Kick Back: The 10 biggest stories you might have missed on Stockhead this week

Happy AND winning? Not something you see often. Picture: Getty Images

Normal service resumes. As much as normal gets in 2020 anyway.

It was the week in which we got the vaccine but didn’t get the vaccine. Which made for an interesting ride for those of us who wanted the vaccine but actually didn’t want the vaccine.

In case you missed it, Asaad Hanna spoke for all of us:

The #vaccine is coming… no more work from home!!, no more online studying!#COVID19 pic.twitter.com/pe8AZsMuOw

— Asaad Sam Hanna (@AsaadHannaa) November 10, 2020

Perfect.

Here’s a few other important things you might have missed this week.

1. Here’s what the Kwinana refinery closure means for Australia’s fuel security

Our most popular story this week is actually from last week, but it’s taken you lot a full seven days to cotton on. We (Australia) moved a little bit closer to something like a fuel crisis. Maybe.

BP is closing its Kwinana oil refinery. It’s the last oil refinery in WA, and Australia’s biggest. It’s the fifth to have closed since 2009. And there are now only three left.

Kwinana will become an “import terminal”. So rather than producing our own fuel, we’re becoming increasingly dependant on importing it from newer, larger, more efficient Asian refineries.

Australia generally holds 20 days’ worth of diesel fuel in reserve, while for jet fuel and petrol supply levels are around 27 days and 25 days. With Kwinan’s closure, we’ll reduce our home soil fuel production capacity by nearly 30 per cent.

Yes, this is a fuel security story.

2. Money Talks: 3 ASX stocks trading well below their fair value

Let’s stick with oil a bit longer, because Morningstar has released its Best Stock Ideas for November which highlights ASX stocks trading below their fair values, and it includes Woodside Petroleum (ASX:WPL). WPL is one of the three stocks Morningstar is watching and waiting for to come back off its early COVID-19 lows.

When it does, Morningstar expects a spicy 61 per cent pop. But it is a bit of waiting game, because a major factor in any rise is the oil price. Basically, it has to hit $60 per barrel to get US shale producers up off their arses and help grind the post-COVID recovery into action.

We’ve got a couple more from Morningstar to watch here.

3. eToro’s Top 10 Trades: Aussies walked away from Tesla and FAANGs in October

Ho hum. Here we go again. The most traded overseas stock for Australians in October was… wait.

Nio?

Demand for the Chinese EV maker’s shares increased by 35 per cent in October compared with September, according to data compiled by trading platform eToro.

If you’d got on Nio back in January for $US3.72, you’d be riding high about 1019 per cent up right now.

But it was also running in third place with a bullet, so not a complete surprise. The second biggest mover was American internet content provider Fastly (NYSE:FSLY), which leapt from 31st place in terms of investor popularity to 5th place in October. You might know it from such hits as the cloud computing services provider to ByteDance, which once operated TikTok.

But the biggest ‘kaching’ for October goes to Palantir. Investor interest in the freshly launched data analytics company blew up 857 per cent in October.

Here’s the October rankings, where Aussies finally went cold on the FAANGs:

| OCTOBER RANK | COMPANY | % CHANGE - MONTHLY | SEPTEMBER RANK |

|---|---|---|---|

| 1 | Nio | 35% | 3 |

| 2 | Tesla | -58% | 1 |

| 3 | Apple | -34% | 2 |

| 4 | Amazon | 13% | 4 |

| 5 | Fastly | 551% | 31 |

| 6 | Advanced Micro Devices | 46% | 10 |

| 7 | Microsoft | -26% | 6 |

| 8 | -21% | 7 | |

| 9 | Palantir Technologies | 857% | 70 |

| 10 | Nvidia | -50% | 5 |

4. IPO Watch: There are still 20+ more new listings to come on the ASX in 2020

If you’re kicking yourself for missing Palantir because IPOs are your thing, settle. You’ve still got about 20 presents to unwrap before the ASX closes for Xmas.

At least 19 IPOs, in fact, according to the ASX, raising $689 million between them. Since this post was written, we’ve seen the launch of Duke Exploration (oversubscribed, healthy rise) and tradie directory hipages (meh, but not down).

The biggest happens on Monday, when yoof fashion chain Universal Store Holdings hits the bourse with a $147.8 million raise behind it. But if you’re looking for something a little different, there’s some forays into sectors that have proven popular in 2020. That includes a tech lender (Harmoney), a kaolin play (WA Kaolin) and our office favourite, East 33 (Sydney Rock Oysters yes Sydney Rock Oysters).

