Octoberfest: Aussie home values to hit record highs in two weeks; CBA says rebound ‘remarkable’

Via Getty

Aussie home prices were up and away for a ninth straight month in October.

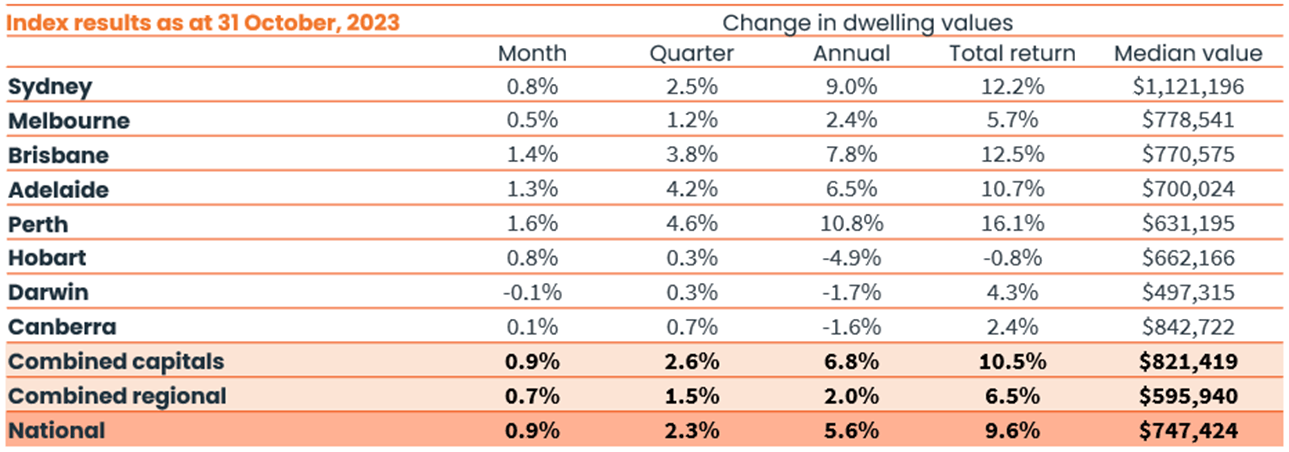

The 0.9% increase in property data firm CoreLogic’s capital city benchmark index released this morning describes an Aussie residential property market on the march, regardless of rising rates, inflation, cost of living pressures and all them other things.

Three Australian cities have now endured house price rises well into double figures in just the first 10 months of 2023.

Stand up, please:

-

Sydney (10.9%)

-

Perth (10.8%)

-

Brisbane (10.2%)

Following similar increases over the previous three months, the firm’s research director Tim Lawless says CoreLogic’s measurement of national home values should smack into a new record high by the middle of this month.

“At this rate of growth, we will see the national HVI reach a new record high mid-way through November, recovering from the -7.5% drop in values recorded over the recent downturn between May 2022 and January 2023,” Tim says.

‘Extraordinary times’

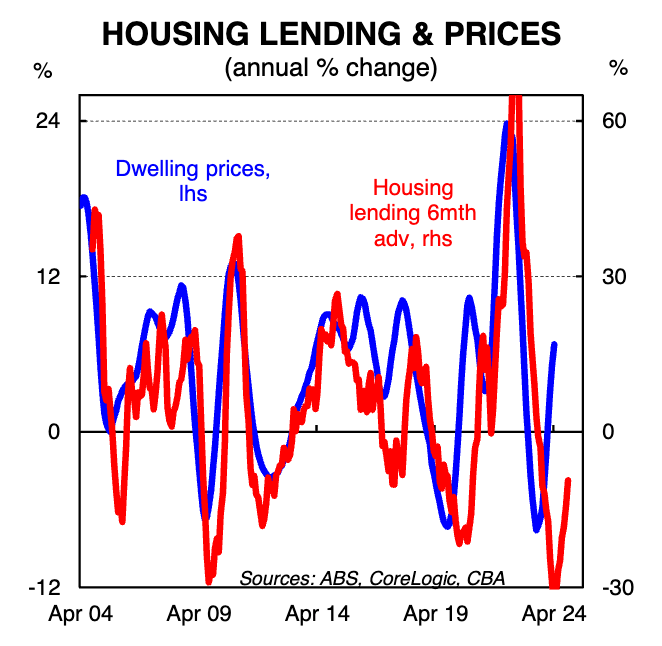

CBA’s Gareth Aird calls the turnaround in property prices since February, ‘quite remarkable’.

