ASX Small Caps Lunch Wrap: Whose amazing tech was just ‘3 kids in a trenchcoat’ all along?

News

News

Aussie markets are lower this morning, because Wall Street saw a huge sell-off, triggered by… yup, US Fed officials hosing down any notions that there are interest rate cuts in the offing.

I know they’re supposed to be open and honest and straightforward and all that, but surely they will have figured out a way to let their people speak publicly without triggering the sort of anus-clenching panic that seems to set in every time they utter more than three syllables in public.

I’ll get into the details of it all shortly, but first we’re off to the world of tech, where retail giant Amazon has announced that it is ditching its “Just Walk Out” shopping technology, because… it was terrible.

Launched to tons of fanfare in 2016, the Just Walk Out tech was supposed to make shopping in one of Amazon’s bricks’n’mortar Amazon Fresh supermarkets as simple as walking in, grabbing what you want and walking out, with the total for whatever you’d loaded into your basket charged to your Amazon account.

Amazon said at the time that there was all sorts of high-tech whizzbangery behind the tech – stuff like QR codes, cameras with facial recognition, and a bunch of other sensors built into the packaging, so that consumers could avoid the horrifying, debilitating physical action of pressing some buttons on their phone, or waving a credit vaguely in the direction of the cashier.

But, here’s the thing. That seamless, high-tech, computer assisted shopping experience was a bunch of smoke and mirrors, as the entire system actually relied on an army of 1,000 Indian workers packed into data centres, watching individual shoppers through the in-store surveillance system, and making a note of everything they put in their basket.

“One eggs. Two milks. One breads. Six… no, seven Mars Bar for Mr Smith … I notice that you are only buying one toothbrush today, Mr Smith… I hope nothing has happened to Mrs Smith. She seems like a very nice lady.”

It’s the tech-world equivalent of the old ‘three kids in a trenchcoat’ gag – a ruse so achingly low-tech and dumb that it’s almost a stroke of genius.

Local markets are down this morning, but paddling hard to try to get on top of a swift and brutal 55-point drop when the morning bell rang.