Here’s the IPO calendar you’re looking for.

5. Where to next for gold? We asked a $US17 billion asset manager

A famous Dutchman once said:

So what happens next, when it feels like we’re around the top? Honestly, we’ve got no idea. Sorry.

Rick Rule does though, because he’s been watching it for 40 YEARS. And he’s head of the US division of $US17 billion asset manager Sprott Inc.

Here’s why Rick thought the US election was a “non-event”, why US treasuries perhaps aren’t safe anymore, and whther the gold price will do exactly as it has done all his life – “responded mostly to fear”.

All you goldbugs liked this headline too:

But that’s fine, because it’s true. They really are, while everyone else is off in Chile.

6. Iron ore prices hurtle to a seven-year high, coking coal prices lag on quotas

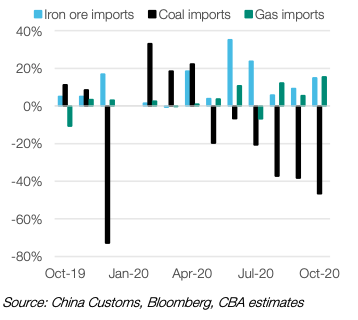

Meanwhile, much less sexy people are still loading up on iron ore, as they have done all year. Iron ore prices traded this week at $US121.75 per tonne, up $US4.90 per tonne on a week ago. That’s their highest point in nearly seven years, in case you haven’t been paying attention.

As usual, it’s linked to demand from China, as this chart shows:

It’s not been a good year for coal, has it?

