ASX Small Caps Weekly Wrap: ASX backs out gracelessly as goldies shine

Pic: Getty Images

- The ASX 200 is licking its wounds after a bruising week on the bourse

- Headline grabber this week is definitely Wisetech’s woes. Yes, again

- Who won the Small Caps race? Read on to find out…

It’s Friday afternoon, and it’s the end of a fairly brutal week for the bulk of the ASX.

The benchmark is down more than 1.6% for the week, late in the Friday arvo session, and a huge chunk of that has come via the same thing that upset the apple cart last week – Wisetech Global, it’s founder and CEO, and the baffling choice he made that has scuppered his career and will forever tarnish his reputation.

Here’s a brief re-cap, which I am shamelessly stealing from something I wrote earlier today – apologies if you’ve already read it… oh, and everything here is “alleged” and “reported” and all that legal mumbo-jumbo.

Richard White (current net worth somewhere around $13 billion) publicly went after his alleged former lover – beauty entrepreneur Linda Rogan – with legal action stemming from a dispute over $91,000 worth of furniture.

The furniture, Rogan said, was bought in anticipation of her moving into a multi-million dollar Sydney house that White allegedly said she could have – before selling the house at a considerable loss, reportedly to someone who paid for it with the (alleged) proceeds of crime.

When White refused to pay for the furniture, Rogan went after him for the money – and in response, White initiated a very public set of bankruptcy proceedings against her, annnd that let the cat out of the bag…

The affair became public, and the whole messy debacle caused a massive sell-down of Wisetech’s shares, which ended up wiping more than 25% off the company’s share price, sending it below $100 a pop.

It was cheap, tawdry and so gallingly unnecessary… and it left White with little option other than to step down as CEO, which he did yesterday afternoon at the company’s Sydney headquarters.

It would have been a very weird couple of hours for staff, as it’s been reported that White’s resignation happened immediately after cake had been served at Wisetech HQ to celebrate the 30th anniversary of the company’s founding.

White hasn’t left the company entirely, though – he will retain the title of “Founding CEO”, and will continue to consult to the company with a salary of $1 million per year.

There’s no word on who the new CEO will be, but whoever steps up to take on the role better be wearing a decent set of asbestos gloves and have medics on speed dial – that’s about as big a poison chalice as corporate Australia has seen in quite some time.

The end result – as far as we’re concerned – is that Wisetech and it’s out-sized effect it has on the market as a whole has dominated the headlines, and the ASX overall trend for the past 10 days or so.

It was, at one point, down by nearly 25% – which is a lot when we’re talking about a company worth upwards of $40 billion.

As you’ll see in a moment, a tech sector that’s been dragged as hard as ours for such a prolonged period is obviously going to show up in the data… and this one sure did.

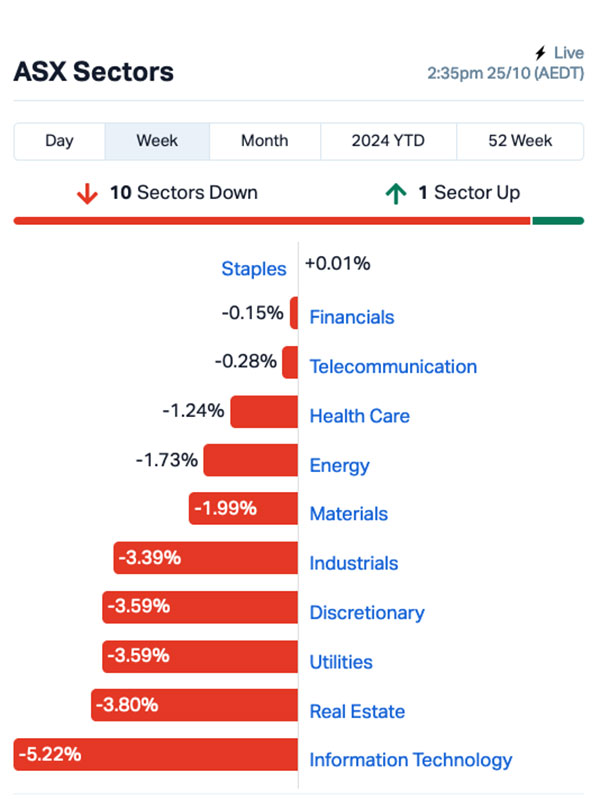

WHAT THE SECTORS DID

Here’s what the market sectors did:

The obvious issue is right there – our tech sector shed a lot of value this week, down more than 5.22%… and the shocking thing is that is taking into account the 3.7% bump it got today on the news that White has stepped down as CEO of Wisetech.