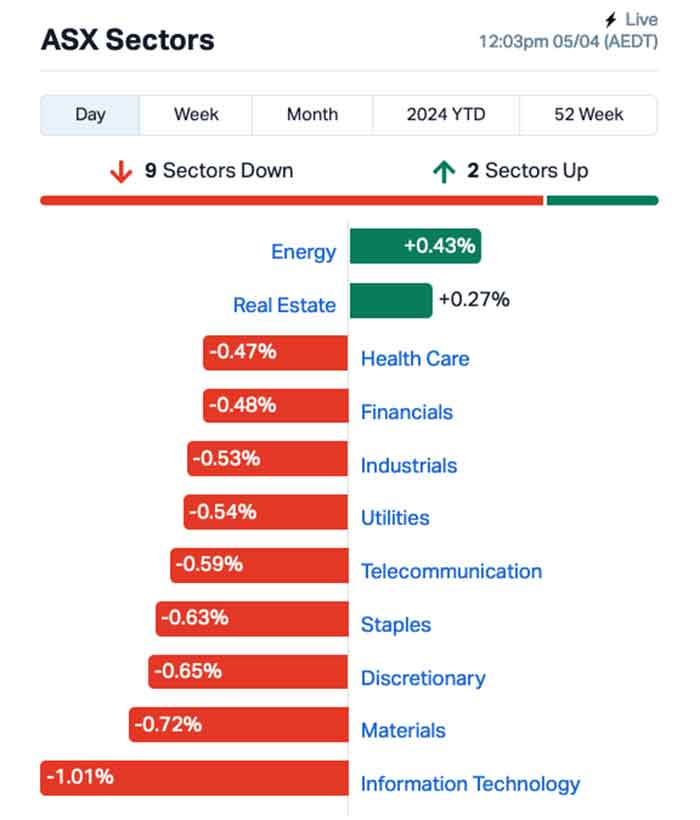

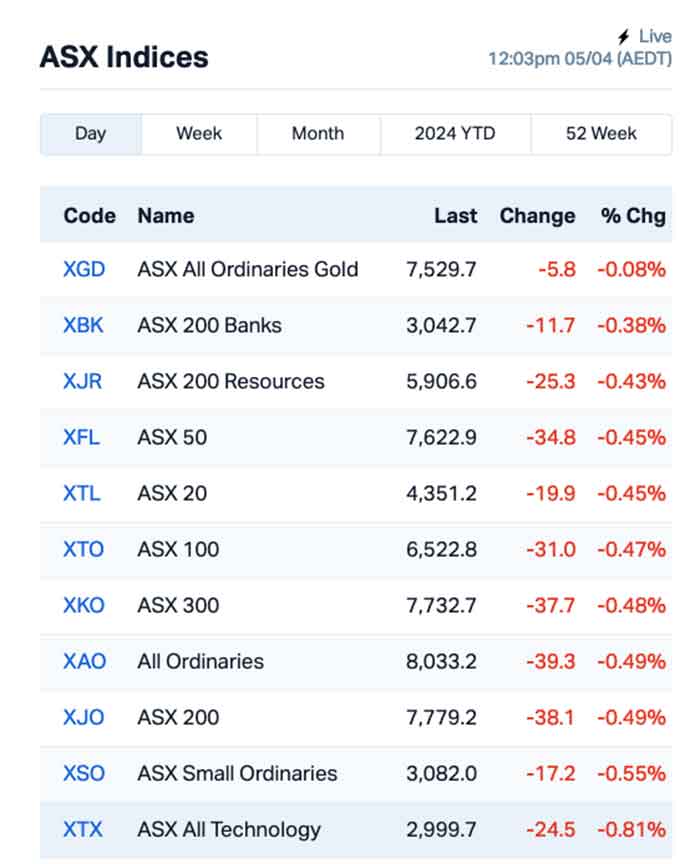

Around midday, the ASX 200 benchmark was still below the waterline, around -0.46% shy of the Happiness Zone, with InfoTech and Materials weighing heaviest on the market, while Energy and Real Estate are bucking the overall downward trend.

Even the goldies are doing it tough today, but the XGD All Ords Gold Index is still shaping up for a bumper month, ahead of the ballgame by +13.75% over the past four weeks.

The closest thing to a happy fat cat on the market this morning is Cooper Energy, which is up +4.5% on yesterday’s news that “Everything is fine. We’re fine. It’s all great. Just great.”

In the US overnight, the S&P 500 shed -1.23% , the blue chip Dow Jones index was down by -1.35%, and the tech-heavy Nasdaq slumped by -1.40%.

That’s because Jerome ‘Feel the Power’ Powell and his US Fed cronies have been at it again, going out in public to throw wet blankets on every ray of hopeful sunshine with their grinchy talk of “no interest rate cuts … not now, and not for a good long while, either”.

Specifically, it was Minneapolis Fed boss Neel Kashkari who said that although the Fed has pencilled in two rate cuts, none may be implemented this year if inflation stays sticky.

“If we continue to see inflation moving sideways, then that would make me question whether we need to do those rate cuts at all,” Kashkari said. “There’s a lot of momentum in the economy right now.”

In US stock news, marketing software company Hubspot rose 5% after Alphabet was reported to be making an offer to buy out the company.

Levi Strauss & Co. surged +12% after cost-cutting measures boosted profitability – turns out a jeans company can save billions of dollars just by removing 70s-era flares from the fashion roster, and forcing everyone who wants a pair of jeans to slide into a set of Daisy Dukes instead.

Ford Motor Co slipped -3% after saying that it will delay the launch of an electric three-row sport utility vehicle by two years.

Brent crude meanwhile keeps going up and has breezed through US$90, trading now at US$91.14 a barrel, as Middle East tensions escalate.

“If we get a direct conflict between Israel and Iran, that’s something that will likely restrict the supply of oil coming from the Middle East. That has not been an issue up until now, but it could become one very quickly,” Matt Maley at Miller Tabak told Bloomberg.

In Asian market news, Japan’s Nikkei is down -1.94% and Chinese markets are closed again today for Ching Ming, which I’ve learned is a real festival and not just a racist joke I read on Twitter.

Taiwan’s markets are also closed, but that’s because of Tomb Sweeping Day, which sounds really unpleasant – but residents there are also celebrating Ching Ming, and to help them do that, the local arm of Pizza Hut released a special, limited edition Ninja Turtle pizza, for unfathomable reasons known only to a handful of people.

I’m sure their hearts were in the right place, and the food technologists employed at the company did their absolute best to meet what sounds like a very difficult brief – but the results are the closest thing to genuine roadkill that I’ve ever seen a fast food company create.

It’s like Donatello got nerfed by a garbage truck while emerging from the sewers to fight crime, or whatever it is those stupid turtles do… I don’t know, because I’m not 7 years old.

