Closing Bell: Iron ore, gold, energy stocks struggle; but Bitcoin is on fire

Confused much? Trump trades rally but gold and iron ore dump. Picture via Getty Images

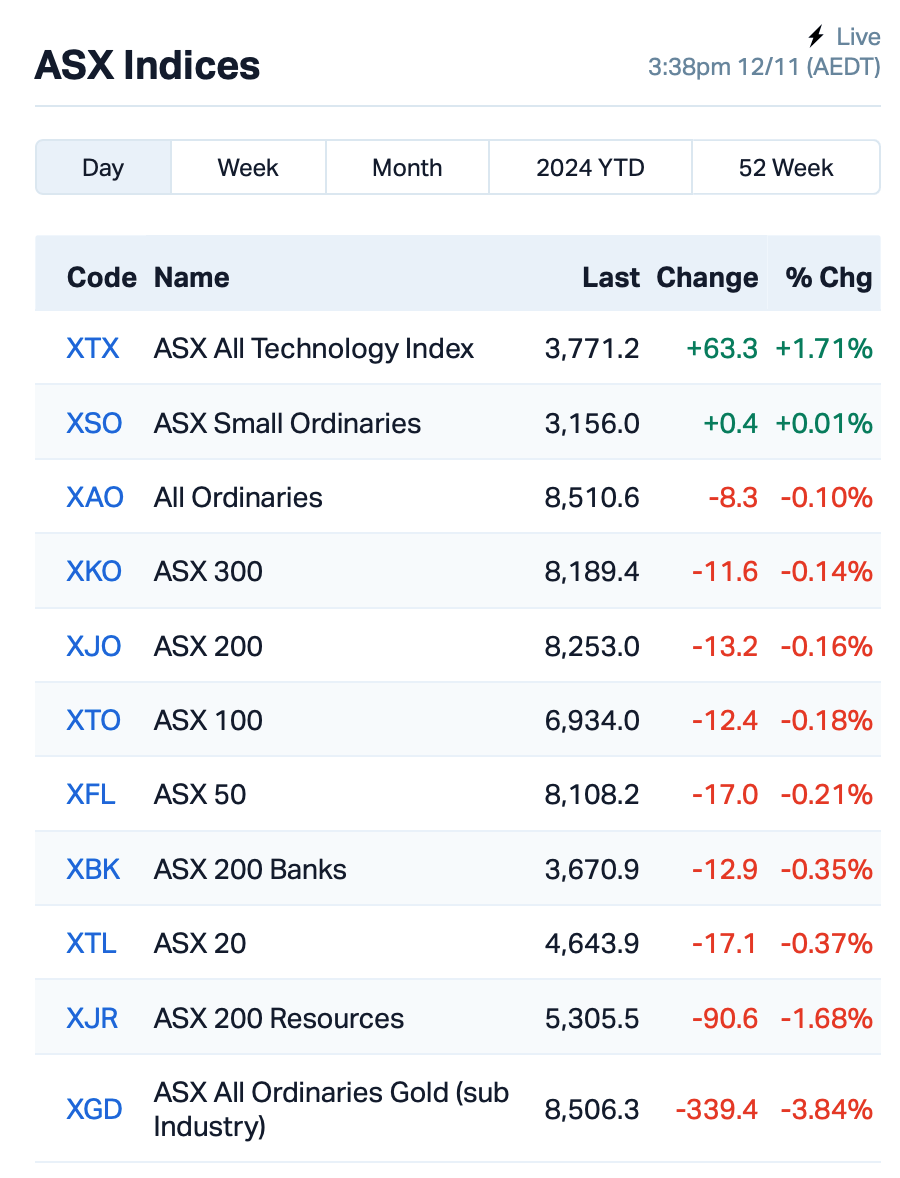

- ASX 200 drops as gold, iron ore and energy stocks struggle

- Paladin shares plunge after cutting uranium output forecast

- Australian business confidence hits two-year high amid easing inflation

The ASX 200 index slipped by 0.13% on Tuesday, extending Monday’s losses, as iron ore, gold, and energy stocks struggled.

Gold miners were especially hard hit, with several major names down over 5% as gold prices fall. The bullion price is now trading at around US$2,619 an ounce at the time of writing, after rising well above US$2,700 last week.

