Closing Bell: ASX plunges as Wall Street falters and inflation comes in hot

The ASX committed to a dive and took a hard plunge today, falling on Wall Street’s woes and higher-than-expected inflation numbers. Pic: Getty Images

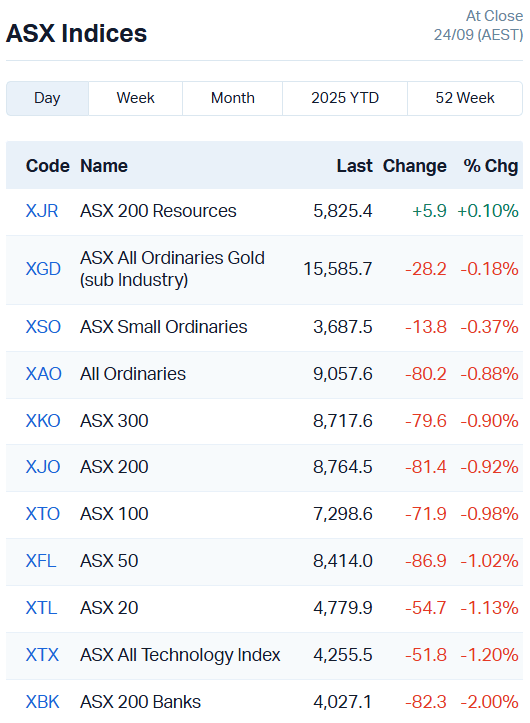

- ASX falls 81 points or 0.92pc by end of trade

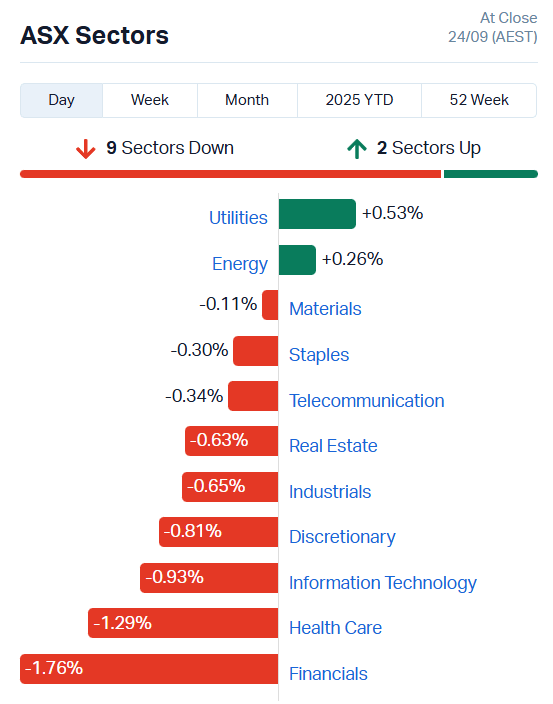

- Utilities and energy sectors the only resistance

- Financials hit hardest, undercut by inflation numbers

ASX returns to September form

The ASX 200 is in a snit once again, pulling sharply back in today’s trade with nine of 11 sectors down.

The bourse had shed 81.4 points or 0.92% by the end of the day, moving lower on broad losses.

The utility and energy sectors, alongside the Resources 200 index, made a valiant effort, but couldn’t hold up the rest of the market.

Even our gold stocks stumbled.

Challenger Gold (ASX:CEL) slid 6.9%, Meeka Metals (ASX:MEK) 4.9% and Gorilla Gold Mines (ASX:GG8) 4.7%.

Not all of them took a fall, though.

Barton Gold (ASX:BGD) ticked up 10.8%, Brightstar Resources (ASX:BTR) 7.8% and Astral Resources (ASX:AAR) 6.7%.

Banks were no help at all. The XBK index for our top seven banking stocks fell 2% by end of trade, and the broader financials sector was deepest in the red, down 1.76%.

Of our seven major banks, the top five fell between 1.4% and 3.24%.

Westpac (ASX:WBC) took the crown for biggest percentage loss, shedding 3.24%, while Commonwealth Bank (ASX:CBA) fell the most in terms of value with its 1.4% dip, losing $2.34 a share.

Today’s inflation reading, coupled with a down day on Wall Street, took the wind right out of their sails.

Aussie inflation numbers come in a little hot

Compounding the market’s woes today was a slightly hotter-than-expected monthly inflation read.

Analysts were predicting the monthly CPI indicator to slide to 2.7% year-on-year, and trimmed mean CPI to 2.5%.

Instead, we got the highest annual inflation reading since July 2024, according to ABS head of prices statistics Michelle Marquardt.