It was the worst of a bad bunch, though – weak iron ore prices, other commodities sinking fast and oil prices that are proving very difficult to predict have also combined to suck a lot of the joy out of the market this week.

But gold – the safe haven that just can’t seem to quit – has been the one glittering prospect since this time last week, and the ASX goldies have made hay while the rest of the market sobbed like a jilted lover.

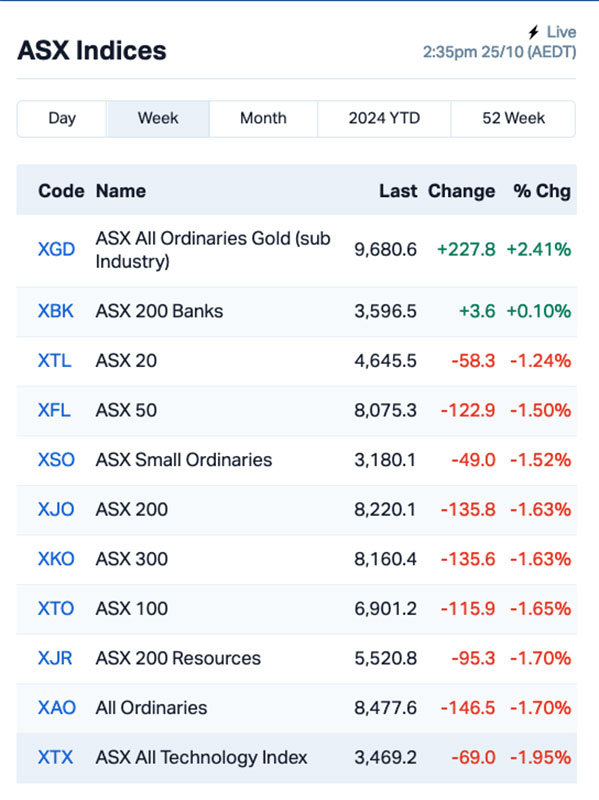

Here’s how the rest of the sub-sectors and ASX indices landed at the end of the week.

THIS WEEK’S ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| BDG | Black Dragon Gold | 0.038 | 153.3 | $8,560,566 |

| OVT | Ovanti | 0.035 | 150.0 | $66,994,805 |

| YRL | Yandal Resources | 0.2475 | 147.5 | $64,273,827 |

| EWC | Energy World Corpor. | 0.025 | 127.3 | $46,183,819 |

| VAR | Variscan Mines | 0.019 | 111.1 | $5,316,004 |

| AVM | Advance Metals | 0.042 | 100.0 | $4,717,977 |

| IEC | Intra Energy Corp | 0.002 | 100.0 | $2,536,172 |

| VPR | Volt Group | 0.002 | 100.0 | $16,074,312 |

| GCR | Golden Cross | 0.004 | 100.0 | $4,389,024 |

| SLZ | Sultan Resources | 0.012 | 100.0 | $2,371,038 |

| DOU | Douugh | 0.009 | 100.0 | $10,820,689 |

| PUA | Peak Minerals | 0.005 | 100.0 | $14,982,662 |

| LRV | Larvotto Resources | 0.69 | 79.2 | $192,497,509 |

| POD | Podium Minerals | 0.059 | 73.5 | $24,101,579 |

| TZN | Terramin Australia | 0.085 | 70.0 | $169,325,018 |

| VR1 | Vection Technologies | 0.015 | 66.7 | $18,572,246 |

| ARD | Argent Minerals | 0.029 | 61.1 | $41,873,844 |

| DME | Dome Gold Mines | 0.16 | 60.0 | $56,539,299 |

| FME | Future Metals | 0.027 | 58.8 | $13,800,972 |

| TZL | TZ | 0.076 | 55.1 | $18,473,984 |

Black Dragon Gold (ASX:BDG) was the winner this week , but not without catching the attention and ire of the ASX watchdogs, which sent the company a price query and then suspended it from quotation after an answer didn’t arrive within the required timeframe.

