ASX Small Caps Lunch Wrap: Who’s elevated being drunk and lazy to an art form this week?

News

News

Local markets have fallen this morning, backing up last week’s dour performance by stumbling back into the basement again the moment the ASX opened today.

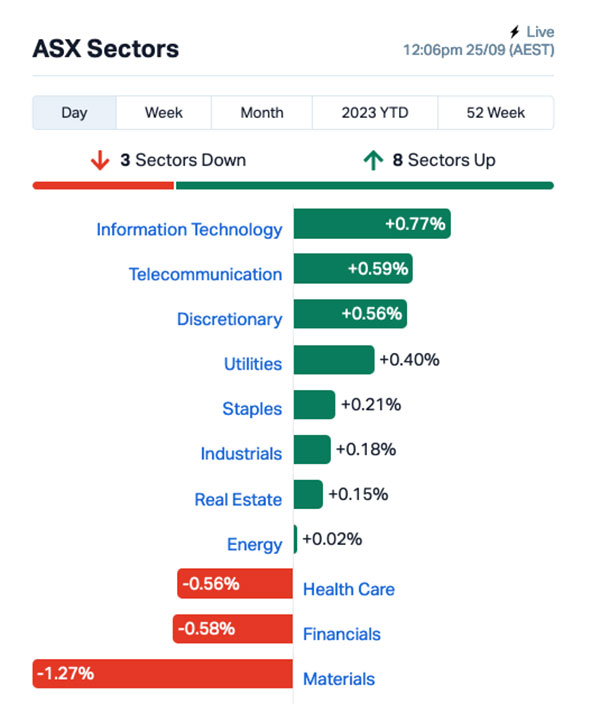

By lunchtime, things were fairly well-mixed – the benchmark was at -0.41%, InfoTech was surging and Materials was deep in the dumps, so… just another Monday morning, really.

Before we get too deep into the reasons why, there’s an interesting yarn emerging from the US this morning, after an Ohio man visiting West Virginia had emergency services scrambling to reach him, deep in the bush and in mortal peril.

47-year-old Christian Leonhardt rang the 911 emergency number, screaming repeatedly down the phone that he was about to be attacked by a bear and was in desperate need of assistance.

Some help was sent, but – as the 911 operator kept the man on the line, as they’re trained to do, the story began to evolve.

Leonhardt, it is alleged, went on to claim that he had been walking through the wilderness for days, then claimed that it was more than one bear currently seeking to attack him.

Then, he claimed, that the bears had been stalking him for a number of days – and then started screaming that the bears had actually attacked, telling dispatchers that he now had a serious head wound, and that he was about to die.

This is, obviously, a very serious predicament – one that prompted an enormous coordinated response, with a large number of emergency personnel sent at high speed to reach the man and save his life.

The response team were most of the way through the process of scrambling a helicopter to reach him when – two hours after the initial call – Leonhardt was found by the first rescue team, without a scratch on him.

There wasn’t a bear in sight, and it took only a few minutes for Leonhardt to explain that the reason he’d called with a cockamamie story about being attacked by a roving gang of bears was because:

Police solved the first issue by agreeing to his second wish – he was driven directly to the West Virginia Regional Jail, where he was charged with one count of falsely reporting an emergency incident, and left to sleep off the booze.

Local markets have had a poor start to the week, following on from a mediocre effort in New York on Friday and compounding the dismal string of sessions the ASX banked last week.

Early in the session, the energy sector got off to a flyer while everything fell sharply around it, but about 15 minutes into the session InfoTech rallied hard to be up 0.8% at lunchtime.

Meanwhile, Materials took a beating to lock in the worst performance of the morning, shedding nearly 1.3%, with heavyweight Financials and Health Care languishing lower as well.

In the fancy seats, Boss Energy (ASX:BOE) has jumped 5.7% this morning – just like pretty much every other uranium player in the country – as uranium prices spike over growing interest in nuclear as a ‘green’ power source continues to climb.

Meanwhile, Latin Resources continued its recent decline, dropping another 6.4% today to $0.258, well down from its $0.38 price at the beginning of the month.

On Friday, the S&P 500 fell by -0.23%, the blue chips Dow Jones index was down by -0.31%, and the tech-heavy Nasdaq slipped by -0.1%, Earlybird Eddy reported this morning.

Ford Motor rose 2% after saying it was serious about reaching a deal with the United Auto Workers (UAW) union. The UAW said it would spare Ford more pain, even as it expanded the strike to 38 more facilities run by rivals General Motors and Stellantis.

Arm Holdings fell almost -2% after getting a neutral rating by Susquehanna Financial, following the Sell rating by Bernstein last week.

Amazon fell modestly after reports the Federal Trade Commission will be suing the company for antitrust violations next week.

Meanwhile, two US Fed Reserve officials – Fed Bank of San Francisco President Mary Daly and Boston Fed president Susan Collins – said that at least one more interest rate increase is possible.

In Japan, the Nikkei is up 0.71% this morning, despite government officials announcing that there’s a pretty serious outbreak of syphilis rampaging through the nation this year.

“The number of new syphilis cases reported in Japan has exceeded 10,000 for two years in a row,” The Japan Times reported this morning, however that particular weepy milestone was reached two months earlier than it was last year.

It’s only the second time that the number of cases has broken through the magic 10,000 infections mark since the time the current survey method was introduced in 1999.

I started Googling for what, precisely, the “current survey method” entails, but was overcome with a sense of existential dread at the horrors that I saw by searching for “Japan” and “syphilis”, even with SafeSearch switched on.

So – pre-empting the raised eyebrows that will eventually accompany me returning this work-supplied laptop – that’s the reason why the search history on it is as grossly obscene and antibiotic resistant as it is.

