Closing Bell: Cettire rejects AFR claims, GDP’s gone back to the 90’s and ASX200 ends above the ice

Cettire denies dodging tax. Picture Getty

- Local markets end slightly higher

- IT Sector slumps 1.2pc

- Small Caps led by AT1

The ASX 200 traded sideways again today, closing the day +0.1% higher as gains in Financials and Real Estate were offset by losses in Tech and Mining stocks.

Traders mulled over the GDP data dropped earlier today which shows that the Australian economy grew at just 0.2% last quarter – meeting expectations – and +1.5% over the past 12 months.

It was the weakest growth rate since the 1990s, providing evidence that the RBA’s persistent rate hikes have been effective.

“Another rate rise would cruel the economy – and we expect to see 100 basis points of cuts in 2024-25,” said Deloitte Access’ partner, Stephen Smith.

“Monetary and fiscal policy need to pivot away from containing inflation to stimulating economic growth.”

To stocks, Tech dragged the ASX lower today, while gold mining stocks tracked the bullion price rally overnight.

Big bank stocks like the Commonwealth Bank (ASX:CBA) and National Australia Bank (ASX:NAB) also rose.

Bitcoin meanwhile is trading within a narrow range in Asian hours of around US$63k, after resetting all time highs overnight of US$69k overnight.

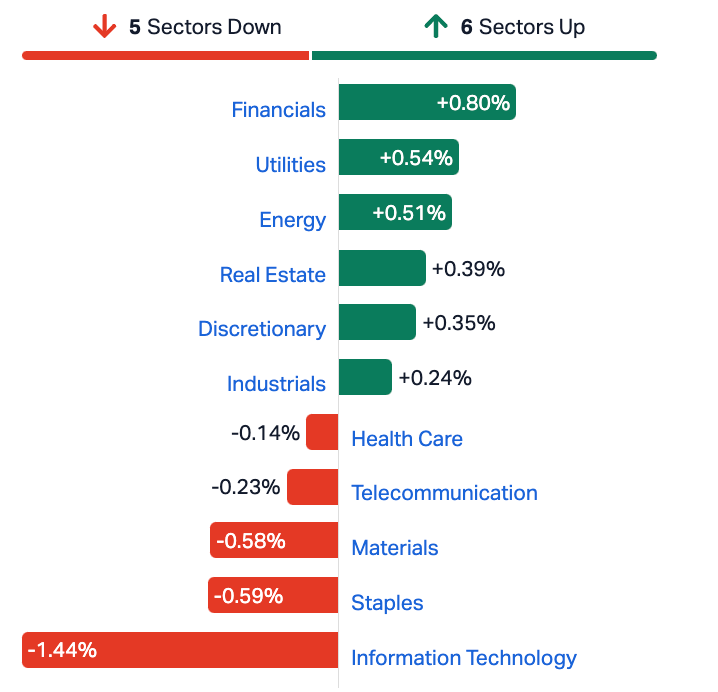

ASX Sectors on Wednesday

Jerome Powell’s testimony preview

Fed Reserve chairman Jerome Powell will give his semi annual testimony to Congress later today (US time).

He faces lawmakers and market participants intent on getting more clarity about how he intends on proceeding with rate cuts this year.

“The question now for the market is to glean any information on when the Fed will begin employing rate cuts and how many,” said Quincy Krosby at LPL Financial.

Prior message from Powell indicates the“danger of moving too soon” and that the Fed should have a “cautious approach”.

But the market seems to be getting ahead of itself as gold and Bitcoin touched record highs.

“Speculation over a Fed rates pivot and continued geopolitical tensions keep gold shining,” said Ewa Manthey at ING Groep.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| NME | Nex Metals Explorat | 2.20 | 69.23 | 719,580 | $4,582,923 |

