Closing Bell: Iffy ASX 200 fizzles, AIC Mines plays master of puppets with takeover target Demetallica

News

News

The benchmark ASX 200 is flat as on Monday. The ASX Emerging Companies (XEC) index has lost 1.3%.

REITs and Gold are higher, Energy and Healthcare are lower.

Not helping local sentiment are drifting US S&P 500 futures which have been unable to reboot following their worst week since June.

The other bugbear for markets big and small remains the US Federal Reserve’s two-day FOMC meeting which is the dominant feature across a fairly busy macro landscape this week.

Futures tied to the blue chip index were 0.15% lower at 1530 AEST in Sydney. Futures for the Dow Jones Industrial Average futures were 0.1% lower, while the Nasdaq 100 futures – after the tech-heavy index crashed 6.2% last week are about 0.5% weaker.

At home cost pressures are in no short supply ahead of tomorrow’s glimpse of the RBA’s meeting minutes for August.

CommSec says filling up the average Aussie people mover is costing the average people unit (family) $228.90 a month. Despite the recent falls in pump prices it costs about $7 a month more to fill up the car compared with the start of the year.

Although we’re all hoping for a week to chill – after all we’ll be kicking it in mournful ease when on Thursday, when the news drops of central bank meets in the US, the UK and Japan – there’s little doubt things will heat up by Friday. In the meantime, the UK, Japan and Canada are taking a knee today.

Here are the best performing ASX small cap stocks [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| ANL | Amani Gold Ltd | 0.0015 | 50% | 2,559,208 | $23,693,441 |

| DRM | Demetallica | 0.29 | 45% | 4,557,150 | $17,369,724 |

| ICR | Intelicare Holdings | 0.04 | 29% | 1,864,230 | $3,734,456 |

| MX1 | Micro-X Limited | 0.165 | 22% | 1,846,817 | $62,303,174 |

| AMA | AMA Group Limited | 0.265 | 20% | 2,301,969 | $236,075,448 |

| PTR | Petratherm Ltd | 0.083 | 20% | 3,147,487 | $15,507,829 |

| BCK | Brockman Mining Ltd | 0.03 | 20% | 154,955 | $232,005,803 |

| AMD | Arrow Minerals | 0.006 | 20% | 45,235,237 | $10,168,825 |

| KGD | Kula Gold Limited | 0.024 | 20% | 3,732,093 | $5,379,391 |

| OAR | OAR Resources Ltd | 0.006 | 20% | 6,123,880 | $10,855,189 |

| VOL | Victory Offices Ltd | 0.037 | 19% | 31,075 | $4,893,288 |

| SPL | Starpharma Holdings | 0.69 | 19% | 962,468 | $236,897,176 |

| HPC | Thehydration | 0.13 | 18% | 25,846 | $15,824,145 |

| BEX | Bikeexchange Ltd | 0.02 | 18% | 810,779 | $8,581,946 |

| CVR | Cavalier Resources | 0.175 | 17% | 10,000 | $4,558,358 |

| FIN | FIN Resources Ltd | 0.021 | 17% | 3,824,111 | $10,070,637 |

| ATC | Altech Chem Ltd | 0.115 | 15% | 8,037,460 | $142,676,587 |

| ADR | Adherium Ltd | 0.008 | 14% | 200,000 | $15,593,869 |

| ADV | Ardiden Ltd | 0.008 | 14% | 17,524,995 | $18,678,347 |

| HOR | Horseshoe Metals Ltd | 0.024 | 14% | 1,297,161 | $11,590,801 |

| MCM | Mc Mining Ltd | 0.67 | 14% | 90,158 | $116,616,373 |

| LDX | Lumos Diagnostics | 0.06 | 13% | 1,116,511 | $11,125,042 |

| PNT | Panthermetalsltd | 0.215 | 13% | 5,889 | $5,795,000 |

| TPD | Talon Energy Ltd | 0.175 | 13% | 1,562,860 | $68,254,660 |

| LKE | Lake Resources | 1.05 | 13% | 48,882,600 | $1,292,675,549 |

The wee explorer Demetallica (ASX:DRM) has received an off-market takeover offer from copper miner AIC Mines Limited (ASX: A1M).

In an exciting development indeed for Demetallica shareholders there’s one A1M share on the hook for every one and a half Demetallica shares.

That makes Demetallica worth about $38 million or 34 cents per share. I’m fumbling at the wee buttons but the offer represents a near 69% upside on DRM’s last closing price of 20 cents a pop.

