CLOSING BELL: Someone please give the market a nudge… I think it’s fallen asleep

News

News

It’s been a quiet day on the markets today – aside from the benchmark sinking slowly like a punctured air bed, there’s not been a whole lot of action coming in via the ASX announcements list.

So I’d like to alert our affiliates that this report might be finishing a little early this afternoon, because really – aside from a couple of big lithium announcements (which I’ll get to shortly – but if you’re super-duper keen, WA’s entrant for Market Darling of the Year Reuben Adams has all the details more than adequately covered right here), the day’s been a big ol’ bust.

However, in Entertainment News, Rolf Harris is dead – so at least there’s something to smile about today.

The benchmark fell early this morning, and then relentlessly failed to recover, dwindling slowly like my hopes of ever finding love again in the social media-driven hellscape that is being a 50-year-old alcoholic who is, quite literally, more gut than man.

We can all blame Wall Street for that sorry mess (the slumping market, I mean – not my drinking), as the looming debt ceiling crisis drags on and on and honestly, I’m falling asleep just writing about it again.

The gist of it, though, is that negotiations are ongoing, neither side wants to be the one that blinks first, and because of that US investors are quietly pooping their Pampers and trying to (even more quietlier) sell things off without looking like they’re selling things off.

Those sneaky rascals.

That led to a severe lack of urgency for local markets, and one by one the sectors figured today would be a great day to have stayed in bed to consume illicitly-sourced edibles and binge-watch Family Guy.

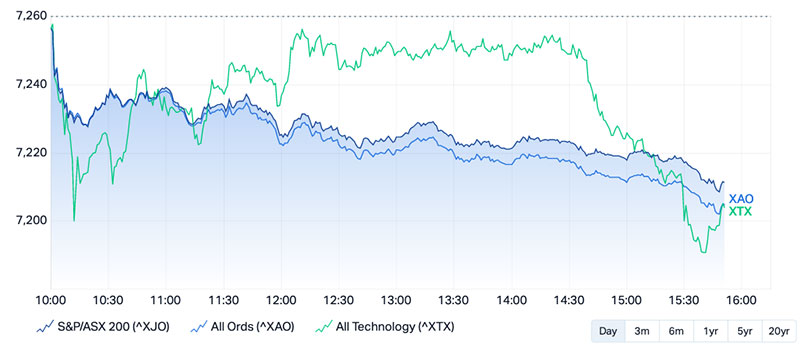

That would certainly be the case for Tech stocks today. After a horror start to the morning, the XTX All Technology index took off like a glorious, soaring ibis. Until 2:45pm, when it joined the rest of the market in the bin.

And here’s a picture!

A triumphant performance, I think we can all agree.

Anyhoo… as it was this morning, Energy (+0.6%) and Utilities (+0.25%) were the only sectors hauling things uphill for most of the day, with a late surge from Consumer Staples to +0.2% the only genuine movement.

The oncoming debt ceiling blah blah blah did help push gold prices higher today, and the Energy sector got its little pump thanks to rising crude prices.

The rest of the sectors were left stranded in the doldrums, as Materials played host to a -1.5% attack of the murky dismals, taking Health Care (-1.1%), Consumer Discretionary (-1.1%), InfoTech (-1.0%) and Real Estate (-0.9%) along for the ride.

Up the pricey end of proceedings, Patriot Battery Metals (ASX:PMT) and 70s pop sensation Leo Lithium (ASX:LLL) put on a few kilos today, up 6.4% and 5.8% respectively, because “lithium”.

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| RB6 | Rubixresources | 0.26 | 44% | 5,904,913 | $5,049,000 |

| CBR | Carbon Revolution | 0.175 | 40% | 4,942,787 | $26,489,378 |

| RMX | Red Mount Min Ltd | 0.004 | 33% | 737,929 | $6,815,553 |

| K2F | K2Fly Ltd | 0.115 | 31% | 317,892 | $15,427,702 |

| NYM | Narryermetalslimited | 0.13 | 30% | 80,850 | $3,048,750 |

| DXN | DXN Limited | 0.0025 | 25% | 300,000 | $3,442,630 |

| RML | Resolution Minerals | 0.005 | 25% | 163,000 | $5,029,167 |

| OCT | Octava Minerals | 0.155 | 24% | 431,847 | $4,645,314 |

| BMG | BMG Resources Ltd | 0.016 | 23% | 75,898,843 | $6,077,364 |

| PVL | Powerhouse Ven Ltd | 0.06 | 22% | 50,000 | $5,916,416 |

| TMX | Terrain Minerals | 0.0085 | 21% | 19,861,998 | $7,582,395 |

| ADO | Anteotech Ltd | 0.04 | 21% | 6,145,629 | $67,647,971 |

| PAB | Patrys Limited | 0.012 | 20% | 4,821,484 | $20,572,684 |

| RRR | Revolverresources | 0.13 | 18% | 127,869 | $12,248,401 |

| CSX | Cleanspace Holdings | 0.3 | 18% | 125,093 | $19,639,978 |

| LME | Limeade Inc. | 0.14 | 17% | 64,442 | $30,844,980 |

| AD1 | AD1 Holdings Limited | 0.007 | 17% | 200,000 | $4,935,414 |

| CXU | Cauldron Energy Ltd | 0.007 | 17% | 100,000 | $5,589,412 |

| PYR | Payright Limited | 0.007 | 17% | 517,265 | $5,285,311 |

| RNT | Rent.Com.Au Limited | 0.028 | 17% | 975,519 | $12,327,701 |

| EMC | Everest Metals Corp | 0.085 | 16% | 628,256 | $9,448,617 |

| MEG | Megado Minerals Ltd | 0.051 | 16% | 11,529,717 | $11,196,045 |

| DES | Desoto Resources | 0.11 | 16% | 54,090 | $5,693,018 |

| AAU | Antilles Gold Ltd | 0.037 | 16% | 1,732,768 | $18,571,177 |

| OSL | Oncosil Medical | 0.015 | 15% | 12,603,016 | $25,720,299 |

In the Small Caps Winners Circle today, this morning’s fight between Rubix Resources (ASX:RB6) and BMG Resources (ASX:BMG) to see who could bag the biggest win has been decided, with Rubix taking line honours on 41.7%.