| SLZ | Sultan Resources Ltd | 2.30 | 64.29 | 4,250,180 | $2,074,661 |

| M4M | Macro Metals Limited | 0.45 | 50.00 | 117,486,556 | $8,436,233 |

| 1AD | Adalta Limited | 3.20 | 28.00 | 64,473,613 | $13,145,102 |

| ASV | Assetvisonco | 1.40 | 27.27 | 676,590 | $7,984,202 |

| AT1 | Atomo Diagnostics | 3.40 | 25.93 | 44,741,154 | $17,258,462 |

| DXB | Dimerix Ltd | 27.50 | 25.00 | 9,201,144 | $96,255,826 |

| NVQ | Noviqtech Limited | 0.50 | 25.00 | 15,959,142 | $5,237,781 |

| TMX | Terrain Minerals | 0.50 | 25.00 | 790,000 | $5,726,683 |

| ARV | Artemis Resources | 1.80 | 20.00 | 5,080,535 | $25,367,942 |

| ADD | Adavale Resource Ltd | 0.60 | 20.00 | 100,000 | $5,055,861 |

| AL8 | Alderan Resource Ltd | 0.60 | 20.00 | 4,333,333 | $5,534,307 |

| MSG | Mcs Services Limited | 0.60 | 20.00 | 584,509 | $990,498 |

| OAU | Ora Gold Limited | 0.60 | 20.00 | 12,459,224 | $28,700,004 |

| UCM | Uscom Limited | 2.70 | 17.39 | 8,846 | $5,625,515 |

| AUZ | Australian Mines Ltd | 1.75 | 16.67 | 38,054,129 | $19,597,666 |

| ODY | Odyssey Gold Ltd | 2.10 | 16.67 | 797,367 | $16,179,680 |

| OPN | Oppenneg | 0.70 | 16.67 | 500,000 | $6,775,078 |

| RNX | Renegade Exploration | 0.70 | 16.67 | 1,896,028 | $6,010,343 |

| DEL | Delorean Corporation | 6.50 | 16.07 | 278,496 | $12,080,371 |

| PLT | Plenti Group Limited | 75.00 | 15.38 | 1,200,411 | $113,507,930 |

| IPT | Impact Minerals | 1.50 | 15.38 | 24,058,429 | $37,241,151 |

| TTM | Titan Minerals | 3.00 | 15.38 | 3,289,990 | $44,092,003 |

| CR1 | Constellation Res | 9.80 | 15.29 | 872,175 | $4,241,961 |

| ALA | Arovella Therapeutic | 15.50 | 14.81 | 2,564,747 | $124,896,092 |

Atomo Diagnostics (ASX:AT1) rocketed by as much as 90% this morning after announcing that it has secured a significant order for its HIV Self-Tests.

Atomo said it secured purchase orders from US-based Viatris Healthcare for approximately $970k worth of HIV Self-Tests, manufactured by Atomo under the Mylan brand, for supply to a number of Low- and Middle-Income Countries (LMICs).

AdAlta (ASX:1AD) announced key results from its Phase 1 extension study of lead asset AD-214, a drug for fibrotic diseases.

AdAlta says the results have positively answered key partnering discussion questions to support progressing AD-214 to Phase II clinical studies in Idiopathic Pulmonary Fibrosis (IPF).

Metalicity (ASX:MCT) says drilling approvals at its 80% owned Yundamindra Gold Project (20% owned by JV partner Nex Metals Exploration (ASX:NME) have been lodged for the first drilling program in over a decade. MCT says following favourable Wardens Court decisions regarding the Yundamindra tenements the company has been undertaking extensive internal and external review of all historical data and activities at the highly prospective gold project.

Constellation Resources (ASX:CR1) announced that it has been conditionally accepted as the preferred applicant for six Special Prospecting Authorities with an Acreage Option (SPA-AO) applications over the Edmond-Collier and Yerrida Basin area. The application areas are considered to be prospective for helium and associated gases. The six SPA-AOs cover a total of 712 graticular blocks (56,192km2) over the Edmond-Collier and Yerrida Basins.

Zoono Group (ASX:ZNO) announced that it has entered into an Exclusive Agency Agreement with OSY Group to promote the sale of Zoono products for the food supply chain sector. OSY is a leading-edge provider of technologies in the hygiene technology sector. The company was recently awarded an Innovate UK Award granting funding to support its food shelf-life extension work.

Artemis Resources (ASX:ARV)’s gound reconnaissance sampling from its 100% owned Artemis tenement E47/1746 delivered assay results from the Mt Marie prospect including:

- 24AR01-14 – 4.67% Li2O

- 24AR01-15 – 2.11% Li2O

- 24AR01-02 – 1.74% Li2O

- 24AR01-06 – 1.68% Li2O

- 24AR01-11 – 1.46% Li2O

Aruma Resources (ASX:AAJ) rose on the back of high-grade rare earths discovered at its Salmon Gums project in the Eastern Gold Fields of Western Australia. Maiden REE-focused drilling there has returned multiple high-grade clay rare earths of “significant thickness”, including: 11m at 904ppm TREO from 18m; 6m at 770pmm TREO from 24m; 18m at 638ppm TREO from 12m and more.

Magellan Financial Group (ASX:MFG) rose after after reporting the funds under management (FUM) in February rose to $37.2bn from $36.3bn in January.

