Closing Bell: Mrs Pelosi goes to Taipei; Pfizer comes back for ResApp

Via China

- The ASX 200 is down, the XEC surged late, up 1.5%

- Tech stocks rise, Cons discretionary and energy dragging

- US Futures flat, Chinese markets higher on Pelosi goes to Taipei day

Ahead of the close here in Sydney, US Futures connected to the Dow Jones, S&P 500 and the tech-heavy Nasdaq are trading slightly higher or flat. US markets skipped a little lower following a triple threat of Federal Reserve presidents talking up chances of further rate hikes.

The XEC Emerging Companies index is higher. The Benchmark ASX 200 is lower.

However, the dominant theme looking forward is now a Chinese response to what the government sees as a violation of national sovereignty. In the wash up, the one thing which really bothers China is trespassing.

The chatty Speaker from the US House of Reps, Nancy Pelosi’s will-she-won’t-she drop-in to Taipei weighed on US and Asian investors, fretting over already tense US-China relations. But that uncertainty at least has been cleared up.

How is the Chinese Communist Party (CCP) taking it?

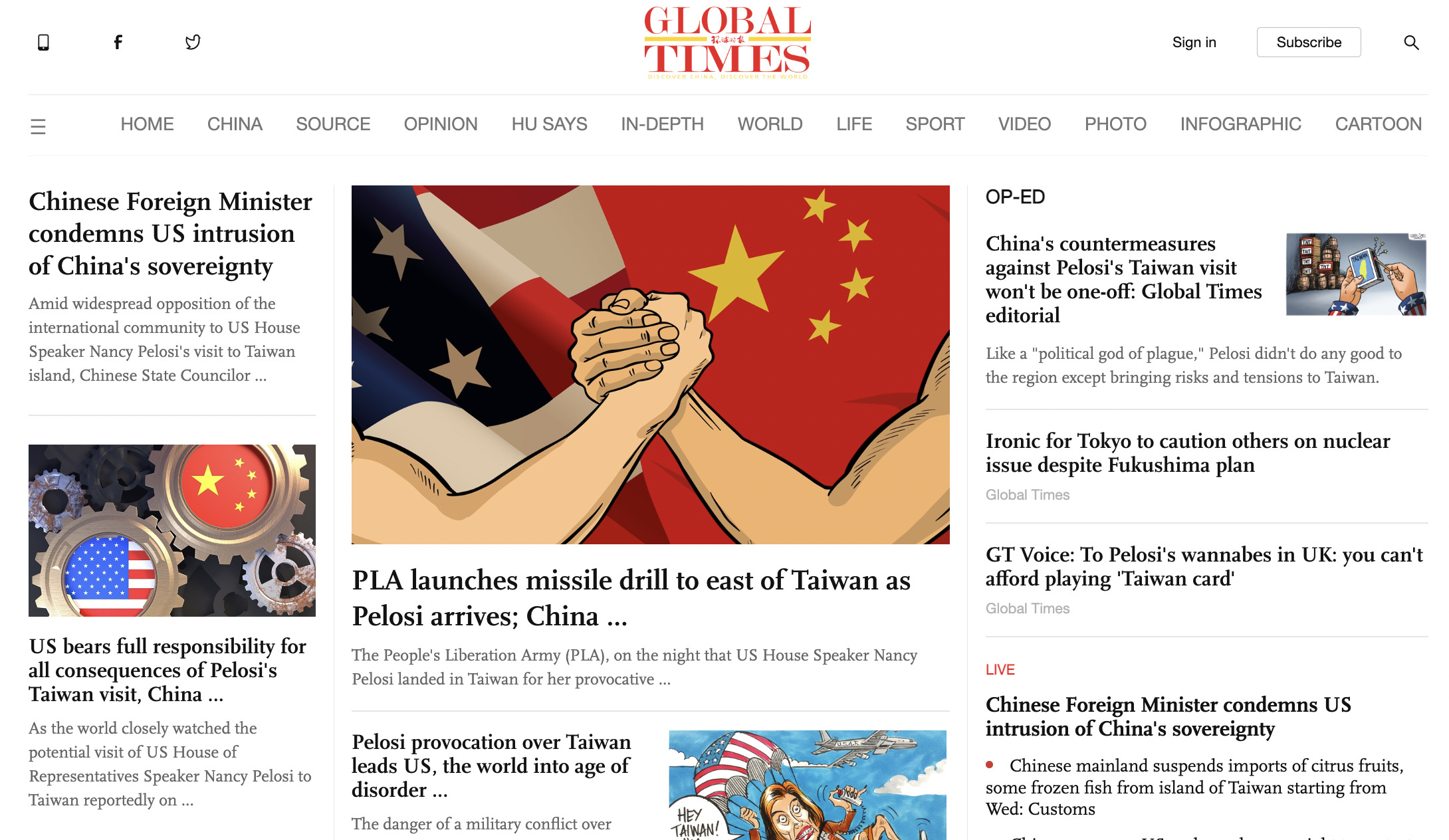

This is the landing page of the Party-run English language Global Times. And if tis is what’s happening on the outward looking news site, imagine the hammering the States are getting via the on-message local sites. Sina.com is furious.

The Chinese People’s Liberation Army is on high alert and will take a series of targeted military operations in response to resolutely safeguard China’s sovereignty and territorial integrity, and resolutely thwart the interference by external forces and the separatist schemes for “Taiwan independence”. — China Ministry of Defence spokesperson Wu Qian

It is literally the only thing on their minds.

