ASX Small Caps Lunch Wrap: Who crashed the ultimate monkey party this week?

News

News

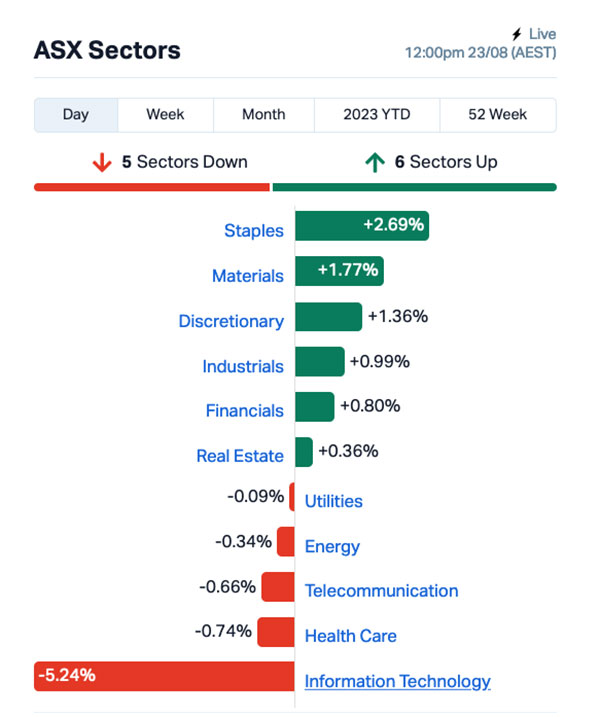

Local markets have defied predictions (and a poor lead-in from Wall Street) to rise 0.7% this morning, and that’s despite an absolute pantsing for yesterday’s high-flyer sector, InfoTech.

Resources and the goldies are doing quite well, though, with the overall result finally giving ASX investors something to smile about this week.

But before I get into the specifics of that, there’s an important scientific breakthrough from the Oregon Health & Science University, where a bunch of wowsers are doing their best to turn being stuck in a cage in a science lab with unlimited access to alcohol into a massive bummer.

The research team are doing their best to find a ‘cure’ for alcoholism – which is, obviously, a horribly insidious affliction that has the capacity to turn otherwise normal people into slobbering, desperate self-destructive idiots.

(I know this because I once, quite famously, tried to drink all of the vodka in the world, and ended up needing a fresh liver to stay alive. I mention this so that I’m not inundated with cranky emails… if I’m making a joke here, it’s about me.)

Anyhoo, the research team in Oregon got their hands on four rhesus macaque monkeys, and started giving them increasing amounts of alcohol, to the point where they were clearly addicted to it.

The addiction comes from alcohol’s effect on the brain, where the release of a highly pleasant blast of dopamine is triggered by that first glorious sip of whisky at the end of a difficult day.

The issue is that dopamine is one of those things that your brain builds up a tolerance to – which means that to get the same result that the “first glorious sip of whisky at the end of a difficult day” provides early in your drinking career, it will, after quite some time, morph into a “first glorious mouthful of rot-gut liquor at 8:00am” kinda situation.

That’s what happened to the monkeys in the lab – the dose of booze was increased until the addiction had really set in, and then… they were allowed to drink as much as they wanted.

Turns out that it was quite a significant quantity of alcohol, and while I’d like to think the monkeys were probably having the time of their furry little lives, they were probably just guzzling grog and feeling woeful.

Probably putting old Leonard Cohen records on the stereo and doom-scrolling through their Facebook feeds to see how all their ex girlmonkey friends are doing without them, howling relentlessly into the echo chamber of their shower, and causing the young children of the neighbourhood to believe that their place was the local “witch house”, because of the incessant demonic screaming.

Luckily, though, the researchers had a plan to throw the brakes on the party. They had developed a gene therapy that effectively resets the dopamine pathway in the brain, which they believed would stop the monkeys craving the rich, icy goodness from the banana daiquiri machines installed in all the cages.

The downside (because there is always a downside) was that the treatment needed to be injected directly into the monkeys’ brains.

The rest of the experiment is a little complex – but the gist of it is that the monkeys that got the therapy ended up decreasing their alcohol consumption by more than 90%.

It’s a really encouraging result, which could lead to a significant drop in the troublingly high number of people with crippling alcohol addictions – either from the therapy, or just the threat that every time they get on the cans, some heavy-set goon in a lab coat will stab them in the brain with a needle.