ASX SMALL CAP LAGGARDS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Name | Price | % Change | Volume | Market Cap | |

|---|---|---|---|---|---|

| CNJ | Conico Ltd | 0.20 | -33.33 | 425,840 | $4,710,285 |

| ABE | Ausbondexchange | 1.10 | -26.67 | 333,320 | $1,690,022 |

| 1AG | Alterra Limited | 0.30 | -25.00 | 104,426 | $3,482,763 |

| XST | Xstate Resources | 1.50 | -25.00 | 959,550 | $6,430,383 |

| WHK | Whitehawk Limited | 3.70 | -24.49 | 19,461,936 | $16,565,465 |

| EDE | Eden Inv Ltd | 0.20 | -20.00 | 433,725 | $9,195,678 |

| ESR | Estrella Res Ltd | 0.40 | -20.00 | 5,003,586 | $8,796,859 |

| ROG | Red Sky Energy. | 0.40 | -20.00 | 828,556 | $27,111,136 |

| SEG | Sports Ent Grp Ltd | 19.00 | -19.15 | 2,200 | $62,215,872 |

| GCM | Green Critical Min | 0.50 | -16.67 | 2,066,940 | $6,819,510 |

| IBG | Ironbark Zinc Ltd | 0.50 | -16.67 | 1,507,200 | $9,563,236 |

| INP | Incentiapay Ltd | 0.50 | -16.67 | 70,175 | $7,463,580 |

| VAL | Valor Resources Ltd | 0.25 | -16.67 | 18,909 | $13,767,040 |

| ICR | Intelicare Holdings | 1.60 | -15.79 | 199,844 | $4,461,665 |

| MXC | Mgc Pharmaceuticals | 42.50 | -15.00 | 75,602 | $21,925,816 |

| REY | REY Resources Ltd | 8.50 | -15.00 | 900 | $21,168,754 |

| FRS | Forrestaniaresources | 1.80 | -14.29 | 200,055 | $3,397,501 |

| HFY | Hubify Ltd | 1.20 | -14.29 | 17,094 | $6,945,908 |

| T3D | 333D Limited | 0.60 | -14.29 | 3,333 | $836,115 |

| TTI | Traffic Technologies | 0.60 | -14.29 | 6,320 | $5,303,691 |

| LVH | Livehire Limited | 3.35 | -14.10 | 86,714 | $14,157,116 |

| CTT | Cettire | 405.00 | -13.09 | 13,811,191 | $1,776,570,105 |

| SRX | Sierra Rutile | 10.00 | -13.04 | 121,857 | $48,787,191 |

| AKN | Auking Mining Ltd | 2.00 | -13.04 | 2,548,279 | $5,413,135 |

| ASQ | Australian Silica | 4.00 | -13.04 | 246,876 | $12,965,577 |

Dicker Data (ASX:DDR) has announced founder, chairman and CEO has David Dicker has sold down ~8.3 million shares representing ~10.2% of the company’s issued capital due to a recent divorce settlement and restructuring of his portfolio. The sale was undertaken at a price of $10.90 per share by way of an underwritten block trade equating to ~$90.47 million.

Cettire (ASX:CTT) dropped -13% after a report by the AFR suggested the company was not paying duties to Australian customs.

Cettire denied the allegations, telling the ASX:

“Cettire believes that all applicable duties and other import charges are paid to the relevant authorities at the point of customs clearance. Goods are unable to clear customs unless the applicable duties are paid.”

IN CASE YOU MISSED IT – PM Edition

Zinc of Ireland (ASX:ZMI) has acquired a 1,380km2 lithium exploration project in Manitoba, Canada, just 40km west of the Tanco LCT mine which has been in production for more than 50 years.

Australia’s first potential producer of manufactured zeolite Zeotech (ASX:ZEO) has signed a MoU for potential offtake with Protekta, which is looking to source the molecular sieves for its signature product targeting the prevention of milk fever in cows.

Viridis Mining and Minerals (ASX:VMM) has secured a further 9.98km2 of licences which extend and adjoin the Cupin South prospect within its flagship Colossus ionic adsorption clay REE project in Brazil.

OD6 Metals (ASX:OD6) was gifted a nice surprise this morning with better than expected recoveries of up to 86% magnet rare earths from recent metallurgical test work on its Grass Patch project near Esperance.

With funding support from mining giant Rio Tinto, Sultan Resources (ASX:SLZ) has started drilling the Calesi magmatic nickel prospect near Kulin in WA’s Wheatbelt region.

Miramar Resources (ASX:M2R) plans to drill the emerging Mount Vernon and Trouble Bore targets at its Bangemall nickel-copper-PGE project in WA’s Gascoyne region by mid-year after identifying another set of strong electromagnetic conductors.

And Raiden Resources (ASX:RDN) will soon carry out a heritage survey with the Ngarluma Aboriginal Corporation, allowing it to conduct maiden drilling over priority lithium-bearing pegmatite targets at its 80%-owned Andover South project in the Pilbara.

TRADING HALTS

Flynn Gold (ASX:FG1)– Pending further announcement

Belararox (ASX:BRX) – Material cap raise

Aurumin (ASX:AUN)– Cap raise

Strike Resources (ASX:SRK) – Potential disposal of the company’s Paulsens East Iron Ore Project

Si6 Metals (ASX:SI6) – Cap raise

Gold Mountain (ASX:GMN) – Cap raise

At Stockhead, we tell it like it is. While AdAlta, Miramar Resources, OD6 Metals, Raiden Resources, Sultan Resources, Viridis Mining and Minerals, Zeotech and Zinc of Ireland are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.