Here are the best performing ASX small cap stocks for 05 April [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap RGS Regeneus Ltd 0.013 160.00 20,312,720 $1,532,185 HHR Hartshead Resources 0.007 40.00 18,800,680 $14,043,411 ENX Enegex Limited 0.025 38.89 39,800 $6,640,488 HCD Hydrocarbon Dynamic 0.004 33.33 255,000 $2,425,747 RIL Redivium Limited 0.004 33.33 432,610 $8,192,564 OSL Oncosil Medical 0.007 30.00 22,011,314 $11,277,706 EXR Elixir Energy Ltd 0.091 28.17 31,692,648 $80,418,171 CDD Cardno Limited 0.490 24.05 464,997 $15,428,962 SIX Sprintex Ltd 0.016 23.08 1,740,114 $6,114,046 OMA Omegaoilgaslimited 0.175 20.69 642,325 $39,627,991 SLM Solismineralsltd 0.120 20.00 1,013,592 $7,807,725 ESR Estrella Res Ltd 0.006 20.00 166,666 $8,796,859 MOH Moho Resources 0.006 20.00 700,000 $2,695,891 BNZ Benzmining 0.155 19.23 182,350 $14,466,137 XPN Xpon Technologies 0.020 17.65 50,000 $5,161,339 NYR Nyrada Inc. 0.115 17.35 3,129,616 $17,582,053 BNL Blue Star Helium Ltd 0.007 16.67 106,006 $11,653,592 EMP Emperor Energy Ltd 0.014 16.67 55,000 $4,088,850 EXL Elixinol Wellness 0.007 16.67 101,015 $7,594,459 FGL Frugl Group Limited 0.007 16.67 84,061 $8,938,647 WSR Westar Resources 0.014 16.67 4,399,677 $2,224,290 BIT Biotron Limited 0.087 16.00 43,504,344 $67,670,663 AME Alto Metals Limited 0.046 15.00 4,064,892 $28,860,927 TGN Tungsten Min NL 0.092 15.00 218,104 $62,913,142

The big news for Friday morning came via Regeneus (ASX:RGS), after it announced that it has successfully completed a big merger with Cambium Medical Technologies sending Regeneous shares up +180%.

The merger will also see a name change for the entity, and there’s been paperwork lodged with the ASX to rebrand to Cambium Bio

(ASX:CBL), while work on the company’s leading collaboration, the development of Elate Ocular, a novel biologic for dry eye disease, continues.

Elixir Energy (ASX:EXR) also had a solid morning on Friday, revealing that the company decided to test the free-flowing capacity of the Lorelle Sandstone between 4,200 and 4,217 metres, following a recent successful suite of Diagnostic Formation Integrity Tests (DFITs) conducted at Daydream-2.

The fresh testing has been deemed a success, with a maximum rate of 2.3 Million Standard Cubic Feet Per Day (MMSCFPD) and stabilised flow rate of 1.3 MMSCFPD (through a 20/64 choke), which the company understands is the deepest unstimulated flow of gas in onshore Australia East of the Perth Basin.

And Biotron (ASX:BIT) has dropped some happy-happy news on the market, announcing that preliminary analyses of data from the BIT225-010 Phase 2 clinical trial of the company’s lead antiviral drug BIT225 provide confirmation, and extension, of the positive results of previous trials in people infected with HIV-1.

Here are the most-worst performing ASX small cap stocks for 05 April [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap AEV Avenira Limited 0.006 -33.33 69,572,317 $19,733,144 MRQ Mrg Metals Limited 0.0015 -25.00 76,923 $5,050,237 ZMI Zinc of Ireland NL 0.015 -25.00 353,296 $4,262,886 VAL Valor Resources Ltd 0.049 -20.97 2,496,964 $11,380,796 H2G Greenhy2 Limited 0.008 -20.00 250,000 $4,187,558 MCT Metalicity Limited 0.002 -20.00 250,000 $11,212,634 MSI Multistack Internat. 0.004 -20.00 181 $681,520 PRX Prodigy Gold NL 0.002 -20.00 12,000 $4,852,353 FGR First Graphene Ltd 0.064 -17.95 763,267 $51,421,634 AYT Austin Metals Ltd 0.005 -16.67 501,616 $7,711,148 CAV Carnavale Resources 0.005 -16.67 209,333 $20,541,310 CYQ Cycliq Group Ltd 0.005 -16.67 4,509,733 $2,145,100 ODE Odessa Minerals Ltd 0.005 -16.67 616,771 $6,259,695 RR1 Reach Resources Ltd 0.0025 -16.67 193,171 $9,836,169 SGC Sacgasco Ltd 0.01 -16.67 2,265,865 $9,356,245 TAS Tasman Resources Ltd 0.005 -16.67 162,044 $4,276,016 M2R Miramar 0.012 -14.29 1,660,298 $2,084,174 OAU Ora Gold Limited 0.006 -14.29 6,005,734 $40,642,006 TMK TMK Energy Limited 0.003 -14.29 2,633,889 $23,645,002 BVR Bellavistaresources 0.125 -13.79 120,859 $7,193,591 VN8 Vonex Limited. 0.013 -13.33 7,666 $5,427,429 TBN Tamboran 0.165 -13.16 1,750,191 $391,454,568 MPA Mad Paws 0.1 -13.04 128,216 $46,501,388 ADG Adelong Gold Limited 0.0035 -12.50 250,000 $3,521,956 CTN Catalina Resources 0.0035 -12.50 2,500,000 $4,953,948