Closing Bell: ASX choppy as traders sit it out; BPM soars on Mt Gibson gold find

ASX slips back after hitting new high ahead of Fed decision. Picture Getty

- ASX slips after hitting new high ahead of Fed decision

- Iron ore prices expected to drop below US$80 by 2025

- Harvey Norman faces class action lawsuit over warranties

The ASX was a bit of a mixed bag today, hitting a new high before pulling back to finish flattish as investors kept an eye on the upcoming US Fed Reserve rate decision set for Thursday morning AEST.

Trading was choppy and volume was thin as traders wait for clarity on the Fed’s potential rate cut, especially after US stocks remained mostly steady overnight.

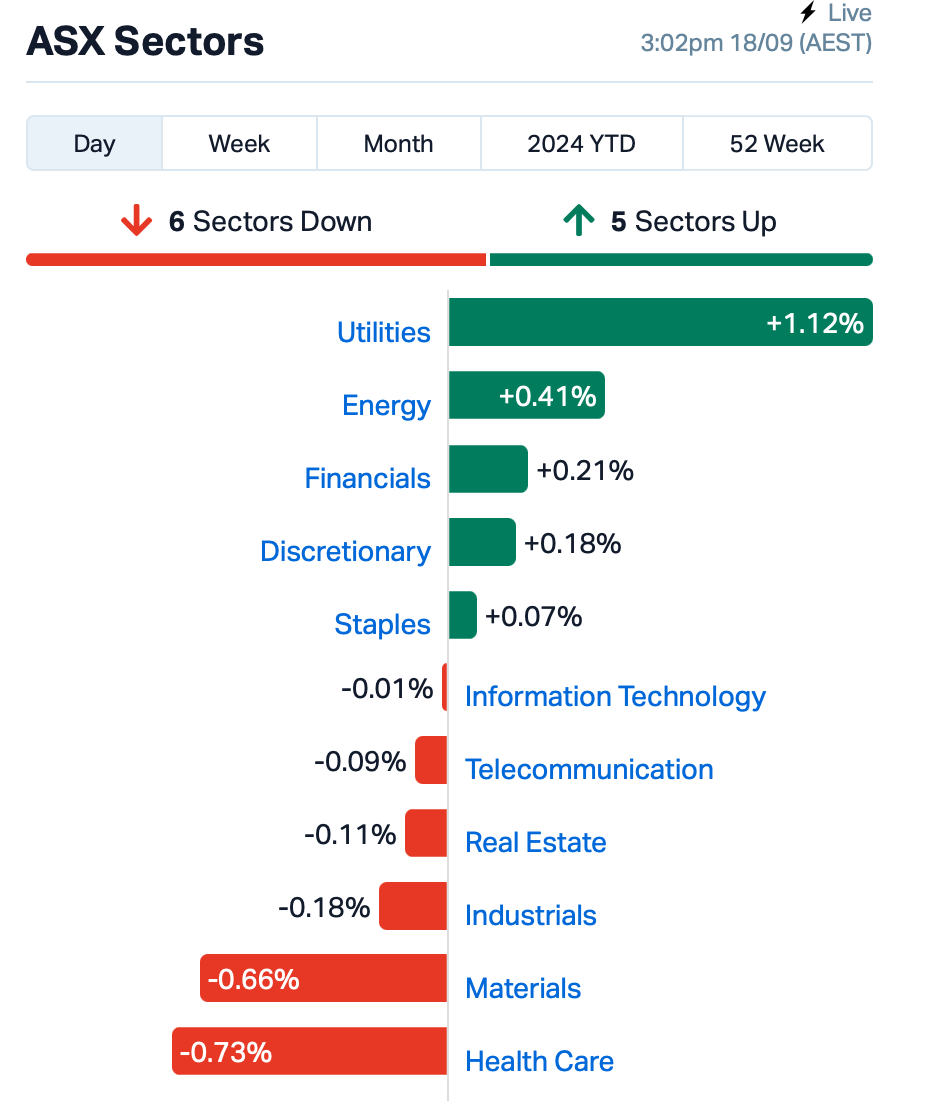

Of the 11 sectors on the ASX, six saw declines, with Health and Mining dragging down gains in Utilities.

