You might be interested in

News

Closing Bell: ASX clipped -1.3pc on broad selloff; BHP makes a $60bn play for Anglo American

News

ASX Small Caps and IPO Weekly Wrap: More downs than ups emerge from the latest 4-day week

News

News

Welcome back to the MCG, ASX… for the afternoon session. How did things play out in the morning, you ask? We’ll field that one.

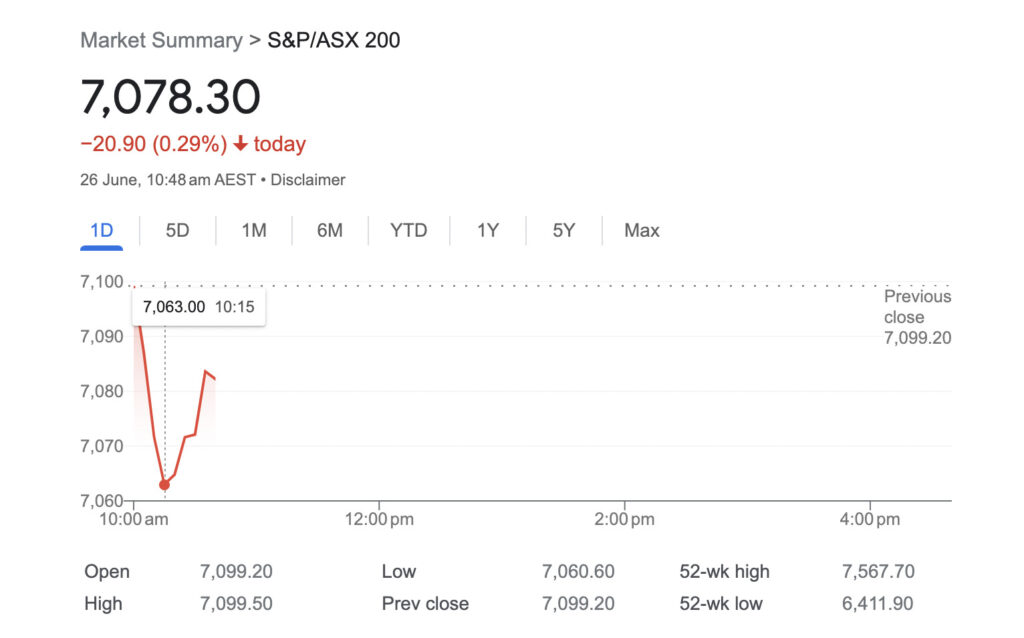

The ASX 200 moped out of bed, all teenagey and hormonally brain addled, like this…

Unfortunately, Wall Street types were off target with high-fiving on Friday, giving us a slugglish start on this side of the world a few days later. That’s just how it works round here. Weak global markets, plus a touch of end-of-financial-year volatility – these are the main factors at play bringing the ASX down atm. What fun, eh?

But on a far more serious note, it seems that the world could be about to find out what happens when two billionaires decide to go to war.

Not in the traditional “all of my citizens could totally kick all your citizens’ collective arses, while we’re safe someone a long way from the fighting”, which has been the way this sort of nonsense has been handled for centuries.

Instead, because neither of them are busy men (apparently), it looks like Mark Zuckerberg and Elon Musk might be about to step into The Octagon in Las Vegas and swing their handbags at each other for a bit.

It started, as most things seem to do these days, with Musk posting something alarmingly stupid to Twitter – in this case, that he would be “up for a cage fight” with Meta boss Zuckerberg.

Uncharacteristically, Zuckerberg might have missed that Musk was probably making what human beings call “a joke”, and responded with the absolutely not-robotic reply: “send me location”.

And the die was cast.

Musk has (of course) suggested the billionaire equivalent of “behind the change sheds on Friday afternoon” – being, of course, inside an MMA octagon in Las Vegas – as the venue, given that it is the spiritual home of lopsided cage fights where millions upon millions of dollars frequently find their way into UFC promoter Dana White’s pockets, while the bulk of his fighters get a packet of peanuts for their efforts.

What makes the prospect of this fight an interesting one is that, on paper, Zuckerberg is an almost unbackable favourite to win.

The bastard off-spring of C3-PO and R2-D2 (the wrap party for Return of the Jedi was a lot wilder than initially reported), Zuckerberg hatched in a lab in 1984, cruelly born without the capacity to feel pain, or human emotion.

