ASX Small Caps Lunch Wrap: Who’s been stocking up on gold at Costco this week?

News

News

Local markets are close to flat at lunchtime today, after recovering from a heart-stopping 0.43% slump earlier in the day, as local investors digested news that the ogovernment shutdown in the US came within a whisker of happening, before a 45-day compromise was found to let the money taps continue to flow.

But it’s been a bit of a rude shock to sentiment in the US – and not just on the markets, either.

Evidence that even the “civilians” are getting the feeling that the US economy is looking pretty sketchy comes from retail juggernaut Costco, which is reportedly doing a very brisk trade in 1-ounce gold bars.

Reports from Costco are that, in between the one-size-fits-all pine coffins and the 44 gallon drums of (mostly) pitted black olives, 1oz of gold bullion is flying off the shelves, despite a limit of two bars per membership.

There are two variants currently available from US Costco – the cheaper one from South Africa’s Rand Refinery sells for US$1,949.99, while the fancier ones from Swiss supplier PAMP Suisse for US$1,979.99 – possibly because it’s got nicer chocolate inside.

With gold currently hovering around US$1850/oz, they’re not outrageously priced – especially considering that anyone with an Executive-level Costco membership is eligible for an automatic 2% discount.

According to media reports, Costco says that the bars are usually gone from the shelves within hours of giving store workers several hernias at once while dragging them out to be put on display.

It’s a pretty bold statement from Costco – and a bit of a searing indictment on just how distrustful Joe Lunchpail has become of how the federal government is handling things.

It’s been a while since there’s been a decent gold rush in the US – and it’s both heartening and frightening that this time around, there’s a corporation that’s been able to marry simmering anti-government fear and straight up “ride an electric scooter round the massive barn we call a store” convenience.

And… the countdown to the inevitable “Costco Gold Heist” headlines starts now.

I give it two weeks. Maybe three.

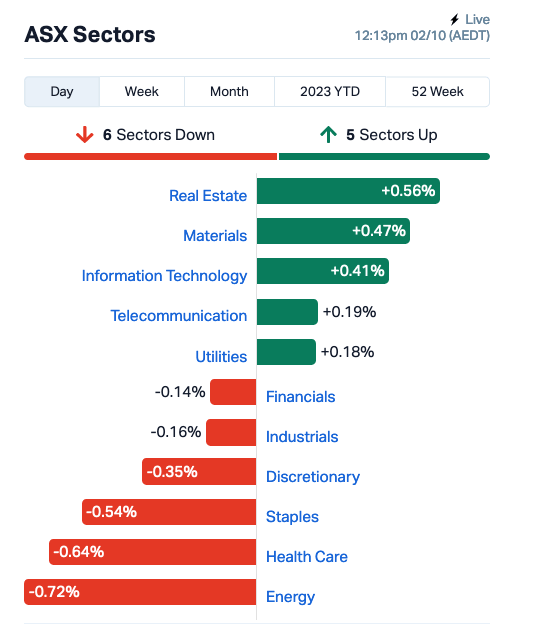

At lunchtime today, the ASX 200 benchmark’s needle is pointing at -0.05%, with a healthy spread between the winners and losers among the markets various sectors.

Out in front, Real Estate’s leading the happy side of things with Materials in a close second place.

However, lagging behind is the Energy sector, thanks to a varied and volatile oil market at present sucking a lot of the wind out of the sector’s sails, while uranium has come off the boil a little as well.

On a more granular level, it’s the Goldies outperforming the rest of the market, with the ASX XGD All Ords Gold index at +0.68%.

Probably because of the whole Costco thing.

The closest to a Large Cap making serious waves this morning is Latin Resources (ASX:LRS), up 5.1%, apparently off the back of last week’s happy preliminary economic assessment from the company’s Colina Lithium Deposit, located in Minas Gerais, Brazil.

In the US, the big news is that there’s been a stay of execution for the federal government, as the widely-anticipated shutdown was averted by a 45-day short-term plan to keep things functioning while the two sides work on something more permanent.

While the shutdown is now off the table, the deal is not going to land without some serious collateral damage – the big loser will be Ukraine, after billions in aid and war effort funding included in the proposed bill was tossed in order to get some of the more moderate Republican lawmakers to agree to it.

