Resources Top 5: All aboard the lithium Armada!

Pic: Via Getty

- Armada picks up four early-stage lithium exploration projects in the emerging hard rock hub of Brazil

- Drill assays imminent from Torque’s Bald Hill-adjacent New Dawn lithium project

- Newfield (diamonds), Podium (PGMs) respond to promising price outlooks

Here are the biggest small cap resources winners in early trade, Thursday November 23.

ARMADA METALS (ASX:AMM)

Lithium prices continue to fall, down ~75% year-to-date.

Incredibly this hasn’t dampened company or punter interest in the battery metal, with acquisitions, drill results and fun stories still sparking rerates at the more speculative end of the bourse.

Today’s big winner in early trade was AMM, which has picked up four early-stage lithium exploration projects for $150k cash and 26m shares in the emerging hard rock hub of Brazil.

“This is an exciting transaction for Armada as we diversify both geographically and into lithium, while remaining in the critical metals space,” chairman Rick Anthon says.

“This area in Brazil is attracting significant exploration attention for the potential discovery of lithium-bearing pegmatites, with a number of other operators in the region and known occurrences.

“This new planned acquisition, along with our nickel projects in Africa, especially the Bend Nickel Project in Zimbabwe where we are currently drilling and results are expected soon, offers exciting new opportunity to Armada and its shareholders.”

The $10m capped stock has almost recovered its year-to-date losses on today’s news. It had ~$2m in the bank at the end of September.

TORQUE METALS (ASX:TOR)

(Up on no news)

It’s been a rollercoaster for TOR, which rerated heavily in September after buying New Dawn, an unmined lithium and tantalum occurrence on granted mining leases, 600m along strike of the established Bald Hill operation.

Hype fizzled following some less-than spectacular initial drill results, but TOR — believing it has something special at New Dawn – doubled down with another drill rig.