“Indeed the lift in housing values occurred in the midst of the RBA’s tightening cycle (recall that the RBA increased the cash rate by 25bp in February, March, May and June 2023), says the bank’s head of Australian economics.

The RBA’s 400 basis points of tightening since May 2022 has reduced home borrower capacity by ~30%, according to CBA’s global economics and markets research arm.

“But property prices are now back to their previous peak (reached in April 2022 – on the eve of the commencement of the RBA’s tightening cycle).”

CBA says now that housing affordability has deteriorated so significantly, the “usual relationship between new lending and home prices has broken down.”

“Housing loan commitments have fallen by around 30% since May 2022. A decline of this magnitude would ordinarily be expected to be accompanied by an ongoing decline in home prices.

“But these are extraordinary times,” according to Aird.

Australia’s population growth has surged over the past year. And home building has not kept pace.

“As a result, vacancy rates have dropped to record lows in most capital cities and the rental market is hot. This has put upward pressure on home prices,” Gareth says.

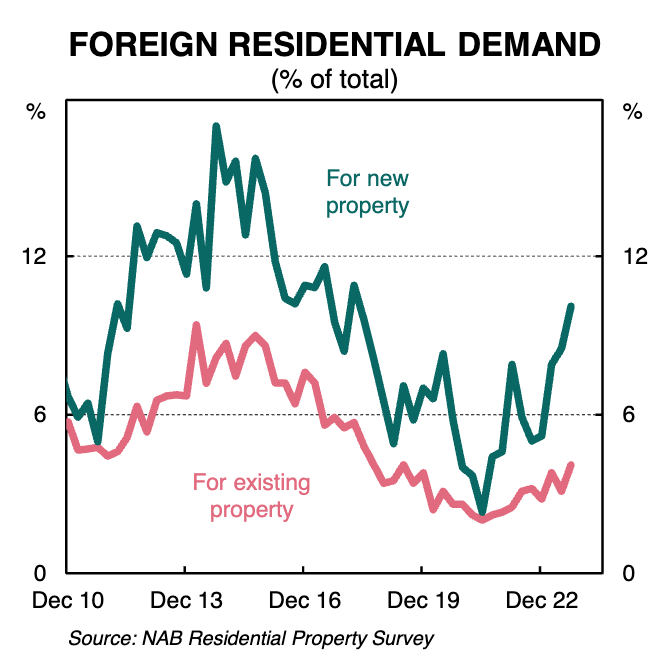

“Foreign buyers are also more active in the market. According to the latest NAB residential property survey the share of total market sales to foreign buyers in new housing markets increased for the fourth straight quarter,” he says.

New sales to foreign buyers have surged – hitting a 5½‑year high of 10.1% in Q3 23.

“Put simply: there is a supply/demand imbalance in the housing market,” CBA has concluded.

“Potential entrants into the housing market and renters feel the impact of this mismatch most acutely. Meanwhile many home borrowers with a mortgage are also feeling the pain of significantly higher mortgage rates.”

