Confessions of a Day Trader: Who doesn’t love a day – or a week- at the races?

Even a one-horse race can be exciting. Picture: Getty Images

Each Monday, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: $10 (previously $40 on alternative platform)

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Monday, November 2

Well this week is going to be interesting. Melbourne Cup Day and the Trump roadshow heading for a vote is going to make it easier to lose money as Tuesday will be quiet and the rest of the week could be a bit manic. Friday night saw a bit of a tech wreck for companies like Atlassian -9% and Twitter – 21%, so expecting a few of the high valued low income stocks like BRN to go lower and stay lower.

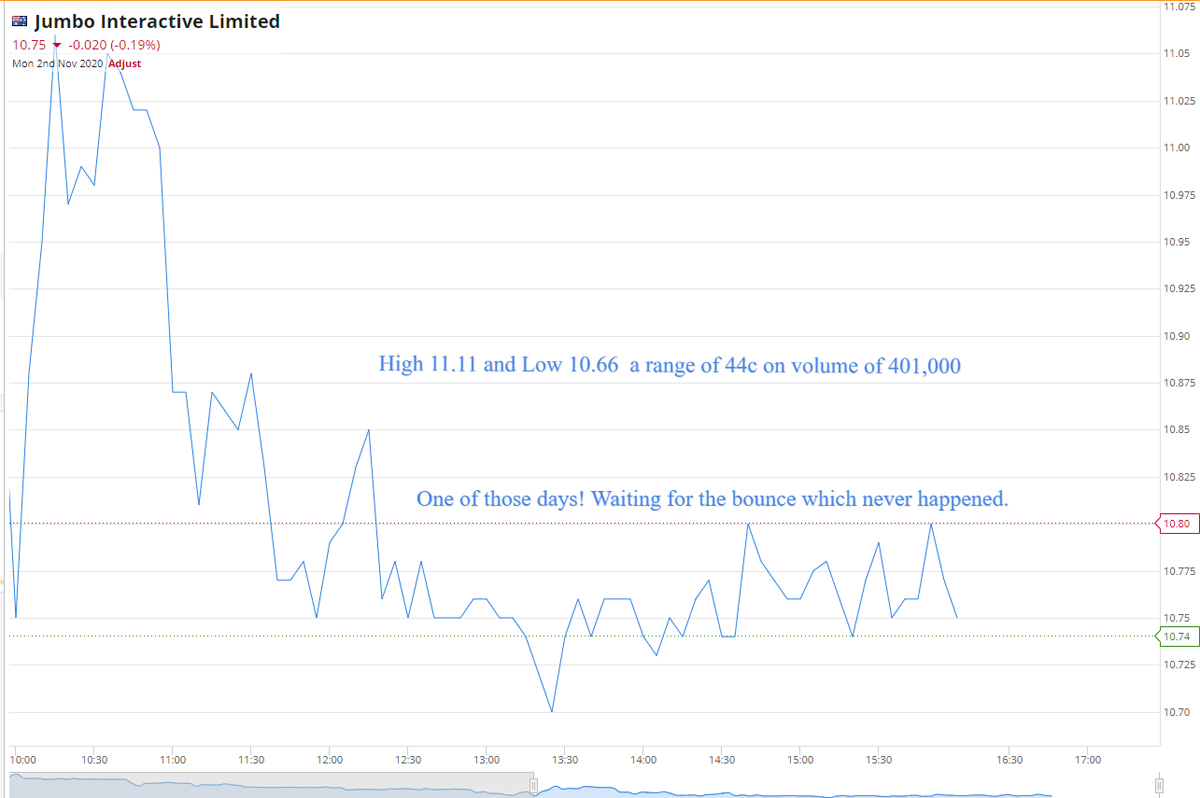

Market opens and I just watch things in-between attending a few meetings with clients and wait. Waiting is the hardest thing to do when you have apps in your pocket which give you second by second information. I still do nothing until I see the futures trying to go higher, so at 1.40pm, I dip the toes in. Buy 500 FMG at 17.21, 500 JIN at 10.76 and 500 Z1P at 5.66. Z1P’s low was 5.61 and JIN’s low was 10.66 before these buys.

At 2.02pm I am exactly up $5.00 and at 2.42pm showing up $2.50. Watch and wait!

Coming into the final 10 mins of trading, sell 500 JIN at $10.80 for +$20. Five mins to go and sell 500 FMG at 17.23 + $10 and waiting on Z1P! Out with 2 mins to go at 5.65 for a loss of $5. All up $25 for the day.

