Property: An Australian rental squeeze? Not yet…. more like a group hug in a few months

Via Getty

As the only country I can think of which is also an entire continent, it seems a bit ludicrous that we find ourselves in a bit of a rental crisis.

But while there’s some hope now among pundits that the Reserve Bank of Australia’s hellish interest rate cycle has peaked, it seems the opposite is the considered outlook for skint renters.

In fact, the cost of renting is likely to increase further for Aussie tenants in the grim months ahead, according to PropTrack economist Anne Flaherty.

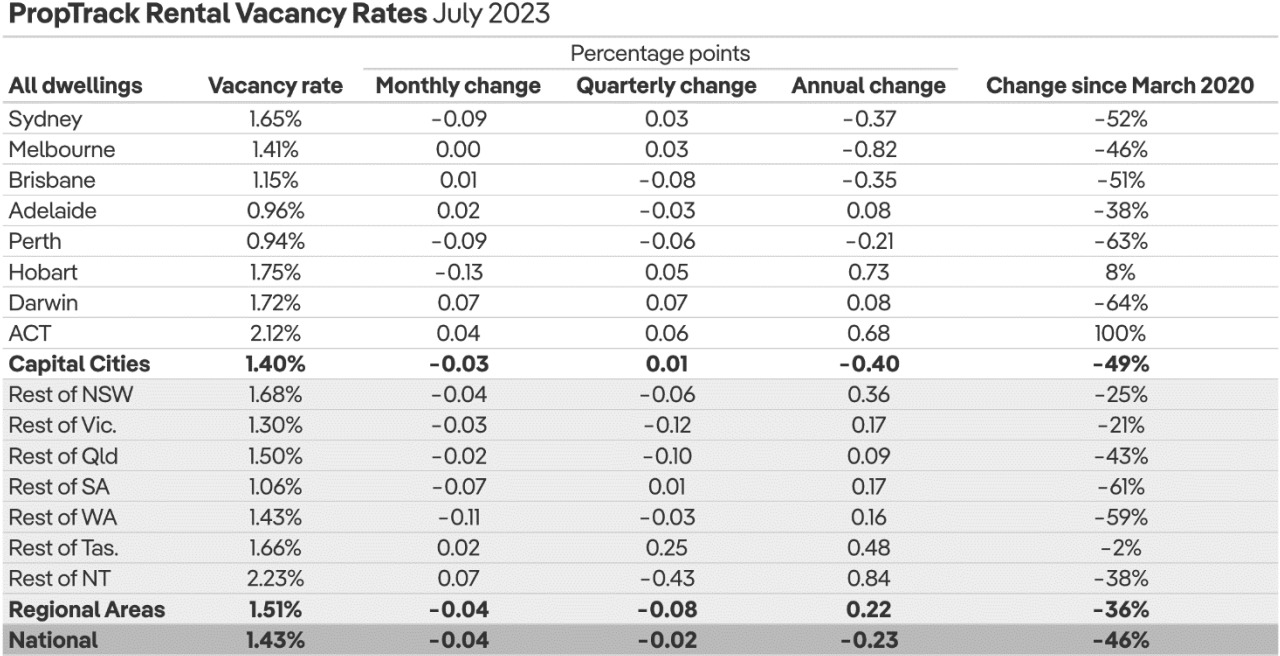

In her latest analysis, Flaherty has calculated that the national vacancy rate fell again in July, with rental vacancies edging lower last month (down 0.04 percentage points/ppt) to 1.43%. A very little number, indeed.

