eToro’s Top 10 Trades: Aussies walked away from Tesla and FAANGs in October

News

News

Australian investors lost some of their appetite for Elon Musk’s Tesla and several FAANG stocks in October and bought other tech and EV stocks instead.

FAANG is the acronym for several leading tech stocks including Facebook, Amazon, Apple, Netflix and Google that trade on the US Nasdaq exchange.

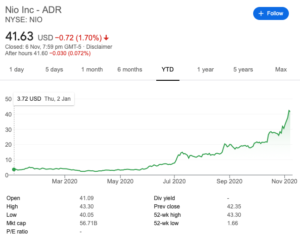

The largest gainer in terms of investor popularity among Australian share buyers was Chinese EV maker Nio (NYSE:NIO), headquartered in Shanghai.

Demand for Nio’s shares increased by 35 per cent in October compared with September, as it stepped up to the number one spot from number three a month earlier.

This is according to data compiled by trading platform eToro.

“Nio replaced Tesla as the most popular EV stock for Australian investors in October with its shares skyrocketing more than 40 per cent,” said eToro market analyst, Josh Gilbert.

Shares in Nio have gained 1019 per cent this year, starting at $US3.72 in January and closed Friday at $US41.62 per share.

Nio’s September quarter EV deliveries increased 154 per cent on year.

American internet content provider Fastly (NYSE:FSLY) leapt from 31st place in terms of investor popularity to 5th place in October.

Investor interest in Fastly jumped more than five-fold or 551 per cent month on month in October.

Fastly provided cloud computing services to ByteDance which operated the popular TikTok app in the US before the app moved to Oracle and Walmart.

Another Nasdaq stock, Advanced Micro Devices (NASDAQ:AMD), enjoyed increased popularity in October, rising to 6th place from 10th in September.

Australian investors bought 46 per cent more shares in the American computer systems designer in October than September.

The California-based company’s share price closed Friday at $US85.88 and started the year at $US48.60.

| OCTOBER RANK | COMPANY | % CHANGE - MONTHLY | SEPTEMBER RANK |

|---|---|---|---|

| 1 | Nio | 35% | 3 |

| 2 | Tesla | -58% | 1 |

| 3 | Apple | -34% | 2 |

| 4 | Amazon | 13% | 4 |

| 5 | Fastly | 551% | 31 |

| 6 | Advanced Micro Devices | 46% | 10 |

| 7 | Microsoft | -26% | 6 |

| 8 | -21% | 7 | |

| 9 | Palantir Technologies | 857% | 70 |

| 10 | Nvidia | -50% | 5 |

Tesla (NASDAQ:TSLA) and Apple (NASDAQ:AAPL) shares slipped from the number 1 and 2 spots, respectively, in the Top 10 stocks traded by Australian investors in October.

Investors in Australia appeared to sell down both stocks, possibly preferring to take some profits, as they recorded a monthly decline in trading activity last month.

“Although trading activity slumped, it is still clear that many investors are bullish on the stock, as it remained second on the list,” Gilbert said.

Tesla posted a positive September quarter earnings report, its fifth consecutive profitable quarter, as it delivered 139,000 EVs.

Trading in Tesla was down 58 per cent last month, and for Apple it was down 34 per cent, said eToro.

Both companies decided to split their shares in August to increase trading liquidity, after their share prices climbed out of the reach of ordinary investors.

Apple gave its investors four Apple shares for every one they held, or 4-for-1, while Elon Musk’s Tesla did a 5-for-1 share split.

Tesla’s share performance has moderated since its share split at the end of August.

The EV maker was trading at $US429.95 per share on Friday, and its share price was $US86.05 at the start of the year on an adjusted basis.

Apple’s share price appears to have plateaued recently, and closed Friday at $US118.69 per share having started the year at $US75.09/share on an adjusted basis.

Another FAANG stock, Amazon (NASDAQ:AMZN) increased its trading activity in October by 13 per cent, and its position was steady at number 4 in the eToro Top Ten.

Amazon’s share price closed at $US3,311.37 on Friday, and is up 74.5 per cent this year.

Two other US tech stocks, Microsoft (NASDAQ:MSFT) and Google (NASDAQ:GOOGL) were less traded in October, down 26 per cent and 21 per cent, respectively.

They were placed at numbers 7 and 8 in the Top Ten of Australian investors’ top stock choices.

Palantir Technologies (NYSE:PLTR) rose to 9th place from 70 in September as investor interest in its shares surged 857 per cent.

The US data analytics company only listed on the New York stock market in September and has lucrative contracts with a number of US government agencies.

The company’s share price surged 13 per cent in October and has surpassed a recent price upgrade from Morgan Stanley at $US13 per share.

US tech company Nvidia (NASDAQ:NVDA), that designs graphics computing devices for the gaming industry, lost popularity despite its share price rising.

It was 50 per cent less traded by Australian investors in October than a month earlier, and fell to 10th place in the Top Ten list.