STATE vs STATE, RATE vs RATE: What 13 bumps to the cash rate does to an Australian

News

It’s not easy being green and gold when your local central bank can dish out 25 basis point rate hikes by the bakers dozen in a very short period of time.

Ours has done that. 13 hikes in 18 months. The cost of money in this girted nation is the highest it’s been in 12 years.

At 4.35% since last Tuesday, there’s barely a lender in the land which hasn’t passed on this latest gut punch.

Of the Big 4 lenders, the Commonwealth Bank joined the three other majors to gaily lift their own lending rate, announcing last week the change to its variable mortgage rates by 0.25%, which kicks into gear for borrowers Monday morning.

While some banks were quick off the mark, hoisting home loan interest rates within days of the rate hike, many more – including three of the big four banks – waited until last week to do so.

But we’re all in trouble now, says Mozo.com.

By the end of last week, 52 lenders all up had announced they’re increasing variable rates on home loans.

20 of those came into effect on Friday. The RBA hiked the cash rate on Melbourne Cup day for the 13th time since May 2022.

Although some of us, it turns out, are in more trouble than others.

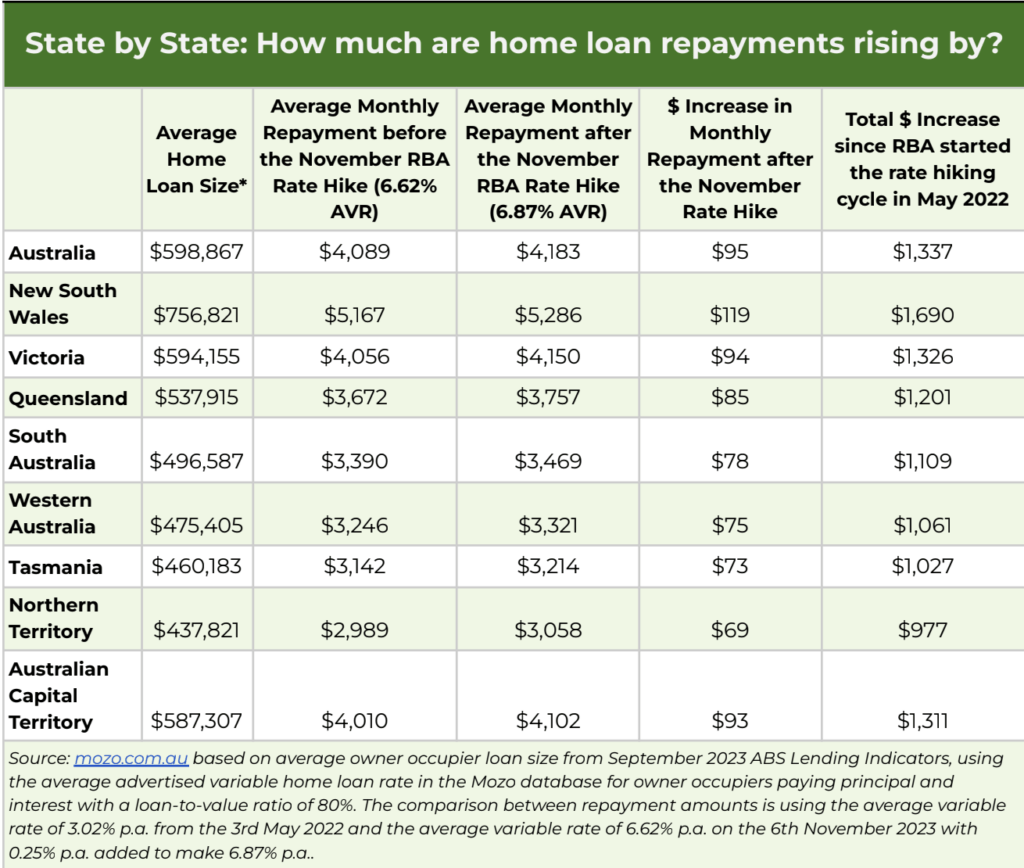

New Mozo analysis shows that the impact on Australian homeowners varies dramatically depending on which state you live in, based on the average home loan size.

But first up, Mozo has also compiled a list of all the lenders that have hiked as of 17th November.

Here’s the shake down in data so raw we baked it in Granny Apple green:

According to Mozo finance expert Rachel Wastell, just how Aussie homeowners are copping the 13 RBA blow to the cash rate depends a lot on which state you’re owning a home in,

based on the average home loan size.

“Thirteen rate hikes and the most aggressive rate hiking cycle since the early 1990s is putting significant pressure on mortgage holders as they struggle to cover rising repayments,” Wastell said.

“The analysis shows that most Aussie mortgage holders have most likely had to find an extra thousand dollars or more every month. That’s nothing to sneeze at, especially in the lead up to Christmas.”

Across Australia, the average owner occupier home loan size sits at $598,867, but state by state it varies widely, from $437,821 in the Northern Territory to $756,821 in

NSW.

According to the average variable rates on the Mozo database, and the latest ABS loan size data, NSW homeowners have been hit the hardest by rising rates, and

are now searching for an extra $1,690 to cover a monthly mortgage repayment of $5,286 on average.

“Thirteen rate hikes and the most aggressive rate hiking cycle since the early 1990s is putting significant pressure on mortgage holders as they struggle to cover rising repayments. The analysis shows that most Aussie mortgage holders have most likely had to find an extra thousand dollars or more every month. That’s nothing to sneeze at in the lead up to Christmas.”

Rachel says Victorians are also feeling the pinch, as their repayments have risen by $1,326 on average since May 2022, to cover a monthly home loan repayment of $4,150.

“Queenslanders, South Australians, Western Australians, Tasmanians and ACT residents with a mortgage are also searching for an extra four figures every month, with repayments rising by more than $1,000 a month since the aggressive RBA cash rate hiking cycle began.”

Homeowners in the Northern Territory, according to the average loan size data, are the only mortgage holders looking for less than $1,000 more a month to cover their repayments – but only just – as their repayments have risen by $977 a month.

“If you’re struggling to find the extra cash to cover these rising repayments, it’s important to keep an eye on the market to see if you can get a lower interest rate,” Rachel says. “This is especially true for homeowners paying rates starting with 6, 7 or 8 as after the November rate hike we still have 17 lenders on the Mozo database offering rates lower than 5.75%.”

“There is a real risk that borrowers are exhausted, and that the thought of checking interest rates after the latest rate hike could be too much to bear. However, it’s more important for homeowners to check rates now than ever, especially as we’re seeing rates on the Mozo database starting with a nine.”

“The thing with home loan rates is that the smallest difference in interest rates can equate to a big difference in repayments. As little as half a percentage point difference in interest rates can add up to tens of thousands of dollars more in interest over a 20 or 30 year loan term.”

“For homeowners paying rates starting with 6, 7 or 8, now could be the time to switch to a cheaper rate, as we still have a number of lenders on the Mozo database offering rates lower than 5.75%. And if you can’t switch due to serviceability, call your lender and ask if you can get a better rate.”

“Remember, if you don’t ask, you don’t get.”