Flaherty’s latest PropTrack Market insight Report is pretty blunt, so here are the bullies:

-

National rental vacancy rates decreased slightly in July, down 0.04 percentage points to 1.43%. Vacancy is now close to half the level seen since the start of the pandemic

-

Lower rental vacancy rates are bad news for renters and reflect fewer rental properties coming to market

-

Sydney saw rental conditions deteriorate in July, with vacancy rates falling 0.09 ppt to 1.65%

-

Melbourne’s rental vacancy rate held steady at 1.41% in July, however, is sitting 0.82 ppt lower than 12 months ago – the largest annual drop of any capital city

-

Brisbane’s rental vacancy rate was largely unchanged over the month, rising just 0.01 ppt to 1.15% in July

-

Adelaide and Perth continue to see the tightest rental market conditions, with vacancy still sitting below 1% in these cities

-

Regional areas also saw the supply of rental properties fall over July, with the vacancy rate dropping 0.04 ppt to 1.51%

Rental markets provide a vivid depiction of how the collision of surging physical demand and insufficient supply is whacking the national housing sector.

Record low vacancy rates and double-digit growth in the prices landlords are asking speak to a ‘the intensity of pressures’ and near perfect storm which is still building, because there’s simply not enough affordable building.

Unfortunately, the broad consensus is that PropTrack’s data is on the money.

According to Westpac’s August Housing Pulse, released on Thursday, most of the indicators suggest the rental squeeze has longer to run with additional supply unlikely to come onto the rental market anytime soon.

PropTrack: Rental supply declines again

Out of everyone, Flaherty says it’s the blighted masses huddling in Melbourne that have copped the worst of it in terms of rental vacancies – of any Aussie market over the past 12 months.

As Australia’s fastest growing capital city, vacancy is likely to fall further in Melbourne, driving rents even higher.

“While vacancy rates in regional areas fell over July, they remain above the levels seen 12 months ago in every state, with regional NT and Tasmania seeing the biggest jump in availabilities. This suggests a slowdown in the trend towards regional living that accelerated during the pandemic.

“Although, pressure is unlikely to ease any time soon for tenants, with the number of vacant properties predicted to remain at extremely low levels over at least the next 12 months,” Flaherty warns.

