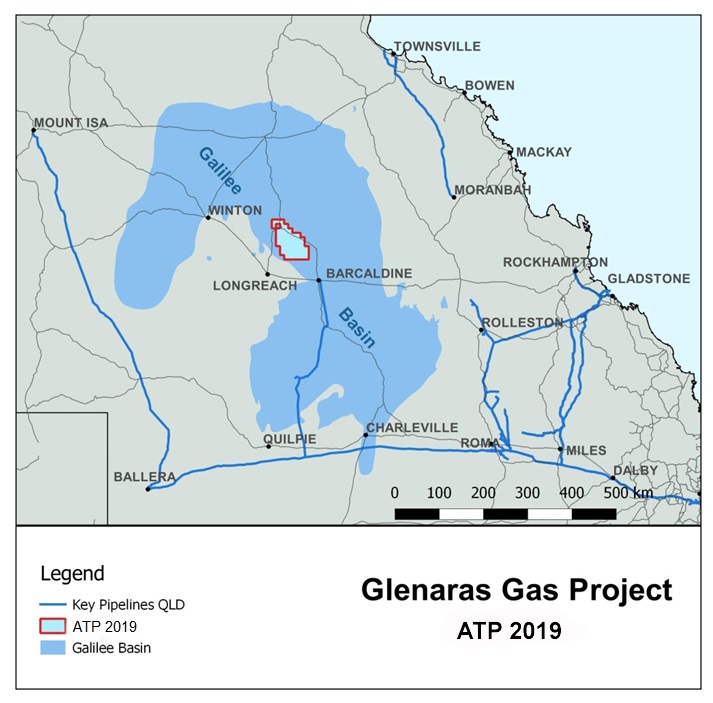

The explorer and producer is on the edge of further drills at its fully-owned Glenaras Gas Project in the Galilee Basin, while exploring deeper in the Surat and Bowen Basins, as Galilee’s managing director and CEO, David Casey looks to add further quality acreage to the portfolio.

Casey told Stockhead, the move comes as both domestic and international gas prices spike, the east coast in particular faces a near-term supply crunch making project’s like Glenaras a high-priority.

In the past five years there have been two oil crashes and Bass Strait gas supply is in long-term decline, Casey says. Additionally, activist pressure on oil and gas exploration in OECD countries has resulted in a gagged investment pipeline and hesitant exploration over the past several years.

“And then the global pandemic has also resulted in short-term demand destruction, the travel industry hammered, planes being grounded… and this has resulted in further decreases in investment in exploration because in our sector, you have to replace the barrels that you produce and that can only be done organically – via exploration, or inorganically – via M&A,” he said.

Even at the end of January, before a shot had been fired in Ukraine, the consultancy EnergyQuest was warning international gas markets would remain tight over the next two years – as years of underinvestment in production flowed through to hit demand and spike prices.

What was thought to be a positive for Australia’s LNG export earnings – the Federal Government flagging that it will more than double to $63 billion in the 2021-22 financial year – now looms as a crisis of neglect, circumstance and incompetence.

As Stockhead’s Bevis Yeo has pointed out in his regular column international gas prices are a strong incentive for Australia LNG exporters to ship more spot cargoes.

And the drain from home grown markets isn’t helped by the fast-growing supply channels linking the east coast and the international market, which was perfectly illustrated in May 2021 when Origin Energy reached a four-year deal to supply 91 petajoules of gas to the domestic market at prices linked to the Japan Korea Marker (JKM).

To make it worse, Bass Strait gas production is expected to fall further from the winter of 2023, raising the spectre of LNG imports to meet demand.

GLL only went back to the market in February and entered into placement subscription agreements with institutional and sophisticated investors raising just shy of $12 million, after issuing some 37m new fully paid ordinary shares at an issue price of 32c. From a peak of 91 cents back in March last year, the GLL share price is currently trading at 30 cents.

The funding is all about Galilee getting a best shot at exploiting Glenaras – which, as it stands – is one of the largest certified, un-contracted contingent resource positions on the east coast.

