Apple, Tesla share splits could handsomely reward investors

Apple is splitting its shares 4-for-1, and Tesla 5-for-1: Getty Images

The upcoming splits in Apple and Tesla shares could be a boon for investors who hold onto these tech stocks as historically companies that have engaged in share splitting have done very well afterwards.

The two tech giants are not the only mega tech companies reported to be contemplating splitting their shares to make them more affordable for investors and increase trading liquidity.

Other tech giants whose share prices have soared into the stratosphere are also expected to follow Apple and Tesla in dramatically increasing their number of issued shares, with reports pointing to Amazon and Google as future share splitters.

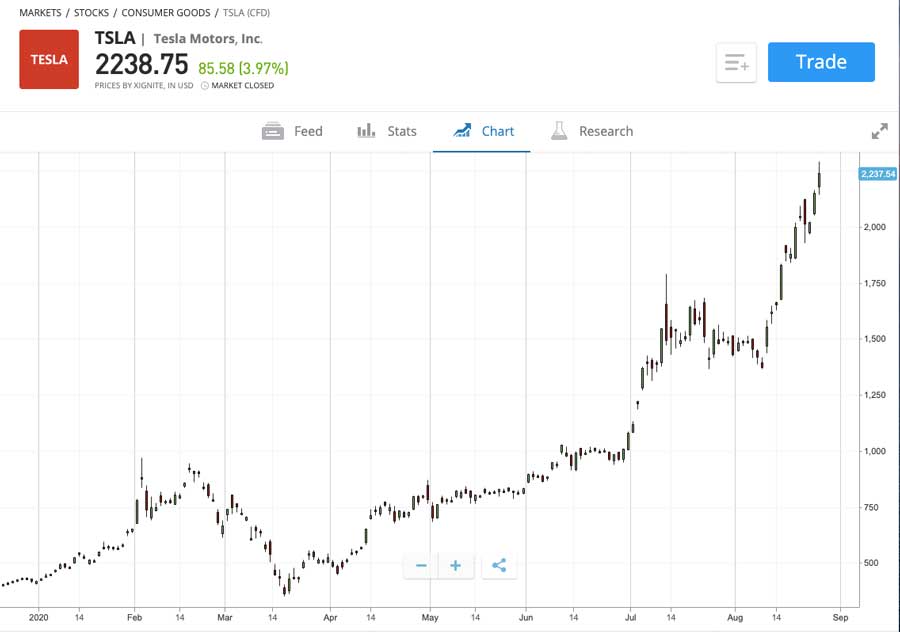

Tesla share price has risen fivefold this year

Looking at their share prices, it is easy to understand the reasoning for a share split.

Apple’s share price was at $US500 ($685) per share on the Nasdaq exchange on Thursday, while Tesla’s share price has hit $US2,238 a share, and was only $US430 a share on January 2.

Apple is giving its investors four Apple shares for every one they currently hold or 4-for-1, while Elon Musk’s Tesla is doing a 5-for-1 share split.

The splits in Apple and Tesla shares are set to happen on Monday, and some investors are smacking their lips at the prospect of some windfall gains.

This is the first time that Tesla has split its shares, but the fifth for Apple.

Logic says that the heady share prices of Apple and Tesla stocks should adjust lower to reflect the smaller proportion of the company that each share represents.

But this is not necessarily so.

Apple and Tesla shares could soar 33 per cent in year ahead: eToro

According to trading platform eToro, the share prices of Apple and Tesla could advance by a third in the coming 12 months following their share splits.

“Tesla and Apple are two of the most talked-about stocks by investors around the world,” eToro analyst Josh Gilbert said.

“Their stock splits are generating a lot of interest, especially with the huge increase of retail investment into the market this year.”

eToro based its conclusion on an analysis of 60 years’ worth of historical data that found on average share prices climb by around 33 per cent after 12 months of a share split.

The trading platform’s researchers looked at companies that have carried out share splitting such as Alphabet, Amazon, Coca-Cola, Disney, Microsoft, and also Apple.

Investors appear to be cottoning onto the potential for Apple and Tesla shares to appreciate.

Since the share splits were announced a few weeks ago, their share prices have jumped 167 per cent and 35 per cent, respectively, eToro noted.

Although splitting shares does not affect a company’s stock market value, it does have a psychological effect on investors, according to eToro.

“Emotion is a big part of investing and investors will often feel that a stock with a lower share price has more growth potential than one with a higher price,” Gilbert said.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.