DOU are now trading down 11% at 23c on only 13m, so going lower on falling volume. Expect they will be 20c soon. Z1P close at 5.66, which is down $1.20 from last Monday. Now checking to see if there is a horse called Stop Loss running tomorrow, or anything market related, as that’s my knowledge of the GG’s. Dread tomorrow as everything just goes so s l o w……

Cup Day

I keep the trading book firmly shut today, as I have to have two fillings replaced and chose the earliest appointment I could get, which was 9.30am, so I could still attend a local lunch time bash without any restrictions. With so many others doing the same, prices and volumes can be manipulated in any way the big boys choose.

All the markets were up about 1.5% overnight and the SPI futures closed up 1.9% on the day, having reached a high of 2% before the Reserve Bank announced the fully predicted rate cut.

Also lots of talk overnight coming out of China on Australian import restrictions and everything seems to get a mention bar iron ore. But the sentiment seems to rub off on to FMG, who close at 17.29, which is up less than 0.5% on good t/o of 7m shares.

APT cracked through the $100 barrier quickly after the open but closed below it at 99.13 +0.88%, yet Z1P never crack the 6.00 barrier, reaching 5.93 before closing up 3.5% at 5.85 – 9c above it’s opening price.

Wondering if FMG are going to start underperforming as a t/o of 7m was more than expected for Cup Day, plus we have the USA fun and games continuing tonight. Lots happening which makes it hard to find trading patterns.

Wednesday, November 4 – Election Day

I needed a glass of water and I check the markets at 2.20am to find Dow is up 1.9% or 519 points. It’s 20 mins into their opening and it seems Trump is firming up to win? Also, Ant Financial’s float, the world’s largest IPO ever, has been suspended at the last minute as the Chinese authorities show their teeth.

Interestingly, the SPI futures are down 20 points. The Dow is now up 2.2%. Go back to bed at 2.45am.

At 8.30am, futures are almost unchanged from yesterday and Dow is up 2%. Going to be interesting… I have no idea of what will happen on who wins the USA elections. Sitting on my hands to see what the futures do when results start to roll in.