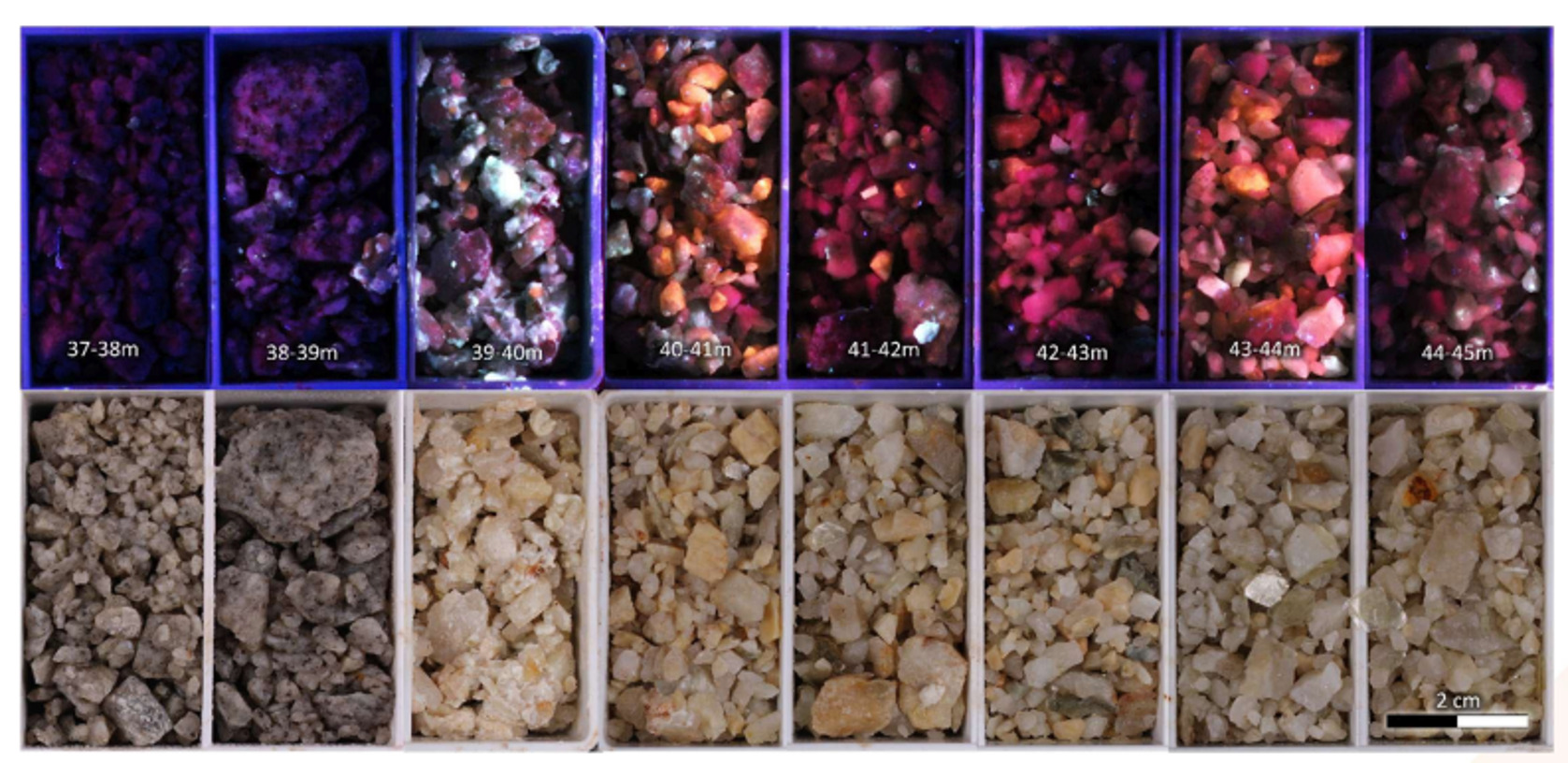

This was enough to get punters interested again. Subsequent drill hole analysis released early this week indicates there is a lot of spodumene, which glows under UV light:

All-important assays are imminent, the company says.

The $27m capped stock is up 20%, year-to-date. It had $3.5m in the bank at the end of September.

NEWFIELD RESOURCES (ASX:NWF)

(Up on no news)

The beleaguered Sierra Leone diamond miner is enjoying some respite today after yesterday’s fairly positive AGM presso.

It is ramping up the flagship Tongo mine, which has an 8.3 million carat resource at a grade weighted average of 2.4 carats per tonne.

That’s high grade – one of the highest in the diamond world, the company says — equivalent to 9g/t gold.

NWF is targeting production of 250,000cts per annum by 2027 and 400,000cts per annum by 2029.

Meanwhile the diamond trade is looking rosier in the medium term, as global rough diamond supply decreases alongside increasing demand.

“This will underpin strength of rough diamond prices in medium and long term,” the company says.

“Rough diamond prices [are] forecast to strengthen in 2024 and have robust price inflation beyond due to predicted supply deficit.”

The $130m capped stock has suffered an abysmal run, down ~65% in 2023 amid weaker pricing for rough diamonds.

MOHO RESOURCES (ASX:MOH)

The minnow bounced 20% in early trade before going into a halt “pending the release of exploration results” at the King Charles rare earths (REE) project.

Peak Charles is an early stage clay-hosted REE project near Esperance, where Lord of the Rings’ inspired prospects like Gimli and Pippin “may indicate the presence of rare earth-enriched intrusions”.

A shallow 43 hole, 1670m drill program along road reserves and existing tracks has been completed, with assays pending.

The $5m capped stock is down 40% year-to-date.

Things were looking desperate with just $10,000 in the bank at the end of September, but the coffers have since been topped up via $470,000 placement and $1.2m entitlement offer.

PODIUM MINERALS (ASX:POD)

(Up on no news)

It’s been a crap year for platinum group metals (PGM), with average basket prices dropping by ~40% for the major PGM producers.

Palladium – which peaked at US$3000/oz in March 2022 — has lost almost half its value since the start of the year, hitting lows of US$936 on the 10th of November.

This decline has made it the worst-performing metal so far this year, which has impacted share prices.

However, like the diamond trade, there are signs of a recovery in 2024.

“Palladium is so historically oversold that it can rally despite the negative macro picture,” says Alex Kuptsikevich, FxPro senior market analyst.

“The $1200 area is worth watching on the road to recovery.

“A decisive break above the previous lows would confirm the reversal and quickly send the price to test the US$1400 level. A break above this level would signal that a new bullish trend has begun in palladium, not just a corrective bounce.”

This is cautiously good news for advanced Aussie explorer Podium, which is progressing its 6Moz PGM (plus nickel, copper and cobalt) Parks Reef project in WA.

The $15m capped stock has been hammered in 2023, down ~65%. It had $2.6m in the bank at the end of September.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.