Monthly CPI came in at a flat 3%, while the RBA’s favoured annual trimmed mean notched 2.6% for the year to August.

What does it mean for markets/investors? If you were counting on an RBA interest rate cut next month, you might want to think again.

Most of the heat appears to be coming from household electricity costs, which bumped up annual housing inflation to 4.5% in August, from 3.6% in July.

“The annual rise in electricity costs is primarily related to households in Queensland, Western Australia and Tasmania having higher out-of-pocket costs in August 2025 than they did in August 2024,” Marquardt said.

Rebates have fallen off and households are feeling the bite of higher energy prices.

For all that, Australian inflation is settling into the RBA’s 2-3% band quite nicely, at a time when much of the rest of the world is struggling with sticky inflation on top of an economic downturn.

ASX Leaders

Today’s best performing stocks (including small caps):

| Code | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| GAS | State GAS Limited | 0.05 | 127% | 5102718 | $8,642,719 |

| EV8 | Everlast Minerals. | 0.545 | 76% | 968691 | $16,430,936 |

| IXRR | Ionic Rare Earths - Rights | 0.003 | 50% | 8332338 | $759,261 |

| PIL | Peppermint Inv Ltd | 0.003 | 50% | 2450000 | $4,943,648 |

| WIN | WIN Metals | 0.031 | 41% | 48442923 | $14,686,629 |

| IS3 | I Synergy Group Ltd | 0.019 | 36% | 6025666 | $24,299,311 |

| IPT | Impact Minerals | 0.008 | 33% | 7512247 | $24,679,980 |

| FME | Future Metals NL | 0.029 | 32% | 13770778 | $21,084,818 |

| CC9 | Chariot Corporation | 0.13 | 30% | 1720845 | $15,994,663 |

| NOV | Novatti Group Ltd | 0.037 | 28% | 9245086 | $16,306,586 |

| AKA | Aureka Limited | 0.125 | 25% | 686899 | $12,815,742 |

| ERA | Energy Resources | 0.0025 | 25% | 1034325 | $810,792,482 |

| SPD | Southernpalladium | 0.84 | 24% | 411777 | $72,191,250 |

| CG1 | Carbonxt Group | 0.094 | 24% | 261584 | $31,818,442 |

| T92 | Terra Critical | 0.105 | 24% | 8778815 | $12,458,921 |

| COY | Coppermoly Limited | 0.016 | 23% | 321236 | $11,474,547 |

| AT1 | Atomo Diagnostics | 0.027 | 23% | 8893440 | $17,823,856 |

| XPN | Xpon Technologies | 0.011 | 22% | 1801360 | $4,386,404 |

| YRL | Yandal Resources | 0.32 | 21% | 4738415 | $81,947,270 |

| BSN | Basinenergylimited | 0.059 | 20% | 740891 | $6,912,886 |

| ALM | Alma Metals Ltd | 0.006 | 20% | 83334 | $9,286,186 |

| EM2 | Eagle Mountain | 0.006 | 20% | 849419 | $5,675,186 |

| ENT | Enterprise Metals | 0.006 | 20% | 48178 | $7,206,586 |

| TEG | Triangle Energy Ltd | 0.003 | 20% | 500000 | $5,473,085 |

| DRE | Dreadnought Resources Ltd | 0.031 | 19% | 39553715 | $132,067,000 |

In the news…

Win Metals (ASX:WIN) has wrapped up the acquisition of the Radio Gold Mine, including a range of mining and processing infrastructure, accommodation facilities, vehicles and other associated equipment.

The mine produced 71,000 ounces of gold between 1918 and 1974, and WIN is keen to swiftly resume operations, targeting shallow open pit and underground development opportunities.

Atomo Diagnostics (ASX:AT1) fielded a speeding ticket from the ASX today, going into a trading halt in response to a purchase order that fell under its material threshold reporting obligations.

AT1 will supply 65,000 HIV self-test kits for the United States Agency for International Development (USAID) destined for Ukraine.

Atomo reported the purchase order through its usual investor relations channels, but the value of the order fell below the company’s materiality threshold of $300,000.

Novatti (ASX:NOV) is celebrating a strategic win for its investee, AUDC, of which NOV owns 57%.

AUDC just inked a partnership with major cryptocurrency platform Coinbase, launching the first Australian dollar-backed stablecoin in the form of the AUDD coin token.

The stablecoin is designed to be pegged to the AUD and redeemable on a 1:1 basis with the Australian dollar.

Yandal Resources (ASX:YRL) has hit 50m at 1.3 g/t gold in drilling at the Arrakis gold discovery, part of the Ironstone Well-Barwidgee gold project. The drill hit extended the known mineralised zone of Arrakis 400m to the northwest.

