Closing Bell: ASX has best week ever… or at least since everything crashed last month. So… wait… damn you Friday!

News

News

The Australian sharemarket has ended the first week of November with another stout performance, momentarily at least laying to rest a few of the ASX Post-October Stress Disorders about the place.

A ridiculously festive Thursday session on Wall Street was the catalyst for more crazy-brave End of Days trade here in Sydney.

Central banks, war, famine, geopolitics, China, Trump, BTC, SBF, Mushrooms, QAN, Bonds, Inflation, Corporate misfires and slightly mixed macro data has done its worst yet failed to deter investors from splashing and cashing.

Looks like markets here, there and on Wall Street are comfortably betting on The Fed not hoisting rates further, after holding for a second straight month on Wednesday.

The door’s open amid stickily sticky and haughtily high inflation, but with a US economy this resilient, the bank must surely be ready to wait and watch for a bit, given the lagging nature of previous hikes and the expectation they’ll materialise somewhere, soon.

But let’s not whistle and dixie or whatever that ludicrous expression is:

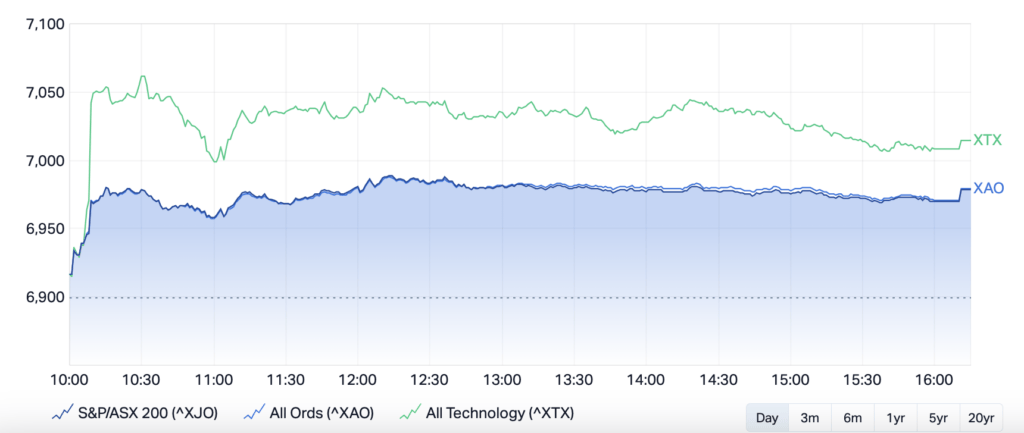

At match out, the S&P/ASX 200 Index is ahead by 78 points, or +1.14%, to above 6,978 on Friday.

The All Ords (XAO) index and the All Tech XTX ended Friday 1.14% and 1.55% higher, respectively.

The benchmark ASX200 is ahead +2.44% for the week.

Both small cap indices had a great few days as well. The Small Ords (XSO) and the ASX Emerging Companies (XEC) index climbed about 1.6% higher to end the week 3.4% and 2.2% the better.

Around the planet, in fact, most markets have rebounded over the past week – which possibly says a little something about everything from the moral agnosticism of the capitalist system to the inherent nature of man and woman. Mainly man, I guess.

It also screams of the over-selling which marked October and the instant some might say unearned optimism that the Fed has finished raising rates.

Some strong but also very mixed US earnings results and the deterioration of an already anxious geopolitical environment hardly got a look in.

At home, interest rate and bond yield sensitive stocks unwound the tension of the last few months in a few short, optimistic sessions.

