Culpeo pulls high grade copper as it chases a new giant in Chile

CPO says the Fortuna and Lana Corina projects have a strong pipeline of high-quality undrilled targets. Pic: Getty Images

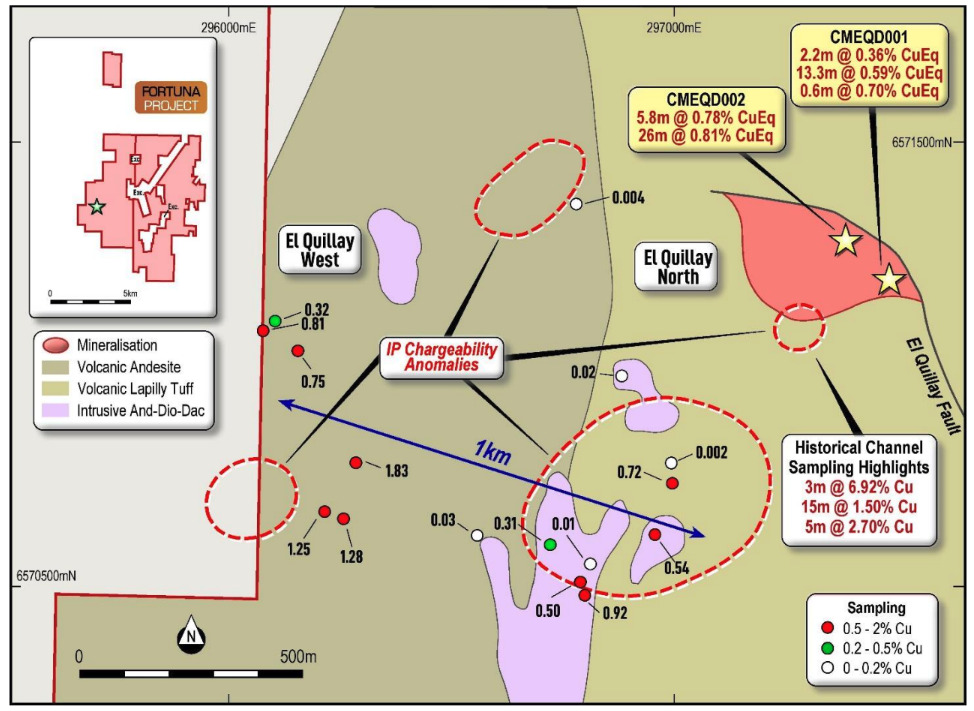

- CPO spots up to 1.83% copper at El Quillay West Prospect at Fortuna project

- Project is in renowned region for copper/gold mines in Chile

- CPO is advancing exploration at both Fortuna and Lana Corina

Special Report: Culpeo Minerals has reported high-grade copper up to 1.83% from first pass surface sampling at the El Quillay West prospect within its Fortuna project in Chile.

The Fortuna project is in Chile’s Coquimbo region, renowned for its numerous world-class copper/gold mines.

Rock chip sampling at El Quillay West identified outcropping copper mineralisation over a 1,000m by 500m trend, and three samples returned assays above 1% copper, with the highest grade reaching 1.83%.

The prospect is a high-priority undrilled target and given its proximity to the main mineralised El Quillay host structure, it is interpreted to represent a new mineralised parallel structure.

In addition, Culpeo Minerals (ASX:CPO) says mapping at El Quillay South has extended the mineralisation by a further 1,000m, bringing the total strike length to over 2,000m.

Active exploration continues at Fortuna

“These results are encouraging given they are coincident with the previously identified chargeability targets at El Quillay West and further reveal the mineralisation potential of the large land package we hold at the Fortuna project,” CPO managing director Max Tuesley said.

“Multiple systematic trench sampling programs have commenced at El Quillay South, while preparations for drilling at the Vista Montana prospect, located just 10km south at Lana Corina, are well advanced.”

Active exploration continues at the Fortuna Project, with a 1,500m systematic trenching program underway at El Quillay South to follow up on historic sampling, which included widths of up to 43.1m at 1% copper and 1.31g/t gold.

In addition, site clearance and drill contractor selection for drilling is underway at the Vista Montana prospect.

“With a strong pipeline of high-quality undrilled copper targets ahead of us, we look forward to providing updates as we continue to advance our projects,” Tuesley said.

Coquimbo is the locale of Antofagasta’s monstrous Los Pelambres mine, which is expected to produce 335,000-350,000t of copper, 8,500-9,500t of molybdenum and 45,000-55,000oz of gold in 2024.

In copper metal terms, the deposit rivals BHP’s entire South Australian portfolio, giving a sense of the scale discoveries in the region can deliver.

Copper futures have been rising in recent days as the world awaits expected rate cuts from the US Fed. The red metal typically rises as rates fall because a weaker US dollar makes copper and other base metals more affordable for international buyers.

At US$4.28/lb, Comex copper futures are 10% up since the start of 2024.

This article was developed in collaboration with Culpeo Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.