Resources Top 5: More copper M&A action, and a beleaguered lithium developer tells investors ‘don’t worry’

Pic: Via Getty

- Demetallica receives $36m takeover offer from copper miner AIC Mines

- South Australian rare earths + IOCG hunter PTR has been forced to retract a slide from a recent presso

- Some good news from lithium play Lake Resources, which has shed 55% from its April 2022 peak

Here are the biggest resources winners in early trade, Monday September 19.

DEMETALLICA (ASX:DRM)

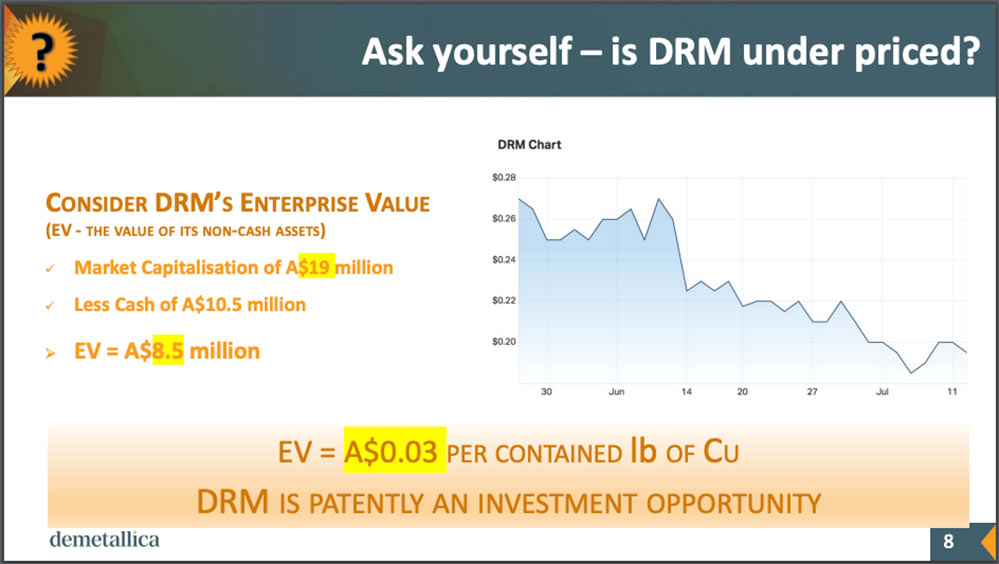

The QLD explorer has received a takeover offer from copper miner AIC Mines (ASX:A1M), which values DRM at ~$36m or 33.7c per share.

That’s a 68% premium to the last closing price, and a 35% premium to its May 2022 listing price.

DRM’s 9.1Mt Jericho copper deposit is only 4km from A1M’s 12,500tpa copper, 6000ozpa gold Eloise copper mine and processing facility, which it acquired in November last year.

In the first eight months of ownership, Eloise generated $104.4 million in revenue and $16.9 million in net mine cashflow at an AISC of A$4.33/lb Cu and AIC of A$4.82/lb Cu.

The $130m miner says this offer for Jericho – part of the Chimera polymetal project — is the start of a regional consolidation drive, as it aims to become a new mid-tier Aussie copper and gold miner.

“Combining these assets will provide the quickest and most efficient means of developing and mining the Jericho deposit – to the shared benefit of both AIC Mines and Demetallica shareholders,” it says.

A mineral resource update at Jericho is due October. The company had $10.5m in the bank at the end of June.

DRM has yet to reply to the offer.

When Stockhead called the board was in a meeting, hashing out the details of a response which should be available on the ASX in the coming hours.

Based on this slide from its most recent presso they may consider a $36m bid opportunistic:

PETRATHERM (ASX:PTR)

