You might be interested in

ESG

The Ethical Investor: Why sustainable aviation fuel is the way forward for tourism and local airlines

News

ASX Large Caps: Energy stocks slump, but Telstra, Woolworths, QBE touch 12-month highs

News

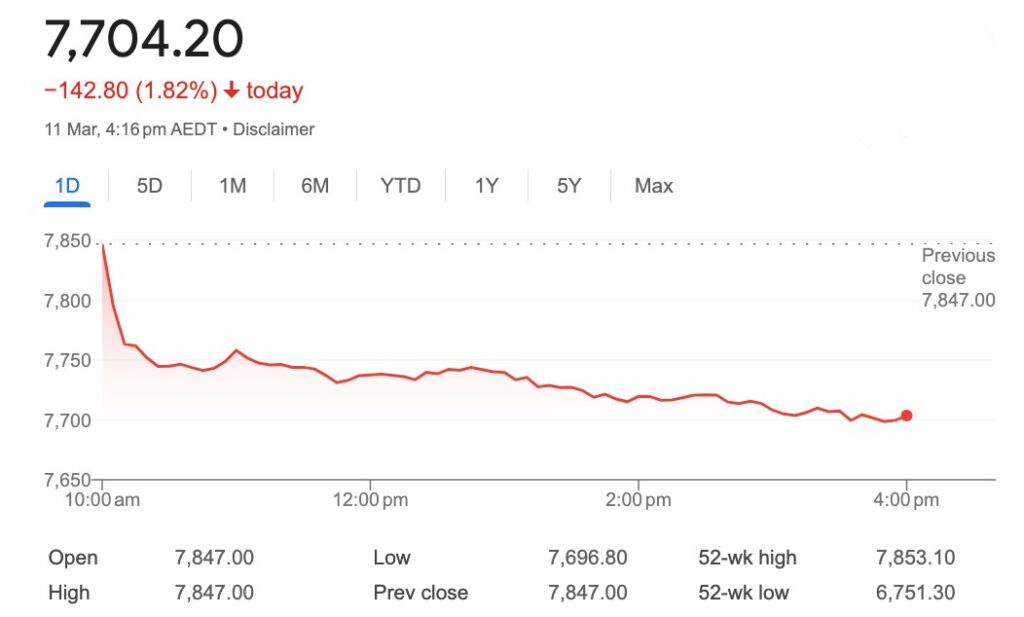

A record close on Friday has found a typically ASX200-flavoured follow-up on Monday after the last session in New York saw US semiconductor darling Nvidia lose 5.6% to snap a six-session winning streak.

At 4pm on March 11, the S&P/ASX200 was down 143 points or 1.82% to 7,704.2…

Local markets have been thwacked from all four corners in the year’s best smackdown on Monday in Sydney, after US markets fell away on Friday.

But Wall St losses only provided the mood music, as the ADX200 copped blows throughout a tough day on Australian and regional markets.

