Closing Bell: Local markets and key commodities slump together on Monday

So. Very. Tired. Via Getty

- ASX 200 ends 0.5pc lower after a difficult start to the week

- Energy Sector the worst of some poor to middling performances

- Small caps led by AuMake on news of a new deal in China

Last week’s record highs seem a distant memory for the Australian sharemarket, which fell in a bit of a heap on Monday, with almost all sectors in the red

By the close, the S&P/ASX 200 Index fell 39.9 points, or 0.5%, to 7931.70.

Local stocks were sharply lower from the start of trade on Monday following a weak previous session on Wall Street and the surprise/not-so-surprising decision by US President Joe Biden to not go back for more.

By lunchtime all 11 sectors were lower. Energy and REITs (real estate investment trust) the worst of a bad bunch.

Resources remain a problem.

South32 (ASX:S32) was the biggest drag on the benchmark index after the miner lowered production guidance for alumina in the coming FY, at the same time writing down the value of its Worsley refinery by circa $US550 following tighter environmental regulations on its forest mining.

Woodside Petroleum (ASX:WPL) stock was sharply lower after revealing its intention to buy a great big (Gulf Coast Driftwood) LNG project in Louisiana for a bargain $US900mn.

Among the miners there were a lot of problem children out and about on Monday.

For starters the price of copper copped its biggest weekly loss since 2022. That’s never good for BHP (ASX:BHP) which owns a lot of that metal and also digs a lot of iron ore which isn’t doing much better.

BHP’s iron ore buddies Rio Tinto (ASX:RIO) and Fortescue (ASX:FMG) were both also down. So was Whitehaven Coal (ASX:WHC) by about 4% in morning trade.

This afternoon in Singapore, iron ore futures were struggling, as markets sought to digest the many and inconsequential smoke signals following Beijing’s Third Plenum.

The benchmark August iron ore (SZZFQ4) on the Singapore Exchange was down 0.2% US$104.30.

More exciting on Monday was that China’s central bank lowered a key short-term policy rate and its benchmark lending rates in an attempt to inject some life back into its still-rotten property sector and boost a little growth.

The cuts come after Beijing last week dropped even-weaker-than-expected Q2 economic data.

The Third Plenum was supposed to clear the stands and maybe start again on economic road map.

ANZ bank summed it all up, this morning:

“The Third Plenum brought together China’s leaders to map out the general direction of the country’s long-term social and economic policies. But little was done to rectify weak economic growth,” ANZ economists said.

Elsewhere, WTI crude futures remain at their lowest levels since mid-June after shedding more than 3% on Friday, weighed down by the renewed hope of an end to fighting in Gaza, and a stronger US dollar.

Among the larger companies making Monday moves, it was a warm welcome back Zip Co (ASX:ZIP) officially rejoined the S&P/ASX 200.

Notoriously, the buy now pay later market darling got booted from the nation’s top 200 index after its share price tanked painfully through 2021 and 2022.

The company has earned its place back in the main game however. Zip stock has gained more than 260% over the last year.

Finally, shares of Select Harvests (ASX:SHV) are up happily enough on Monday, nudging 3% for fifth straight session of wins after brokers at Bell Potter hoisted the price target (PT) to $4.40 from $3.75.

Whenever SHV does well it’s because almonds are doing well.

Bell Potter has lifted long-term EBITDA estimates based on upgraded almond price assumptions, saying SHV pricing has firmed since implying upside to co’s FY24 pricing expectations of A$7.57/kg. SHV shares are up over 50% this year.

And it’s been a funny few days for gold, which rose towards $2,410 early on Monday, following a nearly 2% sell-off on Friday as the greenback strengthened.

Here’s the ASX Sectors at 3.45pm AEST

The Australian dollar also fell further off recent 6-month highs to around $0.67, as it continued to track key commodities, like Dr copper into whatever darkness awaits.

The AUD is at its worst place in over three weeks after the greenback rebounded on strong US economic data.

Not the ASX

Well, first up. Bitcoin doesn’t mind it’s Monday and if he knew, US President Joe Biden won’t much care anymore.

BTC is knocking on the door of US$69k on Monday as spot BTC exchange-traded funds cumulatively netted a record US$17 billion in inflows this month – and it’s not done yet.

And President Joe Biden dropped out of the race for his job sometime on Sunday night in the US.