In China, Shanghai markets are down 0.4% for a variety of reasons, not least of which is that the country’s obsession with building a lot of housing is the backfire that keeps on firing.

“How many vacant homes are there now? Each expert gives a very different number, with the most extreme believing the current number of vacant homes are enough for 3 billion people,” former Chinese official, He King – who is still Chinese, but doesn’t work as an official any more, just so we’re clear – said to Reuters.

There are currently about 1.4 billion people living in China.

In Hong Kong, where real estate is a perpetual source of concern, the Hang Seng is 1.4% lower. One day, soon, I will start understanding what’s going on there, but in the meantime, “it just moves around a lot” remains my go-to reasoning for why.

Here are the best performing ASX small cap stocks for 25 September [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap ICN Icon Energy Limited 0.012 33% 2,056,344 $6,912,123 WEC White Energy Company 0.08 29% 8,799 $4,241,183 MCT Metalicity Limited 0.0025 25% 3,250,000 $7,472,172 AMM Armada Metals 0.026 21% 161 $1,474,241 BGE Bridgesaaslimited 0.03 20% 225,250 $985,900 CXU Cauldron Energy Ltd 0.012 20% 19,370,829 $9,515,687 IEC Intra Energy Corp 0.006 20% 2,566,095 $8,103,908 QXR Qx Resources Limited 0.026 18% 4,883,895 $19,730,971 FRX Flexiroam Limited 0.033 18% 214,712 $18,597,368 EL8 Elevate Uranium Ltd 0.53 18% 905,559 $125,038,863 1AE Auroraenergymetals 0.14 17% 1,491,090 $19,104,831 1AI Algorae Pharma 0.014 17% 4,113,451 $19,628,882 AYT Austin Metals Ltd 0.007 17% 459,249 $6,095,248 ECT Env Clean Tech Ltd. 0.007 17% 775,767 $17,085,331 EEL Enrg Elements Ltd 0.007 17% 5,364,393 $6,059,790 ELE Elmore Ltd 0.007 17% 30,888 $8,396,303 MXR Maximus Resources 0.03 15% 109,996 $8,326,650 NET Netlinkz Limited 0.008 14% 56,674 $24,713,699 WCG Webcentral Ltd 0.125 14% 52,863 $36,203,885 OKR Okapi Resources 0.17 13% 1,396,141 $31,512,902 HFY Hubify Ltd 0.017 13% 32,655 $7,442,044 RBL Redbubble Limited 0.475 13% 30,957 $118,742,494 PGO Pacgold 0.225 13% 22,222 $13,400,113 APC Aust Potash Ltd 0.0045 13% 392,809 $4,154,758 HNR Hannans Ltd 0.009 13% 200,000 $21,796,838

Algorae Pharmaceuticals (ASX:1AI) has surged 25% this morning on no news. The company (formerly Living Cell Technologies (ASX:LCT)) recently announced that it’s signed an MoU with UNSW to develop an AI platform to assist with:

That’s all I know at this stage.

QX Resources (ASX:QXR) is up 22.7% on last week’s news that the company’s 39%-owned Bayrock has expanded the mineral lease area by ~33% at the Vuostok Nickel-Copper Project in northern Sweden with the addition of Nr 102 lease covering an additional 34km2 to expand the total lease area to ~130km2.

Cauldron Energy (ASX:CXU) is up on no news, but it’s moving along with fellow uranium players Aurora Energy Metals (ASX:1AE), Elevate Uranium (ASX:EL8), Alligator Energy (ASX:AGE) and Icon Energy (ASX:ICN), as chatter about a nuclear-powered future builds in intensity.

Here are the most-worst performing ASX small cap stocks for 25 September [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap ARE Argonaut Resources 0.066 -34% 4 $7,316,152 FGL Frugl Group Limited 0.012 -33% 56,345 $17,209,116 AYM Australia United Min 0.002 -33% 103,048 $5,527,732 MTB Mount Burgess Mining 0.003 -25% 814,760 $4,062,587 GTG Genetic Technologies 0.002 -20% 821,851 $28,854,145 IVX Invion Ltd 0.004 -20% 1,242,518 $32,108,161 TMX Terrain Minerals 0.004 -20% 100,750 $6,288,219 CDR Codrus Minerals Ltd 0.075 -18% 731,888 $6,972,680 NNG Nexion Group 0.014 -18% 178,571 $3,439,234 LML Lincoln Minerals 0.005 -17% 230,000 $8,524,271 OAR OAR Resources Ltd 0.005 -17% 29,908 $15,678,814 PKO Peako Limited 0.005 -17% 4,463,468 $2,824,389 OZM Ozaurum Resources 0.105 -16% 5,862,419 $15,875,000 FG1 Flynngold 0.051 -15% 85,501 $8,182,955 PUR Pursuit Minerals 0.009 -14% 197,620 $30,911,700 ADY Admiralty Resources. 0.006 -14% 4,750 $9,125,054 GMN Gold Mountain Ltd 0.006 -14% 85,932 $15,883,550 NAE New Age Exploration 0.006 -14% 483,581 $10,051,292 ESR Estrella Res Ltd 0.007 -13% 118,376 $11,868,575 EXL Elixinol Wellness 0.007 -13% 63,933 $5,011,862 SHN Sunshine Metals Ltd 0.014 -13% 3,490,033 $16,155,564 STA Strandline Res Ltd 0.11 -12% 6,952,541 $182,820,529 ERG Eneco Refresh Ltd 0.022 -12% 377,931 $6,808,959 SLZ Sultan Resources Ltd 0.023 -12% 247,342 $3,852,941 RAS Ragusa Minerals Ltd 0.031 -11% 674,692 $4,990,958