House Speaker Kevin McCarthy is also facing a fight over the outcome, and could possibly be ousted from his very senior position if a challenge this week from far-right Republicans is successful.

McCarthy side-stepped the Trump-aligned so-called “MAGA Republicans” to get the deal signed and delivered, leaving prominent ratchet-jaw Matt Gaetz to start making noises about toppling him.

Yep – the same Matt Gaetz who is under serious investigation by the Ethics committee over a range of even more serious allegations – not least of which centre around the trafficking of underage women for paid sexual favours.

Y’all are doomed, America.

In more detailed US market news, the S&P 500 fell -0.3%, the Dow Jones Industrial Average lost -0.5%, and the Nasdaq Composite crept ahead by +0.1%.

The Fed’s preferred measure of inflation – the US personal consumption expenditures (PCE) index which cuts out volatile food and energy segments – came in lower than the expected for August at +0.2% on Friday. Consumer spending rose +0.4%, down sharply from +0.9% in July.

The yield on the US 10-year Treasury returned to 4.58%, where it was late on Thursday in New York, after temporarily retreating on Thursday, giving MegaTech investors a moment of sunshine which they took. Meta Platforms gained over 2% and Nvidia climbed 1.5%, Christian “I’m not Eddy” Edwards reports.

And, despite some mixed quarterly results, shares in Nike (NKE) surged against the grain on Friday, closing +6.7% higher.

The company’s first quarter revenues were $12.9 billion.

Oil prices have fallen 1%, with the global benchmark Brent crude just above $US92 a barrel and West Texas at $US90.80.

In Japan, the Nikkei is up 1.6% today as ther nation grapples with changes to the excise charged on beer throughout the nation – with most of the confusion stemming from the fact that there are three categories of beer in Japan.

The first is proper beer, made using 100% malted barley as the core ingredient, and made to suit Japan’s exacting standards of mid-level carbonation, vaguely pleasant mouthfeel and as devoid of flavour as possible.

The second category is called “happoshu”, and is made using only 50% malted barley at its core, and is demonstrably worse in every measurable way.

And, because it’s Japan, the third type of beer is called “Third beer”, and it’s best not to ask what’s in it, because it doesn’t really matter – it all tastes like you’ve fallen asleep on the couch and in the middle of the night, a dog has broken into your home and died in your mouth.

The tax on proper beer is coming down, the tax on the other two market segments are going up – probably a well-deserved punishment for whoever it was that made them popular.

There’s no market news from either China or Hong Kong, as both markets are closed for National Day celebrations.

Hong Kong is set to reopen tomorrow, but China’s “National Day” will be keeping the market closed for the entire week, allowing scholars there to research the difference between a day and a week, because apparently that’s not very clear.

Here are the best performing ASX small cap stocks for 02 October [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap AXP AXP Energy Ltd 0.002 100% 158,115 $5,824,681 CT1 Constellation Tech 0.003 50% 366,666 $2,942,401 BIT Biotron Limited 0.096 41% 36,870,812 $61,332,253 GMN Gold Mountain Ltd 0.007 40% 3,476,200 $11,345,393 IMI Infinitymining 0.15 36% 258,142 $8,541,652 MRD Mount Ridley Mines 0.002 33% 1,250,000 $11,677,324 CTO Citigold Corp Ltd 0.005 25% 900,000 $11,494,636 MCT Metalicity Limited 0.0025 25% 4,766,666 $7,472,172 LM1 Leeuwin Metals Ltd 0.31 24% 303,154 $11,196,250 TAR Taruga Minerals 0.011 22% 168,332 $6,354,241 GAL Galileo Mining Ltd 0.36 22% 979,090 $58,299,353 HFY Hubify Ltd 0.018 20% 83,167 $7,442,044 VEE Veem Ltd 0.67 20% 145,796 $76,002,893 CTQ Careteq Limited 0.026 18% 507,903 $4,886,703 BMR Ballymore Resources 0.1 18% 59,567 $12,426,767 LV1 Live Verdure Ltd 0.4 18% 238,517 $38,134,079 HIQ Hitiq Limited 0.021 17% 21,695 $4,802,027 MTB Mount Burgess Mining 0.0035 17% 1,129,515 $3,046,940 RLC Reedy Lagoon Corp. 0.007 17% 940,000 $3,700,102 T92 Terrauraniumlimited 0.18 16% 578,454 $7,998,800 S66 Star Combo 0.11 16% 7,670 $12,832,883 EYE Nova EYE Medical Ltd 0.225 15% 541,471 $37,172,634 AJL AJ Lucas Group 0.015 15% 397,070 $17,884,485 AUZ Australian Mines Ltd 0.015 15% 1,200,443 $8,778,262 BLU Blue Energy Limited 0.015 15% 31,849 $24,062,657