Ovanti (ASX:OVT) backed up last week’s monster climb with a solid effort for this week as well, still off the back of news that it has managed to hire in the former CFO of Zip Co, Simon Keast, as CEO – an observably favourable choice which will take effect from November 1 2024.

Yandal Resources (ASX:YRL) banked a nice third spot on the ladder for the week, off the back of decent gold intercepts from drilling at its New England Granite prospect, and a well-received letter to eligible shareholders about a bunch of $0.24 options, which are set to expire on October 31.

North Stawell Minerals (ASX:NSM) did really well last week, but topped the laggards list this week, which is a pretty shocking change of fortunes.

THIS WEEK’S ASX SMALL CAP LAGGARDS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| NSM | North Stawell | 1.4 | -53.3 | $3,817,471 |

| M4M | Macro Metals | 0.9 | -50.0 | $43,477,283 |

| CDD | Cardno | 16.5 | -47.6 | $5,663,796 |

| MOV | Move Logistics Group | 17.5 | -47.0 | $21,056,313 |

| KLI | Killi Resources | 8.1 | -44.1 | $11,498,347 |

| PER | Percheron | 7.8 | -42.2 | $81,905,361 |

| QEM | QEM | 6.0 | -37.5 | $9,991,853 |

| CML | Connected Minerals | 22.5 | -37.5 | $14,888,956 |

| IAM | Income Asset | 3.1 | -37.4 | $12,176,046 |

| ADA | Adacel Technologies | 30.5 | -36.5 | $23,279,122 |

| OEC | Orbital Corp | 9.0 | -35.7 | $14,605,692 |

| 1TT | Thrive Tribe Tech | 0.1 | -33.3 | $611,622 |

| AFA | ASF Group | 2.0 | -33.3 | $15,847,951 |

| CDE | Codeifai | 0.1 | -33.3 | $2,641,295 |

| LPD | Lepidico | 0.2 | -33.3 | $21,472,812 |

| EEL | Enrg Elements | 0.2 | -33.3 | $3,135,048 |

| BPM | BPM Minerals | 7.7 | -33.0 | $6,290,416 |

| WYX | Western Yilgarn | 2.3 | -32.4 | $2,501,489 |

| PPG | Pro-Pac Packaging | 2.6 | -31.6 | $5,450,631 |

| ILA | Island Pharma | 12.0 | -31.4 | $18,671,688 |

| NXS | Next Science | 13.5 | -30.8 | $36,520,029 |

HOW THE WEEK SHOOK OUT

Monday October 21, 2024

Yandal Resources (ASX:YRL) surged on news of an emerging discovery at the New England granite prospect, part of the wider Ironstone Well-Barwidgee gold project near Wiluna, WA. The first assay results from the 12-hole, 2400m RC program completed across the New England prospect have been received, returning a standout 78m intersection averaging 1.2g/t gold from 96m in hole 24IWBRC0039.

The other hole, 24IWBRC0044, was completed 170m to the north-west, intersecting 14m at 1.8g/t gold from 63m including 3m at 4.9g/t gold from 64m. Gold mineralisation within the emerging discovery, now called Siona, remains open at depth and along strike.

YRL managing director Chris Oorschot described the results as “exceptional”, suggesting they may point to a “significant emerging gold discovery” within the Ironstone Well-Barwidgee project area. The timing of this discovery is even more compelling given the current gold price setting.

YRL plans on completing follow up drilling at Siona as soon as possible to determine the geometry of the mineralisation so that the exploration team can begin to assess the scale of the mineralised system.

