Weekly Small Cap and IPO Wrap: Analysts and August end ancient blood feud as markets continue to rise

News

News

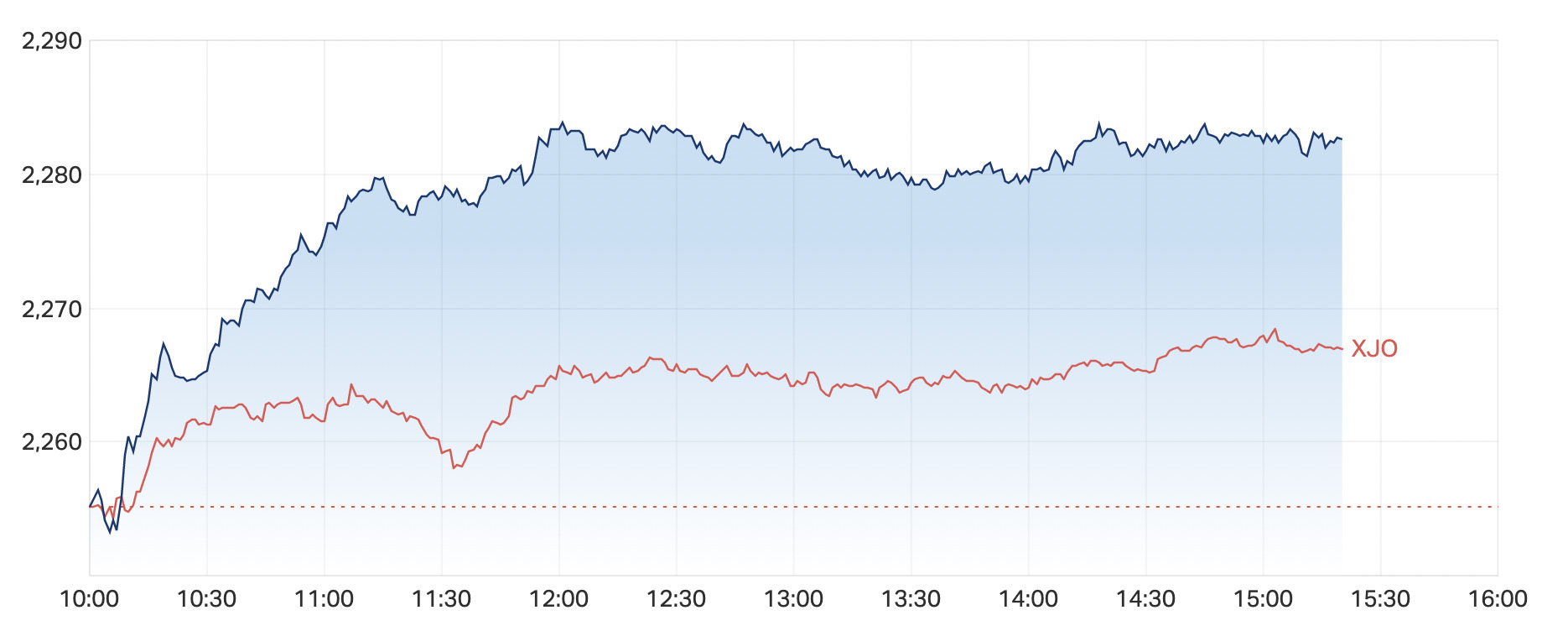

The S&P/ASX Emerging Companies (XEC) index has gained about 2.8% this week, closing out Friday at 3.30pm with what looks like a 1.2% lift. That’s a good effort as superstitious and statistically-minded analysts alike agree – August usually sucks.

Here it is, (below) giving the old benchmark a bit of a whack to end the week.

Rebounding global equity markets managed to keep the spring in its step this week, despite the bad blood between analysts and August.

Solid US earnings data and a palpable sigh of global relief that the US Democratic House of Reps Speaker Nancy Pelosi’s drop in on Taipei didn’t result in war helped buoy regional and North American markets.

Keeping the party upbeat was a slightly less hawkish, more philosophical (whimsical) word or two from the RBA, providing a little leg up to rates exposed sectors like IT, banks telco’s and healthcare, all doing their bit to offset falls in resources and energy.

But don’t break out the optimism just yet.

Dr Shane Oliver says these central banks might canoodle like doves every now and again, but they are still hawks.

In the last week a gaggle of the usual feathery Fed officials made clear the Fed is still a long way from a cup of tea and a nice biscuit.