China had spent weeks warning her not to make the trip. With President Xi Jinping lining up his ‘unprecedented’ crack at a third – and likely endless – term in power, I am pretty sure there’ll be ‘unprecedented’ blowback, and that will impact both US markets and our China-exposed regional markets – which is everyone, but us very much.

Despite the swing away from being best buds toward the trading insults and the punitive restrictions on critical exports like coal and communicating nicely, as much as 40% of our entire national exports still find their way to China. One fifth of our imports come out of China.

Even when we’re wholly on the nose, Chinese nationals remain the lion’s share of international students and inbound tourists.

I’m mentioning this because while the closing bell has rung here, it might be best to keep the peal of Mrs Pelosi’s uninvited visit in the back of your trading mind.

That said, Hong Kong stocks have meanwhile found their feet following Tuesday’s Pelosi-related retreat, though the fallout for China-US relations is likely to play out first on both Hong Kong and mainland markets.

The Hang Seng Index was up 0.7%, while the Shanghai Composite and Shenzhen Composite Index also rose late.

At home, retail sales volumes lifted for a third straight quarter, according to the latest crunching out of the Australian Bureau of Statistics, to a new record peak in June, with decent spending in hospitality and clothing behind an inflation-adjusted 1.4% pick up from the previous quarter, beating market forecasts of 1.2%.

On the local bourse IT stocks led. The consumer discretionary sector did well, while the recent rises across the energy sector left most of those stocks under mounting pressure.

With a looming OPEC+ zooming meet in a few hours and re-bubbling fears of a re-softening global economy, oil prices are in a glass-half-full holding position.

ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks for today [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume |

|---|---|---|---|---|

| VOL | Victory Offices Ltd | 0.035 | 106% | 1,517,415 |

| RAP | Resapp Health Ltd | 0.18 | 50% | 30,226,656 |

| MEB | Medibio Limited | 0.0015 | 50% | 2,535,324 |

| BSX | Blackstone Ltd | 0.24 | 26% | 9,414,695 |

| PRM | Prominence Energy | 0.0025 | 25% | 2,133,566 |

| PSL | Paterson Resources | 0.036 | 24% | 1,693,973 |

| IPD | Impedimed Limited | 0.085 | 23% | 2,383,675 |

| FRM | Farm Pride Foods | 0.2 | 21% | 40,039 |

| AVH | Avita Medical | 2.07 | 21% | 1,002,775 |

| FHE | Frontier Energy Ltd | 0.3 | 20% | 576,608 |

| MMM | Marley Spoon | 0.3 | 20% | 555,532 |

| AL3 | Aml3D | 0.093 | 19% | 1,523,471 |

| NFL | Norfolk Metals | 0.155 | 19% | 46,221 |

| PKO | Peako Limited | 0.02 | 18% | 1,791,978 |

| PVE | Po Valley Energy Ltd | 0.08 | 18% | 1,689,065 |

| ATX | Amplia Therapeutics | 0.115 | 17% | 261,842 |

| CPV | Clearvue Technologie | 0.305 | 17% | 735,408 |

| CAV | Carnavale Resources | 0.007 | 17% | 34,293 |

| MRR | Minrex Resources Ltd | 0.058 | 16% | 16,941,564 |

| GFN | Gefen Int | 0.1275 | 16% | 3,500 |

| ASP | Aspermont Limited | 0.022 | 16% | 623,061 |

| DEV | Devex Resources Ltd | 0.33 | 16% | 842,373 |

| IXR | Ionic Rare Earths | 0.052 | 16% | 23,656,612 |

| ST1 | Spirit Technology | 0.069 | 15% | 319,976 |

| SHP | South Harz Potash | 0.115 | 15% | 749,942 |

ASX-listed additive manufacturer AML3D (ASX:AL3) has surged after sharing the news its got some kind of world-first accreditation from what appears to be a marine and industrial classification body.

AML3D MD Andrew Sales calls it a “game changer,” and something rather similar to Lloyds Register accreditation.

Wait, late mail: Gregor Stronach says AL3’s “enormous thumbs up” comes from “DNV, the world’s leading Marine & Industrial Classification Society, in the shape of the first Additive Manufacturing Facility accreditation with wire-feedstock.”

Gregor still: The accreditation encompasses an “Approval of Manufacturer” (AoM) certificate, which tells the world that the company’s AML3D’s WAM® technology meets the enhanced ‘Class certification’ standards for Integrity and Quality, that are applied to critical components in the Oil & Gas and Marine industry, which is both a big deal and a feather i AML3D’s already plumage-heavy cap. Thanks mate!

“(This) accreditation allows us further access into the marine markets for high-value essential components,” Sales said. “DNV offers a broad range of customers including a heavy focus on the oil & gas sector, a key growth target for AML3D.”

The Adelaide-based company’s shares were trading almost 30% higher after lunch.

As Gregory pointed out earlier today, the ResApp (ASX:RAP) saga is far from a done ditty. I don’t even know what I’m saying it’s so exciting.

The no-good-dirty-Pfizer-deal which in it’s latest iteration was a no-go and all-but scuttled ResApp’s value, has now the firm says, been amended. Again.

(Ed: I can’t pick the language but it has enormously improved the film’s dialogue and Mel’s mullet)

This morning’s ASX announcement has Pfizer bumping up “the proposed consideration to $0.208 per ResApp share, matching the preferred value and within the assessed value range of $0.146 to $0.279 per ResApp share determined by BDO Corporate Finance”.

RAP’s share price were 57% before lunch.

Farm Pride Foods (ASX:FRM) has gone on an apparently unwarranted 18% tear, continuing the see-saw cycle it’s been on since the 4th of July, and skin graft bio-tech wizards Avita Medical (ASX:AVH) has also gained exceptional ground.

Time is a factor, otherwise I’d make some calls and find out what in heaven’s name is going on at the troubled, struggling, wobbly (former Vic State Premier Steve Bracks-backed) co-working hub operator Victory Offices (ASX:VOL).

This hugely indebted business has been cutting its bottom line to the quick to try and staunch the blood loss, but for now, it’s ahead about 70%. There’s a story there. I don’t know it yet.