Energy stocks were also under pressure, while ‘Trump trades such as Tesla, the US dollar, and Bitcoin have been soaring.

Bitcoin surged past US$88,000 this afternoon, driven by optimism surrounding Donald Trump’s support for the crypto sector in the US.

According to the options market, traders are betting it could hit US$100,000 by year-end, with companies like MicroStrategy increasing their Bitcoin holdings.

However, some analysts warn the rally may be stretched, and to expect some profit taking.

On the ASX today, InfoTech was the best performer, led byWiseTech Global (ASX:WTC), which rose by 2%.

BHP (ASX:BHP) is dragging the mining sector lower, down nearly 2% as iron ore prices fall below US$100 per tonne in Singapore.

Afterpay owner Block Inc (ASX:SQ2) surged 11% after broker Piper Sandler initiated coverage with an ‘overweight’ rating, impressed by Block’s strong margin performance despite missing revenue targets.

Meanwhile, uranium play Paladin Energy (ASX:PDN) took a big hit, plunging 28% after slashing its FY25 production forecast by nearly 23% due to issues at its Langer Heinrich mine in Namibia.

Paladin said the mine’s ramp-up has been slower than expected, with issues like variability in ore grade and water supply disruptions affecting production.

As a result, Paladin lowered its forecasted output to between 3 and 3.6 million pounds of uranium, down from the previous range of 4 to 4.5 million pounds. These production delays are expected to increase costs and impact the company’s financial outlook, it said.

Some good news though – Australian business confidence has hit a near two-year high in October, driven by stronger sales and easing input cost pressures, according to a National Australia Bank survey released today.

Consumer confidence also rose, according to the survey, with people eyeing potential interest rate cuts ahead.

What else is happening?

Over in Asia today most markets dropped as traders rethink the impact of President-elect Trump’s policies and the rising US dollar.

Taiwan and Hong Kong led the declines, while emerging Asian currencies traded lower.

The stronger US dollar and higher US Treasury yields are attracting more funds to the US, but concerns over global tariffs, especially on China, weigh on the region.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| GMN | Gold Mountain Ltd | 0.002 | 100% | 903,500 | $3,907,473 |

| HCD | Hydrocarbon Dynamic | 0.003 | 50% | 176,543 | $1,617,165 |

| PRX | Prodigy Gold NL | 0.003 | 50% | 50,000 | $6,350,111 |

| CRB | Carbine Resources | 0.004 | 33% | 355,000 | $1,655,213 |

| RLG | Roolife Group Ltd | 0.004 | 33% | 147,865 | $3,530,989 |

| TAS | Tasman Resources Ltd | 0.004 | 33% | 1,241,700 | $2,415,749 |

| TX3 | Trinex Minerals Ltd | 0.002 | 33% | 977,500 | $2,742,978 |

| TYX | Tyranna Res Ltd | 0.004 | 33% | 125,000 | $9,863,776 |

| JLL | Jindalee Lithium Ltd | 0.360 | 29% | 114,455 | $19,982,396 |

| ERA | Energy Resources | 0.003 | 25% | 291,964 | $44,296,598 |

| RFT | Rectifier Technolog | 0.010 | 25% | 6,639,742 | $11,055,872 |

| ID8 | Identitii Limited | 0.022 | 22% | 5,003,502 | $11,710,936 |

| AX8 | Accelerate Resources | 0.009 | 21% | 1,047,831 | $4,352,278 |

| EMT | Emetals Limited | 0.006 | 20% | 800,000 | $4,250,000 |

| EPM | Eclipse Metals | 0.006 | 20% | 255,906 | $11,264,278 |

| FFG | Fatfish Group | 0.012 | 20% | 1,936,624 | $14,065,730 |

| VR1 | Vection Technologies | 0.028 | 20% | 12,628,734 | $30,511,546 |

| CCM | Cadoux Limited | 0.050 | 19% | 133,870 | $15,578,539 |

| IG6 | Internationalgraphit | 0.064 | 19% | 596,323 | $10,452,150 |

| FNR | Far Northern Res | 0.130 | 18% | 67,282 | $3,989,241 |

| KYP | Kinatico Ltd | 0.130 | 18% | 883,675 | $47,695,118 |

| DOU | Douugh Limited | 0.013 | 18% | 8,319,788 | $11,902,758 |

| WBT | Weebit Nano Ltd | 3.220 | 18% | 2,490,822 | $518,432,610 |

International Graphite (ASX:IG6) has secured a $4.5m grant from the Western Australian government to build Australia’s first commercial graphite micronising plant.