Vection Technologies (ASX:VR1) was rising on news that it has partnered with IT giant Dell to launch its AI-based ‘Algho’ platform, securing its first sale of $500,000. The company says the launch is “testament to the value and potential of Vection’s acquisition of TDB” – the acquisition TDB, which supplied the generative AI layer which powers Vection’s ‘Algho’ platform, goes before shareholders for approval on Monday 28 October.

Drilling at Unico Silver (ASX:USL)’s Cerro Leon silver project in Argentina kicked off with an initial 5000m reverse circulation campaign aiming to expand the project’s current 91Moz silver equivalent resource for 16.5Mt at 172g/t silver equivalent.

Six prospects where silver mineralisation is open at depth or along strike have been prioritised for drilling, including several new areas that fall outside of the current MRE. The first assays are expected by mid-December. Cerro Leon is strategically located within the same structural corridor that is host to AngloGold Ashanti’s world-class Cerro Vanguardia mine. It is host to the second largest vein field in Argentina’s Santa Cruz province, second only to AngloGold Ashant

Carnavale Resources (ASX:CAV) was up on news that it has commenced an extensional drilling program at the high-grade Swiftsure deposit within the Kookynie Gold Project is underway, testing extensions to the Swiftsure bonanza gold grade shoots that contain zones of +30g/t within the resource. The company says it will monitor the drilling carefully and modify the program to chase the best mineralisation as it is encountered.

Elixinol Wellness (ASX:EXL) was up on news that it will be consolidating its securities, from 1.56 billion to a somewhat more manageable 195 million, with the process to be voted on as part of the company’s AGM later this month.

TZ (ASX:TZL) was up on news that it’s entered into a Heads of Agreement to acquire Proptech company, Keyvision Holdings – a “high margin, recurring revenue proptech company that provides Tenant Experience Apps for the property sector: Residential; Commercial; Retail; Aged Care and Community Groups”, according to the announcement.

Quickfee (ASX:QFE) was up after releasing a quarterly business update, revealing quarterly revenue of $5.6 million, up 33% on pcp. The increase was driven by “strong growth in the core Finance product in both Australia and the US”, and has the company set for an expected FY25 EBTDA in the range of $1.5 -$2.5 million, with a stronger second half-year.

Kaiser Reef (ASX:KAU) climbed on news that it has received firm commitments for a Placement of Kaiser shares at $0.15 per share to raise $8 million (before costs) to complete the last stage of the A1 Mine production plan. The funds have been earmarked for completion of the A1 Mine ramp up and expansion for high-grade gold production, and the resumption of drilling at the A1 Mine.

Earlier, Environmental Clean Technologies (ASX:ECT) rose on news of the signing of a Joint Venture Agreement with ESG Agriculture, advancing from the Heads of Agreement signed in July 2024. The company says it marks a significant milestone in the progression of the COLDry Lignite-Nitrogen Fertiliser Project.

TMK Energy (ASX:TMK) was up on news that the first of the three additional pilot production wells at the Gurvantes XXXV Coal Seam Gas (CSG) Project, being drilled as part of the 2024 drilling program, has been successfully drilled to a total depth of 480m and has intersected approximately 60m of net coal, which is “as per prognosis and consistent with the existing three surrounding pilot production wells”.

Peak Minerals (ASX:PUA) surged 150% before receiving a speeding ticket from the ASX. In response, Peak said that on October 15, the company announced it completed the acquisition of an 80% stake in the Kitongo and Lolo uranium projects and the Minta Rutile Project in Cameroon. The acquisition followed thorough due diligence, including recent field visits by director Phillip Gallagher.

Tuesday October 22, 2024

Prodigy Gold (ASX:PRX) said exceptional results have emerged from the Reverse Circulation drilling campaign at the Hyperion Gold Deposit, part of Prodigy Gold’s Tanami North Project. Highlights include significant intercepts such as 25m at 2.2g/t Au and 33m at 2.6g/t Au from the Hyperion and Tethys Lodes. The 17-hole, 1,770 metre programme revealed all holes intersected mineralised intervals, with most grades surpassing previous estimates. This data will be used to update the current Indicated and Inferred Mineral Resource of 8.64Mt at 1.5g/t Au. Additional drilling has also taken place at other nearby prospects, with results pending.