There’s no word on what became of the monkeys involved in the experiment. I’d like to think that the ones that got clean have found steady employment and are getting back on their feet.

The rest have probably gone into real estate.

Local markets are up this morning, climbing 0.7% despite a spectacular 5.24% sell-off of InfoTech stocks that has the sector mirroring the +5.84% surge it was showing at this time yesterday.

Leading the broader market higher – and defying the ASX 200 futures index and its dour -0.3% predictions from earlier this morning – are Consumer Staples and Materials, both chugging along nicely indeed.

In fact, the XJR ASX 200 Resources index is leading the market, up 1.45% with the XGD All Ords Gold index not far behind on +1.09% as well.

There are a number of billion dollar babies making significant gains this morning, including Mcmillan Shakespeare (ASX:MMS), which has stacked on more than 13.6% this morning on news of Normalised Revenue bump of 12.5% to $471.4 million, and an 11.2% climb in normalised EBITDA to $131.3 million.

Wall Street phoned in another piss-weak performance overnight, which saw the S&P 500 fall by -0.28%, blue chips Dow Jones by -0.51%, and the tech heavy Nasdaq index closing flat.

Earlybird Eddy reports that the US 10-year Treasury yield stood at 4.33%, which is a 16-year high on fears over rates outlook, as the annual three-day Jackson Hole Festival of Money approaches.

It’s an exciting time for the biggest bankers in America, and Jerome Powell’s appearance on the main stage should be a highlight, following a three-hour set from co-headliners Metallica.

In US stock news, Nvidia touched an intraday record before retreating ahead of its earnings which should be a major test for AI demand.

“A miss could lead to huge disappointment and thereby a sizable fall in the stock,” said XM analyst and owner of one of the greatest names of all time, Charalampos Pissouros.

And, in a real blow for Dicks’s Sporting Goods, an enormous spike in shrinkage, specifically smash and grab, has caused a significant profit slump for the company, triggering a performance droop of -24%.

It really sucks for Dick’s, because the company’s inadvertent social media marketing campaign had really been producing strong growth spurts each time it went viral.

@ammers_k #stitch with @maria.christine1 #staplessellsstaples #dicks #funny #gottogo #momsoftictok ♬ original sound – They call me Apple Pie Amy

Meanwhile in Japan, the Nikkei is up 0.24% as the country enjoys the final 48 hours of normal existence, ahead of the proposed 24 August release of waste water from the doomed Fukushima nuclear plant into the ocean.

The Japanese government is insisting that the water has been treated sufficiently to ensure that radiation levels are “within safe limits”, but those assurances should be taken with a grain of salt, considering Japan’s well-documented history of massive radioactive monsters emerging from the sea to lay waste to the city of Tokyo.

In China, the national economic outlook is still abysmal, with visibility down to less than 25 metres because of smog and other particulate matter pollution.

Shanghai markets are down 0.6% (I think… it’s kinda hard to see from here…) while in Hong Kong, the Hang Seng is up 0.26% because the people who control the financial systems there live in buildings tall enough not to be clouded in diesel fumes and unemployed young people.

Here are the best performing ASX small cap stocks for 23 August [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap 4DS 4DS Memory Limited 0.135 105% 71,394,764 $107,747,853 SIH Sihayo Gold Limited 0.002 100% 115,731 $12,204,256 CCE Carnegie Clean Energy 0.0015 50% 1,711,875 $15,642,574 RDN Raiden Resources Ltd 0.016 33% 129,441,832 $24,663,227 R3D R3D Resources Ltd 0.058 29% 17,241 $6,554,321 CTQ Careteq Limited 0.029 26% 1,046,688 $3,352,279 NC6 Nanollose Limited 0.07 25% 200,000 $8,337,637 EDE Eden Inv Ltd 0.005 25% 561,040 $11,987,881 FAU First Au Ltd 0.003 20% 250,000 $3,629,983 ZLD Zelira Therapeutics 1.1 20% 5,787 $10,439,383 WYX Western Yilgarn NL 0.255 19% 448,401 $10,676,363 FRB Firebird Metals 0.135 17% 170,917 $8,403,625 MYE Metarock Group Ltd 0.135 17% 1,348 $34,613,990 BRX Belararox Limited 0.495 15% 280,233 $22,258,529 ASE Astute Metals NL 0.047 15% 1,147,684 $14,097,139 AAP Australian Agri Ltd 0.016 14% 2,147 $4,271,393 AL8 Alderan Resource Ltd 0.008 14% 914,255 $4,316,863 KGD Kula Gold Limited 0.016 14% 155,562 $5,224,967 WCN White Cliff Min Ltd 0.008 14% 1,460,000 $8,799,130 HRZ Horizon 0.04 14% 207,953 $24,394,429 JGH Jade Gas Holdings 0.04 14% 35,532 $35,217,147 MMS McMillan Shakespeare 22.23 14% 332,359 $1,357,342,538 WEC White Energy Company 0.091 14% 1,547 $5,472,495 GMN Gold Mountain Ltd 0.009 13% 3,283,134 $18,152,629 HNR Hannans Ltd 0.009 13% 197,526 $21,796,838