The grant will fund Stage 1 of the project, with $2M for the construction of a 3,000 tpa facility in Collie, estimated to cost $4M. Stage 2, aimed at expanding the facility to 10,000 tpa, will receive the remaining $2.5M. This facility will process graphite from the company’s Springdale mine, positioning it as a significant global producer outside of China.

The project will be completed in stages, with a front-end engineering study to finalise the schedule and economics.

Magontec (ASX:MGL) has reached a Memorandum of Settlement (MoS) with Qinghai Salt Lake Magnesium (QSLM) to buy back and cancel 22.68 million shares held by QSLM, representing 28.48% of Magontec’s shares. The MoS was contingent on approval from QSLM’s creditors and the Xining court, both of which have now been granted.

Magontec will seek shareholder approval for the buyback at an upcoming Extraordinary General Meeting (EGM). An EGM timetable will be announced soon.

Bastion Minerals (ASX:BMO) has reported significant results from its recent reconnaissance sampling and pXRF analyses across new properties along the REE Line in Sweden.

Up to 18.5% Total Rare Earth Elements (TREE+Y) and 24% copper were found in magnetite skarn mineralisation at several locations, including Striberg, Karlberg, and Nyberget.

The high magnetic response in the area corresponds to historical magnetite mines, helping identify high-potential zones for further exploration. Additional sampling is planned to prioritise areas for drilling, with laboratory assay results expected later this month.

Javelin Minerals (ASX:JAV) has decided to sell its Bonaparte copper-silver-lead-zinc project in Western Australia’s Kimberley region as part of a strategy to divest non-core assets.

The Bonaparte Project, which covers 564 sq km, has identified mineralisation similar to Mississippi Valley Style deposits, with three key prospects showing promising assay results.

However, following Javelin’s recent acquisition of the Eureka and Coogee gold projects near Kalgoorlie, the company is focusing on its gold exploration initiatives. The Bonaparte project will be sold as Javelin concentrates on its two brownfields gold projects.

EMvision Medical Devices (ASX:EMV) has announced excellent results from its world-first neurodiagnostic technology for early stroke identification.

The EMView multi-site study involved 307 participants, including 277 suspected stroke patients, and demonstrated high diagnostic performance: 92% sensitivity and 85% specificity for haemorrhage detection, and 85% sensitivity and 78% specificity for ischemia detection.

The AI-based algorithms showed improved performance with more clinical data, allowing EMVision to proceed with a validation trial to support FDA clearance and product commercialisation. The trial, expected to cost $4m and last 6-12 months, will further refine the technology.

Also read Tim Borehams’s Health Check: It’s a small world after all for global microcap index additions LTR Pharma and EZZ Life Science

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| AVE | Avecho Biotech Ltd | 0.002 | -33% | 854,663 | $9,507,891 |