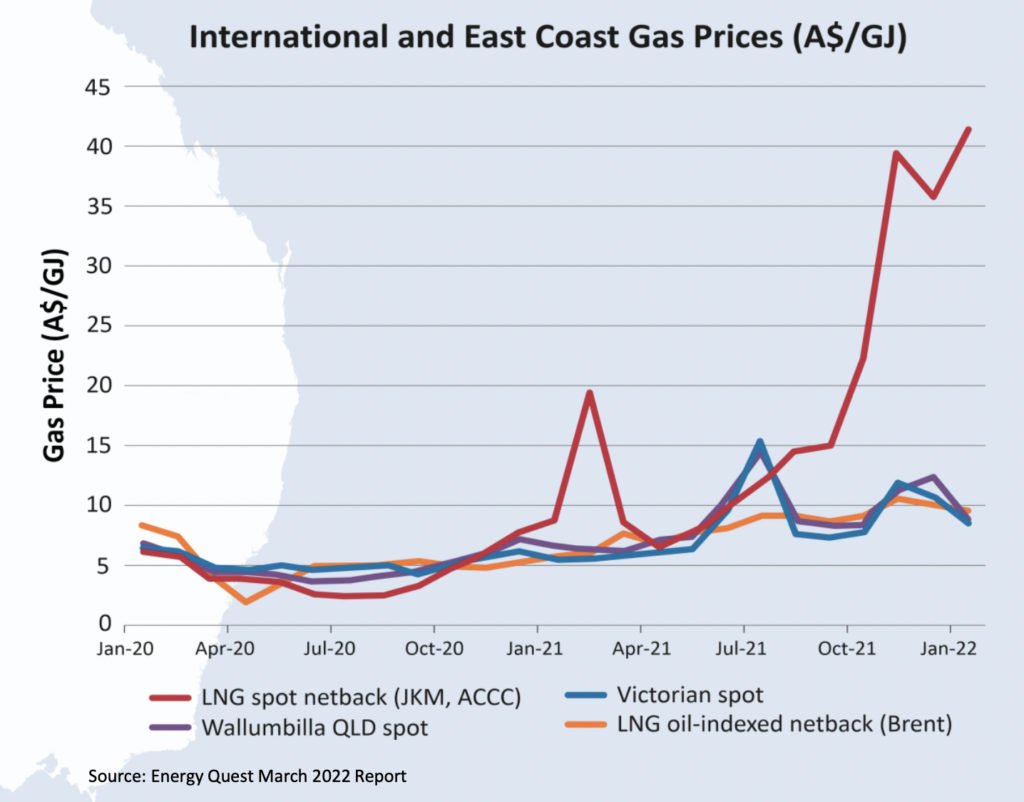

Galilee’s drilling program comes at a time when east coast gas prices boom and while the spot price for Queensland gas (currently at ~A$15/GJ) is robust and rising, but still well short of the current LNG net back price of ~A$40/GJ. Casey should know the best time to hit the resource – he wrote the scoping study on Glenaras long before he took the helm.

East coast prices rose in 2021 though thankfully not to levels seen in the rest of the world with the Wallumbilla spot price averaging $8.89 per gigajoule in 2021, nearly twice the $4.89/GJ in 2020 but only slightly higher than $8.15/GJ in 2019.

But Russia’s invasion of Ukraine has made an untenable situation for global energy prices, in particular natural gas, into something else entirely.

Spot Asia LNG prices recently spiked to USD 56/mmBtu, a massive 25-fold increase on May 2020 USD 2.20/mmBtu lows.

Even traditionally more staid gas hub prices have also spiked, including the pom’s National Balancing Point to a recent peak of US$ 74/mmBtu, that ‘s up 60-fold.

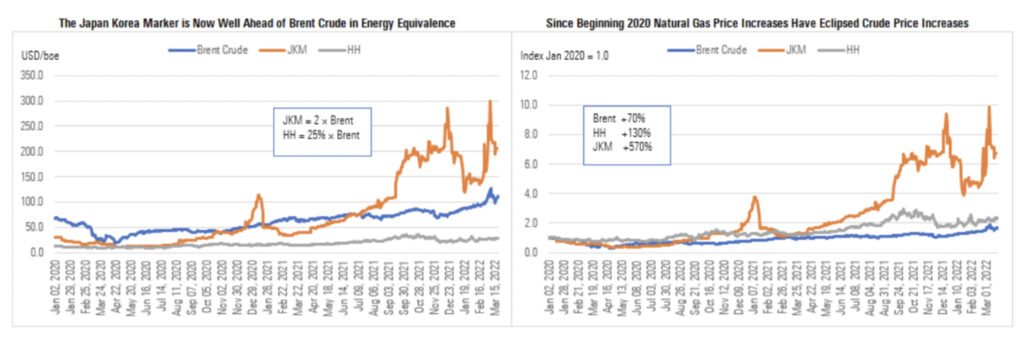

Brent crude sits at around US$100 per barrel or 70% ahead of prices at the beginning of 2020.