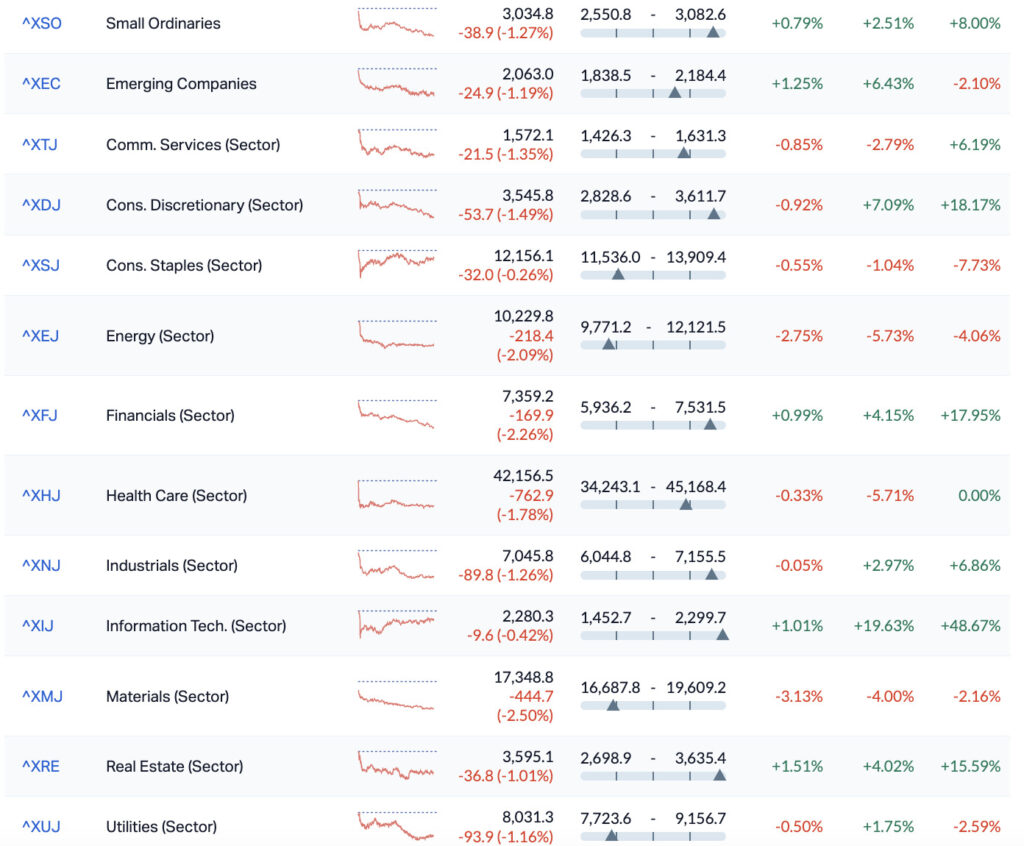

Kicking things in the midriff this morning were the nation’s big four banks who’ve quietly been accumulating gains but were suddenly the object of selling in the early trades.

Still worse on Monday were the miners.

As the day unfolded the other major moneymaker on Aussie markets – the iron ore heavyweights – endured a pounding as an already flimsy iron ore price had holes poked through it on Singapore exchange throughout Monday.

Singapore iron ore futures traded 2.1 per cent lower to $US112.75 a tonne on the April contract. Index heavyweight BHP lost 2.6 per cent and Fortescue Metals dropped 3.1 per cent.

Energy stocks also retreated as crude oil held a loss ahead of reports from OPEC and the IEA this week that may provide clues on the demand outlook. Woodside Energy dropped 2.5 per cent and Santos fell 2.2 per cent. Brent futures fell below $US82 a barrel after closing 1.1 per cent lower on Friday.

All the major banks were in the red by between 2.5 and 1.5% as traders rushed to the exit after Friday’s memorable record highs.

Scanning for winners… er… there’s always Regional Express (ASX:REX) which is higher on a deal with Etihad.

The company told the ASX its passengers fly to either Sydney or Melbourne on Rex and thereafter connect via Etihad to “a further 72 destinations across the globe.:

Both the samll ords and emerging (XEC) index were 1.25% lower.

Around the ‘hood…

Asian-Pacific stock markets mostly dropped on Monday, after the spectacular Nvidia-led losses on Wall Street.

The good news is equities in Hong Kong and Mainland China were largely higher as investors digested the latest inflation figures which were distinctly less deflationary.

It was Japanese shares led the losses in the region, tumbling more than 2% as final data showed that Japan’s economy returned to growth in the fourth quarter of 2023, averting a technical recession and bolstering bets that the Bank of Japan could start raising interest rates soon. Markets in South Korea were also heading lower.

US Markets…

US stocks did sound a general retreat on Friday, ending a bubbly volatile week with a fullstop – or at least a bit of profit taking on Nvidia’s cray-cray run of gains YTD.

The S&P500 lost 0.65% to 5,123.69.

The Nasdaq Composite shed 1.15%.

The softer-hearted Dow Jones Industrial Average gave up 69 points, or 0.17%, to end at 38,722.69.

