ASX Small Caps Lunch Wrap: Markets higher yada yada… Germans legalise Pot!

News

News

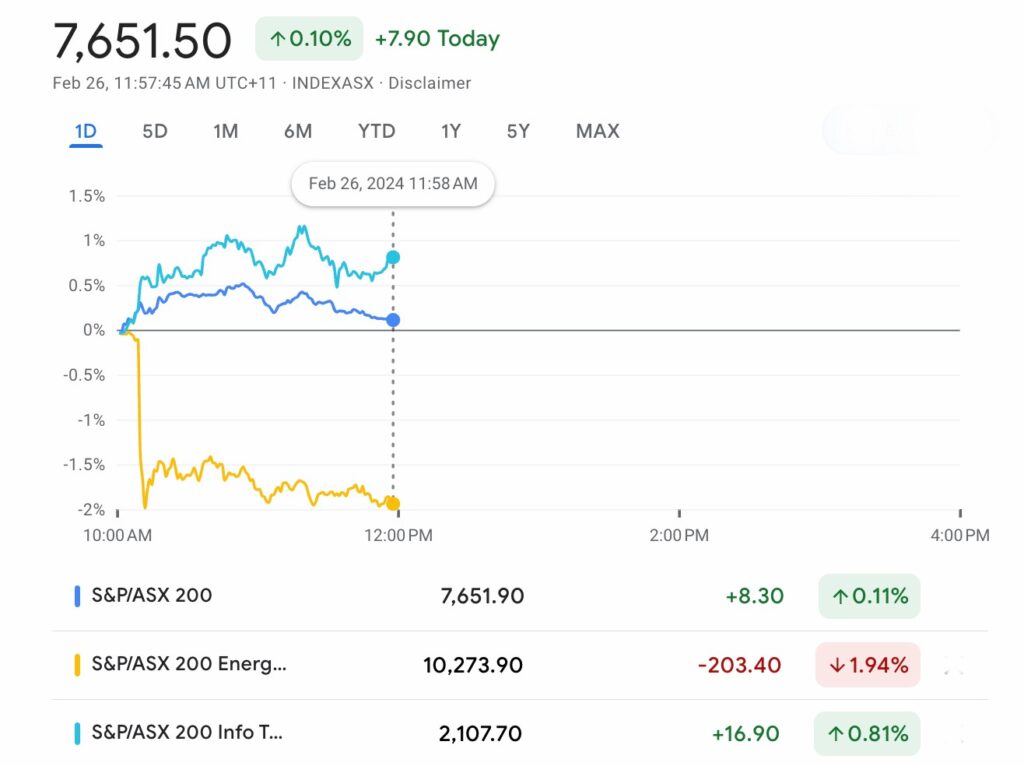

Local markets are timidly ahead at lunch, but still far from genuine progress.

There’s not a lot of direction here on Monday as our new Stockhead data tracker can reveal:

At lunchtime in Sydney the ASX200 was ahead by about 8 points or 0.10%.