That’s because Rubix has entered into a binding agreement to acquire 100% of the Ceiling Lithium Project in the James Bay Region of Quebec, Canada.

That’s the bit of Canada where all the cool kids, like Patriot Battery Metals (ASX:PMT) and Allkem (ASX:AKE) are hanging out for the winter, hunting for lithium and doing their darndest not to get eaten by bears.

In second place, carbon fibre wheel manufacturer Carbon Revolution (ASX:CBR) has jumped 36% on news that the company has established a new US$60 million debt program.

CBR says the loan will be put towards “new funding for further Mega-line automation and capacity expansion, general corporate and other working capital purposes of up to US$37.0 million”, while ensuring that it is fully-funded up-to and beyond the proposed merger with Twin Ridge Capital Acquisition Corp, slated for August this year.

And in third was the morning’s other main contender BMG, which closed out the session up 23.1% on news that its 20-hole RC drilling program at the Bullabulling Project in WA has bitten into some juicy pegmatite.

The results show confirmation of pegmatites in multiple holes, including 28m of pegmatite from 2m at the Ubini prospect, as well as multiple intercepts of pegmatites and felsic intrusives along the line at Purple Panda.

Here are the least best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| GGX | Gas2Grid Limited | 0.001 | -33% | 5,500,000 | $6,115,653 |

| GFN | Gefen Int | 0.005 | -29% | 361,133 | $476,701 |

| PIM | Pinnacleminerals | 0.115 | -26% | 847,595 | $3,964,125 |

| PUA | Peak Minerals Ltd | 0.003 | -25% | 18,619,600 | $4,165,506 |

| UNI | Universal Store | 3.13 | -24% | 3,357,101 | $317,624,153 |

| OLL | Openlearning | 0.03 | -23% | 440,934 | $10,446,894 |

| FGL | Frugl Group Limited | 0.007 | -22% | 18,785 | $8,604,558 |

| TNY | Tinybeans Group Ltd | 0.16 | -20% | 142,355 | $12,277,091 |

| AYT | Austin Metals Ltd | 0.004 | -20% | 566,739 | $5,079,373 |

| MTH | Mithril Resources | 0.002 | -20% | 9,701,250 | $8,422,011 |

| RBR | RBR Group Ltd | 0.002 | -20% | 120,000 | $4,046,012 |

| WSR | Westar Resources | 0.062 | -19% | 54,034,621 | $8,561,955 |

| 29M | 29Metalslimited | 0.825 | -19% | 11,115,218 | $491,693,134 |

| MEM | Memphasys Ltd | 0.017 | -19% | 255,380 | $20,149,928 |

| SRT | Strata Investment | 0.16 | -18% | 20,000 | $33,037,597 |

| CPH | Creso Pharma Ltd | 0.01 | -17% | 45,057,363 | $26,592,026 |

| REZ | Resourc & En Grp Ltd | 0.011 | -15% | 150,000 | $6,497,475 |

| POL | Polymetals Resources | 0.305 | -15% | 45,776 | $34,985,769 |

| AHN | Athena Resources | 0.003 | -14% | 2,728,428 | $3,746,636 |

| AL8 | Alderan Resource Ltd | 0.006 | -14% | 960,000 | $4,316,863 |

| SI6 | SI6 Metals Limited | 0.006 | -14% | 4,700,285 | $10,467,762 |

| IDA | Indiana Resources | 0.043 | -14% | 123,800 | $25,310,241 |

| DYM | Dynamicmetalslimited | 0.225 | -13% | 321,280 | $9,100,000 |

| 1AE | Auroraenergymetals | 0.078 | -13% | 291,566 | $11,047,876 |

| BXN | Bioxyne Ltd | 0.02 | -13% | 95,000 | $43,737,844 |

As I think I may have mentioned earlier, there was seriously not a lot of action on the ASX Announcements list today.

But worth a quick mention is Latrobe Magnesium (ASX:LMG), which is pleased to announce that it has raised $4.2M through a placement to sophisticated, professional and institutional investors.

LMG plans to spend the money to provide working capital for operating the company’s 1,000tpa magnesium demonstration plant in the Latrobe Valley, and to carry out the GHD work necessary to determine a JORC reserve on the amount of fly ash that can safely be removed from the Yallourn landfill.

Meanwhile, Vanadium Resources (ASX:VR8) has announced that the conditions precedent have been satisfied for a $5.91 million equity placement to Matrix Resources (Zhejiang) Co, a wholly owned subsidiary of Zhejiang Lygend Investment Co.

The placement is set to go after receiving Chinese Overseas Direct Investment approval, and VR8 is lined up to deliver 53,763,800 shares to Matrix at an issue price of A$0.11 per share in return for an interest of 9.99% stake in VR8 which represented a ~40% premium to the 30 day VWAP on 3 May 2023.

Zinc of Ireland (ASX:ZMI) – Acquisition announcement.

Mindax (ASX:MDX) – Update in relation to the Mt Forrest Iron Project mineral resource and the status of Norton Gold Fields Pty Limited earning conditions.

Pure Hydrogen Corporation (ASX:PH2) – Announcement in relation to developments for hydrogen fuel cell vehicles.

See? Told ya it was quiet…