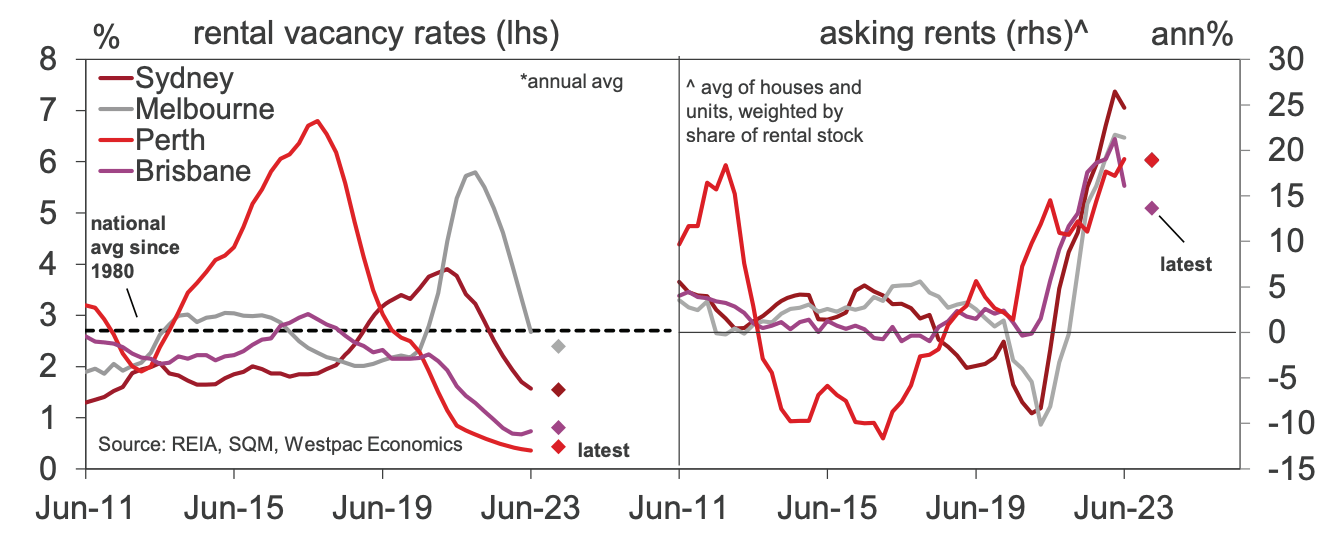

Rental markets: vacancies, asking rents

“Rental vacancy rates have declined materially since mid-2022, to ‘frictional’ levels in many markets, i.e. barely enough to cover the regular churn of tenants moving. On a weighted-average basis, vacancies across the five major capital cities look to be below 1.5%, almost certainly a record low on figures going back to 1980,” Westpac says.

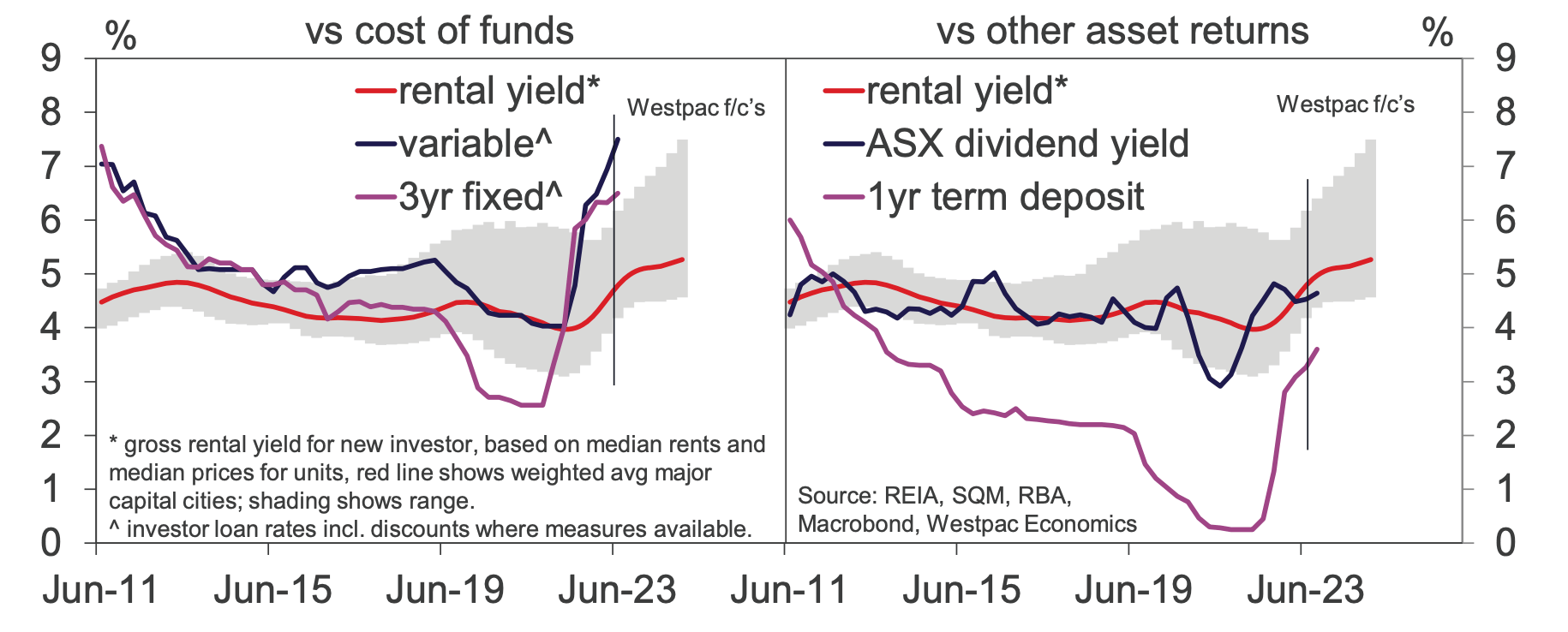

Rental yields: vs cost of funds, comparative returns

However, it’s a different story for smaller capital cities and regional areas, most of which have seen a lift in vacancy rates over the last year. “The difference in conditions clearly linked to differing population flows,” is Westpac’s conclusion.

