FREE WHELAN: July was pretty fly, it’s August we must not trust

Experts

In this Stockhead series, investment manager James Whelan from VFS Group offers his insights on the key investment themes and trends in domestic and global markets. From macro musings to the metaverse and everything in between, Whelan offers his distilled thoughts on the hot topic of the day, week, month or year, from the point of view of a professional money manager.

Firstly something light-hearted after the weekend’s disturbing revelations that a very wealthy American civilian named Trump buried his ex-wife on his golf course for a tax-break. In his defence, she had died.

And also in his defence, but perhaps less so: New Jersey cemeteries are treated differently for tax purposes.

So…

Outstanding tweet.

(Ed: Actually it’s worth checking out Molly Jong-Fast’s Daily Beast US politics podcast The New Abnormal. It’s American, so you might have to pay or … get buried somewhere sporty.)

A quick around the grounds:

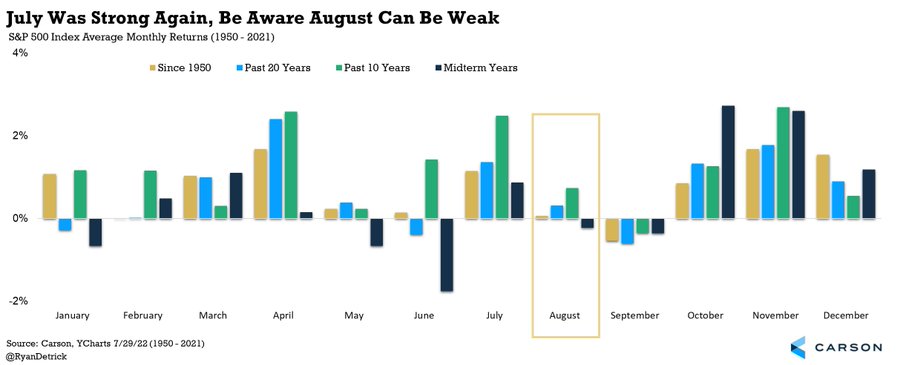

After an absolutely thumping July, we’re now staring down the barrel of an historically weak month, especially in midterm months. Like Lord Voldemort, we can’t name this month without looking around nervously like someone farted.

In July, the S&P 500 up about 9%, the Nasdaq up about 12% and the David Jones too, so some breathing space wouldn’t be out of order.

Voldemort and October are the usual pullbacks months and then get set for a big Christmas rally as money is thrown at anything that moves in order to get votes.

But if this year has shown us anything it’s that all bets are off. So remember: don’t get rash and splash cash.

These poetry workshops really have been excellent value.

I held off on going live with any long trade on European luxury.

The FX risk was too real and the capabilities to hedge it weren’t possible. The only options I had were in USD or in Euros listed in Europe or in London. Going long either of those currencies vs the AUD in a rallying market is a mug’s game and since a big part of the thesis is a Chinese reopening (inherently bullish AUD)… I can’t be a part of it.

I’ll keep looking, but still love the theme.

A few postings ago I mentioned the key signal we were looking for in this US reporting season was for bad news (or not great news) to be reacted to as not-bearish and I can’t find a better way of expressing that then this lovely little chart:

Courtesy Bloomberg

We’re a little over halfway through earnings and there’s only been about 25% of companies miss/not beat expectations or guidance, but it’s clear the market was overly bearish and due a bit of a trot.

We got one.

Hey. We also got one of these: It’s “a technically two consecutive quarters of negative GDP growth but it’s not a recession.” The meaningless debate is thick and fast and so very last week and I’m sick of it.

Fact is the White House is right. It actually needs to be declared as one and let’s be honest there’s a lot of data in the States showing that it’s not even close to a recession. I choose the reality I want and that’s the one I’m shooting for. We had Kyle Rodda on the podcast on Friday and discussed this and many other issues.

The other one discussed is a massive “known unknown” of the Fed’s balance sheet which Kyle remarked was the biggest topic his guests were talking about that had no real clear outcome.

The Fed actually can’t reduce it below a certain level back to its previous level without a bunch of things breaking. But please listen to the podcast and it’s a nice little warning to be aware of.

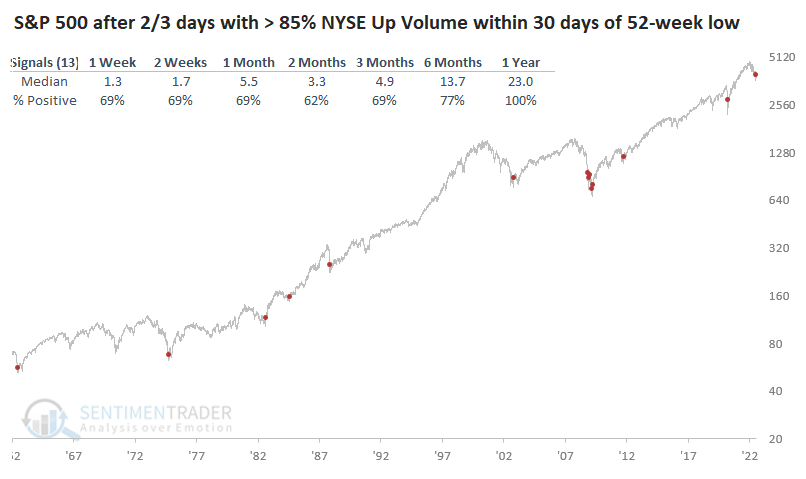

Aside from that we may well be on the precipice of a pretty solid rally and I like to look at Sentiment Trader for these titbits.

When the S&P 500 is up two out of three days with over 85% up volume within 30 days of a 52-week low it’s always up a year later. We hit that stat recently and it’s never been wrong.

Also corporate insider buying is showing clear signs of coming back into the market. Execs are buying their own stocks. They’re usually early but they’re never wrong.

Russia-Ukraine doesn’t get massive, a mild European winter, a little midterm buying, China waking up… we may have something here for Christmas.

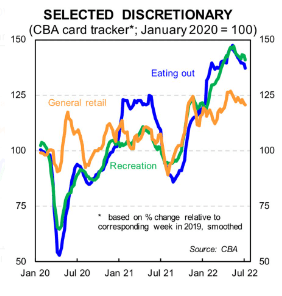

Locally there is a trade shaping up as we approach the cliff (or peak) of borrowers rolling off their fixed term rates into variable. That will put pressure on spending patterns and indeed already has. Thanks to friend of the show Gareth Aird for reminding me CBA has the best data on this published every two weeks.

There’s some clear shorting that can be done on selected stocks based on this trend which I believe will not stop any time soon. HVN? NCK? PMV?

I’ll come up with something soon.

If Nancy’s plane goes missing though and somehow triggers WWIII however…

Happy to hold and continue buying quality on dips.

All the best,

James

The views, information, or opinions expressed in the interview in this article are solely those of the writer and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.