Mining stocks lost ground following a drop in iron ore prices in Shanghai after a two-day break in China.

Analysts at Bank of America (BofA) expects iron prices to dip below US$80 per tonne in 2025 (from today’s level of around US$92).

Like many analysts, BofA believes iron ore is facing headwinds, particularly from China’s housing sector, where demand has plummeted. With steel production down and major exporters ramping up output, a surplus of 190 million tonnes is expected next year, which could push prices below US$80.

Elsewhere, crude prices and oil-related stocks were steady despite Israel pulling off a major strike against Hezbollah by detonating hundreds of pagers used by its members in Lebanon.

In the large caps space today, FMCG giant Harvey Norman (ASX:HVN) took a small hit of 0.3% after news of a class action lawsuit being brought by Echo Law, which claims that the extended warranties sold to customers after September 2018 are basically worthless.

The class action says that the terms of the extended warranties cover nothing that isn’t already covered under Australian consumer law, making them an entirely needless up-sell by staff at the big retailers Harvey Norman and Joyce Mayne.

Woodside Energy (ASX:WDS), meanwhile, rose modestly after inking a deal to supply LNG (liquified natural gas) to Japan, with the terms of the deal covering 400,000 tonnes of LNG annually for a decade.

What else is happening?

Across the region, Asian shares mostly climbed today as investors looked forward to the Fed’s first interest rate cut in over four years.

While the Bank of Japan and Bank of England are also meeting this week, neither is expected to change rates, though their comments could signal future moves.

Japan’s Nikkei, South Korea’s Kospi and the Shanghai Composite all added gains today. Trading was closed in Hong Kong for a holiday.

Meanwhile, Taiwanese company Gold Apollo denied that it produced the pagers used in today’s attacks in Lebanon, despite media reports linking them to the firm.

A company official stated, “Those devices aren’t ours,” adding that Gold Apollo licenses its brand to another company.

Earlier today, thousands of pagers exploded across Lebanon, resulting in at least nine deaths and nearly 3,000 injuries. Hezbollah accused Israel of being behind the attacks, raising tensions in the region.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| BPM | BPM Minerals | 0.093 | 86% | 16,519,391 | $3,356,111 |