Nanoveu (ASX:NVU) was up on news that its current takeover target, EMASS, had completed benchmark testing for its ECS-DOT SoC (System on Chip) chipset, achieving 20x lower energy consumption compared to peers,and “setting a new benchmark for ultra-low power performance in edge AI applications”. Nanoveu is currently in the process of acquiring 100% of EMASS, subject to shareholder approval.

MONEYME (ASX:MME) was up on news it has executed its first asset-backed securities deal in the auto asset class, with the MME Autopay ABS 2024-1 Trust – the second ABS transaction in FY25 and the largest term securitisation deal to date for the company. The Aaa (sf) and AAA (sf) credit ratings for the Class A1 and Commission notes represent 72.4% of the collateralised notes, “reflecting strong credit quality and performance of the Autopay loans,” says MoneyME boss Clayton Howes.

New Zealand goldie Siren Gold (ASX:SNG) is off to the races after its ionic leach soil sampling program extended gold and antimony mineralisation at the Auld Creek prospect for at least 1.5km. SNG believes Auld Creek has what it takes to grow further and enhance the resource on the Reefton project, which currently stands at 558,000oz at 4.72g/t gold equivalent. The Reefton project is situated between the Globe Progress mine, which historically produced 418,000oz at 12.2g/t gold, and the Crushington group of mines that produced 515,000oz at 16.3g/t gold. Auld Creek, with a resource of 105,000oz at 3.84g/t gold and 14,500t at 1.71% antimony for a gold equivalent of 210,000oz at 7.69g/t gold, is now Siren’s largest resource at Reefton and has the potential to increase significantly as exploration proceeds.

Gratifii (ASX:GTI) was up after releasing a positive quarterly report this morning, showing 1Q FY25 cash receipts of $8.31 million, an increase of 32.7% over previous quarter and 14.4% over previous corresponding quarter. That’s put the company in a cashflow positive position, improving by about $1.1 million from 4Q FY24 supported by the increase in cash receipts and reduced investment in inventory.

Plenti Group (ASX:PLT) climbed after the company announced unaudited 1H25 Cash NPAT of $5.5 million, which is a massive increase of 260% on PCP. The company says its loan portfolio has increased to $2.28 billion, 14% above PCP and 3% above prior quarter alongside loan originations of $323.3 million, 11% above PCP and 7% above prior quarter.

MRG Metals (ASX:MRQ) was up on news that Fotinho exploration licence 11000 has been granted over a newly identified, high potential 19,865.18 ha Thorium and Rare Earth Element (REE) district in Mozambique, where historical exploration showed the presence of monazite and highly elevated Th and REE grades, with Th assays >1,000 ppm in soil and panned heavy mineral concentrate and 559 ppm in rock.

A technical review carried out across Alicanto Minerals (ASX:AQI)’s Greater Falun asset has identified compelling copper, gold and silver targets that show there is huge exploration potential still yet to be discovered.

The targets include Wolf Mountain, Stone Lake, Swamp Thing, Birch Mountain, Lustebo and Strömbo, where previous rock chip results returned 11.9% copper, 7.2g/t gold and 185g/t silver. Alicanto is in active discussions with potential strategic partners for Falun and the Greater Falun project with the aim of progressing systematic exploration in this highly prospective region.

Wednesday October 23, 2024

Eastern Metals (ASX:EMS) was up on news that reconnaissance drilling completed at two new targets, Kelpie Hill and Windmill Dam, and at the advanced Evergreen prospect within the 100%-owned Cobar Project in NSW. Initial assays have come back with results such as 7m @ 4.3g/t Au, 2.7g/t Ag, 0.3% Pb from 50m and 1m @ 4.17g/t Au, 2.7g/t Ag from 82m, with the second and third holes returning 3.05m @ 3.9% Zn, 2% Pb, 29.5g/t Ag from 298.5 and 0.5m @ 7.2% Zn, 2.4% Pb from 299m.