ASX SMALL CAP LAGGARDS

Here are the best performing ASX small cap stocks for today [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume |

|---|---|---|---|---|

| GLV | Global Oil & Gas | 0.002 | -33% | 2,553,046 |

| ANL | Amani Gold Ltd | 0.0015 | -25% | 2,851,175 |

| CLE | Cyclone Metals | 0.003 | -25% | 3,089,082 |

| OXX | Octanex Ltd | 0.012 | -20% | 5,047 |

| MYG | Mayfield Group Ltd | 0.36 | -20% | 931 |

| CCE | Carnegie Cln Energy | 0.002 | -20% | 600,207 |

| MGG | Mogul Games Grp Ltd | 0.002 | -20% | 104,999 |

| FGL | Frugl Group Limited | 0.015 | -17% | 8 |

| ADS | Adslot Ltd. | 0.01 | -17% | 784,953 |

| BAT | Battery Minerals Ltd | 0.005 | -17% | 2,087,816 |

| HFY | Hubify Ltd | 0.037 | -16% | 77,260 |

| TMR | Tempus Resources Ltd | 0.062 | -15% | 2,743,798 |

| HAR | Harangaresources | 0.145 | -15% | 5,210 |

| OLY | Olympio Metals Ltd | 0.12 | -14% | 5,662 |

| RR1 | Reach Resources Ltd | 0.003 | -14% | 491 |

| MRI | Myrewardsinternation | 0.052 | -13% | 201,507 |

| NGY | Nuenergy Gas Ltd | 0.027 | -13% | 13,100 |

| PX1 | Plexure Group | 0.34 | -13% | 193,829 |

| ADX | ADX Energy Ltd | 0.007 | -13% | 15,809,288 |

| M8S | M8 Sustainable | 0.007 | -13% | 935,790 |

| TMX | Terrain Minerals | 0.007 | -13% | 840,461 |

| W2V | Way2Vatltd | 0.035 | -13% | 93,380 |

| ZNC | Zenith Minerals Ltd | 0.29 | -12% | 798,141 |

| BVR | Bellavistaresources | 0.22 | -12% | 20,000 |

| GCX | GCX Metals Limited | 0.044 | -12% | 776,535 |

WHAT YOU MAY’VE MISSED ‘COS IT HAS BEEN BUSY AND YR PHONE IS ON SILENT

Mallee Resources (ASX:MYL) chairman Jeffrey Moore has written to existing investors, with an explanation of what the company’s after with its capital raising efforts – and despite how creepily it felt like we were reading someone else’s mail, there’s juicy goss in there that we just can’t wait to share.

Mallee wants to put another $20-70 million in the war chest to bring its recently acquired Avebury Nickel Sulphide Project in western Tassie online, lickety-split.

Moore says Avebury is a “transformative” acquisition and prospect for the company, and existing Mallee shareholders have a chance to nab future nickely goodness at a keenly-priced $0.70 per share.

Frontier Energy (ASX:FHE) has had a big couple of days, celebrating a major milestone this morning with news that its secondary listing on the OTCQX (OTC) market in the United States has been completed and the Company has commenced trading.

Frontier says the US listing was undertaken to enhance the visibility and accessibility of the company to North American investors, with the listing allowing potential North American investors to both trade and settle during US trading hours in US dollars.

“North America provides the world’s largest pool of investors and from my experience OTC is the simplest and most cost-effective way, for both the Company and these investors, to buy shares in their own time zone and currency,” Executive Chairman Grant Davey said.

“With a number of key studies nearing completion at a time when the world needs renewable energy solutions more than ever before, this is promising to be an exciting year for the Company.”

He’s not wrong – news of the listing came on the heels of the company’s announcement that its secured exclusive options (“Land Options”) to acquire land parcels adjacent to the Bristol Springs Project, 120km from Perth in SW Western Australia.

The 651 hectares is “strategically valuable” to Frontier in providing enough room for the company to build out a 500Mw solar energy array to power its green hydrogen strategy.

TRADING HALTS

Orica (ASX:ORI) – Orica’s working on a corporate transaction and associated equity raising, which sounds super-complicated so we’d better leave give them some time and space to get it done.

Zimi (ASX:ZMM) – Zimi wants some Stimmy, in the form of a capital raise.

Arafura Resources (ASX:ARU) – Capital raise, and possible werewolf convention. Aruuuuuu!

Cobre (ASX:CBE) – Capital raise, which is possibly because they just got the champagne bill from the company’s post-price-jump knees-up, after its galaxy-sized 592% rocket ride this month.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.