“The Bank of England hiked rates by another 0.5% and started active bond selling, now expects inflation to peak at 13% and indicated a readiness to do more “forceful” hikes despite expecting a severe recession to start this year,” Dr Oliver said.

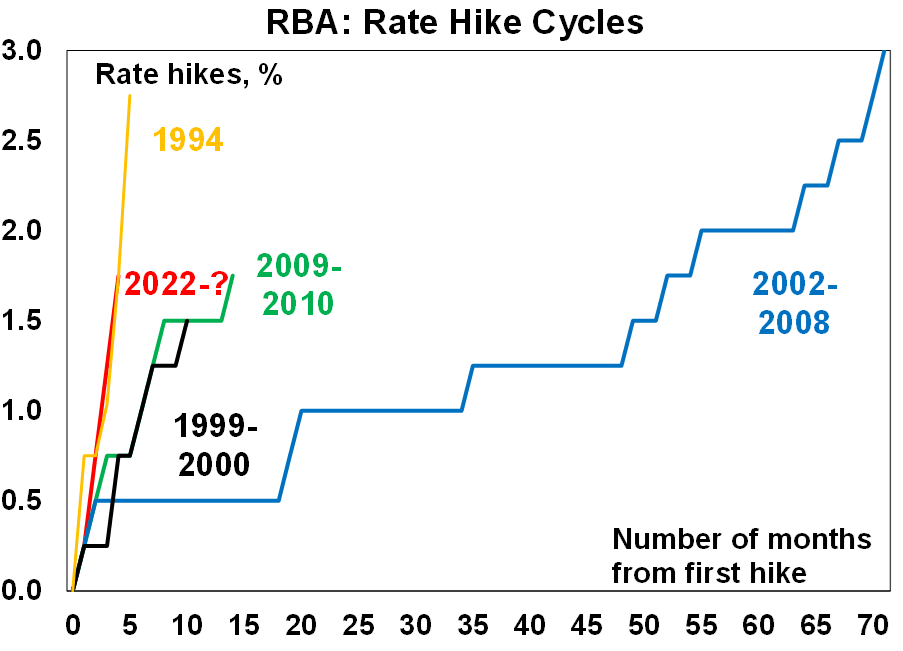

At home, the RBA hiked rates by another 0.5% – four crackers in a row now – and all the talk suggests more are in the post.

“Reflecting the low starting point and the severity of the inflation breakout this is the most aggressive RBA rate hiking cycle seen in the last 30 years, except for the rate hikes that occurred in August to December 1994 with which this cycle is comparable.”

Meanwhile, over in Crazy land, with tonight’s session still in the kitty, Wall Street’s S&P 500 is scratching together a 0.5% gain for the week, as it takes a crack at a third consecutive week of gains.

The Dow Jones Industrial Average has given away 0.4% so far, while the tech-heavy Nasdaq is the outlier, up a small cap-like 2.7% since Monday morning in New York.

US futures are a little higher, but traders are awaiting tonight’s US jobs report to get a head start on positioning as the US Federal Reserve considers which route to take path on the price of money, the cost of inflation and the state of the US economy.

At the time of writing, Futures on the Dow Jones were up 0.3%. S&P 500 futures and Nasdaq 100 futures were 0.4% and 0.35%, higher respectively.

Listed today at about 11am AEST, raising $5.5m at 20c a pop.

SUM is a battery metals explorer with four projects in WA and one in NSW. In WA its assets include the Stallion REE-uranium project, the Philips River lithium project, the Gascoyne REE-lithium projects and the Bridgetown lithium projects (under application).

In NSW, the company has the Windfall antimony project.

Summit Minerals Limited $SUM is pleased to announce that as of 11:00 am 5 August 2022 (WST), the Company commenced trading on the ASX after completing a $4.5 million initial Public Offering (Offer) which closed oversubscribed.

ASX Announcement: https://t.co/iSvGWYhABJ pic.twitter.com/UA1YLCgMWQ

— SUMMIT Minerals Ltd (@summit_minerals) August 5, 2022

I like this response too (and not only because of the explosions):

$SUM 💥

Ultra low MC #ASX #LITHIUM #REE #RareEarths Play💥Newly listed today & currently trading below 20c #IPO price almost $5.5M MC & $1Mil EV at 15.5c💥