Energy Resources of Australia (ASX:ERA) was up after letters went out to shareholders about the previously announced, Rio-backed pro-rata renounceable entitlement offer of new ERA ordinary shares to raise up to approximately $880 million.

Arrow Minerals (ASX:AMD) has taken a significant step forward in developing its projects by signing a Memorandum of Understanding (MoU) with Baosteel for potential sales of iron ore from its Simandou North Iron Project. This partnership will allow Arrow to access key infrastructure, including the Simandou port and rail.

The company has also started the next phase of metallurgical testwork to analyze different iron ore samples. These results will help outline the processing methods and estimate costs for building and operating a processing plant. Arrow’s project is located next to Baosteel’s large iron ore development, which further supports its growth potential.

Adisyn (ASX:AI1) was up on news that it has entered into formal negotiations to acquire 100% of semiconductor IP business 2D Generation, with the goal of leveraging 2D Generation’s “innovative semiconductor solution” to generate opportunities in AI1’s target markets including defence applications, data centres and cybersecurity.

Resource Base (ASX:RBX) was up on the heels of a quarterly this morning, which outlined the company’s recent work in Canada’s James Bay, where completion of the 2024 summer field program following up anomalous targets at the Wali Project resulted in multiple lithium and gold anomalies, with a peak lithium value of 20ppm and peak gold value of 436ppb with associated pathfinder elements.

Nordic Nickel (ASX:NNL) reported excellent metallurgical results from its Hotinvaara nickel-cobalt deposit in Finland. A composite sample produced a clean concentrate of 18.4% nickel and 0.66% cobalt, with a nickel recovery of 62% using a straightforward grinding and flotation process. This indicates that the lower-grade nickel sulphides at Hotinvaara can be processed effectively to create a high-grade concentrate. The current resource estimate at Hotinvaara is 418 million tonnes at 0.21% nickel and 0.01% cobalt. The deposit has significant potential for growth, NNL said, as it covers just a small part of a much larger mineralised area.

Thursday October 24, 2024

Bowen Coking Coal (ASX:BCB) released its quarterly, announcing that “robust mining performance” has delivered 769Kt ROM for the quarter, while the company has managed a mining cost reduction of 7% to $53/ROMt including boxcut costs and 52% lower than this time last year. That has led to 444Kt of saleable coal produced with sales of 415Kt recorded in the quarter, at an average coal price of A$216/t, down slightly on pcp.

Auking Mining (ASX:AKN) was rising on news that the company has completed the purchase of the Grand Codroy uranium exploration project in Newfoundland,Canada. The project features uranium mineralisation within extensive, organic-rich siliciclastic rocks is similar to sandstone-hosted uranium districts in the western United States, and exploration work has returned high-grade historical rock samples including Sample 153: >20,000ppm (2%) Cu and 435ppm U, and Sample 3522: >20,000ppm (2%) Cu and 400ppm U.

Adelong Gold (ASX:ADG) was up on news that it has entered a binding farm-in agreement with Great Divide Mining (ASX:GDM) for a staged acquisition of up to 51% interest in the Adelong Gold Project. Under the agreement, GDM is set to invest $300,000 for an initial 15% stake in Challenger Gold Mines (following successful due diligence), and will earn a further 36% interest upon achieving first gold production from the refurbished Adelong Gold Plant within 12 months, bringing their total interest to 51%.

Earlier, Chimeric Therapeutics (ASX:CHM) was up on news that the company’s Phase 1B ADVENT-AML clinical trial has completed enrolment of relapsed or refractory Acute Myeloid Leukaemia subjects in the dose-finding portion of the clinical trial. The trial is an investigator-initiated study currently open to enrolment at The University of Texas MD Anderson Cancer Center under Principal Investigator Abhishek Maiti MD, Assistant Professor in the Department of Leukaemia.

Duketon Mining (ASX:DKM) was riding high on the release of its September quarterly report which goes into detail of early exploration activities currently underway at the Barlee gold and lithium project, 200km north of Southern Cross in WA. Various programs including desktop reviews, field reconnaissance, mapping and rock-chip sampling are on the go with a number of incoming proposals from external third parties being reviewed as well. Duketon’s tenement package lies along strike and adjacent to Regis Resources’ (ASX:RRL) landholding including the Rosemont, Garden Well and Moolart Well gold mines.