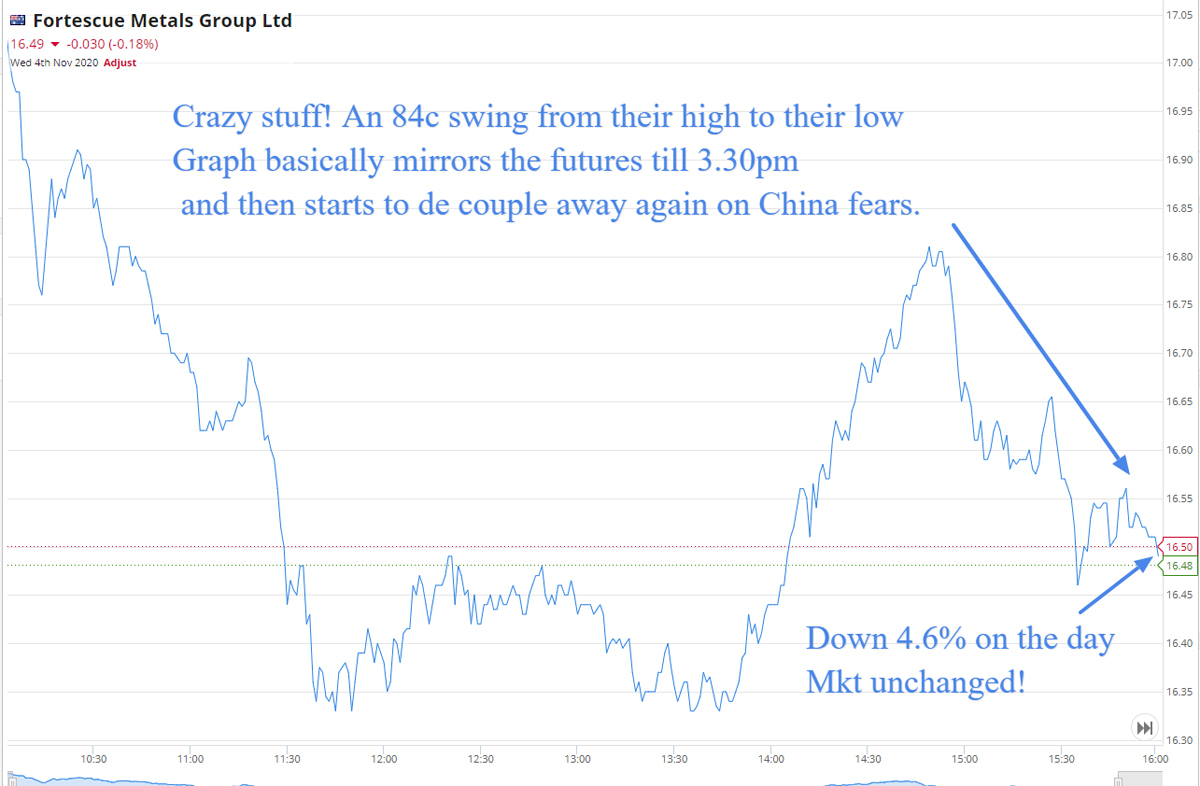

I see that PPH is a big faller, down 14% after their results. Have a quick skim over their presentation and they make money, so I buy 1,000 at 7.54, when the futures are down 25 points at 11.33am. Five mins later the futures are down 30 points. FMG are down a whopping 5.3% on China worries and I shyly buy 500 at 16.37. At that price they are down 78c from today’s high and it’s only 11.40am.

Results starting to roll in, Biden 3 seats vs Trump’s 11. Futures down 40 points. APT opened at 101 and I buy 100 at 98.84. Futures down 47 points and overall am showing a loss of $56 on all three purchases. Two mins later showing me down $184 as futures down 60 points with Biden at 44 and Trump at 26 seats.

12.11pm – down $99. 12.13pm – down $54. 12.15pm – up $36. Crazy, crazy stuff.

PPH bounce and at 12.17pm I’m out at 7.63 for +$90. Also sell my 500 FMG at $16.47 to pocket $50. Now waiting for APT to bounce.

Futures down 53 points and Biden 44 to Trump’s 37. It’s 12.21pm. Cut the APT at bang on 12.30pm for a loss of $58 as just getting too risky.

Futures down 71 points. Then at 1.00pm, the futures are down 24 points with Trump now showing more seats than Biden! Three hours trading left to go.

Buy 1,000 Z1P at 5.89 at 2.04pm, as futures showing down 20 points. Biden 89 Trump 72 with two hours trading left. Futures are now down 5 points and sell 1,000 Z1P at 5.95 and promptly watch them go to touch 6.00 a minute later. Gah.

All prices are changing on every blink of an eye. FMG bounced to 16.66 and PPH touched 7.80 but I don’t care. It’s all too much, so retire for the day up $142 and probably left another $150 on the table, two mins after I sell out.

FMG t/o matches yesterday’s 7m with just under two hours to go. Lay on the floor to catch my breath. Futures end the day up 5 points. Biden 205, Trump 136.

At the end of the day, FMG closed at 16.49 (-4.63%). APT closed at 101.23 (+2.12%). PPH closed at 7.62 (-12.81%) and Z1P closed at 5.95 (+1.71%) with the ASX closing down only 4 points on the day.

Now where’s that beer!

Thursday, November 5

Well, yesterday certainly was exciting and overnight European mkts were up around 1.5% each, with Wall Street closing up 300 odd points higher.

Had a few client meetings early and didn’t get out till 11.00am. Notice that Treasury Wine (TWE) have been smacked around and add them to the watch list on my Marketech app. When I get home, they have been automatically added to my desktop version and showing a bit of support above 8.00, having been sold down to 7.87.

The beauty of starting each day with only cash as your position is that it means that opportunities always appear at some point during a day and not because you are staring at a long term position being down 7% in one go. Big valued stocks that get marked down give you the chance to buy them and with larger than normal volume coming into play.

Buy 1,000 TWE at 8.05 at 11.35am and they bounce quicker than I expect. Was thinking that they may go down to 8.00 but at 11.38am I get taken out at 8.12. A minute later they hit 8.15, which reminds me of yesterday’s trading mayhem. Anyway, that’s a nice $70 in the pocket.

FMG are at 16.78 and APT are at 103 and Z1P are 6.10. Time 12.05pm. The market is up 63 points and the futures are up 20 points. Biden is edging ahead, according to the news. Now, watching and waiting with a cup of tea.

PPH had a day’s high of 7.70 and are currently at 7.57, down 0.5% so getting tempting but their volume is drying up a bit, compared to yesterday’s.

It’s 1.28pm, FMG is touching their day’s low of 16.48 and they are getting tempting… I buy 500 at 16.48, which is one cent above their day’s low. It is bang on 1.30pm. Am prepared to average down, if needed.

TWE are 8.04. Manage to buy 1,000 TWE at the magical 8.00 level, to see if there is another bounce! FMG are 16.51 and it’s 1.50pm. FMG hit 16.56 at 2.03pm, which I take and lock in $40 profit. TWE are now 8.04. Put in an order to sell at 8.05 and I’m out.