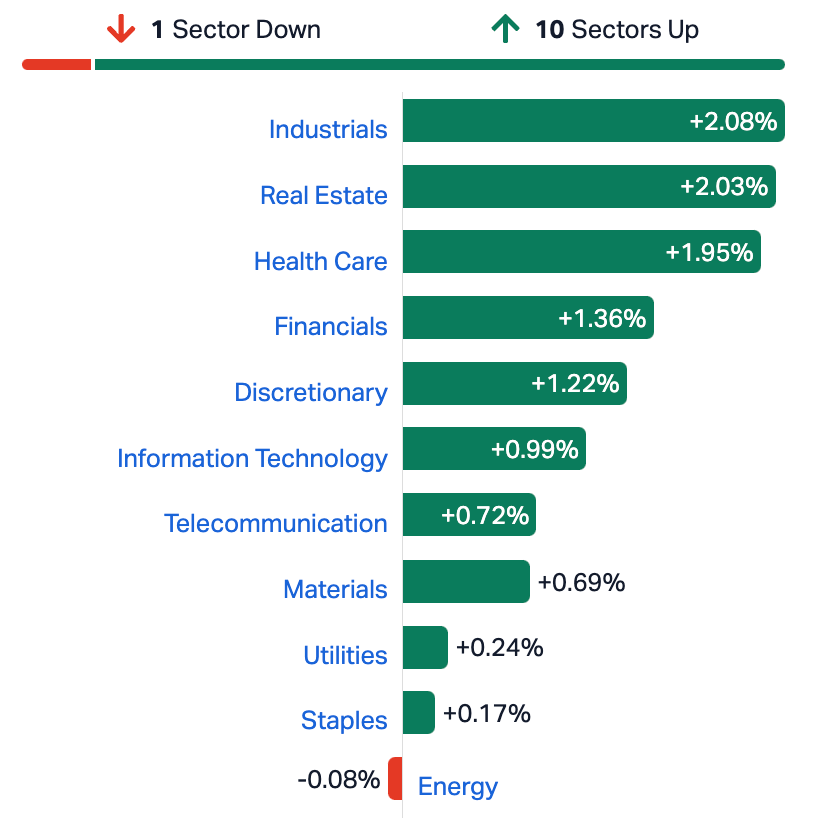

Real estate, IT and Telco Sectors were among the broad based gainers this week, but for the day it was +2%-UP for Industrials Health Care and the Property Sectors.

Looking for an adult to explain, AMP’s head of investment and chief economist Shane Oliver says 10-year bond yields were helped lower by the all-round and sudden spidey-sense that major central banks have finished raising rates…

“With the exception being Japanese bond yields which rose as the BoJ further loosened control over bond yields,” Dr Oliver said.

“Shares have had a nice bounce over the last week from oversold levels and some positives may be starting to help: major central banks led by the Fed are increasingly looking like they are at the top on interest rates (the Bank of Japan and RBA are likely exceptions to this); inflationary pressures generally are continuing to recede; US earnings are coming in better than expected; and we are coming into what is often the strongest part of the year for shares from a seasonal perspective.“

November is seasonally the strongest month of the year for the US market, Dr Oliver added – albeit for Australia: “Seasonal cheer often doesn’t kick in until December.”

Clearly, Qantas get our vote for AGM of the Year.

Late in the day, Qantas (ASX:QAN) fans have given the QAN directors a remunerations protest vote of 82.98%. It’s been a long meeting, and perhaps they’d do well to put this top of the agenda next year.

For the first time in his stewardship over this entire debacle, outgoing chair Richard Goyer reads the room:

“This is obviously a very clear message from shareholders.”

We’re still watching gold…

The price of gold is now treading water after a tempest-tossed October.

Lurking, perhaps more apt.

At around $1,986 an ounce on Friday, the safe haven is getting some support by the softer USD, but lower Treasury yields have probably saved the yellow bacon.

Gold has now retreated from its sterling multi-month highs and looks on track to be about -1% less shiny this week, as all round anxiety over what’s next in the Middle East has tapered off.

Still, you know mankind and his/her markets are copping it when the 1-month gold chart carries that shape.

With the market now turning on the likelihood that the US Federal Reserve is done hiking interest rates – after holding again on Wednesday, investors can now look ahead to tonight’s monthly US jobs report (Saturday 4am in Sydenham) to gauge the strength of the US labor market and lock in further bets on the direction of higher for longer.

Oil prices fell with the Israel and Hamas conflict being relatively contained to mere human losses so far.

Metal and iron ore prices rose, though.

The Aussie dollar is on steroids at around 64.5 US cents.

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| MCM | Mc Mining Ltd | 0.205 | 58% | 236,548 | $52,874,446 |