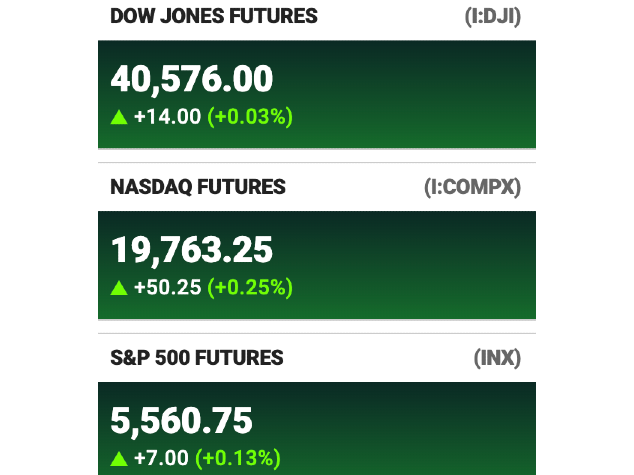

Thee market reaction so far has been mutred. Wall Street futures are a shade firmer, bond yields down a tick and the dollar little changed overall.

Biden backed his VP Kamala Harris for the job, putting her in pole position for the nomination which is officially scheduled for the Democratic convention on August 19.

Someten Ethereum ETFs are slated to go live in the US this week, following SEC approval. Most notably, the Grayscale Ethereum Mini Trust and the ProShares Ethereum ETF are tentatively set to go live on Tuesday.

Crypto ETF approval is going great guns for BTC and friends. There’s institutional acceptance and the ETFs provide greater investor accessibility. Despite some familiar turbulence it’s definitely helped BTC get its groove back.

BlackRock’s IBIT and Fidelity’s FBTC were the main contributors, sucking up around US$19bn and $10bn, respectively.

Stars are aligning for crypto,. it seems. Not only has Trump’s return to the presidency never looked so likely, he’s just appointed a VP with a crypto also continued to support crypto assets in anticipation of a more favourable regulatory environment for cryptocurrencies.

Elsewhere, the conclusion of the German government’s bitcoin sales earlier this month and receding concerns about Mt. Gox’s repayment plans reduced downward pressure on bitcoin prices.

At 3.30pm Monday AEST, US Futures were sitting in the green.

ASX SMALL CAP LEADERS

Here are the best-performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| AUK | Aumake Limited | 0.007 | 75% | 78,099,550.00 | $7,657,627 |