| 88E | 88 Energy Ltd | 0.003 | 67% | 97,040,983 | $43,400,718 |

| MHK | Metalhawk. | 0.145 | 61% | 958,436 | $9,060,300 |

| AL8 | Alderan Resource Ltd | 0.003 | 50% | 667,000 | $2,545,723 |

| IVX | Invion Ltd | 0.003 | 50% | 30,016,580 | $13,533,183 |

| LSR | Lodestar Minerals | 0.002 | 50% | 1,614,667 | $3,372,329 |

| ERL | Empire Resources | 0.004 | 33% | 1,246,262 | $4,451,740 |

| SMM | Somerset Minerals | 0.004 | 33% | 36,116 | $3,092,996 |

| LRL | Labyrinth Resources | 0.024 | 31% | 3,162,422 | $24,199,008 |

| SNX | Sierra Nevada Gold | 0.052 | 30% | 7,705,816 | $4,918,653 |

| AQI | Alicanto Min Ltd | 0.022 | 29% | 806,955 | $12,718,430 |

| EP1 | E&P Financial Group | 0.465 | 27% | 29,036 | $86,753,233 |

| PEB | Pacific Edge | 0.145 | 26% | 513,642 | $93,370,337 |

| GTR | Gti Energy Ltd | 0.005 | 25% | 4,064,367 | $10,199,788 |

| LPD | Lepidico Ltd | 0.003 | 25% | 3,352 | $17,178,250 |

| NAE | New Age Exploration | 0.005 | 25% | 600,000 | $7,175,596 |

| PUR | Pursuit Minerals | 0.003 | 25% | 10,000,000 | $7,270,800 |

| TEG | Triangle Energy Ltd | 0.005 | 25% | 3,951,911 | $8,320,536 |

| VML | Vital Metals Limited | 0.003 | 25% | 25,338 | $11,790,134 |

| WML | Woomera Mining Ltd | 0.003 | 25% | 2,669 | $3,036,278 |

| DKM | Duketon Mining | 0.120 | 20% | 338,061 | $12,241,158 |

| AOA | Ausmon Resorces | 0.003 | 20% | 1,000,351 | $2,647,498 |

| ASR | Asra Minerals Ltd | 0.006 | 20% | 1,293,333 | $11,157,790 |

| AVE | Avecho Biotech Ltd | 0.003 | 20% | 200,000 | $7,923,243 |

BPM MINERALS (ASX:BPM) said it may have found an extension to Capricorn Metals’ (ASX:CMM)’s Mt Gibson gold project in WA, which boasts 3.24Moz of gold. This project is key for Capricorn, operator of the Karlawinda gold mine. A recent study estimated a $339 million cost to restart Mt Gibson, aiming for 152,000oz of gold annually for the first 7.5 years, with production set to start late next year.

BPM’s Claw discovery near Mt Gibson yielded a promising high-grade hit from the Louie prospect: 30m at 1.84g/t gold from just 25m deep, including 5m at 7.12g/t. The $9 million explorer is currently testing a 1km-long gold anomaly found during initial drilling, showing similar geology to Mt Gibson. Investors are eagerly awaiting results from six reverse circulation holes drilled into this anomaly.

TITAN MINERALS (ASX:TTM) bounded out of a trading halt today to reveal Gina Rinehart’s Hancock Prospecting, through its subsidiary Hanrine, had pledged to spend up to US$120 million chasing copper at its Linderos project in Ecuador.

That could give Australia’s richest an eventual 80% stake, with US$2m changing hands after the companies entered into a formal binding JV and earn-in agreement. Prep for an initial 10,000m of drilling is underway, looking for something big to the south of TTM’s 3.1Moz gold, 22Moz silver Dynasty project.

The project also lies to the south of Lumina Gold’s world class Cangrejos project and to the west of Lundin Gold’s extraordinarily low cost Fruta Del Norte, in which Newmont has a 32% stake acquired in its takeover of Newcrest.

Surface geochemistry of the early-stage Linderos has identified the potential for multiple porphyries, with results from 3700m of drilling at the Copper Ridge prospect including a hit of 308m at 0.4% copper equivalent from 54m.

88 Energy (ASX:88E) was up on news of a Significant Contingent Resource Update for Project Phoenix, with the Gross Best Estimate (2C) Contingent Resources increasing by over 50%, with an additional gross 128 million barrels of oil equivalent (MMBOE), 81 MMBOE Net Entitlement to 88E, added from the SMD-B and SFS reservoirs, comprising 115 million barrels (MMbbl) of Gross recoverable hydrocarbon liquids (oil and natural-gas liquids), 73 MMbbl Net Entitlement to 88 Energy; and 68 billion cubic feet (BCF) of Gross recoverable gas, 43 BCF Net Entitlement to 88 Energy.

Medtech Invion (ASX:IVX) was on the rise after it received a report authored by Scendea detailing a recently completed investigator-led Phase II prostate cancer trial using the photosensitiser INV043. The trial results showed that INV043 administered sublingually (under the tongue) has a solid safety profile and demonstrated promising efficacy signals three months post treatment, including 40% of patients showing a positive response as measured by the RECIST 1.1 standard, with 10% showing a complete response.

Metal Hawk (ASX:MHK) was up on news of an exploration update, with the company announcing that a UAV magnetic survey has been completed at Leinster South over prospective stratigraphy along the eastern limb of the Lawlers Anticline. Additionally, new rock chip gold results have extended the surface footprint and strike potential of Siberian Tiger, with further mapping and geochemical sampling set to continue to identify new drill targets.

Hiremii (ASX:HMI) was rising on news that the company has received commitments from new professional and sophisticated investors to raise $600,000 (before costs) via a placement at $0.06 per share, a 33% premium to the company’s last closing price. The funds raised will be utilised for the continued development of the Hiremii AI driven recruitment platform, expansion of recruitment service and general working capital.