The morning’s high-flyer is 4DS Memory (ASX:4DS), after the company announced some really, really good news about the development of its Interface Switching ReRAM for next generation gigabyte storage in mobile and cloud tech.

It’s all hugely complicated, but the company had a shocker a while back when the tech failed miserably on the spec bench – but this morning’s announcement shows a massive positive step in the development, with test results that were so good, even the board was surprised.

At the time of writing, 4DS is up 93%, but at times this morning it was trading at well over the +100% mark.

I don’t have time to unravel it all here for you – but Christian’s emerged from his fog of jetlag and cheese fumes to pen this explainer, which you should definitely read.

Raiden Resources (ASX:RDN) is also having a crackerjack morning, climbing nearly 42% by lunchtime, thanks to news that the company has found a ~3.5km long, 600m wide pegmatite field at its Andover South tenements with individual pegmatites outcropping up to 30m widths.

“Our initial investigations on the Andover South projects are starting to yield positive results – the widths of the pegmatites defined to date, of up to 30 metres in outcrop, are providing encouragement that the pegmatite system may be of significant size,” RDN MD Dusko Ljubojevic said.

“Furthermore, multiple swarms of pegmatites are being noted throughout the licence area with further areas to be mapped and sampled.

“Our teams are now mapping and sampling the remaining tenements of the Andover South and Andover North project area and we hope to provide results to the market in the near term.”

And in third place, Western Yilgarn (ASX:WYX) has stacked on a healthy 25.6% on news that assays confirm multiple targets from high quality auger geochemistry at the Bulga Project, including three Lithium-Caesium-Tantalum (LCT) pegmatite targets, five Nickel-Copper-Platinum-Palladium (Ni-Cu-PGE) targets and a lower order Gold (Au) target as well.

Here are the most-worst performing ASX small cap stocks for 23 August [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap 4DS 4DS Memory Limited 0.135 105% 71,394,764 $107,747,853 SIH Sihayo Gold Limited 0.002 100% 115,731 $12,204,256 CCE Carnegie Clean Energy 0.0015 50% 1,711,875 $15,642,574 RDN Raiden Resources Ltd 0.016 33% 129,441,832 $24,663,227 R3D R3D Resources Ltd 0.058 29% 17,241 $6,554,321 CTQ Careteq Limited 0.029 26% 1,046,688 $3,352,279 NC6 Nanollose Limited 0.07 25% 200,000 $8,337,637 EDE Eden Inv Ltd 0.005 25% 561,040 $11,987,881 FAU First Au Ltd 0.003 20% 250,000 $3,629,983 ZLD Zelira Therapeutics 1.1 20% 5,787 $10,439,383 WYX Western Yilgarn NL 0.255 19% 448,401 $10,676,363 FRB Firebird Metals 0.135 17% 170,917 $8,403,625 MYE Metarock Group Ltd 0.135 17% 1,348 $34,613,990 BRX Belararox Limited 0.495 15% 280,233 $22,258,529 ASE Astute Metals NL 0.047 15% 1,147,684 $14,097,139 AAP Australian Agri Ltd 0.016 14% 2,147 $4,271,393 AL8 Alderan Resource Ltd 0.008 14% 914,255 $4,316,863 KGD Kula Gold Limited 0.016 14% 155,562 $5,224,967 WCN White Cliff Min Ltd 0.008 14% 1,460,000 $8,799,130 HRZ Horizon 0.04 14% 207,953 $24,394,429 JGH Jade Gas Holdings 0.04 14% 35,532 $35,217,147 MMS McMillan Shakespeare 22.23 14% 332,359 $1,357,342,538 WEC White Energy Company 0.091 14% 1,547 $5,472,495 GMN Gold Mountain Ltd 0.009 13% 3,283,134 $18,152,629 HNR Hannans Ltd 0.009 13% 197,526 $21,796,838