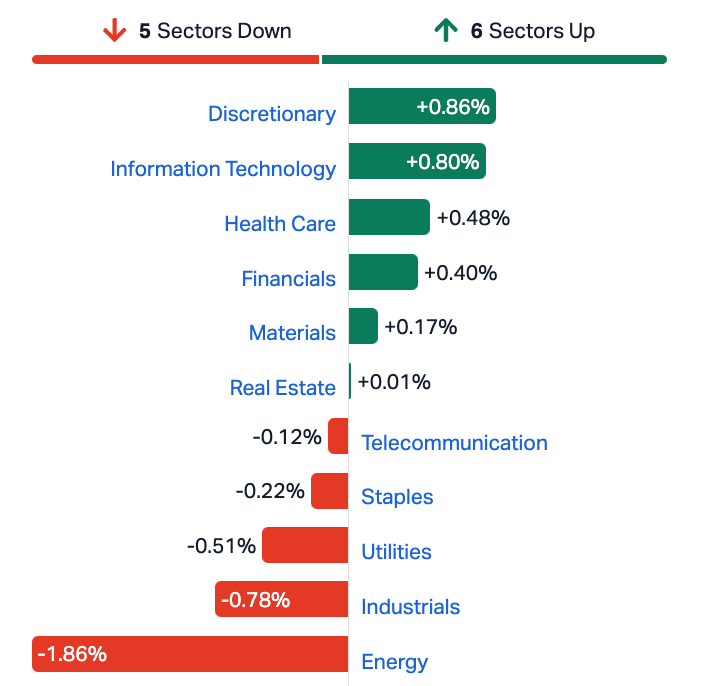

As the squiggly coloured lines above show, there’s lingering excitement for the teeny tiny local IT Sector. But that’s been absolutely whaled by the broader Energy Index, where tumultuous falls across everything from a fossil is hurting local producers.

Local tech blue chips WiseTech Global (ASX:WTC) , Xero (ASX:XRO) and data centre player NextDC (ASX:NXT) were all ahead between 1 and 1.5% at lunch.

Most of the major energy players were lower.

Yancoal Australia (ASX:YAL) lost over 3%. Woodside Energy Group (ASX:WDS) 1.5%. Santos (ASX:STO) (below) about 4.5%.

These were the worst of the worst at lunch on Monday:

On the earnings front, insurer NIB Holdings (ASX:NHF) is due to drop 1H numbers, after Suncorp Group (ASX:SUN) jumped 3% thanks to a 14% surge in 1H cash earnings.

TPG Telecom (ASX:TPM) was smacked 6.5% after Superloop (ASX:SLC) surged (heaps) after welcoming a big bid from CEO Phil Britt’s Aussie Broadband. Good to see competition in the local telco world.

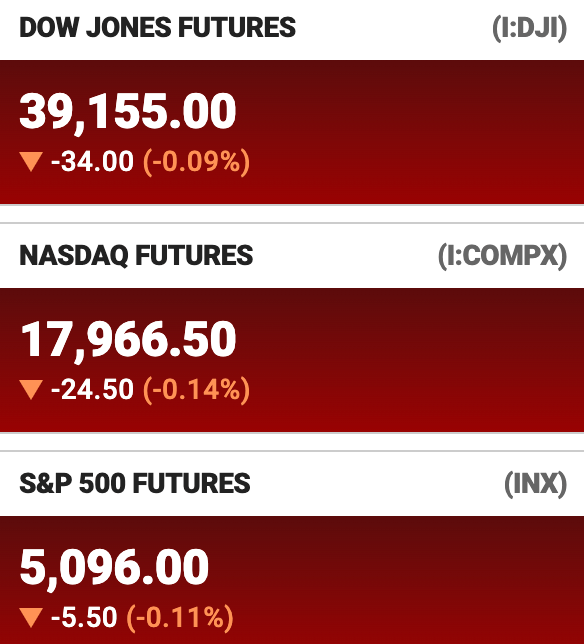

No such bother on Wall Street, which closed near record highs again on Friday, without trying too hard.

US shares are galloping into the close of February and all three major indices have sparkling new milestones to show March when we get there on Friday.

The US triumvirate of averages ended last week ahead.

The S&P500 added 1.66%, breaking above 5,100 for the first time, while the tech-heavy Nasdaq gained 1.4% briefly beating a 12-month high on Friday; and finally the Dow Jones Industrial Average found itself 1.3% closing at all-time high over the shortened week of trade.

To recap – NVDA reported gargantuan revenues totalling US$22.103 billion, easily above projected revenues of around US$20.550 billion.

On top of that, EPS (earnings per share) came in way, way above expectations, reaching US$5.16, compared to the expected US$4.61.

Nvidia’s earnings are up 486% year on year.