| CDE | Codeifai Limited | 0.001 | -33% | 1,005,654 | $3,961,942 |

| RIE | Riedel Resources Ltd | 0.001 | -33% | 334,000 | $3,335,753 |

| SI6 | SI6 Metals Limited | 0.001 | -33% | 59,451 | $4,150,938 |

| ADY | Admiralty Resources. | 0.005 | -29% | 1,622,290 | $18,406,356 |

| PDN | Paladin Energy Ltd | 7.000 | -28% | 16,263,435 | $2,895,414,053 |

| TRM | Truscott Mining Corp | 0.058 | -26% | 70,142 | $14,273,888 |

| ERL | Empire Resources | 0.003 | -25% | 1,922,311 | $5,935,653 |

| PRO | Prophecy Internation | 0.535 | -22% | 223,214 | $50,801,894 |

| JAY | Jayride Group | 0.007 | -22% | 1,115,824 | $2,146,140 |

| GRE | Greentechmetals | 0.095 | -21% | 35,575 | $9,969,597 |

| HTG | Harvest Tech Grp Ltd | 0.012 | -20% | 338,913 | $13,006,553 |

| BNL | Blue Star Helium Ltd | 0.004 | -20% | 816,701 | $13,474,426 |

| FHS | Freehill Mining Ltd. | 0.004 | -20% | 1,219,081 | $15,392,639 |

| GBZ | GBM Rsources Ltd | 0.008 | -20% | 3,099,649 | $11,566,889 |

| IS3 | I Synergy Group Ltd | 0.004 | -20% | 400,000 | $1,781,089 |

| MOM | Moab Minerals Ltd | 0.004 | -20% | 616,923 | $4,464,294 |

| TTI | Traffic Technologies | 0.004 | -20% | 10,909 | $5,594,090 |

| ADR | Adherium Ltd | 0.009 | -18% | 262,371 | $8,344,380 |

| GW1 | Greenwing Resources | 0.045 | -17% | 19,462 | $12,995,180 |

| AGD | Austral Gold | 0.025 | -17% | 75,455 | $18,369,341 |

| MCE | Matrix C & E Ltd | 0.250 | -17% | 342,655 | $67,143,354 |

| NSX | NSX Limited | 0.025 | -17% | 522,691 | $13,733,429 |

| AKN | Auking Mining Ltd | 0.005 | -17% | 3,693,472 | $2,348,102 |

IN CASE YOU MISSED IT

Green Technology Metals (ASX:GT1) has visually observed up to 30% spodumene in thick intervals of pegmatites intersected by its Phase 1 diamond drilling at its Root lithium project in Ontario, Canada. Confirmation by assaying could extend pegmatite mineralisation below current pit depths.

With the wet season in Côte d’Ivoire drawing to a close, Many Peaks Minerals (ASX:MPK) has started a 5000m reconnaissance auger drilling program along the highly prospective structural corridor hosting the Ouarigue South prospect that strikes for 9km. It will also start a 5000m air core campaign at Odienné that will assess priority targets delineated from the previous quarter’s auger drill results.

Phase 1 diamond drilling at Terra Metals’ (ASX:TM1) Dante Reefs project in WA has returned promising intersections of copper, gold and platinum group metals at Reef 1 North, reinforcing its potential to host copper, gold, PGMs, vanadium and titanium.

Terrain Minerals’ (ASX:TMX) recent first pass aircore drilling at its Wildflower gold project in WA’s Murchison province has intersected gold with hole 24WFAC062 returning a 9m intersection grading 1.17g/t from 30m including 3m at 2.61g/t.

Drilling also returned multiple wide zones of lower-grade supergene gold anomalism such as 42m at 0.11g/t from surface in hole 24WFAC050 and 18m at 0.14g/t in 24WFAC051. New modelling has indicated that current drilling might only have intersected a supergene halo proximal to primary gold mineralisation.

Follow-up reverse circulation drilling will test potential northwest trending structures the follow the three holes and is interpreted as a potential repetition of the sheer zones hosting the Rothsay deposit.

Codeifai (ASX:CDE) is hosting an investor webinar on Wednesday, November 14 at 2:00pm AEDT (11:00am AWST).

CDE executive chairman and group CEO John Houston will be joined by chief operating officer Martin Ross to update shareholders on ConnectQR and its importance to the business. The briefing will be followed by a Q&A. Questions can be submitted to [email protected] now, or in written form during the webinar.

Those interested may register by clicking the following: Registration Link.

Javelin Minerals (ASX:JAV) has decided to put its Bonparte copper-silver-lead-zinc asset in WA’s Kimberley region up for sale as part of the company’s strategy to dispose of non-core projects.

The decision follows Javelin’s recently announced purchase of the highly prospective Eureka Gold project near Kalgoorlie. Along with its Coogee Gold Project, JAV now owns and is fully focused on its two brownfields gold exploration projects in WA’s Eastern Goldfields.

“The Bonaparte project has been exposed to very little recent exploration and has significant upside based on the historical copper, silver, lead and zinc exploration results,” JAV executive chairman Brett Mitchell said.

“Given our very active exploration schedule totally focused on Eureka and Coogee, we have decided to offer Bonaparte for sale”.

At Stockhead we tell it like it is. While Codeifai, Green Technology Metals, Javelin Minerals, Many Peaks Minerals, Terra Metals and Terrain Minerals are Stockhead advertisers, they did not sponsor this article.

At Stockhead we tell it like it is. While Weebit Nano and Equinox Resources are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.