You might be interested in

Tech

‘Identify trading opportunities with greater accuracy’: Moomoo’s Nasdaq partnership gives investors deeper insights into Nasdaq traded stocks

Tech

InvestmentMarkets launches the ‘Google for Investors’

Health & Biotech

News

This will not come as much of a shock to many of our constant readers but I don’t consider myself as particularly insightful on markets, investing, the flow of capital or what makes an economy tick.

I’m a financial journalist by trade but in fact, aside from family and friends, my true passion is for the work of Shakespeare, the tribulations of the St George Dragons and for coffee, cigarettes and things that are cheap.

I have found all these things contribute in their own way to my understanding and interpretation of the movement of global markets.

A good journo and a decent person could do worse than being a bit of a humanist. It doesn’t even warrant a capital letter.

Humanism (start of a sentence) is a bit of a philosophical outlook on the world today which tries to put the emphasis on the qualities of an individual and the optimism of social potential. Fortunately the Americans have a Humanist Society of sorts and they do a decent job of defining it:

‘Humanism is a progressive philosophy of life that, without theism or other supernatural beliefs, affirms our ability and responsibility to lead ethical lives of personal fulfillment that aspire to the greater good.’

So there’s a bit of Utilitarianism in there, but largely it’s all about banking on the moral agency of individual human beings. Trusting that they’ll eventually do good.

In our line of work, we don’t always get glaring examples of it in action. Particularly from the very top.

And so, as I was doing my rounds earlier this week, I popped onto the Berkshire Hathaway website to see what W. Buffett’s been up to.

Aside from consistently picking and holding remarkable stocks and buying companies, for much of the current mess of a millennium, Buffett’s been studiously giving away his wealth at a rate which is – I think – mathematically impossible, to my humanities leaning brain.

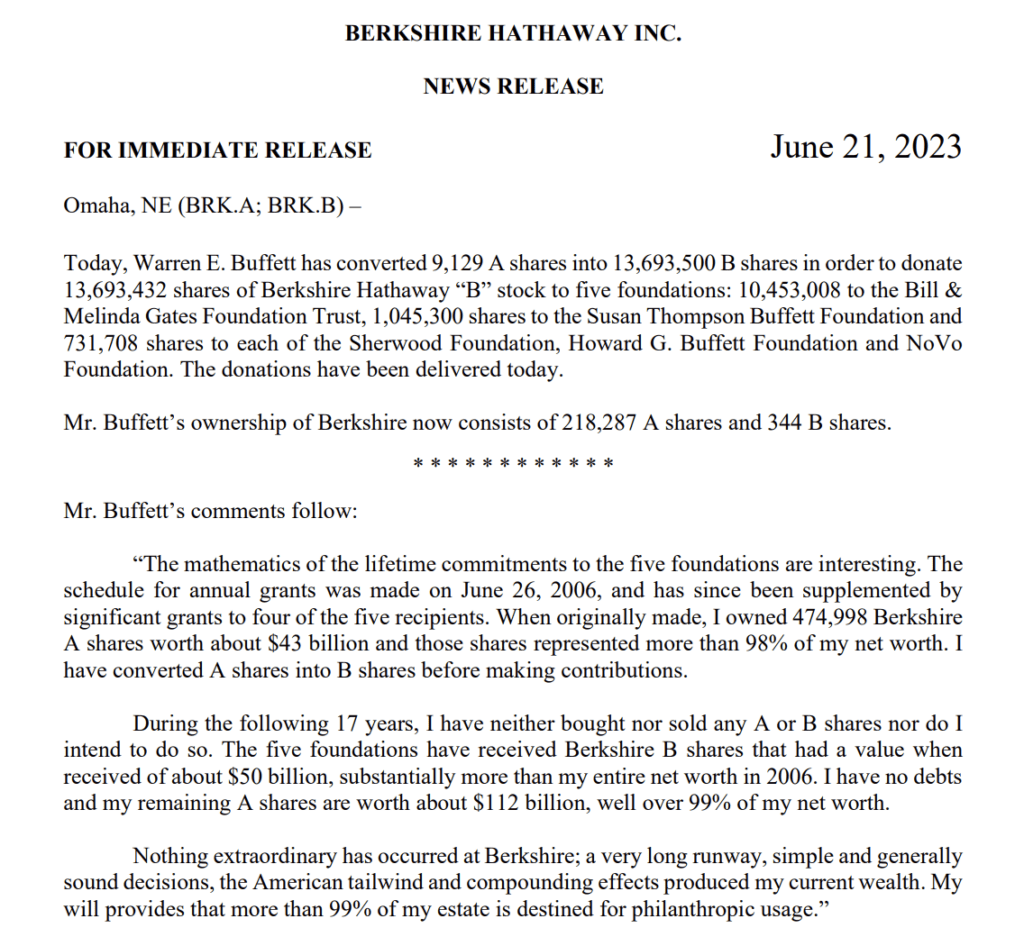

I’ll just write down what he says, and then I think I’ll add the release (below), which is typically self-effacing and without a skerrick of vanity, hubris or interesting font choices:

The value of Buffett’s Berkshire shares when he started giving it all away (circa 2006) was US$43bn or 98% of his net worth.

Over the following 17 years, he’s donated shares across four charities worth US$50 billion.

Yet, bear with me, his current Berkshire stake is worth well over US$112.5bn according to Forbes, and it represents over 99% of his net worth.

The story goes that Mrs Buffett (Astrid Menks) always gives him a few bucks when he heads off to the office in Omaha everyday, so he can stop off and get a McMuffin or two on the way, time permitting.

I thought I’d also add that time always permits.

He was born in 1930, made his first investment at 11 and apparently chugs five Cokes a day and gets that Macca’s goodness for breakfast every morning.

He’s been quoted saying he’d gladly yield up an extra year of his life to be able to eat what he wants.

A philosophy I admire. As I do this:

Lessons I’ll be taking away this w’end include:

Be nice.

Respect compound interest.

Think further about this (also rather famous) comment from the Oracle of Omaha when hitting equities:

“The stock market is a device for transferring money from the impatient to the patient.”