Earlier, Sierra Nevada Gold (ASX:SNX) has reported staking two additional areas prospective for high-grade silver-gold-copper-antimony near its Blackhawk Project, Nevada USA. Initial sampling has returned 1,880g/t Ag from a quartz stockwork zone at Crystal Peak and 31.2g/t Au from G Mine area associated with copper up to 4.94%, while outcropping quartz stockwork zone at Crystal Peak returned high-grade silver results of 1,880 g/t Ag, 752g/t Ag, 485g/t Ag, 427g/t Ag, 142g/t Ag & 141g/t Ag within a 60m x 30m densely quartz veined area.

And, Paradigm Biopharmaceuticals (ASX:PAR) said it had received a detailed set of comments from the FDA following the Type D meeting response submitted in April 2024, which will progress its Phase 3 (PARA_OA_012) trial of iPPS for knee OA.

PAR said the regulatory body confirmed that its Phase 2 clinical data (PARA_005 and PARA_OA_008) supported the safety and tolerability of the twice-weekly 2 mg/kg dose, and that the clinical monitoring for adrenal effects would continue. The company said the FDA has also provided guidance on the use of the selected dosing regimen of 2 mg/kg iPPS, administered twice weekly.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| FAU | First Au Ltd | 0.001 | -33% | 300,000 | $2,717,990 |

| BNL | Blue Star Helium Ltd | 0.003 | -25% | 7,771,128 | $9,724,426 |

| TMX | Terrain Minerals | 0.003 | -25% | 61,750 | $7,064,115 |

| SRN | Surefire Rescs NL | 0.006 | -21% | 2,317,083 | $13,904,155 |

| ADD | Adavale Resource Ltd | 0.002 | -20% | 14,179 | $3,059,413 |

| FGH | Foresta Group | 0.004 | -20% | 6,474,086 | $11,776,895 |

| NAE | New Age Exploration | 0.004 | -20% | 950,200 | $8,969,495 |

| RGL | Riversgold | 0.004 | -20% | 1,818,731 | $6,637,313 |

| TX3 | Trinex Minerals Ltd | 0.002 | -20% | 2,800 | $4,571,631 |

| VML | Vital Metals Limited | 0.002 | -20% | 620,413 | $14,737,667 |

| AAJ | Aruma Resources Ltd | 0.017 | -19% | 2,491,736 | $4,663,222 |

| AD1 | AD1 Holdings Limited | 0.005 | -17% | 1,349,910 | $6,584,090 |

| AHN | Athena Resources | 0.005 | -17% | 400,000 | $6,422,805 |

| ASR | Asra Minerals Ltd | 0.005 | -17% | 857,017 | $13,389,348 |

| DTR | Dateline Resources | 0.005 | -17% | 1,318,077 | $14,968,079 |

| LPD | Lepidico Ltd | 0.003 | -17% | 4,597,002 | $25,767,375 |

| PUR | Pursuit Minerals | 0.003 | -17% | 36,491,832 | $10,906,200 |

| RLC | Reedy Lagoon Corp. | 0.003 | -17% | 3,954,144 | $1,858,622 |

| DAL | Dalaroometalsltd | 0.028 | -15% | 31,500 | $8,196,375 |

| ASV | Assetvisonco | 0.023 | -15% | 1,071,105 | $19,881,762 |

| TMK | TMK Energy Limited | 0.003 | -14% | 5,296,818 | $24,225,642 |

| NWF | Newfield Resources | 0.086 | -14% | 9 | $94,070,292 |

IN CASE YOU MISSED IT

Rock chip sampling at Argent Minerals’ (ASX:ARD) Kempfield polymetalllic project in NSW has defined outcropping gold-silver-lead-zinc mineralisation outside of the defined resource area.

Culpeo Minerals (ASX:CPO) has reported high-grade copper up to 1.83% from first pass surface sampling at the El Quillay West prospect within its Fortuna project in Chile’s Coquimbo region, which is renowned for its numerous world-class copper-gold mines.

EBR Systems (ASX:EBR) will undertake a fully underwritten institutional placement and entitlement offer to raise $50m to support the commercialisation of its WiSE CRT system in anticipation of US FDA approval in Q1 CY25.