Interesting Top20 holding 64%💥

I’m IN😎

Let’s see how we go over next few weeks🤞💥 pic.twitter.com/Wft1BASQoR

— YellowStripes💥 (@YellowStripes78) August 5, 2022

Here are the best performing ASX small cap stocks for August 1 – August 5:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| VOL | Victory Offices Ltd | 0.037 | 118% | $5,840,377 |

| PX1 | Plexure Group | 0.335 | 109% | $120,218,009 |

| CBE | Cobre | 0.175 | 103% | $29,773,262 |

| FXG | Felix Gold Limited | 0.195 | 95% | $16,633,280 |

| CDD | Cardno Limited | 0.55 | 83% | $16,405,478 |

| PGD | Peregrine Gold | 0.765 | 82% | $16,080,534 |

| RAP | Resapp Health Ltd | 0.19 | 65% | $163,342,445 |

| PAR | Paradigm Bio. | 1.71 | 63% | $344,283,861 |

| LER | Leaf Res Ltd | 0.037 | 54% | $42,281,732 |

| M2M | Mt Malcolm Mines NL | 0.1 | 54% | $4,902,080 |

| OSX | Osteopore Limited | 0.22 | 52% | $21,694,624 |

| ALT | Analytica Limited | 0.0015 | 50% | $6,920,702 |

| MEB | Medibio Limited | 0.0015 | 50% | $4,134,735 |

| RR1 | Reach Resources Ltd | 0.0045 | 50% | $7,640,203 |

| LIN | Lindian Resources | 0.2 | 48% | $178,152,873 |

| PRL | Province Resources | 0.1475 | 48% | $165,199,040 |

| ICN | Icon Energy Limited | 0.02 | 43% | $11,321,550 |

| MRR | Minrex Resources Ltd | 0.058 | 41% | $58,308,083 |

| DLM | Dominion Minerals | 0.072 | 41% | $12,426,030 |

| LNR | Lanthanein Resources | 0.022 | 38% | $18,432,163 |

| IHL | Incannex Healthcare | 0.28 | 37% | $288,525,156 |

| SPQ | Superior Resources | 0.06 | 36% | $86,762,241 |

| TYX | Tyranna Res Ltd | 0.03 | 36% | $47,503,181 |

| OBM | Ora Banda Mining Ltd | 0.068 | 36% | $87,935,187 |

| NYM | Narryer Metals | 0.135 | 35% | $3,628,625 |

| CY5 | Cygnus Gold Limited | 0.215 | 34% | $25,366,843 |

| CFO | Cfoam Limited | 0.004 | 33% | $3,669,203 |

| LSR | Lodestar Minerals | 0.008 | 33% | $12,169,061 |

| NTL | New Talisman Gold | 0.002 | 33% | $4,690,838 |

| SIT | Site Group Int Ltd | 0.004 | 33% | $4,204,981 |

| TSL | Titanium Sands Ltd | 0.016 | 33% | $18,876,888 |

| CNJ | Conico Ltd | 0.0385 | 33% | $47,550,071 |

| ST1 | Spirit Technology | 0.073 | 33% | $43,871,756 |

| GRE | Greentechmetals | 0.29 | 32% | $7,194,400 |

| ECT | Env Clean Tech Ltd. | 0.021 | 31% | $36,041,285 |

| MMM | Marley Spoon | 0.315 | 31% | $99,265,720 |

| AS2 | Askari Metals | 0.34 | 31% | $15,098,205 |

| BPH | BPH Energy Ltd | 0.017 | 31% | $9,974,224 |

| LGM | Legacy Minerals | 0.17 | 31% | $7,097,574 |

| CXM | Centrex Limited | 0.17 | 31% | $97,414,675 |

| QAL | Qualitaslimited | 2.28 | 30% | $687,960,000 |

| BVR | Bellavista Resources | 0.2475 | 30% | $8,394,427 |

| AVH | Avita Medical | 2.07 | 30% | $156,037,790 |

| SXG | Southern Cross Gold | 0.53 | 29% | $33,933,199 |

| NSB | Neuroscientific | 0.245 | 29% | $34,433,194 |

| HPG | Hipages Group | 1.65 | 27% | $204,368,563 |

| SIS | Simble Solutions | 0.014 | 27% | $5,555,326 |

| SOP | Synertec Corporation | 0.14 | 27% | $46,456,873 |

| AL3 | Aml3D | 0.099 | 27% | $19,746,660 |

| BIR | BIR Financial Ltd | 0.038 | 27% | $6,700,266 |

Cobre (ASX:CBE) has now found, not only a bunch of gold and copper this month, but also added circa 600% to the value of its shares.

Even taking a day off on Thursday for a trading halt, new set of drawers and a pipe, Cobre has still managed to climb by around 120%.

Cobre completed its $7m cap raise at what probably struck investors asa bargain 15 cents a pop for sophisticated and institutional investors.

Cobre says the offer built up significant demand.