Thanks to the R2 unit’s diminutive stature, he stands barely 5’7” tall, and weighs slightly more than about four loaves’ worth of day old, unbuttered toast.

But, far from being the robotic killing machine his pedigree might suggest, there’s an outside chance that anyone expecting The Terminator of Meta to turn u for the fight might be disappointed to find the company’s CEO is less “Killer Cyborg”, and more “Roomba with a Nerf gun on top”.

He’d be up against Musk, who – by his own admission – is an out of shape blob of wheezing, asthmatic lard.

But at somewhere around 6’0”, tipping the scales at several thousand pounds, he could get lucky and end up in a situation where he could get Zuck with a foreshadowed “signature move” Musk calls “The Walrus”.

“I have this great move that I call ‘The Walrus’, where I just lie on top of my opponent & do nothing,” Musk tweeted – although it remains unclear if that was him doing a spot of pre-fight grandstanding, or giving his children their “where did I come from?” talk.

Anyhow – if the fight does ever go ahead, it’s guaranteed to be a moneyspinner, and will definitely turn heads and attract an decent sized audience – the prospect of watching a 5’7” Dyson Stick Vacuum grapple with a Sentient Beachball would be worth stopping to watch, even if they weren’t two of the richest men in the world.

Right, where were we? Unsurprisingly, things haven’t improved much in the ASX in the time it took you to read that intro.

The benchmark is actually pretty much a gob of gum stuck under said bench today, on which lies a recently REKT crypto trader, using one of those long, curved panel monitors for warmth.

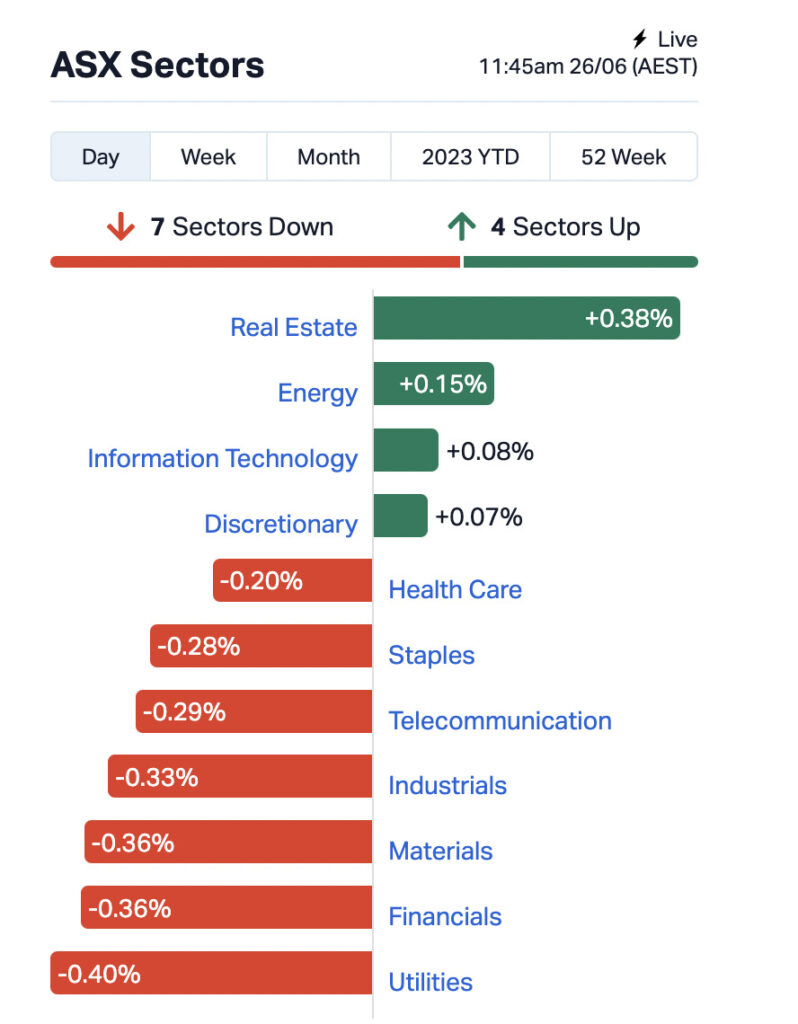

The ASX 200 is negative 0.32% at the time of writing. Sector-wise, here’s where we’re at…

Real Estate and Energy are keeping things afloat today, while Utilities, Financials, Materials and, well, almost everything else, is letting the entire side down.