It ain’t got much truck with us – our IT team being a flea on the back of a mastadon – but that won’t stop investors all over from watching whether the AI momentum can keep rolling amid the kind of malingering economic and inflation risks about the place.

On that note, in the States, they’ll be watching Thursday’s monthly personal consumption expenditures price (PCE) index, the Fed’s favoured inflation gauge.

Nvidia finished 0.4% higher on Friday, BTB, hitting a fresh all-time high of US$805.55 earlier in the day briefly skipping past the US$2 trillion market cap milestone, before taking a knee.

Elsewhere on the US corporate front, the adopted father of Aussie BNPL Afterpay (ASX:APT), formerly Square, now Block also surged 16% on a Q4 revenue surprise.

Block clocked analysts with some strong sales projections and traders seemed to like its plan to integrate Afterpay with the Block Cash App offering it provides for OS customers.

The US sectors were mixed on Friday. Utilities, Materials and Industrials were ahead, while oil prices sucked the energy out of Energy.

Futures tied to the Dow Jones Industrial Average, the S&P 500 and the Nasdaq were all around 0.1% lower at lunch in Sydney.

Around the hood…

Finally, it’s worth some brain space to consider how and why Japanese shares rose 1.6% and finally jumped the shark of the 29 December 1989 bubble high, after a long, slow climb out of the more than 82% hole the 2009 GFC made in local markets.

And – hold the phone – Chinese shares gained 3.7% thanks to the ongoing life-by-a-thousand-Band-Aids supporting economic policy measures out of Beijing.

The People’s Bank of China (PBoC) cut it’s 5-year prime lending rate by 0.25% to 3.95% late last week. That’s significant.

The cut was expected. The gravity of it impressed.

The 25 basis points was deeper than ever before. The aim: to revive the utterly broken property market (the 5-year lending rate is the key mortgage lending rate).

With confidence amongst property buyers so depressed though it’s unclear whether it will be enough. Home prices continued to fall in January.

Other indicators worth your time:

Total Chinese domestic tourism spend over the Lunar New Year Golden Week holiday period definitely surged – relative to the 2023 holiday.

While that’s a good sign, it’s not what local media are making of it.

There’s cash under the bed for this spend, because households aren’t splurging on usual (online) nonsense.

2023 was a crap year for all sorts of measures, so the base was low and still very much impacted by Covid-zero policiers.

This year the Lunar New Year was a lot longer. AND it included Valentine’s Day which is huge in China – whereas the 2023 holiday had no space for such economic love.

China has some way to go.

Not like the Deutschlanders…

German lawmakers have approved legislation that would make cannabis partially legal for personal use in the country.

The new law allows for the possession of 50g of cannabis for private consumption and growing up to three plants. In public, adults would be allowed to have up to 25g of cannabis.

Here are the best performing ASX small cap stocks for 23 February [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap WHK Whitehawk Limited 0.037 54% 16,327,453 $8,113,697 CNJ Conico Ltd 0.003 50% 400,000 $3,140,190 ENV Enova Mining Limited 0.043 43% 40,100,587 $19,227,880 ASP Aspermont Limited 0.009 29% 1,000,000 $17,189,443 29M 29Metals Limited 0.345 28% 7,657,378 $189,355,139 CTO Citigold Corp 0.005 25% 370,000 $12,000,000 MTL Mantle Minerals 0.0025 25% 3,061,947 $12,394,892 SIS Simble Solutions 0.005 25% 5,716,487 $2,411,803 KGN Kogan.Com Ltd 7.44 22% 2,435,485 $617,974,993 LGP Little Green Pharma 0.15 20% 872,501 $37,511,655 AQD Ausquest Limited 0.012 20% 447,340 $8,251,492 OAU Ora Gold Limited 0.006 20% 171,051 $28,700,004 GHY Gold Hydrogen 1.51 20% 989,717 $96,595,409 PBL Parabellum Resources 0.078 18% 8,000 $4,111,800 CCR Credit Clear 0.265 18% 269,606 $93,905,070 AUQ Alara Resources Ltd 0.04 18% 250,000 $24,414,976 EXL Elixinol Wellness 0.007 17% 228,320 $3,797,230 GSR Greenstone Resources 0.007 17% 1,365,842 $8,208,681 LML Lincoln Minerals 0.007 17% 500,000 $10,224,272 POS Poseidon Nick Ltd 0.007 17% 941,052 $22,281,209 RGS Regeneus Ltd 0.007 17% 715 $1,838,621 MCL Mighty Craft Ltd 0.015 15% 375,480 $4,746,718 MYE Metarock Group Ltd 0.195 15% 193,075 $52,109,415 1MC Morella Corporation 0.004 14% 1,017,217 $21,625,798 BFC Beston Global Ltd 0.008 14% 500,632 $13,979,328