| CLE | Cyclone Metals | 0.0015 | 50% | 505,209 | $10,264,505 |

| EMU | EMU NL | 0.0015 | 50% | 392,516 | $1,667,521 |

| KNM | Kneomedia Limited | 0.003 | 50% | 175,000 | $3,009,571 |

| NAG | Nagambie Resources | 0.029 | 45% | 470,051 | $11,634,526 |

| TSL | Titanium Sands Ltd | 0.01 | 43% | 5,502,941 | $12,402,633 |

| 8IH | 8I Holdings Ltd | 0.009 | 39% | 160,343 | $2,309,127 |

| STK | Strickland Metals | 0.15 | 36% | 46,274,634 | $176,126,071 |

| AHN | Athena Resources | 0.004 | 33% | 1,135,664 | $3,211,403 |

| AVE | Avecho Biotech Ltd | 0.004 | 33% | 276,642 | $8,094,876 |

| ME1 | Melodiol Glb Health | 0.004 | 33% | 41,295,728 | $11,487,311 |

| OAR | OAR Resources Ltd | 0.004 | 33% | 5,069,038 | $7,839,407 |

| GRE | Greentechmetals | 0.54 | 32% | 3,349,301 | $23,299,844 |

| NTM | Nt Minerals Limited | 0.009 | 29% | 945,555 | $6,019,320 |

| NXS | Next Science Limited | 0.315 | 29% | 1,404,511 | $71,465,300 |

| PNR | Pantoro Limited | 0.041 | 28% | 38,073,629 | $166,528,976 |

| DCL | Domacom Limited | 0.032 | 28% | 177,307 | $10,887,544 |

| ARV | Artemis Resources | 0.028 | 27% | 7,922,209 | $34,703,204 |

| TZL | TZ Limited | 0.03 | 25% | 573,408 | $6,162,195 |

| SQ2 | Block | 80.74 | 25% | 821,279 | $2,132,504,378 |

| X2M | X2M Connect Limited | 0.049 | 23% | 50,000 | $7,183,738 |

| ASP | Aspermont Limited | 0.011 | 22% | 20,010 | $21,948,873 |

| CXU | Cauldron Energy Ltd | 0.011 | 22% | 3,425,035 | $8,762,118 |

| MHK | Metalhawk. | 0.12 | 20% | 329,699 | $7,877,101 |

| SIO | Simonds Grp Ltd | 0.18 | 20% | 164,711 | $53,985,968 |

The big one today remains, MC Mining (ASX:MCM).

The situation is as follows – MCM has been the target of an off-market cash takeover offer from Senosi Group Investment Holdings and Dendocept, both already substantial MCM shareholders.

MCM says a proposal letter (dated 1 November) landed at HQ and within it is the outline of the Consortium’s proposal and intention to make an off-market cash takeover offer for all the shares in the Company not currently held by the two majority shareholders.

This includes an indicative cash consideration offer range of AUD$0.20-AUD$0.23 per ordinary share, based on MCM’s undiluted share capital.

MCM says it’s getting an independent bunch of directors to make a call on this – since current directors – Christine Yi He, Ontiretse Mathews Senosi, An Chee Sin and Zhen Brian He are all linked to both Senosi and Dendocept already.

TZ (ASX:TZL) says its wholly owned subsidiary, TZI Australia has received a big purchase order for the supply of Smart Lockers, System Electronics and Software for a European-headquartered global transport and logistics company.

The purchase is worth circa $2.6mn, TZ told the ASX on Friday.

TZL anticipates that supply will commence prior to the end of the calendar year and should be completed in early 2024. The customer is keen to ship at least 50% of the Locker Bank order before Christmas.

“We have made significant progress towards shoring up the fundamentals of this business. The positive first quarter and now confirmation of this significant order demonstrates that the Company is heading in the right direction,” John Wilson the Group CEO said.

“Our ability to secure orders like this, particularly in a competitive market environment, validates that the Company has a compelling value proposition and that customers do value what we have to offer.”

Back on the winners ladder late on Friday is the stock price of local investments platform DomaCom (ASX:DCL).

DCL soared like a soaring investments platform yesterday and has gone off into the ether again today – largely on the back of an obscure and non-binding Memorandum of Understanding (MoU) with Super Fierce – “Australia’s premier superannuation advice technology platform”.

This all I’ve learned about the Super Fierce side so far – it’s not a lot, but if a pic is worth a 1000 words youse all owe me.

The big sell of this alliance appears to be DomaCom can add residential property investments to Aussie super members via Super Fierce.

A very excited DCL says the Super Fierce MoU is ‘a significant milestone’ in the investment platform’s mission ‘to provide accessible and diversified investment solutions for all Australians’.

DCL told the ASX that the tie up is ‘set to redefine investment opportunities in the residential property sector for superannuation members’.

“Our partnership with Super Fierce is a significant milestone in our mission to provide accessible and diversified investment solutions for all Australians.”

Their words. Big words, too. And here are also the words of John Hewson, DCL’s non-exec chair:

“Superannuation and residential property are the two largest financial assets owned by Australians. However, access to residential property as a component of a balanced superannuation investment is currently limited to the wealthiest 5% of Australians.

