Closing Bell: ASX pulls off a comeback for the ages as big names lead late surge

News

News

Australian shares failed to launch before lunch on Monday, but they were upper by supper as Chinese data, hardly recognisable in its mild positivity helped bring home some mildly positive returns.

Things looked close at the close, but local traders perhaps began to digest that China’s deflationary pressures eased slightly over the weekend and that credit lending grew more than expected in August (no one expected much).

This shows both that people were in fact paying attention when the People’s Bank of China (PBoC) last month called out major Chinese lenders to get out and foist more loans on hesitant property developers and their victims/customers.

Consumer prices improved, ticking off structural deflation as a potential short-term headwind, according to data released (and yes, probably tweaked) on Monday.

China’s State Council’s also gone and accelerated the sale of bonds to the hopelessly profligate but cash-strapped local governments.

These are all, in their own way, good signs of both a less terrible Chinese economy, more domestic activity and that the central government is shaking a few pennies at its littany of problems.

So too, iron ore October futures contacts in Singapore have risen another 2.5% to now go for US$116.05 a tonne. Futures for the steel-making plaything of BHP, Rio and Fortescue (all up around 1.5%( have been selling like hotcakes ever since they hit $100 in mid-August.

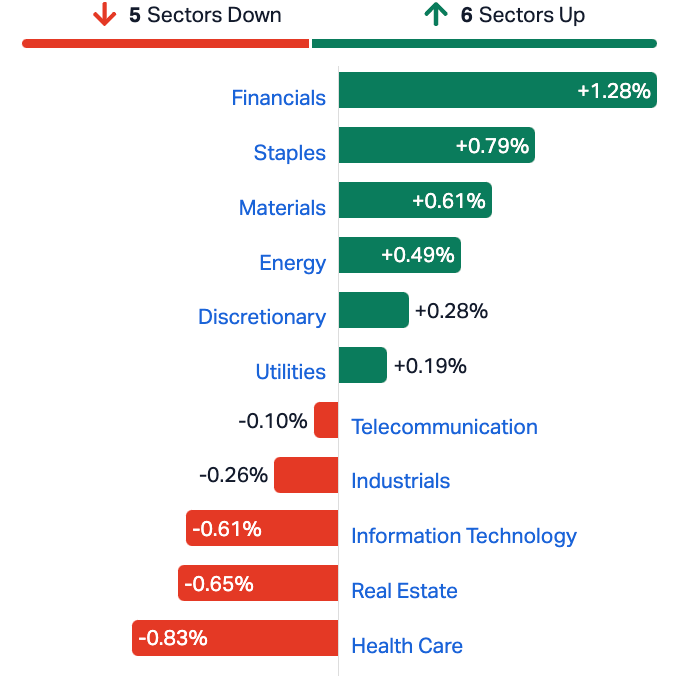

Elsewhere on the ASX, the Financial Sector picked up the ball and ran with it, making about +1.3% of sturdy inroads by the whistle. The 4 major banks comprise about 99.9% of the local market, so that helped everyone.

On the debit ledger, by mid-afternoon, the major lithium diggers were among the major Monday losers. Sentiment chilled around Liontown which lost 1.3% regardless of the American giant Albemarle’s closing in on its proposed $6.6 billion takeover. And Pilbara Minerals (ASX:PLS) did its swing thing, shedding 2.6%, the target of probs the same sellers, who’ll buy tomorrow. selling.

Tawdry Tech lost about -0.6%, better than the -1.2% it was giving away in the AM.

Last week didn’t help tech, admittedly, the Nasdaq Composite tumbled 1.9%, as the Dow Jones gave up 0.8% and the S&P 500 dropped 1.3%.

Those losses came as a string of stronger-than-expected US economic data renewed fears that the Federal Reserve could tighten policy further. US markets, jumping at the shadow of a Federal Reserve governor, are now banking a near 50% and rising chance of another rate hike in November, following the looming, hopeful pause in September.

