You might be interested in

Mining

Monsters of Rock: BHP's $60 billion Anglo American gambit far from a done deal

Mining

Monsters of Rock: MinRes has 'seen the bottom' in lithium prices, Lynas tightens the screws on rare earths supply

News

News

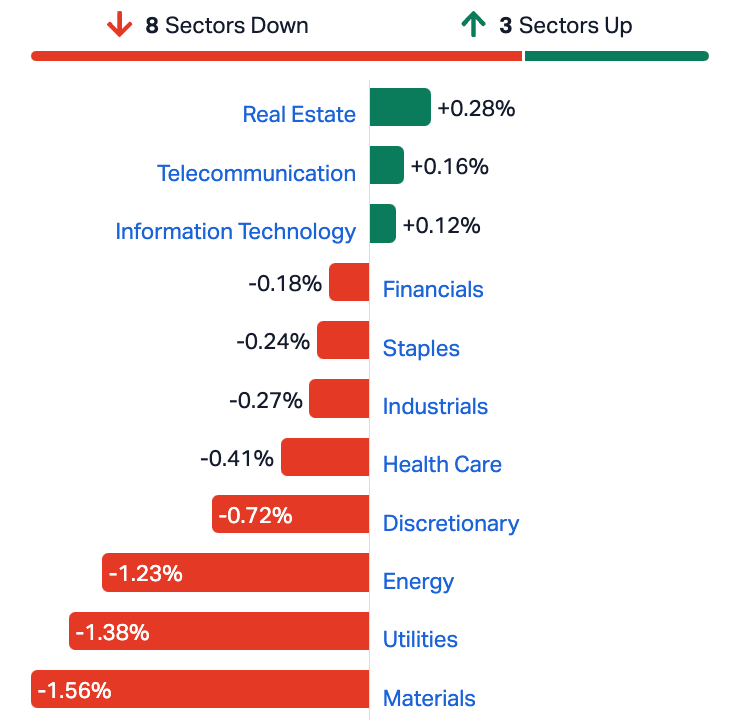

At match-out on Thursday November 23, the S&P/ASX 200 (XJO) index was down about 44 points, or -0.62% at 7,029:

Everyone struggled on Thursday.

A major downer has been the drag by the big iron ore miners where conditions are looking good enough for everyone to stop and get into some profit-taking after a strong recent rally.

Fortescue Metals Group (ASX:FMG) fell over -2%. BHP (ASX:BHP) fell -1.67% to $47.05, Rio Tinto (ASX:RIO) and Mineral Resources (ASX:MIN) both down ~-1.2%.

That never helps the benchmark.

Elsewhere, anything on the bourse with the slightest interest in the local cash rate took a bit of a backward step on Thursday. Especially the over-sensitive consumer-related names.

That’s at the feet of our RBA Governor M. Bullock. She spoke last night about the end of days inflation situation none of us realised so was so end of days.

The news is we’re doomed so get used to it.

Hey. I wrote this (below) this morning. It’s terrific and full of great points.

Meanwhile back on the big bourse, the big discretionary names with any news out that wasn’t terrific copped it.

Super retail, down. Harvey Norman Holdings (ASX:HVN) fell 3.5%, Domino’s Pizza Enterprises (ASX:DMP) lost -1.9% and Super Retail Group (ASX:SUL), -1.5%

Nick Scali (ASX:NCK) crashed almost 10% after founder, Anthony Scali, really chose the wrong day to reveal he’d just sold $50m of his own stock.

Oil has had a rough run too. Ask some of our local producers, which have led the sector deep into the red following the overnight news OPEC+ had delayed its monthly meeting, reportedly due to Saudi fury around unagreed production cuts.

Brent lost 5% before settling 1.2% lower at US$77.10.

Then there’s Appen (ASX:APX) , down near 30% after a weak trading update and a desperate-looking share placement at $0.55 per share to raise $30 million to shore up its balance sheet.

Chinese and regional markets mixed

Over in China, the Shanghai Composite is slightly higher while down south, the tech heavy Shenzhen Component index was up almost +0.2% — both indices snapping 2-day declines as US markets lifted regional sentiment following Wall St’s rally.

Over on the Hang Seng, the Hong Kong benchmark was down badly at lunchtime, short almost a full third — or some 64 points, although the market looked pretty vacant on feather thin volumes ahead of vacations for its two nearby investor markets in the US and Japan.

An index of Chinese Real estate majors has climbed strongly in the AM trade on news that ailing developers such as Country Garden and Sino-Ocean Group were on the draft list of developers being considered for financial support.

Industrial profits and manufacturing activity data await Chinese traders next week.

Geert is free

Really, really far-right Dutch politican Geert Wilders has delivered a huge surprise victory in The Netherlands’ elections, leaving his Freedom Party as the largest bloc in a parliament Wilders now largely controls.

The Freedom bloc still has hurdles to overcome to find a cohesive government in a very divided Dutch political scene.