“But the US$ 32/mmBtu spot Asia LNG price quoted as the Japan Korea Marker, or JKM, is up a staggering 570%,” says Mark Taylor at Morningstar

“Even the lumbering HH gas price in the U.S. is up around 130% to USD 5.0/mmBtu, an increase nearly double that for Brent crude. The JKM has moved from being around half the price of Brent in energy equivalence to around double—crude normally trades at a premium to gas given oil’s higher utility,” Taylor said.

Meanwhile HH has moved from being less than a fifth the price of Brent in energy equivalence to more than a quarter of Brent’s value.

“Higher commodity prices and supply chain kinks in part linked to war in Ukraine have led companies to begin increasing prices, which will spur inflation higher and prompt so-called “demand destruction” as consumers buy less to deal with higher costs,” Taylor adds.

Damien Boey head of equity strategy at Barrenjoey in a note this week to investors said ,“demand destruction is adding further inflationary pressures to the global economy as commodity supply shocks rear their ugly heads.”

On the Australian eastern seaboard the threat of gas shortfalls from 2024 is very, very real. The competition watchdog has been all over this, warning the Aussie liquefied-gas exporters they’re failing to live up to a promise that they’d maintain sufficient local supply.

Bevis, writing from Perth, says the east is way behind the the eight ball when compared with WA’s mandated 15% domestic gas reservation policy.

While the market was likely to have enough supply this year, the ACCC describes the outlook as “finely balanced.”

The watchdog forecasts shortages in southern states within two years that could hike costs for households with gas heaters and intensify pressure on gas-reliant manufacturers already struggling to remain viable.

Casey told Stockhead producers need to understand the contributors to upward pressure on east coast gas prices.

Russian output of key commodities as a portion of global production is significant, and natural gas at 17% is the central pillar, notes Emanuel Datt principal of Datt Capital, a boutique investment manager focused on identifying high growth and special situation opportunities.

“The Ukraine-Russia conflict is having a massive supply side impact with global sanctions now placed on a large amount of global supply coming out of Russia. Russia is one of the biggest oil and gas producers in the world, and any disruptions stand to have a major impact on prices.

“We’re already seeing disruptions with the US banning imports of Russian oil, natural gas, and coal. The United Kingdom and major gas importers such as Germany are scrapping imports of Russian oil and gas as well,” Datt flags.

He says, Russia provides around 40% of the natural gas, 30% of the oil used by the EU, functions critical to the EU’s industrial and agricultural production – especially Germany with its significant manufacturing base.

In early February, JPMorgan analysts projected that disruptions to oil flows from Russia could push oil prices to $120 per barrel, which, indeed, it already has. (For context, oil was priced in the $60 per barrel range a year ago and started 2020 in the $70s and $80s.)

Some analysts have warned that worst-case scenario oil prices could hit $200, and Russia has warned that $300 oil prices could be on the horizon, depending on what Europe, which is much more reliant on Russian oil and gas than the US, does.

The massive differential between international and east coast gas prices depends on how soon local producers can have an impact before east coast gas prices start to close the gap.

The Walumbilla Qld spot price has ~doubled in the past year ($5 to $10/GJ) – but hasn’t moved anything like global spot LNG prices, which are increasingly having more and more influence on domestic gas prices.

“So, for now, it is highly likely east coast domestic gas prices will increase further in the medium-term.” Casey says

“Proposed LNG import terminals will actually help Galilee’s Glenaras Project because they will set a “floor” price on east coast gas, and it is likely to be significantly higher than current east coast gas prices. But they will not fullfil the entire east coast demand.