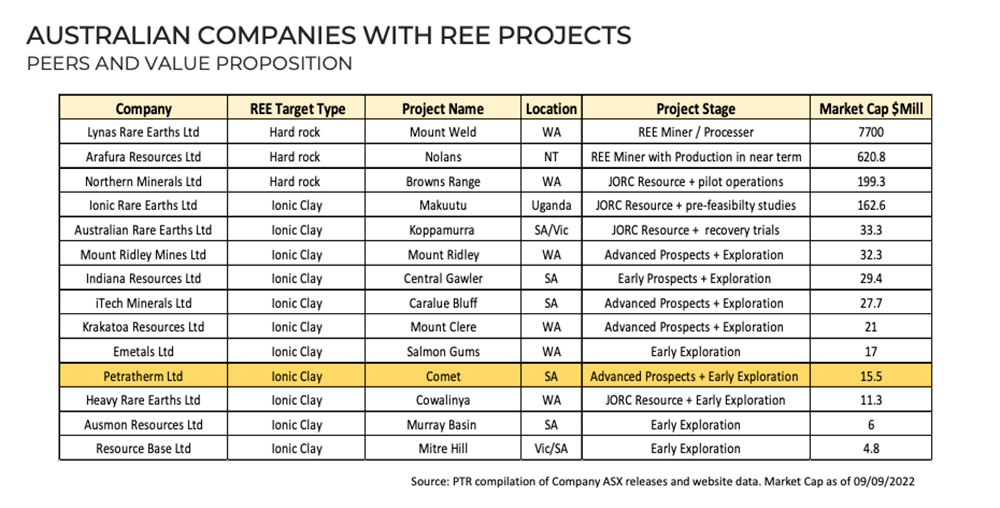

South Australian rare earths + IOCG hunter PTR has been forced to retract a slide from a recent presso which contains a comparison between PTR and other REE companies.

In a possible example of the Streisand Effect, PTR has enjoyed a small rocket this morning.

This is the slide in question, which is still available online:

Also adding fuel to the fire is our very own Barry Fitzgerald, who over the weekend said of PTR – “if both SA copper and rare earths were housed inside a lightly capitalised explorer with a technically proficient exploration team running the show, Garimpeiro for one would sit up and take notice.”

Shares in PTR went ballistic in April on a major rare earth discovery at the Comet project within the Northern Gawler Craton of South Australia.

NOW READ: Why are ASX stocks so in love with clay rare earths projects? A punter’s guide

KULA GOLD (ASX:KGD)

KGD will raise $1.8m to expedite WA lithium exploration and “assess new opportunities in the sector”.

The placement will be undertaken at $0.02 per share, which was its last closing price.

“Funds raised from the Placement will focus on accelerating lithium exploration work at the Company’s 100% owned Brunswick Project in the South West ~45km from the Greenbushes lithium mine, as well as follow up recently identified Westonia Ni/PGE/Gold prospects adjacent to the Edna May gold mine in WA,” it says.

“Kula is also assessing new opportunities in the lithium sector that would complement the existing Brunswick lithium project.”

LAKE RESOURCES (ASX:LKE)

Finally — a silver lining for the near-term lithium producer, which has shed 55% from its April 2022 peak on a revolving door of bad news.

Last week LKE admitted it was having an argument with tech partner Lilac Solutions re demonstration plant deadlines.

LKE and Lilac are using Direct Lithium Injection (DLE), which promises to produce cheaper, higher quality, and more environmentally friendly lithium than incumbent processes.

DLE has been used in water treatment for decades but its use in the lithium sector is in its infancy.

LKE has today attempted to alleviate investor concern about the tech, saying today that “all parties are confident on-site operations will be successful”.

“Lake confirms that construction of the facility to house the Lilac demonstration plant is now complete,” it says.

“Dry commissioning of the demonstration plant commenced on Wednesday September 14.

“Lilac has advised Lake that, subject to completion of dry commissioning, it expects to begin wet commissioning of the plant on September 22; once wet commissioning is complete, Lilac expects to begin onsite processing of Kachi brines in the first week of October.”

The first 2000 litres of lithium concentrate produced from the demonstration plant (a smaller version of the real thing) will be converted into lithium carbonate, which will be qualified by a tier 1 battery maker.

“Lake will continue to update the market on the Kachi Project, the Dispute, and, as the demonstration test work continues, on the progress, the timelines, milestones and outcomes,” it says.

“Lake confirms offtake discussions continue to advance and new appointments to the Lake board are in final stages of consideration.”

BROCKMAN MINING (ASX:BCK)

(Up on no news)

In April last year, Chinese-owned BCK and major miner Mineral Resources (ASX:MIN) formed a JV to bring a 25 million tonnes a year Pilbara iron ore hub into production.

$11.1bn market cap MIN will fund ~$105m worth of initial development works at the ‘Marillana’ and ‘Ophthalmia’ project mine sites, as well as on the transport corridor and port area.

The development timeframe was estimated at about three-and-a-half years.

It is part of MIN’s plan to turn from a 20Mtpa miner to a 90Mtpa major in 3-5 years through a series of developments and acquisitions.

In Feb, MIN announced that the Government of WA had granted a port capacity allocation to MRL and Hancock Prospecting for a new iron ore export facility at the Port of Port Hedland.

MIN is aiming to ship at least 20 million tonnes of iron ore per annum from this facility.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.