Biotron’s (ASX:BIT) Festival of Mystery Gains is continuing again today, picking up from where it left of on Friday and adding another 39.1%, again on no news.

The ASX has already been through the motions of the standard “is there something you’re not telling everyone?” routine, thanks to the company’s rising rapidly and i surprising volume for the third session from the past five, following positive-but-not-headline-making news around this time last week.

Leeuwin Metals (ASX:LM1) is also moving nicely at lunchtime today, up 26% despite no market-moving news since 04 September, which was nearly a month ago. Likewise, Infinity Mining (ASX:IMI) is climbing on no fresh news, up 22.7%.

Galileo Mining (ASX:GAL) is making decent progress today, up 20.3% after delivering the maiden Indicated and Inferred Mineral Resource Estimate for the company’s Callisto Pd–Pt–Au–Rh–Ni–Cu sulphide deposit.

Galileo says its sitting on 17.5 Mt @ 1.04g/t 4E1, 0.20% Ni, 0.16% Cu (2.3g/t PdEq2 or 0.52% NiEq3), and the contained metal includes 585,000oz 4E, 35kt Ni and 28kt Cu (~1.27Moz PdEq or ~91,000t NiEq)

Roughly 8Mt (46%) of the resource is inside the indicated category with a 2.5g/t PdEq grade or 0.58% NiEq (metal content within indicated resource category of ~639,000oz PdEq or ~45,800t NiEq).

Here are the most-worst performing ASX small cap stocks for 02 October [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap MEB Medibio Limited 0.001 -33% 5,000 $9,151,115.64 MOH Moho Resources 0.007 -22% 176,000 $2,448,319.91 CTN Catalina Resources 0.004 -20% 2,982,500 $6,192,434.46 MOM Moab Minerals Ltd 0.008 -20% 8,442,789 $7,119,634.73 GMR Golden Rim Resources 0.021 -19% 96 $15,381,297.57 DOU Douugh Limited 0.005 -17% 280,221 $6,341,851.58 SNS Sensen Networks Ltd 0.047 -16% 564,334 $38,148,554.14 PEB Pacific Edge 0.105 -16% 10,099 $101,339,639.00 CXU Cauldron Energy Ltd 0.011 -15% 9,247,856 $12,370,392.59 AOA Ausmon Resorces 0.003 -14% 830,000 $3,392,512.70 AYT Austin Metals Ltd 0.006 -14% 1 $7,111,122.59 BXN Bioxyne Ltd 0.012 -14% 836,666 $26,623,035.57 BUR Burleyminerals 0.155 -14% 1,384 $18,233,416.08 PSL Paterson Resources 0.027 -13% 135,701 $12,316,123.83 GGE Grand Gulf Energy 0.007 -13% 82,477 $14,934,288.46 RMX Red Mount Min Ltd 0.0035 -13% 258,910 $10,694,304.15 HAR Harangaresources 0.21 -13% 463,222 $12,195,364.80 TMB Tambourah Metals 0.175 -13% 114,091 $16,588,070.60 STM Sunstone Metals Ltd 0.015 -12% 1,116,002 $52,393,742.94 NTM Nt Minerals Limited 0.008 -11% 214,236 $7,206,290.24 OAU Ora Gold Limited 0.008 -11% 3,660,506 $43,015,056.01 LEX Lefroy Exploration 0.18 -10% 101,674 $32,091,600.40 ALM Alma Metals Ltd 0.009 -10% 214,771 $11,140,007.87 CCO The Calmer Co Int 0.0045 -10% 1,002,945 $4,085,596.41 EFE Eastern Resources 0.009 -10% 334,121 $12,419,464.61