| AD1 | AD1 Holdings Limited | 0.006 | 50% | 1,065,836.00 | $3,594,594 |

| HCT | Holista CollTech Ltd | 0.008 | 33% | 995,826.00 | $1,672,800 |

| FFF | Forbidden Foods | 0.012 | 33% | 14,370.00 | $2,045,011 |

| JAY | Jayride Group | 0.009 | 29% | 350,867.00 | $1,654,164 |

| KOR | Korab Resources | 0.009 | 29% | 165,128.00 | $2,569,350 |

| TRU | Truscreen | 0.024 | 26% | 90,382.00 | $10,499,231 |

| DGR | DGR Global Ltd | 0.029 | 26% | 20,546,412.00 | $24,004,950 |

| AEV | Avenira Limited | 0.005 | 25% | 269,388.00 | $9,396,136 |

| LPD | Lepidico Ltd | 0.003 | 25% | 16,690,705.00 | $17,178,239 |

| MSG | Mcs Services Limited | 0.005 | 25% | 1,100,010.00 | $792,399 |

| WTM | Waratah Minerals Ltd | 0.335 | 22% | 1,356,277.00 | $49,325,237 |

| EVR | Ev Resources Ltd | 0.006 | 20% | 8,627,194.00 | $6,856,357 |

| KRR | King River Resources | 0.013 | 18% | 318,320.00 | $16,810,428 |

| LVH | Livehire Limited | 0.026 | 18% | 581,498.00 | $8,131,154 |

| GLH | Global Health Ltd | 0.140 | 17% | 17,287.00 | $6,965,944 |

| PCK | Painchek Ltd | 0.042 | 17% | 5,116,854.00 | $58,889,850 |

| ECT | Env Clean Tech Ltd. | 0.004 | 17% | 2,598.00 | $9,515,431 |

| EXL | Elixinol Wellness | 0.004 | 17% | 70.00 | $3,963,547 |

| FHS | Freehill Mining Ltd. | 0.007 | 17% | 1,654,292.00 | $17,999,067 |

| VML | Vital Metals Limited | 0.004 | 17% | 114,737.00 | $17,685,201 |

| THB | Thunderbird Resource | 0.037 | 16% | 879,227.00 | $7,664,673 |

| JPR | Jupiter Energy | 0.030 | 15% | 300,000.00 | $33,114,957 |

| NRX | Noronex Limited | 0.015 | 15% | 2,970,442.00 | $6,352,985 |

| WCN | White Cliff Min Ltd | 0.015 | 15% | 10,731,213.00 | $21,117,036 |

Chinese-Aussie shopping agent AuMake International (ASX:AUK) was up on Monday morning on news that the company has entered a non-binding three year strategic co-operation framework with Chinese State-Owned Enterprise Yangtze River New Silk Road International Logistics, to “establish a comprehensive end-to-end supply chain network for Australian goods and services”.

Under the agreement, Yangtze River “intends to purchase a minimum of $100mn” worth of Aussie goods from Aumake each year.

How’s that for a handy MOU.

Doing math, AUK puts the value of the deal at a minimum of $300mn.

The story goes, as per AUK, At the beginning of each agreement year, both companies will formulate detailed procurement plans clearly specifying the types of goods, quantities, and delivery schedules.

In turn, Aumake saus it’ll utilise “its extensive sales channels in Australia to assist Yangtze River in developing a supply chain network for Australian products.

“The procurement network will focus on Australian agricultural and livestock products, fast-moving consumer goods (FMCGs), frozen goods, and bulk resource commodities.”

Aumake will look to establish strategic alliances with domestic partners for specific Australian goods and services like its relationship with Petersons

Wines and the successful establishment of a new company, Hunter Valley Wine and Tourism Alliance.

This joint venture marks the launch of an innovative conceptual tourism and wine gift store under the brand ‘Wine Couture.’

Aumake’s MD, Joshua Zhou, said it was a milestone agreement.

We are extremely delighted to be working with Yangtze River New Silk Road International Logistics (Hubei) Group Co., Ltd through our collaborative strategic framework.

We continue to demonstrate our value as innovative and trusted partners in bridging China and Australia trade. Further opportunities in these key areas are progressing, which have the potential to broaden into more significant agreements over time.”

White Cliff Minerals (ASX:WCN) has rocked the market on Monday with a stellar discovery, after announcing more IOCG, copper and epithermal mineralisation from its Great Bear Lake copper-gold-silver project in northern Canada last week, the ASX junior has signed on none other than John Hancock.

Not a euphemism for a signature, mine you (pun, sadly, intended), but a true to life member of WA’s mining royal family whose success in the global resources game extends beyond his famous name.

The grandson of WA’s superstar of Pilbara mining, Lang Hancock, John has >40 years’ experience from representing the prolific Hope Downs iron ore project to making early stage investments as a money man backing lithium and uranium companies such as Vulcan Energy (ASX:VUL) and Aura Energy (ASX:AEE).

Hancock will advise on WCN’s three-project portfolio in Canada as well as significantly expand exploration work at both the Great Bear Lake and Rae copper (Nunavut-Coppermine) projects.

“Attracting someone of John’s experience and calibre is a great development for White Cliff,” MD Troy Whittaker says.

EV Resources (ASX:EVR) made headway on news that surface rock chip samples of up to 71% Cu and 874g/t Ag demonstrated previously unknown copper and precious metals potential at the Khartoum project in northern Queensland, with the company reporting that the high-grade copper values include 10.9% Cu, 9.11% Cu, 8.6% Cu and 4.16% Cu.

And Swoop Telecommunications (ASX:SWP) was higher after signing a key customer contract and committed to construct, own and operate a significant new fibre infrastructure network in Melbourne, with initial committed revenues of a minimum of $24 million and up to $36m over the next 22 years.

Astute Metals (ASX:ASE) was up early on Monday morning, with assay results from a further four drillholes at its Red Mountain lithium project in Nevada, USA. Astute says drilling has found thick intersections of lithium above 1,000ppm, with the standout result being 13.7m @ 1,070ppm Li / 0.57% Lithium Carbonate Equivalent1 (LCE) from surface, including 83.8m @ 1,230ppm Li / 0.65% LCE from 16.8m.