Rents have continued to surge strongly, average asking rents rising by around 20% over the year to June across the major capital cities. Gains have been more modest for units, especially in smaller capital cities.

The latest weekly data also suggests the pace may have moderated a touch since mid-year. Growth has been much more subdued across the smaller capitals, asking rents holding about flat in Canberra and Hobart.

Westpac says the surge in rents has significantly outstripped dwelling price growth, producing a significant lift in gross rental yields (annual rental return as % of dwelling price).

On a weighted average basis, yields on units have risen from around 4% to 4.8%, the top end of the range seen since the early 2000s.

Gross rental yields range up to above 6% in some markets, the bank estimates.

“Of course, rental returns take a back seat to capital gains for many prospective investors. As such, the lift in prices, and price expectations might be expected to be a bigger positive,” Westpac says.

Sentiment-wise, Westpac says the picture looks fairly mixed.

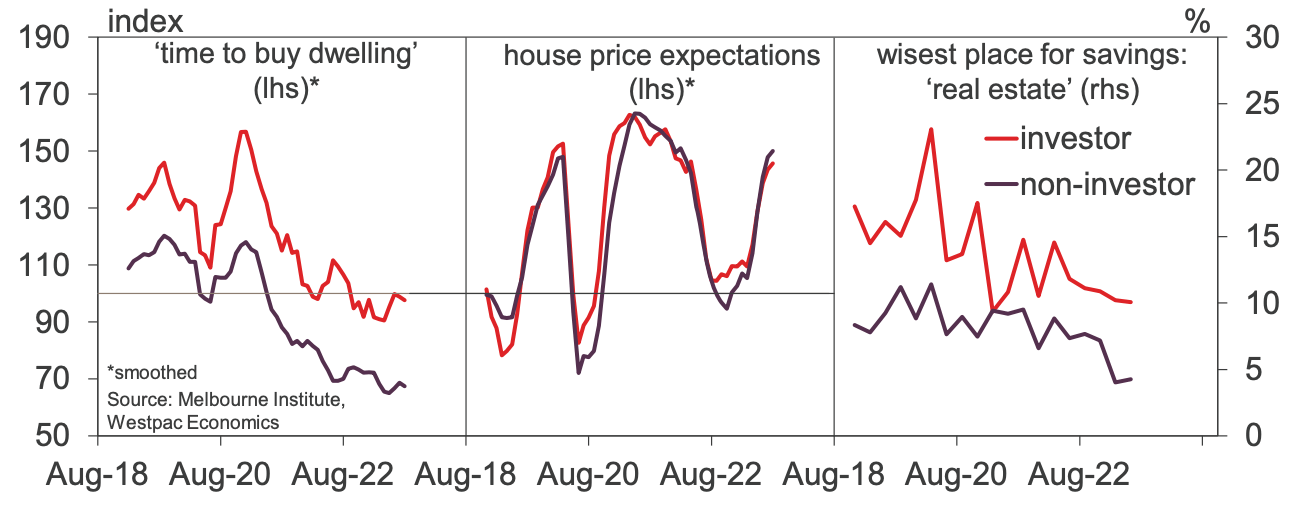

Check out the chart below. That’s housing-related sentiment for Aussies with investment properties.

“While price expectations are positive, they are not markedly more positive amongst investors.”

Housing-related sentiment: investors vs non-investors

Westpac says ‘time to buy a dwelling’ and real estate as the ‘wisest place for savings’ are still around historical lows, albeit higher than non-investors.

“To date, the firming in rental yields and return to positive price growth does not look to be enough of a draw-card for investors.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.