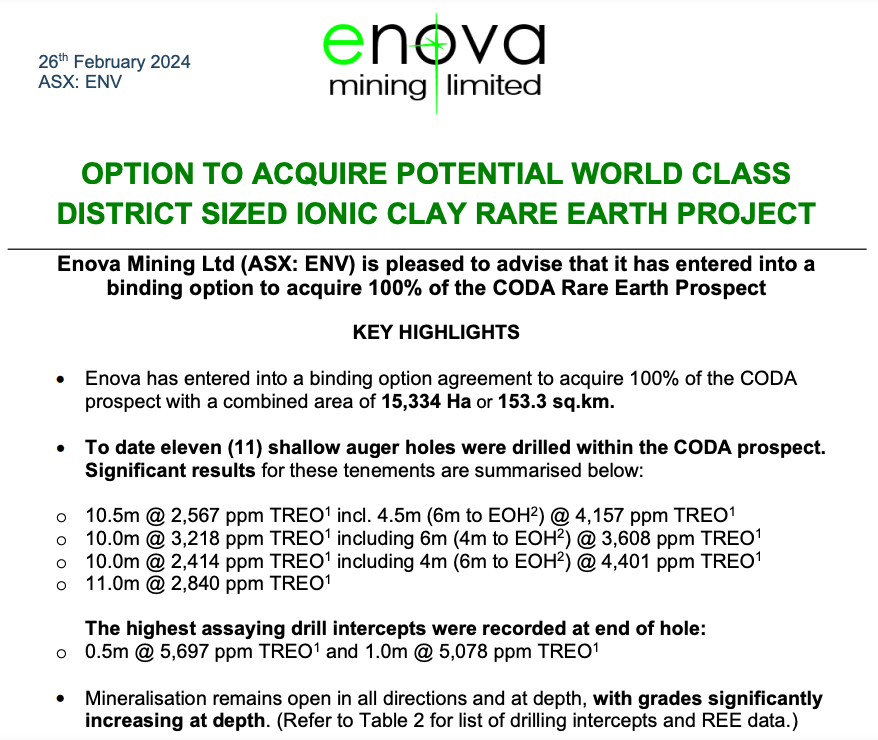

NT focused critical mineral explorer Enova Mining (ASX:ENV) has gone big in Brazil after screaming out of a trading halt for this happy REE announcement:

Enova says it’s entered into a binding option agreement with someone called Rodrigo de Brito Mello under which it’s been granted an option to acquire a 100% interest in the CODA tenements, providing Enova with exposure to prospective rare earth-enriched ionic absorption clay (IAC) exploration tenements situated “in the mining friendly state” of Minas Gerais, Brazil.

MD Eric Vesel says “highly impressive” exploration drilling results confirm the potential for REE-enriched IAC in two of the CODA tenements and likely continued success in the remaining tenement areas.

Vesel says the CODA tenements offer “an immediate walk-up drilling opportunity to commence an aggressive exploration campaign with a ready to mobilise on-ground team.”

The tenements are strategically located nearby to well-developed highways, infrastructure, water access, hydro-electric/wind power and proximity to regional centres.

