You might be interested in

News

ASX Small Cap Lunch Wrap: Market flattish as Superloop snares Origin contract off Aussie Broadband

News

ASX Small Caps News Wrap: Who’s taking full responsibility by firing 1500 people this week?

News

News

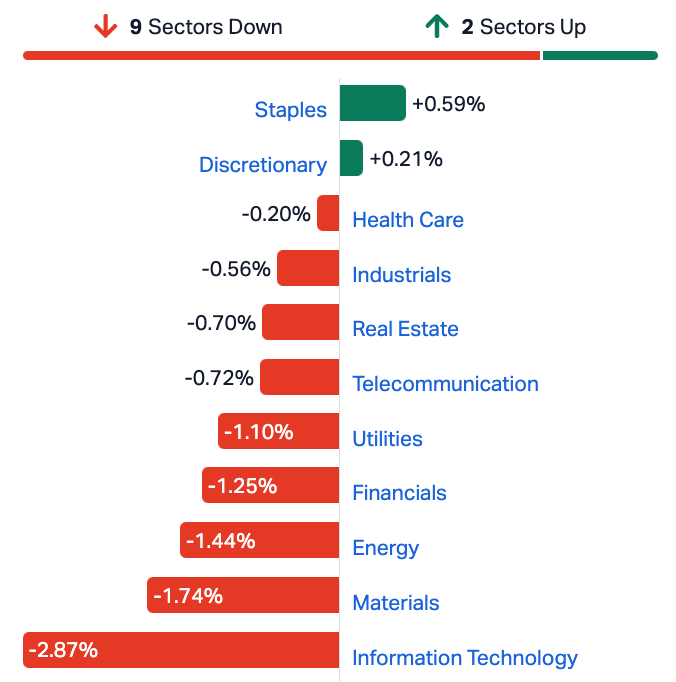

The Australian share market reminded participants on Friday that it will jump if anything looks remotely like a cliff.

The benchmark gave away about 1% on Friday, ending the week about 0.5% shorter.

One brightish light however, were the consumer stocks which ended an encouraging 5 sessions well making it a good week for retailers, but otherwise most sectors fell or sat about equivocating.

The Tech Sector was a red mess late on Friday, having alternated between hero and villain all bloody week.

Friday was the pièce de résistance however, with a string of large cap tech names leaving a trail of earnings disappointment across the ASX.

WiseTech (ASX:WTC) shares crashed midweek (-19%), tearing a near $2bn hole in billionaire boss Richard White’s bank account.

WiseTech did a lot right on the big day – reaping a swag of logistics segment revenue, lifting its dividend payout and delivering a net profit over $212m, up almost 10%.

But for once this earnings season, playing smart with the forward guidance cost someone big time.

The stock crashed on weaker-than-wanted earnings forecasts, with investors not thinking that the CIO’s team were holding back even as they pegged revenue to top the $1bn threshold.

Not done with the bosses wallet, WTC lost about 5% more on Friday.

Elsewhere Megaport (ASX:MP1) and Xero (ASX:XRO) lost more than 3% while Altium (ASX:ALU) dropped circa 2.5% after a not-decent-enough report.

Iress (ASX:IRE), which crashed 35% on Monday, attracted over 6% in hopeful bargain hunters.