“LNG is a much more heavily traded commodity than previously. It is a deeper market, therefore gas prices are diverging from oil indices and more closely linked with spot LNG indices – what I mean here is that there’s a very real nexus between east coast gas prices and global LNG prices now (as opposed to a very limited relationship a few years ago when LNG was not traded as deeply),” Casey says.

As per ACCC figures, the Gladstone LNG producers were forecast to withdraw more than they sold into the east coast domestic market in 2022, before the recent surge in global LNG prices.

“Given the extremely high delta between spot LNG prices and domestic gas prices that now exists, producers are very likely to withdraw even more going forward, which will only increase the supply side pressure on the east coast.” the Galilee CEO adds.

There is also work on a number of frontier basins such as the Beetaloo

Gas will still play a key role in the energy mix for several years to come even as the world transitions to lower carbon alternatives.

“Energy security is now very much front and centre. Germany, which switched off its nuclear and coal, is now building LNG import terminals.

“Baseload power for renewables, which has a much lower footprint than coal, cannot provide supply certainty when the sun isn’t shining, or the wind isn’t blowing. Manufacturers need affordable feedstock and energy that is reliable, otherwise they will go out of business,” Dave says.

Gas supports electrification and the energy market transition. Affordability and reliability position gas as an extremely important transition fuel.

So developments in the Perth Basin and the Beetaloo sub-Basin, to name two of the hottest addresses now look ever more likely to go ahead, Bevis says.

“Most of our short to medium term emissions reductions are likely to come from renewable energy replacing coal, regardless of how much certain coal-lump-carrying politicians might wish otherwise,” he adds.

There’s also that matter that our Asian neighbours are still very hungry for gas – Wood Mackenzie has confirmed the dearth in domestic production and the fast-tracking of coal to gas transition and intermittent renewables generation will combine to structurally increase demand for gas imports.

“That’s a recipe for strong prices and you would be a fool to think that Australian companies (and governments) won’t be keen to capitalise on that, Bevis warns.

Bevis keeps his eye on everyone, for a fantastic debrief on the Aussie energy – oil and gas focused stocks – pop over this way.

Here’s but a sample of Bev’s bevy:

Strike Energy (ASX:STX) – with a Market Cap around $350m, Strike delivered a 300 petajoule resource for the West Erregulla gas field in the Perth Basin ahead of Christmas – this resource is hosted within the primary target Kingia Sandstone and the company believes that up to 128 petajoules could be present in other formations such as the High Cliff and Wagina/Dongara sandstones. Strike also has the Walyering-5 well with Talon.

Talon Energy (ASX:TPD) – Talon, as above, participating in the promising Walyering-5 gas well that targets up to 38.7 billion cubic feet of gas and 0.98 million barrels of condensate. The oil and gas company with a $65m market cap has also acquired the Condor prospect that could have the potential to host up to 10 times the gas resources at Walyering and the right of refusal over the Ocean Hill gas discoveries,

Vintage Energy (ASX:VEN)– Vintage is the operator of the Vali and Odin gas fields as well as the Cervantes-1 exploration well that Metgasco has interests in. The latter targets a gross prospective resource of about 15.3 million barrels of oil.

Warrego Energy (ASX:WGO) – a market cap of over $170 – Warrego also shares the West Erregulla gas field with Strike but that is not its only project. WGO also holds STP-EPA-0127, the largest onshore Perth Basin exploration permit application that straddles a relatively unexplored major rift basin with recognised structural and stratigraphical characteristics of the Northern Perth Basin and the Southern Carnarvon Basin.

Woodside Petroleum’s (ASX:WPL) is Australia’s most LNG leveraged company, and is currently the most exposed to spot or gas hub pricing, he says.

The gas major, which is set to become a global top 10 energy company after reaching a binding deal to acquire BHP’s (ASX:BHP) oil and gas assets, has been quick to promote the low carbon dioxide content (about 0.1%) of the field.

“We anticipate Woodside’s near-term earnings to soar due to higher prices for all hydrocarbons, and in particular for uncontracted LNG, or spot cargoes, which attract spot pricing, Taylor says. “Our Woodside fair value estimate remains AUD 40 per share, with a 4-star rating at the current price—a higher AUD/USD exchange rate offsets the fair value benefit of short-term pricing gains.”