7. Barry FitzGerald: Biden time? Uranium battlers faintly feel the whoosh factor

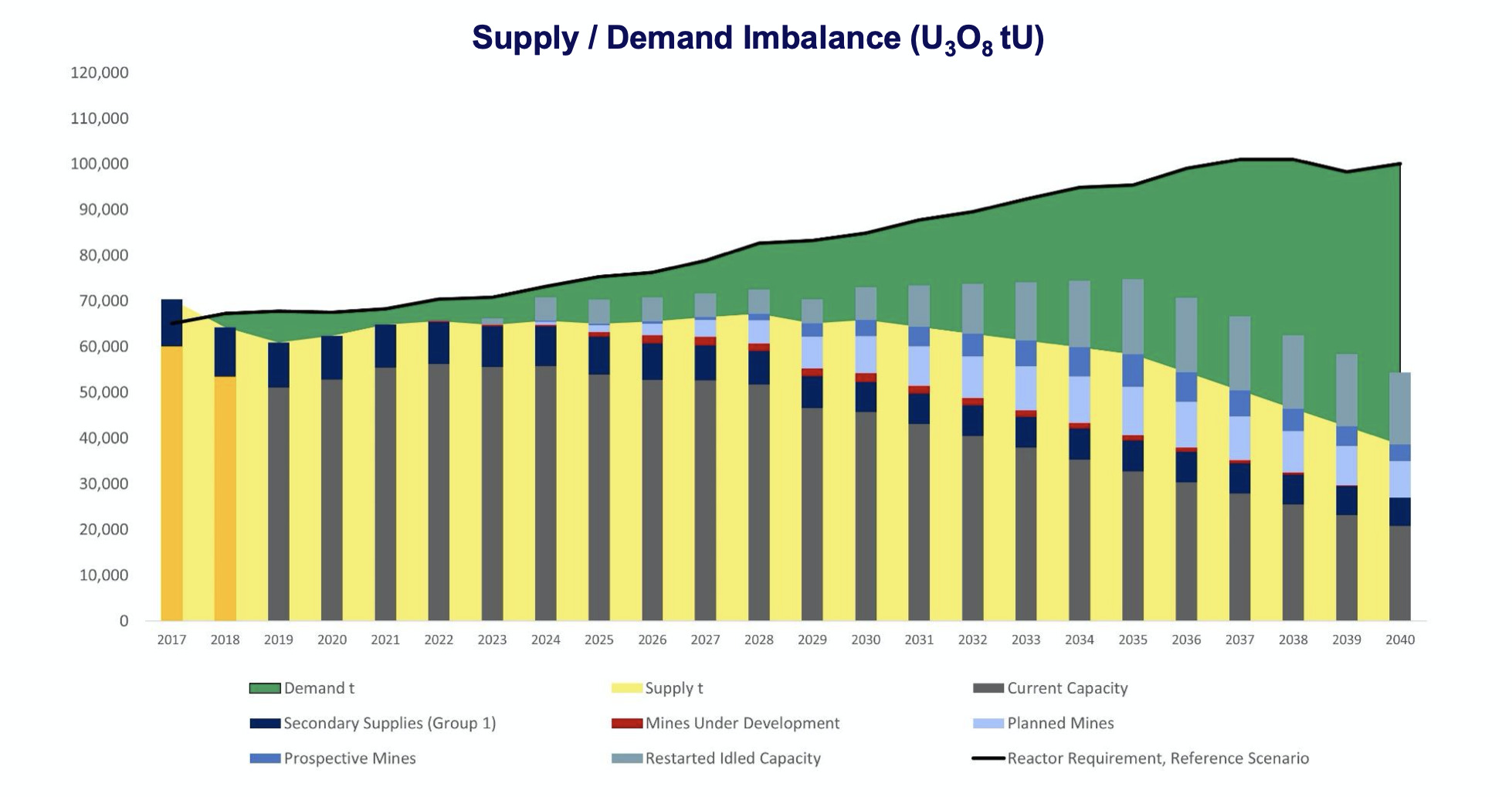

Garimpeiro’s now free from lockdown and enjoying IRL conversation with organic beings other than his cat. One thing hasn’t changed though – the price of uranium, which remains a good $US30/lb short of the incentive price – the price considered necessary to encourage new mine developments to meet long-term demand.

But the Western world’s biggest uranium group, Canada’s Cameco, has made a point of telling whoever will listen that Greta Thunberg “has not gone away”. Note – China has a goal of 25 million EVs on the road by 2030 and wants to be carbon neutral by 2060.

Cameco boss Tim Gitzel quotes a “clan of scientists” in China claiming that goal would require a quadrupling of nuclear power capacity – about “200 reactors for China alone”.

Noted small cap company-maker Tolga Kumova’s ears are pricked:

Is it just me or does it feel like #uranium is going to be flavour of the month again? pic.twitter.com/E20c2RskM7

— Tolga Kumova (@KumovaTolga) November 12, 2020

Here are the dozen or so ASX uranium juniors waiting for, as Barry calls it, the “whoosh” factor.

And if you need us to draw it for you, well… The Nuclear Fuel Report can do it better than we can:

That’s in this special report on why Biden and BoJo are about to change the yellowcake narrative.

8. Confessions of a Day Trader: Who doesn’t love a day – or a week – at the races?

Phew. After a ropey second week where even Tooheys New was off the Friday drinks table, our resident trader actually managed to pick a few bottoms.

Until Friday, that was, when his favourite stock FMG failed to bounce, dragging our kitty down from an exciting $327 for the week to a passable $197.