All three major US indices took on water in choppy conditions last week – the worst for the 30-stock Dow since October.

The S&P500 lost 0.25%, the Dow and tech-heavy Nasdaq fell 0.95% and 1.2%, respectively.

Nvidia running out of puff, defined Friday in New York, as the AI darling gave up circa 5% of gains in the morning to log its worst session in almost 10 months.

But hey – Nvidia still finished up more than 6% for the week, so bad is relative and in NVDA’s case it’s incestuous. It’s added US$1 trillion in market cap this year (2024) so…

Former glory Mega tech, Apple, finally rose in Friday trading finding 1% and thus ending its longest losing streak (seven sessions) since January ’22.

But like an anti-NVDA – APPL was still down 5% on the week, making it the worst performer in the 30-stock Dow.

US February jobs data came in at a higher-than-expected increase of 275k jobs compared to the estimated 189k. Good for the economy, bad for rate cuts.

Oil prices fell last week as demand out of China and ample global supply butted heads.

The West Texas Intermediate contract for April settled down 1.2%.

With the sustainability of higher prices sans significant Chinese demand recovery, the US crude and the global benchmark copped losses of 2.5% and 1.8%, respectively.

Among the US sectors, Real Estate was the best performer, and Tech was the worst.

US Futures are heading lower on Monday at the close in Sydney:

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| RR1 | Reach Resources Ltd | 0.004 | 100% | 67,247,954 | $6,420,594 |

| TSK | Task Group Holdings | 0.765 | 91% | 8,919,114 | $142,515,309 |

| INP | Incentiapay Ltd | 0.007 | 75% | 1,659,484 | $4,975,720 |

| IS3 | I Synergy Group Ltd | 0.014 | 56% | 2,612,078 | $2,736,723 |

| MAG | Magmatic Resrce Ltd | 0.09 | 45% | 5,760,174 | $18,952,953 |

| ESR | Estrella Res Ltd | 0.005 | 43% | 15,063,597 | $6,157,802 |

| BTN | Butn Limited | 0.13 | 34% | 33,698 | $17,752,804 |

| AHN | Athena Resources | 0.004 | 33% | 379,907 | $3,211,403 |

| NYR | Nyrada Inc. | 0.1025 | 28% | 8,470,585 | $12,480,696 |

| 1TT | Thrive Tribe Tech | 0.028 | 27% | 1,739,914 | $6,525,673 |

| MCT | Metalicity Limited | 0.0025 | 25% | 400,000 | $8,970,108 |

| NAE | New Age Exploration | 0.005 | 25% | 955,000 | $7,175,596 |

| TMR | Tempus Resources Ltd | 0.005 | 25% | 100,000 | $2,923,995 |

| TMX | Terrain Minerals | 0.005 | 25% | 4,901,130 | $5,726,683 |

| MX1 | Micro-X Limited | 0.1275 | 21% | 1,437,459 | $54,476,139 |

| BMR | Ballymore Resources | 0.12 | 20% | 54,784 | $17,633,059 |

| OAU | Ora Gold Limited | 0.006 | 20% | 108,322 | $28,700,004 |

| TX3 | Trinex Minerals Ltd | 0.006 | 20% | 1,000,000 | $7,435,123 |

| CR1 | Constellation Res | 0.13 | 18% | 60,000 | $5,489,597 |

| SGA | Sarytogan | 0.26 | 18% | 1,648,875 | $16,928,980 |

| NGS | NGS Ltd | 0.013 | 18% | 819,814 | $2,763,501 |

| SPQ | Superior Resources | 0.013 | 18% | 7,393,387 | $22,013,425 |

| DAL | Dalaroo Metals | 0.02 | 18% | 326,566 | $1,406,750 |

| IKE | Ikegps Group Ltd | 0.445 | 17% | 24,283 | $60,892,331 |

Up and at ’em early is Task Group Holdings (ASX:TSK) where the stock is off and soaring as it price doubles after local retail-tech player gave a consenting nod to a $310m takeover from US firm PAR Technologies.