TMK Energy (ASX:TMK) reminded eligible shareholders that its Entitlement Issue was to close on October 25, at 5.00pm AWST, with no extensions. Many shareholders, including the Board and Management, have shown strong support for the offer, taking up significant portions of their entitlements. Currently, the second pilot well (LF-06) is drilling at 226 metres in Mongolia, with further updates expected as drilling progresses. CEO Dougal Ferguson encourages all eligible shareholders to consider this opportunity to participate in the company’s success before the deadline.

Greenvale Energy (ASX:GRV) rose after announcing positive results from its Liquefaction Test Program 5, conducted by the University of Jordan for its Alpha Torbanite Project in Queensland. This program aimed to improve the viscosity of the bitumen product, with results suggesting that a premium-grade C170 product could be achieved with further adjustments.

The tests explored various conditions, including temperature and pressure, to maximise bitumen yield and quality. While viscosity measurements were limited due to small sample sizes, the findings indicate that optimising these conditions could lead to a product that meets the desired specifications. The Greenvale Board will now evaluate the results to decide on the next steps for the project.

Wellnex Life (ASX:WNX) said it was progressing with its dual listing on the London Stock Exchange (LSE) after announcing plans in April. The company successfully completed a placement with UK investors at $1.40 per share, showing strong support for its move. Wellnex expects to generate a significant portion of its revenue from the UK and Europe, particularly with its Haleon partnership. The company is finalising the necessary regulatory steps, including those related to its medicinal cannabis business, and aims to complete the listing by the end of 2024. An extraordinary general meeting held on 26 September approved the issuance of shares to support this process, which will enhance its international presence and investor reach.

And, Rhythm Biosciences (ASX:RHY) said it hopes to be able to get its blood-based bowel cancer screening test to market.

In a prezzo released Thursday, Rhythm said it is in the “final stages of development” of the second-generation version of its lead assay, Colostat. Colostat shows great promise in replacing the maligned ‘poo test’, which is less accurate and not exactly user-friendly. The federal government’s national program provides free poo tests for those aged between 45 to 74. But the ‘ick’ factor means participation is low which is a pity because (a) it saves lives and (b) the program costs a sh*tload to run.

Friday October 25, 2024

Advance Metals (ASX:AVM) has entered into a binding sale agreement with Golden Minerals Company (NYSE: AUMN, TSX: AUMN), to acquire a 100% interest in the Yoquivo Silver Project located in northwest Chihuahua State, Mexico, which boasts 17.23M oz silver equivalent (AgEq2) @ 570 g/t AgEq, with the purchase coming at a time when silver prices are at record highs.

Earlier, Godolphin Resources (ASX:GRL) was up on news that the company has reached a major milestone, after process development testing produced the first Mixed Rare Earth Carbonate (MREC) from its Narraburra REE project. Godolphon reports that the quality of the MREC – an intermediate product from rare earth mining and processing which can be sold to specialist refining companies for processing into rare earth metals and oxides – is “excellent”, and indicates a high value product with significant concentrations of Tb and Dy with low impurities.

Battery materials and technology company Talga Group (ASX:TLG) was also up early, on news that it has been selected for an EU Innovation Fund grant for its commercial scale Luleå Anode Refinery, part of its integrated Vittangi Anode Project, awarded by the European Commission. Talga successfully applied for a $115 million grant under the IF23 call, and is one of 85 entities out of 337 applicants to share in a total of $7.8 billion in grants under the EU Innovation Fund.

Just out of the charts but rising with news was Golden State Mining (ASX:GSM) which was rising after the company released a quarterly report covering how things are progressing at its Yule project, and targeting work across its other gold and lithium focused projects.

Similarly, Buxton Resources (ASX:BUX) was up after company CEO Martin Moloney sent out a refreshingly frank and simple letter to the company’s 1,413 shareholders. It’s all good news – and if you’re looking for a light read when you’re done here, defo check it out, if only because it’s just so gosh-darn friendly.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.