DRM’s 9.1Mt Jericho copper deposit is only 4km from A1M’s 12,500tpa copper, 6000ozpa gold Eloise copper mine and processing facility, which it acquired in November last year.

In the first eight months of ownership, Eloise generated $104.4 million in revenue and $16.9 million in net mine cashflow at an AISC of A$4.33/lb Cu and AIC of A$4.82/lb Cu.

The $130m miner says this offer for Jericho – part of the Chimera polymetal project — is the start of a regional consolidation drive, as it aims to become a new mid-tier Aussie copper and gold miner.

“Combining these assets will provide the quickest and most efficient means of developing and mining the Jericho deposit – to the shared benefit of both AIC Mines and Demetallica shareholders,” it says.

A mineral resource update at Jericho is due October. The company had $10.5m in the bank at the end of June.

DRM has yet to reply to the offer.

When Stockhead called the board was in a meeting, hashing out the details of a response which should be available on the ASX in the coming days.

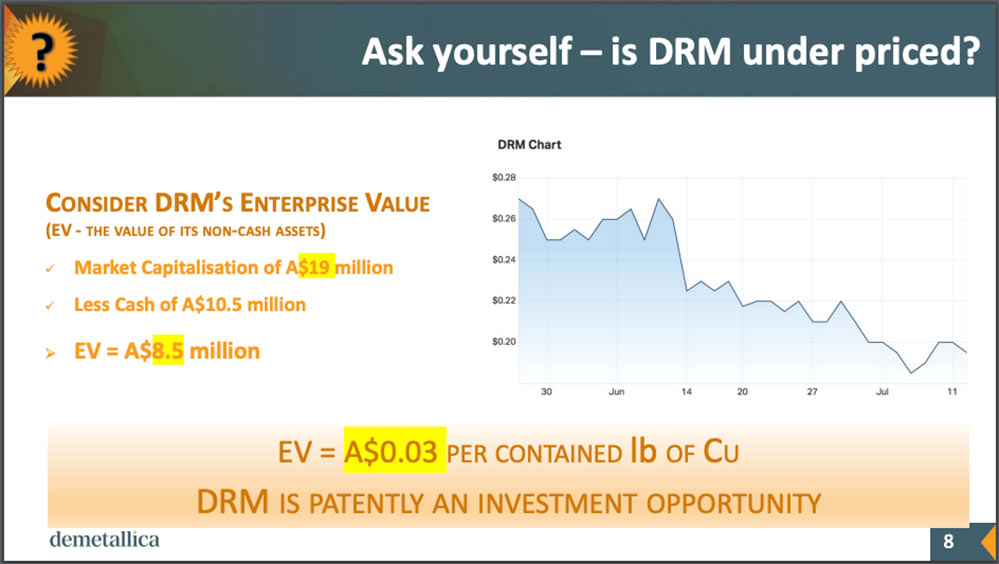

Reuben says based on this slide from its most recent presso, they may consider a $36m bid opportunistic:

Up today well over 20% is Kula Gold (ASX:KGD)is raising $1.8m to expedite WA lithium exploration and “assess new opportunities in the sector”.

The placement will be undertaken at $0.02 per share, which was its last closing price.

“Funds raised from the Placement will focus on accelerating lithium exploration work at the Company’s 100% owned Brunswick Project in the South West ~45km from the Greenbushes lithium mine, as well as follow up recently identified Westonia Ni/PGE/Gold prospects adjacent to the Edna May gold mine in WA,” it says.

“Kula is also assessing new opportunities in the lithium sector that would complement the existing Brunswick lithium project.”

Petratherm (ASX:PTR), which caught the laser-guided attention of Barry Fitzgerald on Friday, is off to the races this morning, stacking on close to +25% as it became almost painfully apparent that its sitting on the cusp of turning into a much meatier proposition for investors.

Here are the best performing ASX small cap stocks [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| WBE | Whitebark Energy | 0.002 | -33% | 1,961,611 | $16,944,658 |