Housing Future Fund: Less of a mess

PM Anthony Albo’s team in the upper house just got its signature housing policy off the operating table and into the recovery ward, after 5 m,onths of fiddling on the part of Adam Bandt, King of the Greens, who announced earlier today he’d throw his party’s support behind the Albo Housing Future Fund.

The $10bn plan is to bulk up an investment fund which you’d hope will generate enough to toss into making 30,000 new social and affordable homes over the next 5 years.

All Adam – he who wields the balance of power in the senate like he deserves it – wanted was another $1bn for public and community housing… which the whole thing was about anyway.

The Aussie Dollar: Less than last month

Intrepid IG Markets’ Tony Sycamore’s been reporting from the front lines of the deteriorating outlook for the Pacific Peso.

“Last week was a torrid one for the AUD/USD, with everything, including the proverbial kitchen sink, being thrown at the little Ozzie battler.”

The AUD ended the week 1.15% lower at .6377.

“The aggressive selling in the AUD/USD kicked in last Tuesday after the RBA kept rates on hold at 4.10% for a third consecutive month, and following another round of dire Chinese data, the Caixin services PMI fell from 54.1 in July to 51.8 in August.”

Just how bearish are the FX traders feeling about the currency which bought you such hits as the Lobster, Pineapple and the Watermelon?

Speculative net short positions in the AUD/USD jumped by almost 12% last week from -83.5k -70.2k, according to the Commodity Futures Trading Commission (CFTC).

China: Less deflating than last week

China’s consumer prices rose by 0.1% yoy in August 2023, compared with market forecasts of a 0.2% gain and after the first drop in over 2 years of 0.3% in July.

Non-food prices picked up while the cost of food fell further. Producer prices crashed 5%, the least-worst crash in 5 months of carnage.

Bloomberg says China’s deflationary pressures eased slightly and data expected this week may show a pick-up in credit demand, adding to a recent trickle of signs the nation’s economy is stabilising.

Analysts expect officials this week will report a boost in loans last month as well.

US Futures: Best is Less

US stock market futures are steady ahead of Monday trade, with itchy and angsty US traders keeping a wide-eyed eye on some of the inflation indicators set to drop later this week.

Good news on indicators like jobs, confidence, retail spend and the like are utterly unwelcome right now. No one wants to give The Fed any encouragement.

The US central bank’s gone and lifted its policy rate by 5.25% over the last 18 months, hoisting the cost of borrowing in what is still an unsettled accounting of 40-year high inflation and the cheeky US spenders driving it.

Via FoxUS traders will get a looksee of consumer and producer inflation reports on Wednesday and Thursday, respectively.

Retail sales and consumer sentiment data will also be released this week. Major US tech firms Oracle and Adobe will report earnings on Monday and Thursday.

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| EDE | Eden Inv Ltd | 0.003 | 50% | 9,324,140 | $6,727,274 |

