Taroom Trough poised to explode following Shell’s success

Energy juniors hope to strike it big on the back of Shell development in the Taroom Trough. Pic: Getty Images

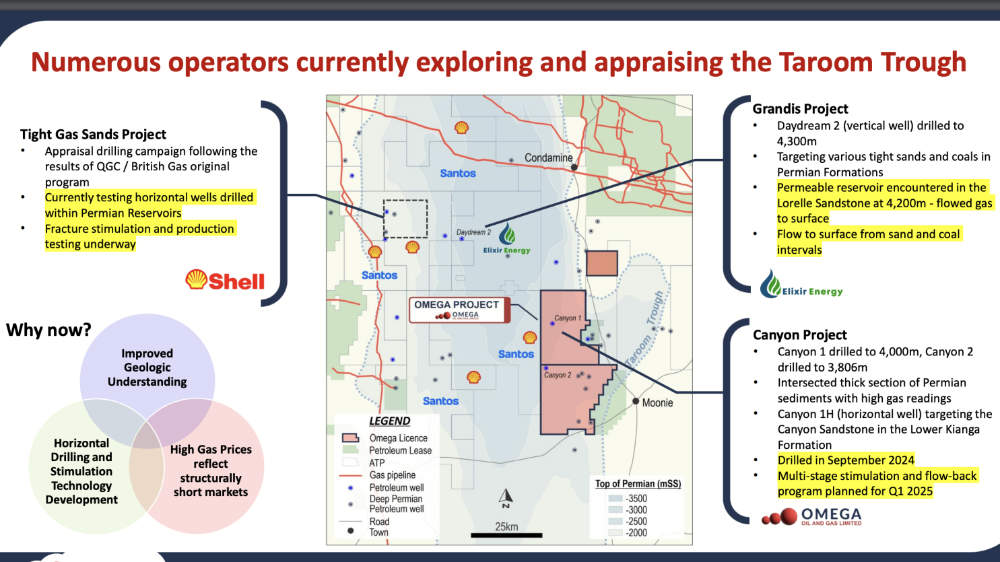

Supermajor Shell’s reportedly successful appraisal program at the Taroom Trough could pry the play open to ease east coast gas woes.

A common theme in resources exploration in frontier regions is that things only really take off when a major player decides to go all in.

Not only does such a decision validate the region’s prospectivity, the entry of major companies typically brings services companies knocking on the door to peddle their wares.

This is hugely positive for junior explorers operating in the same region.

Having a measure of validation from a major makes it easier to sell one’s project to potential investors while the availability of rigs and other equipment saves on having to pay mobilisation costs associated with moving them from other regions or even overseas.

Shell’s game in the Taroom Trough

According to industry sources, this is exactly what Anglo-Dutch supermajor Shell is bringing to the Taroom Trough within the southern Bowen Basin, Queensland.

While the tight-lipped £160bn ($309bn) London-headquartered company hasn’t outright said anything to the effect, there are plenty of signs that its exploration and appraisal program is going well.

Media outlets first reported in September that Shell was flaring gas from one of the three appraisal wells it had drilled in Taroom Trough, which quickly led to speculation that it might have confirmed its prospectivity.

Flaring – the burning of methane that would otherwise escape into the atmosphere and cause even more of an environmental headache – typically only occurs when there’s natural gas to spare.

A bigger flare translates to more gas flow and it seems that said flare at Shell’s well is pretty significant.

Stockhead’s sources have now indicated that the third appraisal well, which is believed to include a 1000m horizontal section through the target reservoir, was indeed tested and flowed gas strongly.

Shell has also reportedly committed to a long-term development program that includes drilling and completing multiple wells and has lined up or is lining up the services and contracting required to do so.

Opening the play

Major players don’t commit to such moves without good reason, so if Shell is proceeding with a development program at the Taroom Trough, it has clearly met the supermajor’s standards for commerciality.

This could in turn go a long way towards alleviating the Australian Energy Market Operator’s forecasted gas supply crunch on the east coast.

As MST head of energy research Saul Kavonic told Stockhead at the beginning of this month, the Taroom Trough has the potential to add multi trillion cubic feet of new gas supply to the east coast from an area that is close to existing infrastructure.

It also places juniors operating in the region in an even stronger position.

After stumbling in the first half of October after production testing of its Daydream-2 vertical well resulted in lower gas flow rates than previously measured stabilised gas flow rates, Elixir Energy (ASX:EXR) has dusted itself off and continued to progress its Taroom Trough activities.

The lower flow rates, which it attributed to either the multiple open and closures of the well or to adverse reactions to fluids introduced into the wellbore, didn’t prevent it from executing a non-binding memorandum of understanding with Australian Gas Infrastructure Group (AGIG) to investigate the potential for developing gas infrastructure to support production for its Grandis project.

It noted that the issues seen in Daydream-2 are commonly encountered in early stage tight gas plays and can be remedied by operational changes to fluid use and well management.

Planning is currently underway for the drilling of the Daydream-3 appraisal well is currently underway to further de-risk Grandis project gas resources.

Omega Oil & Gas (ASX:OMA) is working its way towards testing its Canyon-1H horizontal well, which had recorded strong gas shows and indications of condensate throughout the 822m long horizontal section of the targeted Permian Canyon sandstone.

While the gas is undoubtedly welcome, the condensate content provides a boost to the Canyon project’s development economics. The horizontal section also provides greater surface area for increased flow rates, which could also account for the reported success of the Shell appraisal well.

The company is currently finalising the design and preparations for an eight-stage fracture stimulation program of this horizontal section, which will be flow tested in Q1 2025.

Services giant Halliburton has already been awarded the contract to carry out the fracture stimulation work.

At Stockhead, we tell it like it is. While Omega Oil and Gas is a Stockhead advertiser, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.