| ARE | Argonaut Resources | 0.0015 | -25% | 1,001,000 | $7,238,051 |

| CCE | Carnegie Cln Energy | 0.0015 | -25% | 910,980 | $30,205,147 |

| PET | Phoslock Env Tec Ltd | 0.062 | -23% | 19,307,702 | $49,951,241 |

| CT1 | Constellation Tech | 0.005 | -17% | 1,000,000 | $8,827,202 |

| CTO | Citigold Corp Ltd | 0.005 | -17% | 4,918,737 | $17,001,955 |

| QFE | Quickfee Limited | 0.066 | -16% | 57,658 | $21,042,576 |

| EQE | Equus Mining Ltd | 0.105 | -16% | 199,309 | $23,353,994 |

| IKW | Ikwezi Mining Ltd | 1.42 | -15% | 12,740 | $68,291,956 |

| SHG | Singular Health | 0.11 | -15% | 4,453 | $8,487,579 |

| REZ | Resources & Energy Grp | 0.0205 | -15% | 1,999,007 | $11,995,339 |

| AQC | Auspaccoal Ltd | 0.53 | -15% | 677,561 | $31,300,582 |

| JXT | Jaxstaltd | 0.018 | -14% | 1,411,772 | $7,194,142 |

| 1MC | Morella Corporation | 0.024 | -14% | 47,383,364 | $161,438,082 |

| FAU | First Au Ltd | 0.006 | -14% | 293,623 | $6,519,877 |

| VRS | Veris Ltd | 0.086 | -14% | 811,586 | $52,374,946 |

| GW1 | Greenwing Resources | 0.31 | -14% | 138,421 | $44,369,046 |

| CMD | Cassius Mining Ltd | 0.031 | -14% | 695,063 | $14,534,673 |

| BUX | Buxton Resources Ltd | 0.095 | -14% | 522,267 | $16,041,200 |

| KFM | Kingfisher Mining | 0.555 | -13% | 632,182 | $21,916,801 |

| CLZ | Classic Min Ltd | 0.0165 | -13% | 17,882,903 | $8,506,765 |

| CHL | Camplifyholdings | 2.08 | -13% | 54,877 | $67,029,151 |

| CLT | Cellnet Group | 0.027 | -13% | 35,378 | $7,551,434 |

| ARO | Astro Resources NL | 0.0035 | -13% | 11,841,237 | $18,820,965 |

| GTG | Genetic Technologies | 0.0035 | -13% | 4,174,453 | $36,935,861 |

Gold Mountain (ASX:GMN) has signed a binding heads of agreement to acquire up to 75% in a package of Brazilian lithium licences.

The agreement with Mars Mines gives the company an exclusive 60 day licence to acquire four separate project areas covering 285km2 over parts of the highly prospective Borborema Province and São Francisco craton within the eastern Brazilian lithium belt which covers all known past and present lithium producing districts in the country.

All four projects are located in areas known to host lithium-bearing pegmatites and are along strike from and covering known pegmatite bodies.

“We are excited about the proposed acquisition of up to 75% interest in these highly prospective lithium projects in northeastern Brazil,” chief executive officer Tim Cameron said.

Global X has had to call a halt to trading on two of its currency hedged ETFs (ASX:USTB) and the squishy-sounding (ASX:USHY) because someone dun goofed and they’re on the market with incorrect names.

Far be it from us here to pitnick about tpyos and such… but that does seem to be a pretty big mistake to make – hopefully they’ll have the right name tags on when the halt gets halted sometime tomorrow.

Meanwhile, Skin Elements (ASX:SKN) has shrugged off a “Please Explain” from the ASX over its recent price jump, which saw it trading more than 100% up since 15 September to this morning.

SKN has told the ASX that there’s nothing that it’s aware of that the market hadn’t already been told about, so the reason for the hike looks set to remain one of those spooky Unsolved Mysteries of the ASX, which actually sounds like it could be a pretty great TV show and well worth getting Leonard Nimoy back from beyond the grave as host… using SKN’s product so he doesn’t look quite so dead, of course.

And last cab off the rank is news from Morella Corporation (ASX:1MC) that Alex “The Big Cheese” Cheeseman has stepped down as CEO, effective not-exactly-immediately-but-close-enough.

Cheeseman was meant to provide the company with 6 months’ notice under his contract, however 1MC has let him go with an end date of 7 October “due to circumstances”. For real – that’s all the announcement says. Make of that what you will.

The CEO position won’t be filled, 1MC continues – current MD James Brown (don’t make a joke… don’t make a joke…) says he feels good (dammit!) about absorbing those responsibilities into his portfolio of Important Stuff to Do.

Moho Resources (ASX:MOH) – A rare double-banger, here from Moho: a capital raise and results incoming from its REE play. Verrry interesting.

Grand Gulf Energy (ASX:GGE) – Test results are due back from Jesse 1A. Betcha $10 GGE’s the father.

Carbonxt Group (ASX:CG1) – Capital raise.

IVE Group (ASX:IGL) – Capital raise.

Respiri (ASX:RSH) – Equity raise, cause sometimes you’ve just gotta be different.

Gold Mountain (ASX:GMN) – Capital raise.