“DomaCom is set to change this.”

MoU Highlights:

1. Strategic Partnership: DomaCom is joining forces with Super Fierce, the exclusive superannuation advice technology platform in Australia, to create a strategic partnership.

2. Residential Property Investments: Pending a thorough due diligence process, the DomaCom platform will introduce residential property investments for superannuation members using Super Fierce’s technology.

3. Expanding Market Reach: This partnership is expected to unlock new avenues to market, enabling the development of innovative financial products that merge property investments with superannuation.

4. Strategic Benefits: DomaCom is poised to achieve the following advantages through this collaboration:

• Expand its investment product offerings

• Provide more cost-effective, fully digitised personal financial advice

• Leverage the robust capabilities of its platform, including the secondary market trading

• Introduce an appealing product tailored for first-time homebuyers

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| FRS | Forrestaniaresources | 0.001 | -80% | 53,459 | $255,754 |

| MGT | Magnetite Mines | 0.004 | -50% | 685,902 | $167,487 |

| VPR | Volt Power Group | 0.001 | -33% | 746,001 | $16,074,312 |

| IDX | Integral Diagnostics | 1.935 | -27% | 3,091,314 | $618,695,418 |

| ADR | Adherium Ltd | 0.003 | -25% | 200,000 | $19,997,633 |

| PVS | Pivotal Systems | 0.003 | -25% | 5,671,418 | $3,073,517 |

| SRN | Surefire Rescs NL | 0.012 | -25% | 18,940,096 | $26,478,958 |

| VN8 | Vonex Limited. | 0.016 | -24% | 1,504,841 | $7,598,401 |

| OMX | Orangeminerals | 0.034 | -23% | 117,020 | $2,227,508 |

| TOY | Toys R Us | 0.011 | -21% | 5,280,466 | $13,754,489 |

| EDE | Eden Inv Ltd | 0.002 | -20% | 122,638 | $8,409,092 |

| MRQ | Mrg Metals Limited | 0.002 | -20% | 10 | $5,514,797 |

| ZNO | Zoono Group Ltd | 0.044 | -20% | 76,075 | $10,446,022 |

| MHI | Merchant House | 0.051 | -19% | 20,000 | $5,938,789 |

| SCT | Scout Security Ltd | 0.013 | -19% | 154,305 | $3,690,688 |

| RLG | Roolife Group Ltd | 0.009 | -18% | 553,337 | $7,948,139 |

| FBR | FBR Ltd | 0.019 | -17% | 18,649,161 | $91,423,351 |

| RNO | Rhinomed Ltd | 0.029 | -17% | 10,301 | $10,000,189 |

| LVH | Livehire Limited | 0.045 | -17% | 3,300 | $19,076,777 |

| ZNC | Zenith Minerals Ltd | 0.1 | -17% | 92,956 | $42,285,706 |

| HMD | Heramed Limited | 0.04 | -17% | 705,138 | $13,416,681 |

| RIE | Riedel Resources Ltd | 0.005 | -17% | 512,000 | $12,356,442 |

| TAS | Tasman Resources Ltd | 0.005 | -17% | 300,347 | $4,276,016 |

| YPB | YPB Group Ltd | 0.0025 | -17% | 200,000 | $2,230,384 |

| CLU | Cluey Ltd | 0.073 | -16% | 20,010 | $17,540,380 |

Acrow Formwork & Construction Services (ASX:ACF) – pending the release of an ASX announcement regarding an acquisition, institutional share placement and debt facility

Cleo Diagnostics (ASX:COV) – pending an announcement to be made by the Company to the market in connection with the publication reporting results of Cleo’s first clinical validation study for the triage test

Buxton Resources (ASX:BUX) – pending an announcement of assay results from the Dogleg Prospect

Astron Corporation (ASX:ATR) pending the release of an announcement regarding a material capital raising transaction

Pilot Energy (ASX:PGY) pending an announcement with regards to a capital raising that the Company is proposing to execute, which is to be managed by Whairo Capital Pty Ltd and to allow for the execution of that raise in an orderly manner. Nice, adult

Race Oncology (ASX:RAC) – requested to allow analysis and interpretation of data received relating to an investigator-initiated Phase 2 human clinical trial, where Race’s lead asset, bisantrene, is being studied in patients with Acute Myeloid Leukaemia

AdAlta (ASX:1AD) – pending an announcement by AdAlta in relation to a proposed capital raising