Profit for the day so far is $160 and maybe get another go at TWE and the 8.00 level before the close but nothing else to see here today. TWE closed bang on 8.01, FMG at 16.63 and Z1P at 6.24.

Friday, November 6

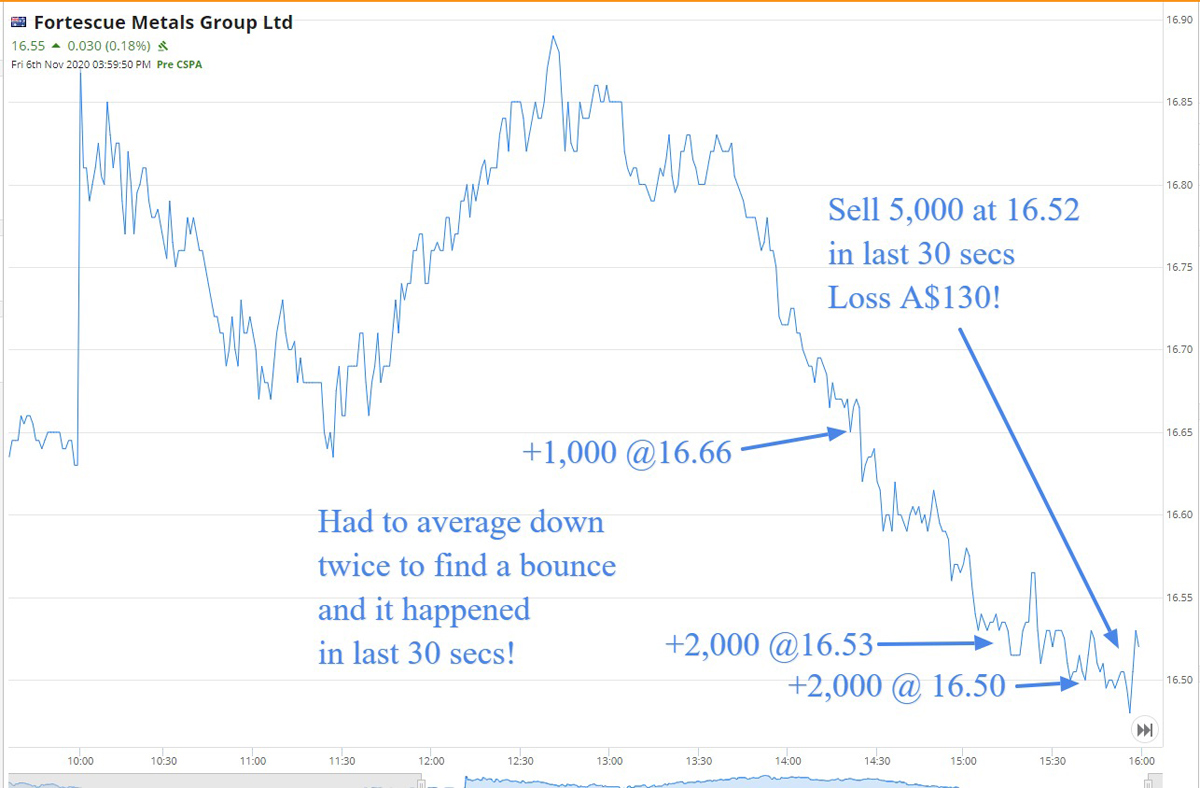

Waited till 2.18pm before buying 1,000 FMG at 16.66, which has been a ‘lucky’ level for me. You can’t believe how much a share can move around, without any real information. Within 5 mins they fall to 16.60, so haven’t found the bottom yet. I buy 2,000 at 16.53. Time is 3.12pm.

Now watching them keep falling and leveling around the 16.50 level and at 3.43pm, I buy another 2,000 at 16.50 as they are so over-sold, surely! 10 mins to go and down $255, 7 mins to go and down $205. 5 mins to go and down $280. And it’s not until the last 2 mins that they bounce.

With 30 seconds to go I sell all the 5,000 at 16.52 for a nail-biting loss of $130.

If you look at their chart for the day, you will see where I tried to find the bottom. Bit of a bummer of a trade to close the week on but boy it was an exciting one. A better buzz than any computer game will ever give you!

Now waiting for Monday to see what that will bring and maybe, just maybe, we may have an election result from the USA. This week we have had the Melbourne Cup, interest rates cut to just below zero and the USA elections results rolling in, and for the week I am up $197.

Phew.

Wash up: +A$197

Commission: A$130

Best trade: 1000 TWE, +$70

Worst trade: 5000 FMG, -$130

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.