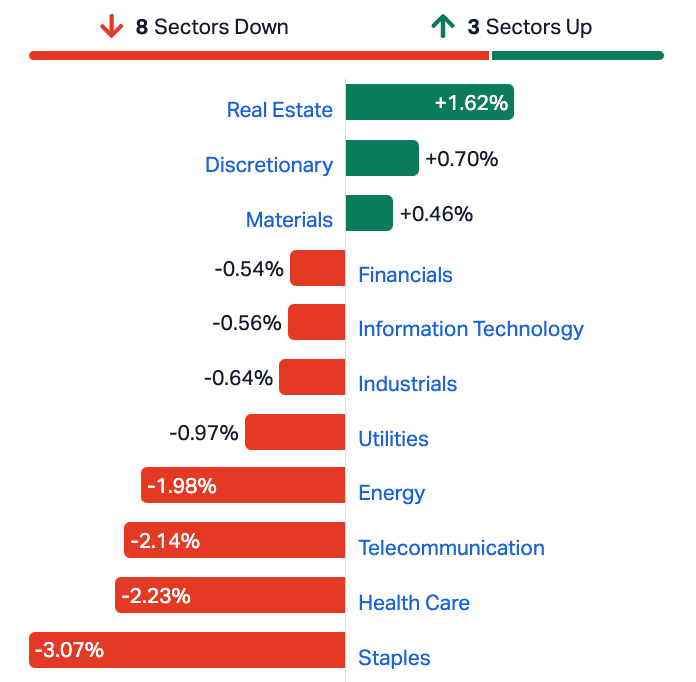

One good day for the Materials Sector on Thursday was also a dissipating memory, with weak US leads and Jackson Hole uncertainty encouraging the punters to hit pause and go to the pub.

The main ASX culprits with some not-spectacular-enough earnings included some big boppers like Pilbara Minerals (ASX:PLS) down despite lifting net profit and South32 (ASX:S32) which slumped 5.3 per cent.

After some China-inspired hope led to gains for the major iron ore miners, traders took the money today; BHP (ASX:BHP) lost 2% and Fortescue Metals Group (ASX:FMG) gave away about 1.3%.

Around the region, Asia-Pacific bourses bled all over the place infected by the unwelcome anticipation on Wall Street in the hours before US monetary policy returns to the frontal lobe as central bankers’ polish their double-speak for the annual Jackson Hole meeting on Friday Wyoming time.

With Federal Reserve chair Jerome Powell kicking things off, Japan’s market was most exposed, although South Korea’s Kospi and Hong Kong’s Hang Seng index joined our own benchmark, dropping around 1%.

Japan’s Nikkei 225 turned tail by about 2%.

The ASX Small Ordinaries Index (XSO) was down by circa 1.2% near the close on Friday losing circa 0.3% for the week. The ASX Emerging Companies Index (XEC) was down by almost 1.1.%, to close the week 0.9% the worse.

Russia’s misunderstood and clearly upset President Vladimir Putin has confirmed his latest Macbethian masterstroke by breaking his peace around the totally normal plane crash that took place outside Moscow killing several unlucky travellers and one failed coup leader from a few weeks earlier.

Vlad sent his condolences to the families of those who died in the crash without confirming by name if Wagner group leader Yevgeny Prigozhin, who was listed as a passenger on the plane, had died.

In Kremlin speak that means: he’s dead, I did it.

Bloomberg has oil heading for a 2nd week of terrific declines. They say supply is improving and that China’s (world’s biggest consumer of oil) economic woes are hitting demand.

West Texas Intermediate (WTI) futures were steady near $US79 a barrel on Friday in Singapore, and about 2.5% lower for the week.

Farhan Badami, Market Analyst at eToro, told Stockhead that it’ll be economic crunch time next week, with enough numbers dropping to recalibrate everyone’s inflation vs rates game.

The week features a significant run of economic health indicators, including the monthly Consumer Price Index (CPI) and Commodity Prices reports, as well as monthly retail sales and home loans.

“With the impact of the RBA’s mammoth rate rise run finally starting to surface in consumer behaviour data, all eyes will be on these crucial insights to determine whether any of them may influence the RBA’s interest rate decision the following week.

“As it stands, the broad market is tipping another pause from the central bank but if CPI indicators in particular come in higher than expected – last month’s number was 5.4% – this could easily change outlooks,” Farhan says.