PARTech has lobbed an 81c a pop offer at TSK which is easily double its closing price of just under 39c on Friday last week.

The US bid values Task at $140.7m.

TASK shares jumped out of the blocks this morning when the news dropped and are almost skirting the offer price.

PARTech meanwhile, has offered TASK investors two options: an all cash offer of 81 cents or a 50% scrip alternative, which implies an equity value of $343m.

The agreement isn’t the first US takeover to come Task’s way. Four years earlier a deal fell through as COVID took over, but this time TSK’s board looks to be taking no risks – unanimously recommending it to shareholders “in the absence of a superior proposal.”

And we’ve got a bit of Aussie semiconductor action on Monday with Archer Materials (ASX:AXE) revealing it has designed a miniaturised version of its Biochip graphene field effect transistor (“gFET”) chip.

“The Archer Biochip contains a sensing region of which the gFET is the core component. Each gFET chip contains multiple gFETs, each of which is a transistor, which acts as a sensor,” the company says.

Archer says it’s miniaturised the total chip size by redesigning the layout of the circuits creating these gFET transistors.

“The new miniaturised design has been sent to a foundry partner for a whole-wafer fabrication of reduced size gFET chips, which Archer intends to integrate with other parts of the Biochip technology.”

Magmatic Resources (ASX:MAG) is still soaring after executing a Farm-in and Joint Venture agreement with FMG Resources on Friday – they’re a wholly owned subsidiary of Fortescue (ASX:FMG).

The new best buds plan to explore the Myall Project in central west NSW which consists of a contiguous 244km2 tenement covering the northern extension of the Junee-Narromine Volcanic Belt.

“The project hosts significant porphyry-associated copper-gold mineralisation within a similar geological setting to the Northparkes copper-gold mine 50km to the south,” the company says.

Finally, big news on the lithium front as Voltaic Strategic Resources (ASX:VSR) and Delta Lithium (ASX:DLI) have joined forces to go hard at in the next phase of exploration at Ti Tree Lithium Project, ”through a significant and strategic $12 million Farm-in and Joint Venture“.

Voltaic says the executed agreement is binding and follows a period of due diligence already undertaken by Delta.

CEO Michael Walshe told the ASX on Monday that entering a “mutually advantageous strategic partnership with Delta Lithium is an excellent outcome for both companies.”

Walshe says Voltaic will receive an immediate payment of $1.25 million that further bolsters its “already robust proforma cash reserves” to more than $7m.

“This enables Voltaic to undertake considered and cost-effective exploration at the Paddys Well and Meekatharra projects and provides a platform to pursue transformative growth opportunities.

Delta has already advanced Yinnetharra, completing >115,000m of drilling and delivery of a significant maiden resource within just over a year since acquiring it.

“This transformative deal positions Voltaic for substantial near-term project development catalysts, and leveraging Delta’s robust balance sheet, offers a significantly de-risked route to production and cashflow.”

PNG focused energy minnow Mayur Resources (ASX:MRL) dropped half year numbers this morning showing progression in getting its key Central Lime Project and Orokolo Bay Industrial Sands Project to Final Investment Decision.

MRL has a portfolio of renewable energy plans across PNG, making a significant hire in snagging ex-OkTedi, Oil Search (ASX:OSH) and current Santos (ASX:STO) independent non-executive director to oversee government and community relations across Mayur’s PNG portfolio.

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| AXP | AXP Energy Ltd | 0.001 | -50% | 275,510 | $11,649,361 |