| AXP | AXP Energy Ltd | 0.002 | 33% | 3,315,000 | $8,737,021 |

| DXN | DXN Limited | 0.002 | 33% | 34,987,429 | $2,585,010 |

| KEY | KEY Petroleum | 0.002 | 33% | 20,440,488 | $2,951,892 |

| KNM | Kneomedia Limited | 0.004 | 33% | 1,600,000 | $4,514,356 |

| MTH | Mithril Resources | 0.002 | 33% | 1,500,050 | $5,053,207 |

| OMX | Orangeminerals | 0.04 | 33% | 42,290 | $1,490,021 |

| M2M | Mtmalcolmminesnl | 0.033 | 32% | 469,140 | $2,558,588 |

| CNW | Cirrus Net Hold Ltd | 0.0535 | 30% | 36,373,691 | $38,130,262 |

| CTQ | Careteq Limited | 0.027 | 29% | 1,422,799 | $4,664,580 |

| NVO | Novo Resources Corp | 0.25 | 25% | 2,243,889 | $7,500,000 |

| DCX | Discovex Res Ltd | 0.0025 | 25% | 1,000,000 | $6,605,136 |

| EMU | EMU NL | 0.0025 | 25% | 50,000 | $2,900,043 |

| ID8 | Identitii Limited | 0.016 | 23% | 2,868,136 | $4,505,988 |

| SRT | Strata Investment | 0.19 | 23% | 62,000 | $26,260,654 |

| WCN | White Cliff Min Ltd | 0.011 | 22% | 5,499,526 | $11,313,167 |

| WGR | Westerngoldresources | 0.039 | 22% | 282,130 | $3,255,032 |

| MOB | Mobilicom Ltd | 0.0085 | 21% | 7,102,984 | $9,286,737 |

| KLI | Killiresources | 0.064 | 21% | 796,600 | $3,157,478 |

| DVL | Dorsavi Ltd | 0.012 | 20% | 248,333 | $5,566,616 |

| T92 | Terrauraniumlimited | 0.115 | 20% | 660,001 | $4,954,095 |

| AKP | Audio Pixels Ltd | 11.8 | 19% | 5,071 | $289,179,990 |

| ACM | Aus Critical Mineral | 0.425 | 18% | 2,502,318 | $10,703,250 |

| CNQ | Clean Teq Water | 0.41 | 17% | 532,124 | $20,256,803 |

| AOA | Ausmon Resorces | 0.0035 | 17% | 1,100,000 | $2,907,868 |

Well, incredibly Novo Resources (ASX:NVO) has ended flat after it jumped as high as 38%% on its market debut.

After raising $7.5m to join the ASX, Canadian gold miner Novo Resources sits Smaug-like atop one of the largest prospective tenures for gold and battery metals in WA’s Pilbara region for 10,500km2 and is concentrating on the development of its Egina JV with its biggest shareholder, De Grey Mining (ASX:DEG) .

Back in June, De Grey Mining made a cornerstone investment of $35m to earn up to a 50% interest in Novo’s Becher gold project, 28km away from DEG’s massive Hemi gold deposit which forms part of the 11.7Moz Mallina gold project. In Victoria, Novo also owns the Belltopper project.

Novo Executive Co-Chairman and Acting CEO Mike Spreadborough said this was an exciting milestone for Novo and Novo is looking forward to ‘continuing to deliver value to its new and existing shareholders’ through the ASX listing.

In Canadian accent:

“We are delighted to be listed on the ASX and I would like to welcome all new shareholders to Novo, the future is very exciting. I would also like to extend my thanks to all the many people involved in getting us to this stage and acknowledge all the hard work that went into getting us ASX ready.

“The ASX listing is the logical next step for Novo and will facilitate our Australian growth plans, considering the local investor appetite for mining and exploration opportunities. We are focused on accelerating our exploration activities and seeking value accretive opportunities to grow long-term shareholder value.

“We have several exploration programs planned for the second half of 2023 and we look forward to getting boots on the ground and drill rigs spinning. We will be delivering regular updates as drilling progresses at Becher, Nunyerry North, Balla Balla and our Belltopper Project in Victoria. We also look forward to working with our Egina JV partner De Grey, as they take over all exploration efforts within the Egina JV, with a 39,000 m program set to commence at Becher in September.”

Shares were listed at 20c and traders got in and got out by the close.

Cirrus Networks (ASX:CNW), wadded 30% on news that it’s entered into a Scheme Implementation Deed under which it is proposed Atturra will acquire 100% of Cirrus for $0.053 per share.

Octava Minerals (ASX:OCT) now owns 100% of its Talga lithium project in the WA Pilbara after purchasing the remaining 30% from First Au (ASX:FAU).

This includes a 20% free carried interest held by FAU to a decision to mine via a $200,000 cash payment, the issue of 1.25 million shares to FAU to be escrowed for six months, and a 0.75% net smelter royalty.