Capital gains

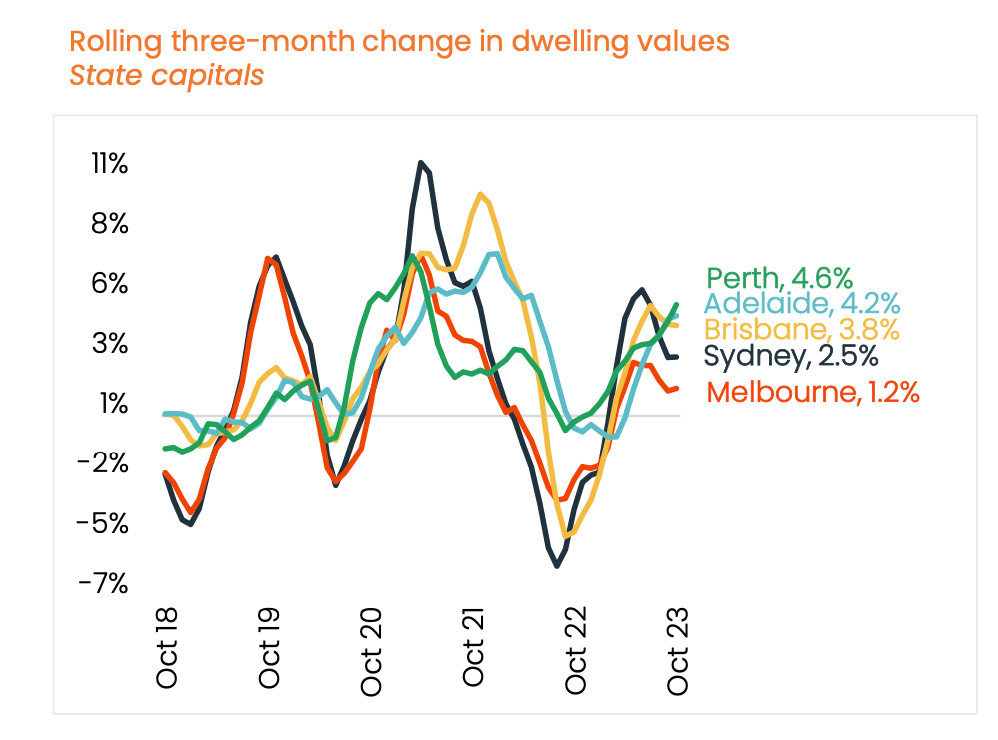

According to CoreLogic, although housing values are consistently rising across most capital cities, there’s been a clear slowdown in the quarterly pace of growth trend.

The three months ending June 2023 saw capital city home values rise by 3.7%. Since then the growth trend has ‘drifted back’ to 2.6% over the three months to October.

“The slower rate of appreciation can probably be attributed to a combination of higher advertised stock levels alongside stretched affordability,” Mr Lawless says.

“With an acceleration in the flow of new listings coming onto the market, it’s unlikely buyer demand will be able to keep pace as we move through spring amid high interest rates and low sentiment.”

CoreLogic notes Aussie dwelling values rose across each of the capital cities except Darwin (-0.1%) in October with Perth (+1.6%), Brisbane (+1.4%) and Adelaide (+1.3%) continuing to outperform the other capitals.

Bracing for race day

New RBA boss Michele Bullock will meet with her board on Melbourne Cup Day next week.

Gareth’s team now expects a 25bp rate increase at the November RBA Board meeting, which would take the cash rate to 4.35%.

“A Cup Day rate increase may weigh on near term sentiment in the housing market,” he says.

“But overall we expect the underlying demand for housing to remain firm against a backdrop of constrained supply and strong rental growth.

He says Aussie households on average expect home prices to continue to lift.

The Westpac MI house price expectations index rose again (a further 3.8% to 160.4) in October – another new cycle high in the month.

An the WBC/MI home price expectations index has historically had a close leading relationship with price outcomes, CBA says.

Octoberfest: CoreLogic

- Price outcomes over October were divergent across the country in magnitude

- Prices lifted in all capital cities apart from Darwin

- Dwelling prices rose by 0.8% in Sydney following similar sized gains over the previous three months.

- Sydney home prices have now increased by 11.6% since the trough in January.

- Monthly price rises also posted in Brisbane (1.4%), Adelaide (1.3%) and Perth (1.6%). Values rose more modestly in Melbourne (0.5%) and Canberra (0.1%)

- Dwelling prices across the 8 capital cities posted a larger gain for houses (1.0%) compared to units (0.7%) in October. This has been a familiar trend since prices turned earlier in the year.

- Prices also firmed across regional Australia.

- CoreLogic’s regional benchmark index increased by +0.7% in October.

- CoreLogic calculates the flow of new capital city listings has also surged to be almost 12% higher than a year ago.

- But total listings (ie: new listings plus re‑listings) remain lower than this time last year and below the previous five year average. The upshot is that home sales are tracking only slightly above the five year average.

- Ergo sum: home buyer activity not expected to be a tailwind on consumer spending.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.