Let’s find a few specific stand-outs, good… and very much less than good:

Good

• Metal Hawk (ASX:MHK): +112%. Here’s a surging, low-cap ($12.38m) Materials-sector outlier today. It’s got some news – positive “thick, high-grade rare earths” assay results from its maiden aircore drilling operation at the Fraser South project, located 150km north-east of Esperance, Western Australia. As noted in today’s Top 10 at 10.

• Ragnar Metals (ASX:RAG) +35%. “A huge news day for $8m capped Ragnar Metals,” writes Reubs. “Which will buy four lithium and REE projects in Sweden, while unloading the non-core Tullsta nickel project to BHP (ASX:BHP) for $9.8m.

• Cassius Mining (ASX:CMD): +24%. Some beaut assay results of its own at its Soalara Limestone project in Madagascar. “~80% of Phase 2 assays show average 97.44% wt CaCO3, classified as “high” purity limestone,” reads an ASX announcement today.

• ECS Botanics (ASX:ECS): +20%. Leaning on Reubs here again: “ECS Botanics has secured two binding offtake agreements worth at least $11.9m to supply medicinal cannabis dried flower over a three year term.

“First supply under both agreements – which will occur next quarter (Q1 FY24) – come after recent agreements worth $9.9m to supply products in the German market.”

• And something quite a bit higher capped ($3.63bn) for you here >

Metcash (ASX:MTS): +4.74%… on a very positive (“record year”) full-year results announcement.

Very much less than good

• Nyrada (ASX:NYR): -30%. The drug-development company specialising in drugs to treat cardiovascular and neurological diseases, has revealed that its cholesterol-lowering drug candidate won’t be taken forward into a clinical trial phase.

• Lark Distilling Co (ASX:LRK) : -19%… on not exactly the company’s greatest ever Quarterly Sales & One-off Costs Update.

So, yep, US markets ended the week with a fairly profound slump, leaving the Dow lower by 0.65%, the S&P down 0.77% and the tech-heavy Nasdaq bearing the brunt of investor’s sour sentiment, falling 1.01% by the end of Friday’s session.

The losses in the tech sector were led by a range of the industry’s interest-sensitive mega-stocks – Microsoft, Tesla and Nvidia the main culprits – as the full weight of US Fed chief Jerome Powell’s statements to Congress during the week settled into the base of Wall Street’s investor hive-mind.

In Japan, the Nikkei is +0.21%, on news that there might be something of a Jamiroquai revival in the works – albeit, a slightly shorter version than the already diminutive original.

Japanese toy-marker Bandai Namco has revealed that it is set to release a poseable action figure of the group’s frontman, Jay Kay, standing 15 centimetres (5.9 inches) in height (the doll, not the singer).

The doll is part of the company’s S.H.Figuarts range of “super articulated figures”, and will ship with 3 papercraft black sofas (a la the epic Virtual Insanity music video), a selection of 7 different hand poses (3 left, 4 right) and with not one but two horrifyingly detailed interchangeable facial sculptures for it to wear, one of which will haunt your nightmares forever.

The promo video for the toy is almost as good as the original music clip, with the added bonus of not becoming tedious past the two-minute mark.

In China, Shanghai markets are down (-1.21%) at the time of writing, while Hong Kong’s Hang Seng is, likewise slightly in the red (-0.12%).

And in the land of made-up monies that you can’t touch (especially in places where they’re de-banked)… ah look, whatevz, but we’ll be strangely nice about it today in this column.

Bitcoin is back up around US$30.5k again. That’s good, right? Actually, it just dipped closer to $30k in the time it took to finish this sentence.

Ah well. Rob “I sold all my $PEPE For Beer Money Profit, Honest” Badman has more over here. Something about BlackRock, something about the ASX hosting Blockchain Week, something about DeFi coins. Enjoy. #tothemoon