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| EMU | EMU NL | 0.002 | 100% | 525,516 | $1,450,021 |

| MRI | Myrewardsinternation | 0.015 | 50% | 3,409,636 | $3,974,660 |

| GDM | Greatdivideminingltd | 0.295 | 48% | 1,880,966 | $0 |

| BVS | Bravura Solution Ltd | 0.715 | 43% | 5,877,496 | $224,177,001 |

| ELE | Elmore Ltd | 0.004 | 33% | 7,135,054 | $4,198,151 |

| AWJ | Auric Mining | 0.054 | 32% | 323,611 | $5,365,243 |

| AUZ | Australian Mines Ltd | 0.02 | 25% | 10,136,057 | $10,461,158 |

| BFC | Beston Global Ltd | 0.01 | 25% | 18,253,883 | $15,976,375 |

| MRQ | Mrg Metals Limited | 0.0025 | 25% | 403,334 | $4,371,837 |

| TSL | Titanium Sands Ltd | 0.005 | 25% | 1,240,698 | $6,847,219 |

| YRL | Yandal Resources | 0.059 | 23% | 120,000 | $7,574,548 |

| 4DS | 4Ds Memory Limited | 0.135 | 23% | 44,797,999 | $179,579,754 |

| SI6 | SI6 Metals Limited | 0.006 | 20% | 3,549,022 | $9,969,297 |

| PHL | Propell Holdings Ltd | 0.025 | 19% | 56,216 | $2,527,466 |

| AML | Aeon Metals Ltd. | 0.019 | 19% | 1,223,526 | $17,542,410 |

| AX1 | Accent Group Ltd | 2.17 | 18% | 4,798,841 | $1,019,288,623 |

| RVS | Revasum | 0.175 | 17% | 10,000 | $15,887,498 |

| CHK | Cohiba Min Ltd | 0.0035 | 17% | 710,126 | $6,639,733 |

| IEC | Intra Energy Corp | 0.007 | 17% | 3,353,198 | $9,724,690 |

| TSO | Tesoro Gold Ltd | 0.022 | 16% | 1,321,646 | $20,018,639 |

| STK | Strickland Metals | 0.045 | 15% | 2,909,762 | $62,409,399 |

| RNT | Rent.Com.Au Limited | 0.023 | 15% | 523,494 | $10,273,084 |

| 1AG | Alterra Limited | 0.008 | 14% | 2,236,717 | $4,875,868 |

| ASR | Asra Minerals Ltd | 0.008 | 14% | 432,500 | $10,082,710 |

| CCZ | Castillo Copper Ltd | 0.008 | 14% | 1,991,977 | $9,096,537 |

Sabre Resources (ASX:SBR), jumped over 40% following an ASX update which Gregor astutely noticed had “lithium”, “Andover” and “major” in it.

“Sabre told the market this morning that it has gobbled up a slightly larger slice of the prospective lithium pie near Azure’s barnstomer Andover project, which it plans to explore,” he says.

That’s it. So skyward it went.

On Friday, Bravura Solutions (ASX:BVS) baffled to the upside by almost 30% – a gain directly attributable to an earnings report which “achieved guidance across all metrics with a significant closing cash balance”, before laying out all the bad news.

The finance sector management software maker jumped after dropping some unpleasant results which may have given investors the nudge that the worst is behind it.

Bravura’s operating expenses rose from $221.3 million to $257.7 million, operating EBITDA declined $53.4m, from $45.3 million in the pcp to a deficit of $8.1 million and an adjusted NPAT of -$23.1 million, which represents a $48.8m decline against the pcp figure of $25.7 million.

From the earnings announcement:

Bravura’s trading performance has driven the requirement and urgency for change. This has resulted in a new CEO, Chair and refreshed board joining Bravura in 2HFY23.

FY23 was a year of underperformance and great disappointment for shareholders, and the Company acknowledges it will take time to rebuild trust.

That last line was wrong, apparently.

Nickel-cobalt hopeful Australian Mines (ASX:AUZ) has gained almost 20% on no news – the last time the market heard from AUZ was when we all got told last week that CEO Michael Holmes is exiting the company to “pursue other interests” at the end of October.

Artemis Resources (ASX:ARV) was ahead strong around 14%, ostensibly on recent news of new gold targets and an updated JORC tables from its Lulu Creek project, and finally, as Gregor cannot lie:

“Metals Australia (ASX:MLS) has jumped 17%, for no apparent reason.”

Brisbane-based Great Divide Mining (ASX:GDM) is a brand-new entrant to the local bourse and has made an immediate impression on investors following a $5 million public offering.