| JAV | Javelin Minerals Ltd | 0.001 | -50% | 276,539 | $4,352,462 |

| NAG | Nagambie Resources | 0.015 | -40% | 5,884,100 | $19,915,892 |

| LRL | Labyrinth Resources | 0.004 | -33% | 1,870,619 | $7,125,262 |

| FTL | Firetail Resources | 0.041 | -29% | 3,419 | $8,636,522 |

| CT1 | Constellation Tech | 0.0015 | -25% | 200 | $2,949,467 |

| MRD | Mount Ridley Mines | 0.0015 | -25% | 995,624 | $15,569,766 |

| MTL | Mantle Minerals Ltd | 0.0015 | -25% | 6,256,753 | $12,394,892 |

| NES | Nelson Resources | 0.003 | -25% | 4,285,277 | $2,454,377 |

| VPR | Volt Power Group | 0.0015 | -25% | 532,739 | $21,432,416 |

| LML | Lincoln Minerals | 0.005 | -23% | 1,330,460 | $11,076,294 |

| EEL | Enrg Elements Ltd | 0.007 | -22% | 175,000 | $9,089,685 |

| CKA | Cokal Ltd | 0.075 | -21% | 3,180,772 | $102,500,153 |

| LYK | Lykos Metals | 0.027 | -21% | 81,214 | $6,404,089 |

| HTM | High-Tech Metals Ltd | 0.12 | -20% | 10,641 | $3,712,723 |

| CTN | Catalina Resources | 0.004 | -20% | 419,525 | $6,192,434 |

| CTO | Citigold Corp Ltd | 0.004 | -20% | 5,796,825 | $15,000,000 |

| EDE | Eden Inv Ltd | 0.002 | -20% | 14,020 | $9,195,678 |

| VML | Vital Metals Limited | 0.004 | -20% | 703,297 | $29,475,335 |

| BEX | Bikeexchange Ltd | 0.45 | -20% | 8,521 | $10,437,450 |

| BNZ | Benz Mining | 0.11 | -19% | 109,704 | $15,022,526 |

| LSA | Lachlan Star Ltd | 0.045 | -17% | 145,410 | $11,208,953 |

| AMM | Armada Metals | 0.015 | -17% | 12,750 | $3,744,000 |

| PKD | Parkd Ltd | 0.025 | -17% | 180,000 | $3,120,416 |

| AQX | Alice Queen Ltd | 0.005 | -17% | 470,810 | $4,145,905 |

Dimerix (ASX:DXB) has hailed the interim results of its ACTION3 Phase 3 trial of the DMX-200 drug a success, with analysis showing it is performing better than the placebo in reducing proteinuria (using a statistical measure) in patients with focal segmental glomerulosclerosis.

Iltani Resources (ASX:ILT) has intersected grades up to 1,070g/t indium – the highest known indium drilling assay ever reported in Australia – at its Orient silver-lead-zinc project in North Queensland.

Moab Minerals (ASX:MOM) has announced the potentially transformational acquisition of a package of advanced, large-scale uranium assets in Tanzania after entering into a binding share sale agreement to purchase 81.85% of Linx Resources, which owns 80% of the Manyoni and Octavo projects.

Spherical purified graphite from Lithium Energy’s (ASX:LEL) Burke project in northwest Queensland has been confirmed as highly suitable for the anode material in lithium-ion batteries following recent electrochemical battery test work.

Arizona Lithium (ASX:AZL) has inked a mining services agreement with the Navajo Transitional Energy Company (NTEC) for permitting and future operations at its Big Sandy project.

Galan Lithium (ASX:GLN) has been awarded a highly prospective tenement less than 30km south of the giant Greenbushes lithium mine in Western Australia, increasing the size of its tenure at Greenbushes South to 315km2.

Nordic Nickel (ASX:NNL) has rolled out a new resource for the Hotinvaara prospect, which now totals 418Mt @ 0.21% nickel or 862,800t contained nickel, representing just 2% of the total 240km2 area within its wider Pulju project in Finland.

And drilling of ADX Energy’s (ASX:ADX) Welchau-1 gas exploration well in the ADX-AT-II exploration licence in Upper Austria is progressing faster than expected, currently reaching a depth of 1,028m about four days ahead of the well plan due to better than planned drilling penetration rates.

At Stockhead, we tell it like it is. While ADX Energy, Arizona Lithium, Dimerix, Galan Lithium, Iltani Resources, Lithium Energy, Moab Minerals and Nordic Nickel are Stockhead advertisers, they did not sponsor this article.