Octava shot up 27% in early trade, but settled lower in arvo trade.

Octava says the geology of its tenure is similar to the nearby 18Mt @ 1% Li2O Archer lithium deposit held by Global Lithium Resources (ASX:GL1) and has significant gold prospects to boot.

The explorer says Talga also holds the potential for intrusion-related gold deposits, hosting the same mineralised Archean greenstone stratigraphy and structure as the nearby Warrawoona gold discovery made by Calidus.

“There is highly prospective geology at Talga that has already provided initial indications of the potential for discovery,” Octava MD Bevan Wakelam says. “We will continue to actively conduct detailed exploration programs over the project area.”

Elsewhere, Orange Minerals (ASX:OMX) is up over 32% on no news I can see, and Australian Critical Minerals (ASX:ACM) also rose sharply up 18%, on nothing I spotted, other than evidently being terrific companies on Monday.

Gregor says the company remains the most exciting of the year’s IPOs, however, riding the latest lithium surge this morning to clock in at +125% since it made its debut in early July.

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| CLE | Cyclone Metals | 0.001 | -50% | 1,014,094 | $20,529,010 |

| MEB | Medibio Limited | 0.001 | -50% | 1,439,115 | $12,201,488 |

| ERD | Eroad Limited | 0.695 | -35% | 172,494 | $120,984,925 |

| XTC | Xantippe Res Ltd | 0.001 | -33% | 1,112,999 | $26,292,008 |

| OLI | Oliver'S Real Food | 0.017 | -26% | 2,842,278 | $10,136,834 |

| MCT | Metalicity Limited | 0.0015 | -25% | 33,340,250 | $7,472,172 |

| TYM | Tymlez Group | 0.003 | -25% | 225,000 | $4,952,781 |

| MSG | Mcs Services Limited | 0.018 | -25% | 409,800 | $4,754,392 |

| RCE | Recce Pharmaceutical | 0.5 | -23% | 1,097,327 | $115,865,302 |

| TZL | TZ Limited | 0.017 | -23% | 100 | $5,648,679 |

| KOB | Kobaresourceslimited | 0.075 | -21% | 100,021 | $10,014,583 |

| MRI | Myrewardsinternation | 0.012 | -20% | 628,088 | $6,399,507 |

| RMX | Red Mount Min Ltd | 0.004 | -20% | 4,852,170 | $12,621,755 |

| FTC | Fintech Chain Ltd | 0.013 | -19% | 170,266 | $10,412,313 |

| LBT | LBT Innovations | 0.014 | -18% | 715,760 | $6,030,144 |

| NAG | Nagambie Resources | 0.024 | -17% | 801,797 | $16,870,063 |

| CLU | Cluey Ltd | 0.1 | -17% | 109,791 | $24,193,628 |

| ME1 | Melodiol Glb Health | 0.005 | -17% | 3,464,557 | $17,683,922 |

| ROG | Red Sky Energy. | 0.005 | -17% | 979,965 | $31,813,363 |

| STP | Step One Limited | 0.535 | -16% | 54,860 | $118,617,786 |

| GSM | Golden State Mining | 0.037 | -16% | 2,323,458 | $8,407,884 |

| TOR | Torque Met | 0.3 | -15% | 1,816,966 | $34,448,148 |

| WC8 | Wildcat Resources | 0.3 | -15% | 15,200,431 | $236,294,235 |

| AFL | Af Legal Group Ltd | 0.165 | -15% | 58,514 | $15,319,477 |

| GHY | Gold Hydrogen | 0.205 | -15% | 670,049 | $13,661,526 |

International Graphite (ASX:IG6) – Pending the release of an announcement regarding an upgrade to

the Mineral Resource Estimate at the Springdale Graphite Project.

iCetana (ASX:ICE) – Pending news of a capital raise.