The company is focusing on a high-potential portfolio of gold and critical metals assets with initial emphasis on its Yellow Jack gold project in Greenvale, Queensland.

That’s a shallow, open-resource site that, the company notes, has close proximity to existing heap leach and Carbon-in-Pulp process plants enabling project development with limited capital expenditure.

GDM has today confirmed the engagement of a number of consultants to support the development of its mineral resource estimation (MRE), and that process has already kicked off.

The firm’s CEO, Justin Haines:

“With our listing today we have hit the ground running by confirming engagement of consultants to work on our maiden JORC 2012 compliant mineral resource estimate at Yellow Jack – which we expect to be completed within the coming weeks.

“We have also commenced seeking tenders for drone-based LIDAR surveys over priority targets as well as further drilling to be conducted at the Yellow Jack Gold project following release of the MRE.”

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| CLE | Cyclone Metals | 0.001 | -50% | 2,339,150 | $20,529,010 |

| ARN | Aldoro Resources | 0.13 | -37% | 1,604,038 | $27,597,867 |

| MXC | Mgc Pharmaceuticals | 0.002 | -33% | 1,456,786 | $11,677,079 |

| MTH | Mithril Resources | 0.0015 | -25% | 120,833 | $6,737,609 |

| RML | Resolution Minerals | 0.004 | -20% | 181,300 | $6,286,459 |

| ROO | Roots Sustainable | 0.004 | -20% | 583 | $693,611 |

| MKL | Mighty Kingdom Ltd | 0.017 | -19% | 1,520,320 | $6,850,611 |

| IRI | Integrated Research | 0.42 | -17% | 1,035,401 | $87,405,747 |

| CI1 | Credit Intelligence | 0.125 | -17% | 750 | $12,524,874 |

| EEL | Enrg Elements Ltd | 0.005 | -17% | 1,320,000 | $6,059,790 |

| ROG | Red Sky Energy. | 0.005 | -17% | 3,311,855 | $31,813,363 |

| AKO | Akora Resources | 0.165 | -15% | 78,900 | $18,521,649 |

| AIV | Activex Limited | 0.017 | -15% | 50,000 | $4,310,052 |

| PRX | Prodigy Gold NL | 0.006 | -14% | 20,000 | $12,257,755 |

| G50 | Gold50Limited | 0.13 | -13% | 206,600 | $14,703,750 |

| NC6 | Nanollose Limited | 0.06 | -13% | 19,045 | $10,273,159 |

| TTT | Titomic Limited | 0.02 | -13% | 2,118,493 | $19,909,816 |

| SOV | Sovereign Cloud Hldg | 0.096 | -13% | 11,850 | $37,334,074 |

| AGD | Austral Gold | 0.028 | -13% | 76,285 | $19,593,963 |

| SPX | Spenda Limited | 0.007 | -13% | 460,240 | $29,371,377 |

| THR | Thor Energy PLC | 0.0035 | -13% | 319,571 | $5,837,166 |

| AUQ | Alara Resources Ltd | 0.035 | -13% | 36,338 | $28,723,502 |

| NZK | NZK Salmon Ltd | 0.175 | -13% | 5,449 | $108,290,942 |

| HIQ | Hitiq Limited | 0.021 | -13% | 684,669 | $6,402,703 |

| TAM | Tanami Gold NL | 0.036 | -12% | 180,536 | $48,178,979 |

Sarytogan Graphite (ASX:SGR): Processing material metallurgical test results before release to the market

Queensland Pacific Metals (ASX:QPM): Pending financial close of the Moranbah Project acquisition

Diablo Resources (ASX:DLO): Pending an announcement regarding exploration results

Buxton Resources (ASX: BUX): Pending an announcement of assay results from the Copper Wolf Project

Elixir Energy (ASX:EXR): Pending an announcement by the Company with respect of a fundraising

Black Cat Syndicate (ASX:BC8): Pending the release of an announcement regarding a proposed capital raising

Raiden Resources (ASX:RDN): Proposed capital raise