US Futures don’t really matter so much right now, but here they are ahead of the holiday:

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| VPR | Volt Power Group | 0.0015 | 50% | 147,375 | $10,716,208 |

| TAS | Tasman Resources Ltd | 0.007 | 40% | 2,350,084 | $3,563,346 |

| AMM | Armada Metals | 0.055 | 38% | 2,098,453 | $6,902,723 |

| AI1 | Adisyn Ltd | 0.026 | 37% | 69,769 | $2,655,960 |

| AHN | Athena Resources | 0.004 | 33% | 1,852,051 | $3,211,403 |

| MCT | Metalicity Limited | 0.002 | 33% | 390,000 | $6,376,629 |

| SIH | Sihayo Gold Limited | 0.002 | 33% | 20,000 | $18,306,384 |

| POD | Podium Minerals | 0.048 | 30% | 441,871 | $13,480,454 |

| MKL | Mighty Kingdom Ltd | 0.018 | 29% | 5,555 | $5,885,174 |

| SCT | Scout Security Ltd | 0.019 | 27% | 185,196 | $3,486,411 |

| OLI | Oliver'S Real Food | 0.024 | 26% | 286,650 | $8,373,906 |

| PKO | Peako Limited | 0.005 | 25% | 1,477,680 | $2,108,339 |

| TMG | Trigg Minerals Ltd | 0.01 | 25% | 749,937 | $2,998,050 |

| NSB | Neuroscientific | 0.071 | 25% | 15,508 | $8,242,478 |

| CHM | Chimeric Therapeutic | 0.035 | 21% | 50,555,692 | $15,996,234 |

| CAG | Caperangeltd | 0.12 | 20% | 25,000 | $9,490,830 |

| TOR | Torque Met | 0.21 | 20% | 3,014,653 | $22,911,714 |

| ASP | Aspermont Limited | 0.012 | 20% | 4,179,864 | $24,387,637 |

| LVT | Livetiles Limited | 0.006 | 20% | 33,667 | $5,885,553 |

| MOH | Moho Resources | 0.012 | 20% | 8,357,498 | $5,100,666 |

| NGY | Nuenergy Gas Ltd | 0.024 | 20% | 1,269,874 | $29,619,110 |

| SIT | Site Group Int Ltd | 0.003 | 20% | 14,565,841 | $6,506,226 |

| VMS | Venture Minerals | 0.012 | 20% | 3,253,095 | $19,500,130 |

| FL1 | First Lithium Ltd | 0.625 | 19% | 890,743 | $36,777,125 |

| NWF | Newfield Resources | 0.13 | 18% | 115,000 | $97,025,197 |

As my dear Reuben reported earlier, it’s a bit of a big day for Armada Metals (ASX:AMM) because even though the price of Li2O has plunged circa three-quarters this year, it certainly hasn’t killed off enthusiasm in the battery metal.

Which leads us to AMM, which has picked up four early-stage lithium exploration projects for $150k cash and 26m shares in the emerging hard rock hub of Brazil.

“This is an exciting transaction for Armada as we diversify both geographically and into lithium, while remaining in the critical metals space,” chairman Rick Anthon says.

“This area in Brazil is attracting significant exploration attention for the potential discovery of lithium-bearing pegmatites, with a number of other operators in the region and known occurrences.

“This new planned acquisition, along with our nickel projects in Africa, especially the Bend Nickel Project in Zimbabwe where we are currently drilling and results are expected soon, offers exciting new opportunity to Armada and its shareholders.”

Reubs says the $10m capped stock has almost recovered its year-to-date losses on today’s news. It had ~$2m in the bank at the end of September.

Keeping it REE-al (sigh) on Thursday arvo is Moho Resources (ASX:MOH), charging ahead in early trade before going into a halt “pending the release of exploration results” at the King Charles rare earths (REE) project.

Peak Charles is an early stage clay-hosted REE project near Esperance, says Reuben, where Lord of the Rings inspired prospects like Gimli and Pippin “may indicate the presence of rare earth-enriched intrusions”.

A shallow 43 hole, 1670m drill program along road reserves and existing tracks has been completed, with assays pending.

The $5m capped stock is down 40% year-to-date.

And mysteriously hanging onto this morning’s surprise gains is security-as-a-service platform Scout Security (ASX:SCT) which is in the business of providing ‘affordable DIY solutions to some of the largest security, internet service and telecommunications providers in the world’.

SCT recently dropped an investor presso and this morning has advised people to ignore some far too loose financial info:

Chimeric Therapeutics (ASX:CHM) and its lead CHM 1301 therapy have found support all through the session – it’s up a full thirds at the close, following some very positive preclinical data for the cell therapy player.