Here are the best performing ASX small cap stocks for June 26 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| MHK | Metalhawk | 0.185 | 113% | 3,282,415 | $5,823,379 |

| MEB | Medibio Limited | 0.0015 | 50% | 254,272 | $4,547,927 |

| PYR | Payright Limited | 0.006 | 50% | 2,182,027 | $3,523,541 |

| RAG | Ragnar Metals Ltd | 0.027 | 35% | 4,924,923 | $7,583,698 |

| MTB | Mount Burgess Mining | 0.002 | 33% | 3,240,025 | $1,324,757 |

| MTH | Mithril Resources | 0.002 | 33% | 13,736,822 | $5,053,207 |

| BOD | BOD Science Ltd | 0.064 | 31% | 304,383 | $7,502,953 |

| CAV | Carnavale Resources | 0.0025 | 25% | 10,924,907 | $5,467,103 |

| OLI | Oliver's Real Food | 0.02 | 18% | 15,000 | $7,492,443 |

| AU1 | The Agency Group Aus | 0.027 | 17% | 538,499 | $9,857,262 |

| SLA | Silk Laser Australia | 3.31 | 17% | 1,275,529 | $149,801,719 |

| LM1 | Leeuwin Metals Ltd | 0.35 | 17% | 666,404 | $13,435,500 |

| AUK | Aumake Limited | 0.0035 | 17% | 1,688 | $4,461,778 |

| BOA | Boadicea Resources | 0.056 | 17% | 1,062,119 | $3,838,950 |

| M4M | Macro Metals Limited | 0.0035 | 17% | 22,200 | $5,961,233 |

| PVW | PVW Res Ltd | 0.065 | 16% | 177,937 | $5,513,962 |

| CMD | Cassius Mining Ltd | 0.029 | 16% | 2,847,865 | $12,418,205 |

| STP | Step One Limited | 0.38 | 15% | 612,311 | $61,162,296 |

| ECS | ECS Botanics Holding | 0.023 | 15% | 4,396,620 | $22,134,613 |

| ODE | Odessa Minerals Ltd | 0.016 | 14% | 16,621,762 | $13,259,566 |

| ST1 | Spirit Technology | 0.042 | 14% | 275,777 | $27,217,374 |

| AW1 | American West Metals | 0.135 | 13% | 15,449,494 | $31,939,394 |

| CAE | Cannindah Resources | 0.18 | 13% | 325,156 | $89,916,792 |

| EX1 | Exopharm Limited | 0.009 | 13% | 295,931 | $3,515,385 |

| LSR | Lodestar Minerals | 0.0045 | 13% | 4,027,800 | $7,373,589 |

Here are the most-worst performing ASX small cap stocks for June 26 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| NYR | Nyrada Inc. | 0.04 | -49% | 653,877 | $12,324,687 |

| BP8 | Bph Global Ltd | 0.002 | -33% | 50,655 | $3,854,189 |

| EMU | EMU NL | 0.002 | -33% | 188,970 | $4,350,064 |

| FAU | First Au Ltd | 0.002 | -33% | 225,000 | $4,355,980 |

| MRQ | Mrg Metals Limited | 0.002 | -33% | 9,355,555 | $5,957,756 |

| PUA | Peak Minerals Ltd | 0.002 | -33% | 75,711 | $3,124,130 |

| WEL | Winchester Energy | 0.002 | -33% | 413,326 | $3,061,266 |

| ABE | Ausbond Exchange | 0.115 | -26% | 111,399 | $6,006,731 |

| AUH | Austchina Holdings | 0.003 | -25% | 1,190,277 | $8,311,535 |

| ICN | Icon Energy Limited | 0.003 | -25% | 19,414 | $3,072,055 |

| PHL | Propell Holdings Ltd | 0.028 | -24% | 17,999 | $4,453,154 |

| AD1 | AD1 Holdings Limited | 0.004 | -20% | 490,002 | $4,112,845 |

| ERL | Empire Resources | 0.004 | -20% | 700,000 | $5,564,675 |

| BFC | Beston Global Ltd | 0.009 | -18% | 217,025 | $21,967,516 |

| LRK | Lark Distilling Co. | 1.33 | -18% | 364,162 | $122,573,822 |

| E79 | E79 Gold Mines | 0.083 | -17% | 161,033 | $5,655,680 |

| CPT | Cipherpoint Limited | 0.005 | -17% | 2,302 | $6,955,450 |

| DDT | DataDot Technology | 0.0025 | -17% | 250,000 | $3,632,858 |

| ODM | Odin Metals Limited | 0.016 | -16% | 6,482 | $14,233,320 |

| YOJ | Yojee Limited | 0.016 | -16% | 887,691 | $21,535,786 |

| EPN | Epsilon Healthcare | 0.017 | -15% | 1,970 | $6,007,080 |

| BRX | Belararox | 0.265 | -15% | 417,987 | $12,688,306 |

| ADS | Adslot Ltd | 0.003 | -14% | 20,000 | $8,677,719 |

| GTR | Gti Energy Ltd | 0.006 | -14% | 818,377 | $13,634,279 |