YRL is awaiting another three results from the Arrakis trend, testing its 2.2km strike to the northwest and southeast. The company is planning to drill another 1,200 metres of diamond drilling in October, as well as infill reverse circulation drilling.

ASX Laggards

Today’s worst performing stocks (including small caps):

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| QEM | QEM Limited | 0.024 | -35% | 2480671 | $8,746,813 |

| FG1RA | Flynngold - Rights | 0.002 | -33% | 332190 | $391,316 |

| AYT | Austin Metals Ltd | 0.003 | -25% | 453198 | $6,336,765 |

| BMO | Bastion Minerals | 0.0015 | -25% | 500000 | $4,409,906 |

| MOM | Moab Minerals Ltd | 0.0015 | -25% | 1001309 | $3,749,332 |

| PAB | Patrys Limited | 0.0015 | -25% | 3685723 | $9,167,513 |

| ASE | Astute Metals NL | 0.016 | -24% | 13271054 | $14,928,286 |

| DDT | DataDot Technology | 0.004 | -20% | 131122 | $6,054,764 |

| PCL | Pancontinental Energ | 0.008 | -20% | 10872719 | $82,860,802 |

| RDN | Raiden Resources Ltd | 0.004 | -20% | 1835214 | $17,254,457 |

| RFT | Rectifier Technolog | 0.004 | -20% | 108888 | $6,909,920 |

| BGT | Bio-Gene Technology | 0.033 | -20% | 4320036 | $12,507,505 |

| CGR | Cgnresourceslimited | 0.043 | -19% | 230000 | $4,811,244 |

| DMG | Dragon Mountain Gold | 0.009 | -18% | 81395 | $4,341,388 |

| VMC | Venus Metals Cor Ltd | 0.105 | -18% | 850088 | $25,006,407 |

| RBD | Restaurant Brands NZ | 2.74 | -17% | 4181 | $410,455,541 |

| AKG | Academies Aus Grp | 0.1 | -17% | 64430 | $15,913,736 |

| PRX | Prodigy Gold NL | 0.0025 | -17% | 8285000 | $20,225,588 |

| RGL | Riversgold | 0.005 | -17% | 10621445 | $10,102,276 |

| TMX | Terrain Minerals | 0.0025 | -17% | 22201778 | $8,045,443 |

| BTM | Breakthrough Minsltd | 0.13 | -16% | 155859 | $10,659,458 |

| DAL | Dalaroometalsltd | 0.047 | -16% | 1267394 | $16,618,108 |

| 8CO | 8Common Limited | 0.033 | -15% | 123679 | $8,739,701 |

| MTB | Mount Burgess Mining | 0.0085 | -15% | 56573 | $4,256,383 |

| AON | Apollo Minerals Ltd | 0.006 | -14% | 2483726 | $6,499,198 |

In Case You Missed It

EMVision Medical Devices (ASX:EMV) launches a study evaluating its first responder brain scanner in a mobile stroke unit that brings the emergency department to the patient.

Artemis Resources (ASX:ARV) has commenced drilling the Titan prospect at its Karratha project in WA, with a 1600m campaign underway as it hunts for shallow gold mineralisation.

Tylah Tully looks into Investigator Resources (ASX:IVR) and its expansion of an optimised pit shell to deliver more silver ounces from Australia’s highest-graded primary deposit in Stockhead’s latest StockTake.

Adavale Resources’s (ASX:ADD) first drilling campaign at London Victoria produced the project’s strongest gold intercept in 30 years, with hole ALRC014 delivering a 48m hit.

West Coast Silver (ASX:WCE) has awarded the contract for phase 2 drilling at its near-surface Elizabeth Hill silver play in WA’s Pilbara.

Caspin Resources’ (ASX:CPN) ore sorting of samples from the Kelpie deposit has improved high- and low-grade samples by three and six times respectively.

Tylah Tully casts her eye over Anson Resources (ASX:ASN) and a definitive offtake deal with LG Energy Solution for supply of battery-grade carbonate in today’s Break It Down.

Auravelle Metals (ASX:AUV) has ticked off a second heritage survey at Nuckulla Hill in South Australia, making way for the next round of drilling.

Race Oncology (ASX:RAC) has gained the tick of approval from Korea for its investigational new drug application for a Phase 1 clinical trial into RC220 cancer drug.

Trading halts

Australian Unity (ASX:AYU) – cap raise

FirstWave Cloud Technology (ASX:FCT) – cap raise

Harvest Technology Group (ASX:HTG) – funding facility

QMines (ASX:QML) – cap raise

At Stockhead, we tell it like it is. While Brightstar Resources is a Stockhead advertiser, it did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.