Mithril Silver and Gold’s (ASX:MTH) LIDAR survey over its Copalquin gold and silver project in Mexico has more than doubled the number of previously known historical mines and workings. This indicates that a large epithermal gold-silver system is present.

Paradigm Biopharmaceuticals (ASX:PAR) has received a positive response from the US Food and Drug Administration for progression of its Phase 3 trial of injectable pentosan polysulfate sodium (iPPS) for knee osteoarthritis (OA). This follows the FDA confirming that the Phase 2 trial supported safety and tolerability of a twice weekly 2mg/kg dosage.

PharmAust (ASX:PAA) has submitted a request for orphan medicinal product designation (OMPD) to the European Medicines Agency (EMA) for its lead drug monepantel for the treatment of amyotrophic lateral sclerosis (ALS).

Riversgold (ASX:RGL) has recorded more enticing shallow gold intercepts including a 16m intersection grading 4.69g/t gold from drilling to convert a large exploration target at its Northern Zone gold project into resources.

Spartan Resources (ASX:SPR) has started development of the underground exploration drill drive at its Dalgaranga gold project in WA. This ‘Juniper Decline’ will allow the company to grow resources via underground drill platforms.

Sun Silver (ASX:SS1) has raised $13m to advance its flagship Maverick Springs silver project in Nevada. This includes a $5m cornerstone investment from high profile US investment firm Nokomis Capital that was made at a 10.28% premium to the last closing price of SS1 shares.

Torque Metals (ASX:TOR) has defined a resource of 250,000oz grading 3.1g/t gold for its Paris project. Strong signs of linking structures and mineralisation both outside and adjacent to the resource area have been identified, which highlights the potential for further growth through exploration.

Passive seismic conducted by Uvre (ASX:UVA) has identified several potential paleochannel targets at its Frome Downs uranium project. A follow-up geophysical program is currently being planned to refine the targets.

ADX Energy (ASX:ADX) has intersected a 6.5m vertical oil column at its Anshof-2A sidetrack appraisal well in Upper Austria. This is three times greater than the oil column at the Anshof-3 discovery well and also features better porosity and permeability.

Bailador Technology Investments (ASX:BTI) has invested $7.7m in high-growth fitness studio management software platform Hapana, which has a presence across 17 countries and high-quality clients including Body Fit Training (BFT), KX Pilates, Strong Pilates, Gold’s Gym, and F45.

Sovereign Metals (ASX:SVM) has successfully installed an industrial scale spiral concentrator plant at its expanded laboratory and testing facility in Lilongwe, Malawi. This plant has a throughput rate of 3t per hour and will produce graphite pre-concentrate using material sourced from its Kasiya rutile-graphite project to facilitate ongoing testwork and offtake discussions with lithium-ion battery makers and traditional graphite markets.

Notably, the spiral is identical to the model selected for the Wet Concentrator Plant envisioned in the company’s 2023 pre-feasibility study process flowsheet.

Toubani Resources (ASX:TRE) has appointed former Barrick and Gold Fields project director Mike Nelson as a non-executive director. He will bring his expertise developing international gold and copper projects such as Reko Diq and Quebrada Blanca Phase II to the role.

TRADING HALTS

Develop Global (ASX:DVP) – pending an announcement in relation to the execution of a material contract.

Trigg Minerals (ASX:TMG) – pending an announcement regarding a proposed acquisition.

Anson Resources (ASX:ASN) – pending the release of an announcement regarding a capital raising.

EBR Systems (ASX:EBR) – pending an announcement concerning a proposed capital raising.

At Stockhead, we tell it like it is. While ADX Energy, Bailador Technology Investments, Sovereign Metals, Toubani Resources, Argent Minerals, Culpeo Minerals, EBR Systems, Mithril Silver and Gold, Paradigm Biopharmaceuticals, PharmAust, Riversgold, Spartan Resources, Sun Silver, Torque Metals and UVRE are Stockhead advertisers, they did not sponsor this article.

Today’s Closing Bell is brought to you by Webull Securities. Webull Securities (Australia) Pty. Ltd. is a CHESS-sponsored broker and a registered trading participant on the ASX.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.