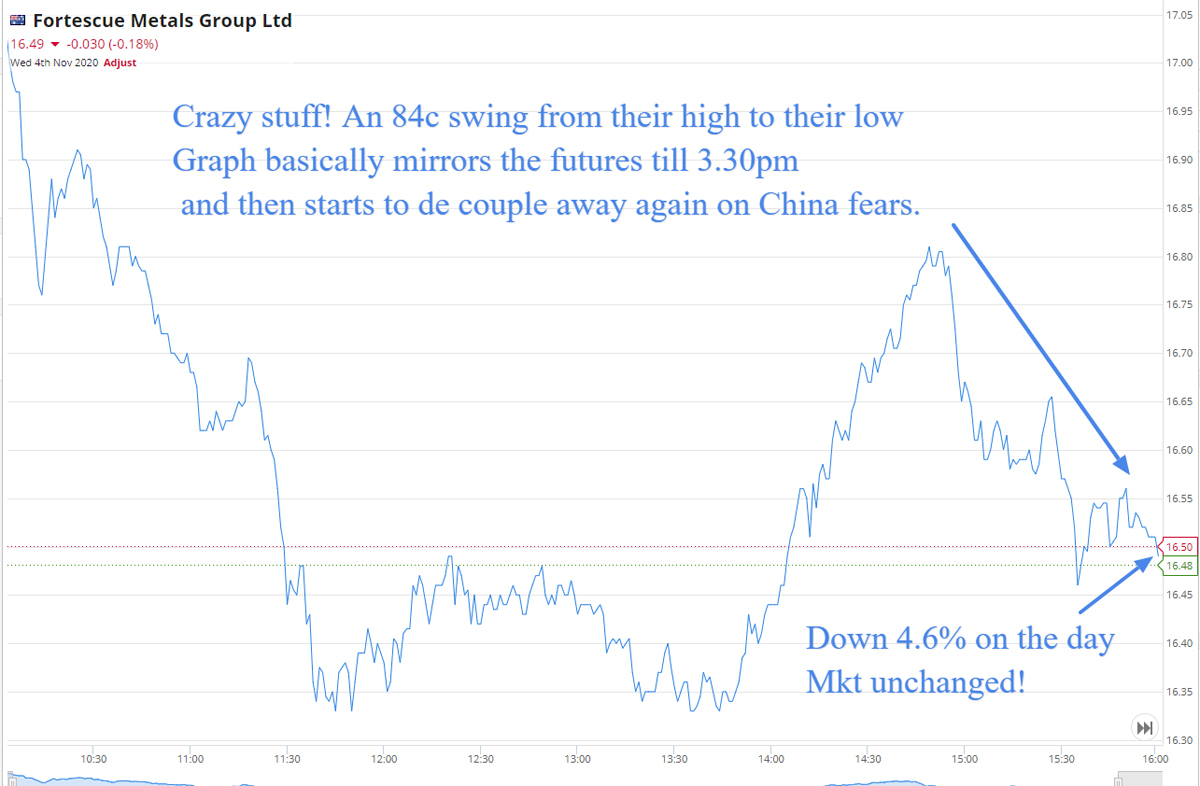

But it was a mental week – Cup Day and that US election within 48 hours, plus the scrambling for days afterwards. This is the kind of stuff that gets a day trader’s pulse up:

This week we learn a lot about selling at the close because “starting each day with only cash as your position is that it means that opportunities always appear at some point”. Also – why to keep your book closed on Cup Day… Tune in Monday to see how Bottom Picker fared in all the forth and bubble following the Covid vaccine announcement.

9. Directors’ Trades: Lots of multi-million dollar trades, but this $15m plunge took the cake

We’ll keep this one brief, because the money says it all.

If you’re a firm believer in directors who are firm believers in their own stock, pay attention. Biotech PYC Therapeutics (ASX:PYC) is fighting various eye disease with “Cell Penetrating Peptides”. Its lead program targets retinitis pigmentosa, which causes vision loss.

The program is still at the pre-clinical stage, but PYC is hoping to get to human trials in the coming months.

So is chairman Alan Tribe – he snapped up a $15 million purchase of shares in PYC’s $55 million rights issue.

That’s the level of skin in the game there’s only one kind of respect for – the Clint Eastwood kind:

10. Australia’s cannabis sector can reach further highs in 2021 – here’s how it’ll happen

Finally, remember cannabis?

Americans do – they appeared to vote overwhelmingly for Joe Biden, who has pledged to decriminalise recreational cannabis at a federal level.

Another five states individually voted to make cannabis legal, namely, New Jersey, Montana, South Dakota, Arizona and Mississippi – although the latter was only for medical cannabis.

This now means one-third of Americans will live in places where marijuana is legal for all above 21. That sounds like a lot.

And here in Oz, f further, largely unheralded milestone for our cannabis sector popped up. Private health insurer HIF announced it will pay rebates for medicinal cannabis across all but one of its Extras policies. About $105 back per script, in fact.

Get in.

BONUS ITEM: Is it possible? Could there be some validation for the long-suffering “safe haven” cryptoheads. Throughout all the US election ructions, Bitcoin finally moved out of lockstep with its main crypto counterparts this week – here’s the price action from eToro in October:

| October rank | Cryptoasset | % change trading activity (m/m) | September rank |

|---|---|---|---|

| 1 | Bitcoin | 16% | 1 |

| 2 | Ethereum | -49% | 2 |

| 3 | Cardano | -16% | 5 |

| 4 | Ripple | -33% | 3 |

| 5 | Tron | -55% | 4 |

| 6 | Tezos | -42% | 6 |

| 7 | Neo | -43% | 7 |

| 8 | Litecoin | -16% | 9 |

| 9 | IOTA | -53% | 8 |

| 10 | Stellar | -31% | 10 |

The game is afoot. Have a good weekend, and thanks for being such a massive Stockhead.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.