The local mini-pharma reports that its next gen, off the shelf CLTX CAR NK cell therapy “demonstrates the synergies of assets in the Chimeric portfolio, as it combines the recently announced efficacy of CHM 1101, Chimeric’s CLTX CAR T cell therapy, with the efficacy and off-the-shelf convenience of CHM 02012, Chimeric’s NK cell platform, to create a next generation CLTX CAR NK cell therapy.”

That said, we’re talking up to 300% ‘enhanced cell killing demonstrated compared to first generation NK cells,’ as well as some decent evidence of the drug marching ‘into two new solid tumours – pancreatic cancer and ovarian cancer.’

Jennifer Chow, CEO and MD, says the CHM 1301 program is set to advance to the next stage of preclinical development under academic research collaboration.

“We are very pleased with the rapid success being shown with our next generation CHM 1301 platform… We believe this work is highly impactful as it demonstrates the synergy of the assets that currently exist in Chimeric’s portfolio, the ability for Chimeric to expand into new disease areas and the potential for enhanced efficacy with an off the shelf version of our CHM 1101 CAR.”

Here are the day’s worst performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| BP8 | Bph Global Ltd | 0.001 | -50% | 4,340 | $3,231,126 |

| ACM | Aus Critical Mineral | 0.185 | -49% | 4,964,804 | $10,703,250 |

| AYM | Australia United Min | 0.002 | -33% | 6,033 | $5,527,732 |

| APX | Appen Limited | 0.6125 | -29% | 8,961,076 | $135,584,185 |

| REZ | Resourc & En Grp Ltd | 0.011 | -27% | 1,309,852 | $7,497,087 |

| AVM | Advance Metals Ltd | 0.003 | -25% | 27,462 | $2,889,387 |

| ENT | Enterprise Metals | 0.003 | -25% | 300 | $3,197,884 |

| KPO | Kalina Power Limited | 0.004 | -20% | 751,981 | $7,575,979 |

| LSR | Lodestar Minerals | 0.004 | -20% | 44,937 | $10,116,987 |

| ODE | Odessa Minerals Ltd | 0.008 | -20% | 6,051,042 | $9,471,118 |

| BNZ | Benzmining | 0.295 | -17% | 10,369 | $39,648,698 |

| OZM | Ozaurum Resources | 0.15 | -17% | 5,560,789 | $28,575,000 |

| ESR | Estrella Res Ltd | 0.005 | -17% | 2,500 | $10,554,431 |

| ME1 | Melodiol Glb Health | 0.0025 | -17% | 4,326,622 | $12,654,126 |

| SFG | Seafarms Group Ltd | 0.005 | -17% | 883,654 | $29,019,595 |

| SKN | Skin Elements Ltd | 0.005 | -17% | 568,850 | $3,536,917 |

| PSQ | Pacific Smiles Grp | 0.905 | -16% | 2,902,888 | $172,348,493 |

| BMO | Bastion Minerals | 0.016 | -16% | 295,445 | $3,973,950 |

| 14D | 1414 Degrees Limited | 0.055 | -15% | 81,841 | $15,480,954 |

| RDN | Raiden Resources Ltd | 0.051 | -15% | 72,928,513 | $157,908,491 |

| ACP | Audalia Res Ltd | 0.012 | -14% | 250,000 | $9,689,907 |

| CCO | The Calmer Co Int | 0.006 | -14% | 2,162,166 | $5,719,835 |

| INP | Incentiapay Ltd | 0.006 | -14% | 333,333 | $8,855,445 |

| OAU | Ora Gold Limited | 0.006 | -14% | 64,074,642 | $39,355,173 |

| VAL | Valor Resources Ltd | 0.003 | -14% | 39,231 | $13,556,672 |

Mt Malcolm Mines (ASX:M2M) – Pending an announcement relating to the release of a proposed capital raise

Moho Resources (ASX:MOH) – Pending an announcement regarding the release of exploration results at the Company’s Peak Charles Project

Origin Energy (ASX:ORG) – Pending an announcement with an update in relation to the proposed acquisition of Origin by way of scheme of arrangement

Ballymore Resources (ASX:BMR) – Requested as BMR expects to announce a material financing transaction and an accelerated non-renounceable entitlement offer (ANREO)

Far (ASX:FAR) – Pending the release of information by the Company to the market relating to correspondence received overnight with respect to a potential tax claim from the Tax Authority of the Republic of Senegal regarding the sale by FAR of its interest in the RSSD Project in 2021

Cazaly Resources (ASX:CAZ) – Pending an announcement regarding a propsed equity raise

Botanix Pharmaceuticals (ASX:BOT) – Pending release of an announcement regarding a proposed capital raising

Senetas (ASX:SEN) – Pending release of an announcement regarding a proposed capital raising

Whitebark Energy (ASX:WBE) – Pending release of an announcement regarding a proposed capital raising

TG Metals (ASX:TG6) – Pending release of an announcement regarding a proposed capital raising

Brightstar Resources (ASX:BTR) – Pending release of an announcement regarding a proposed capital raising