ASX SMALL CAP LAGGARDS

Here are the least performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| NRZ | Neurizer Ltd | 0.006 | -33% | 17,870,329 | $17,121,876 |

| APC | Aust Potash Ltd | 0.001 | -33% | 742,261 | $6,030,284 |

| ME1 | Melodiol Glb Health | 0.002 | -33% | 186,404 | $918,791 |

| DRO | Droneshield Limited | 1.435 | -27% | 47,866,521 | $1,494,598,764 |

| DOU | Douugh Limited | 0.003 | -25% | 14,600 | $4,328,276 |

| NTL | New Talisman Gold | 0.014 | -22% | 80,456 | $7,947,532 |

| BEL | Bentley Capital Ltd | 0.012 | -20% | 99,886 | $1,141,919 |

| CAV | Carnavale Resources | 0.004 | -20% | 73,002 | $17,117,759 |

| MBK | Metal Bank Ltd | 0.019 | -17% | 71,132 | $8,980,564 |

| CTN | Catalina Resources | 0.003 | -17% | 410,000 | $3,715,461 |

| DTR | Dateline Resources | 0.005 | -17% | 1,150,000 | $8,745,282 |

| WEL | Winchester Energy | 0.003 | -17% | 136,376 | $4,089,057 |

| AVC | Auctus Invest Grp | 0.550 | -16% | 39,625 | $52,599,823 |

| CSX | Cleanspace Holdings | 0.475 | -16% | 234,705 | $43,708,254 |

| DBO | Diabloresources | 0.017 | -15% | 24,652 | $2,061,429 |

| LIO | Lion Energy Limited | 0.018 | -14% | 221,870 | $9,176,533 |

| BRX | Belararoxlimited | 0.240 | -14% | 493,128 | $23,864,926 |

| RFT | Rectifier Technolog | 0.006 | -14% | 115,000 | $9,673,888 |

| SRN | Surefire Rescs NL | 0.006 | -14% | 588,303 | $13,904,155 |

| NXS | Next Science Limited | 0.250 | -14% | 211,439 | $84,591,580 |

| S32 | South32 Limited | 2.970 | -13% | 40,112,812 | $15,490,064,303 |

| GLL | Galilee Energy Ltd | 0.020 | -13% | 1,100,230 | $7,814,127 |

| QGL | Quantum Graphite | 0.550 | -13% | 229,435 | $215,198,026 |

| ALY | Alchemy Resource Ltd | 0.007 | -13% | 615,365 | $9,424,610 |

TRADING HALTS

Highfield Resources (ASX:HFR) – to provide clarification to the announcement made 19 July 2024.

Anteris Technologies (ASX:AVR) – pending an announcement in relation to a proposed capital raising.

Wellnex Life (ASX:WNX) – pending an announcement in relation to a proposed listing on the London Stock Exchange and associated capital raising.

Frontier Energy (ASX:FHE) – pending an announcement regarding debt finance for the Stage One development of the Waroona renewable energy project.

Peak Rare Earths (ASX:PEK) – pending an announcement regarding the funding and development of the Ngualla rare earth project.

SRJ Technologies Group (ASX:SRJ) – pending an announcement regarding a material acquisition and a capital raising.

Jervois Global (ASX:JRV) – pending the release of an announcement in relation to the US$100 million 12.5% Idaho Cobalt Operations senior secured bonds.

LTR Pharma (ASX:LTP) – pending the release of an announcement in relation to a proposed capital raise.

Dorsavi (ASX:DVL) – pending an announcement by the Company to the market in relation to a capital raising.

ICYMI – PM Edition

Lycaon Resources (ASX:LYN) has completed a heritage clearance survey over its Stansmore project in WA’s West Arunta region and is carry out detailed planning for an initial phase of drilling.

Perpetual Resources (ASX:PEC) has discovered high-grade tin plus anomalous lithium, rubidium, niobium and manganese at its Itinga project in the ‘Lithium Valley’ region of Minas Gerais, Brazil.

Pure Hydrogen (ASX:PH2) has signed a memorandum of understanding that could see it supply five hydrogen fuel cell vehicles and supporting infrastructure to the Vietnam ASEAN Hydrogen Club (VAHC). If fully executed, this could generate revenue of about $8.8m for PH2.

Regener8’s (ASX:R8R) independent review of historical data and recent work at Regener8’s Kookynie project in WA has indicated its most compelling near-term gold targets are contained at the May and Green Bullet prospects.

Spartan Resources (ASX:SPR) has awarded Barminco the contract to develop an exploration drill drive at its Dalgaranga gold project that will enable underground drilling to infill and extend existing deposits along with exploration for new high-grade shoots.

At Stockhead, we tell it like it is. While Lycaon Resources, Perpetual Resources, Pure Hydrogen, Regener8 and Spartan Resources are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.