Up about 60% this week, ResApp (ASX:RAP) is back. And Pfizer is back for RAP. And it just keeps on entertaining fans of the cut and thrust of big and slightly less big pharma. In any case, this healthcare sector saga is far from a done ditty.

Here are the least performing ASX small cap stocks for August 1 – August 5:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| CPT | Cipherpoint Limited | 0.006 | -44% | $2,383,278 |

| BMH | Baumart Holdings Ltd | 0.12 | -40% | $14,474,476 |

| OPY | Openpay Group | 0.305 | -39% | $46,692,405 |

| LVT | Livetiles Limited | 0.039 | -34% | $36,920,852 |

| EVE | EVE Health Group Ltd | 0.001 | -33% | $5,050,483 |

| SIH | Sihayo Gold Limited | 0.002 | -33% | $12,204,256 |

| VMG | VDM Group Limited | 0.001 | -33% | $6,927,661 |

| ANL | Amani Gold Ltd | 0.001 | -33% | $47,386,882 |

| OXX | Octanex Ltd | 0.012 | -29% | $3,107,732 |

| ADS | Adslot Ltd. | 0.01 | -29% | $24,249,265 |

| MTH | Mithril Resources | 0.005 | -29% | $17,581,398 |

| LBY | Laybuy Group Holding | 0.1075 | -28% | $28,030,112 |

| DUB | Dubber Corp Ltd | 0.68 | -27% | $201,352,557 |

| PEB | Pacific Edge | 0.485 | -27% | $392,937,406 |

| NET | Netlinkz Limited | 0.025 | -26% | $88,179,562 |

| PVS | Pivotal Systems | 0.14 | -26% | $22,325,275 |

| CLE | Cyclone Metals | 0.003 | -25% | $24,466,948 |

| KFE | Kogi Iron Ltd | 0.003 | -25% | $5,661,522 |

| VIP | VIP Gloves | 0.009 | -25% | $7,081,033 |

| APX | Appen Limited | 4.39 | -24% | $544,398,430 |

| ARU | Arafura Resource Ltd | 0.275 | -24% | $501,693,546 |

| SPX | Spenda Limited | 0.013 | -24% | $44,543,264 |

| MPR | Mpower Group Limited | 0.023 | -23% | $6,391,009 |

| AWV | Anova Metals Ltd | 0.01 | -23% | $14,980,942 |

| PYR | Payright Limited | 0.1 | -23% | $7,821,422 |

| SNX | Sierra Nevada Gold | 0.31 | -23% | $12,855,170 |

| TBN | Tamboran | 0.19 | -22% | $104,332,466 |

| IOU | Ioupay Limited | 0.097 | -22% | $54,293,182 |

| CG1 | Carbonxt Group | 0.115 | -22% | $24,630,723 |

| BXN | Bioxyne Ltd | 0.014 | -22% | $8,962,036 |

| FFG | Fatfish Group | 0.028 | -22% | $29,011,637 |

| NSM | Northstaw | 0.14 | -22% | $5,617,780 |

| FBR | FBR Ltd | 0.032 | -22% | $86,146,003 |

| NIM | Nimy Resources | 0.25 | -22% | $13,786,443 |

| ENT | Enterprise Metals | 0.011 | -21% | $7,182,788 |

| PKD | Parkd Ltd | 0.023 | -21% | $2,304,603 |

| CCE | Carnegie Cln Energy | 0.002 | -20% | $30,205,147 |

| DEM | De.Mem Ltd | 0.14 | -20% | $35,262,847 |

| KEY | KEY Petroleum | 0.002 | -20% | $3,935,856 |

| NMR | Native Mineral Res | 0.12 | -20% | $5,736,697 |

| XST | Xstate Resources | 0.002 | -20% | $8,037,954 |

| EWC | Energy World Corpor. | 0.049 | -20% | $127,798,600 |

| SNG | Siren Gold | 0.225 | -20% | $18,576,783 |

| HMX | Hammer Metals Ltd | 0.066 | -20% | $53,000,650 |

| SHE | Stonehorse Energy Lt | 0.017 | -19% | $11,635,396 |

| MAP | Microbalifesciences | 0.255 | -19% | $58,844,938 |

| ASO | Aston Minerals Ltd | 0.081 | -19% | $92,423,068 |

| TGM | Theta Gold Mines Ltd | 0.077 | -19% | $40,166,596 |

| KAL | Kalgoorlie Gold Mining | 0.13 | -19% | $9,416,498 |

| AGH | Althea Group | 0.13 | -19% | $41,762,222 |