Still soaring on Monday after winning attention as an Aussie AI prospect on Friday, is the cybersecurity minnow WhiteHawk (ASX:WHK).

This is what WHK says about WHK:

WhiteHawk is a cloud-based cyber security exchange platform that delivers Artificial Intelligence based Cyber Risk Profile’s, interactive online maturity models, tailored Cyber Risk Scorecard reports, matching to innovative products, solutions and best practices, all via an intuitive virtual consult.

The platform enables customers to leverage their tailored Security Story to find affordable and impactful cyber tools, non-technical context, and relevant services through our algorithms, online customer journey and accessible expertise.

And as the world is discovering, Germany has made pot legal.

The German Bundestag voted on Friday to legalise cannabis by removing it from the scary German Narcotics List from 1 April 2024.

This is easily the most significant legislative change in global cannabis markets since Canada legalised cannabis in 2018. Yeah. That’s already happened.

Basically this means the existing medical access pathway will be substantially improved through the removal of prescribed conditions, narcotic reporting, and pharmacy stockholding limitations; and the easing of the rules around telehealth services, e-scripts, and direct delivery to patients.

And Little Green Pharma (ASX:LGP) is up on Monday because the Aussie med cannabis producer is all over Germany and the new laws present LGP with a cracking opening, given its well-established partnerships with German distributors.

LGP also has a rather large bank of cannabis genetics, and ownership of the largest and most advanced EU GMP recognised medicinal cannabis facility in Europe strategically located just two hours from the German border.

Germany is the largest medicinal cannabis market in Europe and the law change instantly makes it the largest federally legal cannabis market globally, and is anticipated to result in an increase in the number of patients and consumers by multiples while catalysing similar changes across Europe.

LGP says “the change allows for the establishment of not-for-profit cannabis clubs, limited home cultivation and possession of personal use quantities.”

Here are the most-worst performing ASX small cap stocks for 23 February [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap BP8 BPH Global Ltd 0.001 -50% 55,900 $3,908,232 OSXDA Osteopore Limited 0.3 -38% 4 $4,957,396 NXD Nexted Group Limited 0.35 -33% 1,352,635 $116,296,306 CDX Cardiex Limited 0.084 -30% 1,743,560 $30,066,229 VIT Vitura Health Ltd 0.165 -27% 1,157,143 $129,571,602 ESR Estrella Res Ltd 0.003 -25% 21,049,211 $7,037,487 RML Resolution Minerals 0.003 -25% 1,163,240 $5,039,987 SFG Seafarms Group Ltd 0.003 -25% 15,665,353 $19,346,397 AUZ Australian Mines Ltd 0.017 -23% 26,120,269 $24,860,868 BSE Base Resources 0.11 -21% 4,934,702 $164,921,659 JAY Jayride Group 0.015 -21% 498,062 $4,489,873 CTN Catalina Resources 0.004 -20% 79,131 $6,192,434 EEL Enrg Elements Ltd 0.008 -20% 2,487,103 $10,099,650 PUA Peak Minerals Ltd 0.002 -20% 1,003,458 $2,603,442 SKN Skin Elements Ltd 0.004 -20% 821,000 $2,947,430 COB Cobalt Blue Ltd 0.15 -19% 3,434,471 $69,524,297 PPE Peoplein Limited 1.01 -19% 1,374,700 $128,617,224 PTR Petratherm Ltd 0.024 -17% 452,492 $6,517,783 EDU EDU Holdings Limited 0.1 -17% 59,570 $19,825,733 BPP Babylon Pump & Power 0.006 -14% 84,490 $17,496,843 FGL Frugl Group Limited 0.006 -14% 4,347,406 $7,291,817 MRC Mineral Commodities 0.024 -14% 13,736 $27,565,233 PRX Prodigy Gold NL 0.003 -14% 100,000 $6,128,877 VAL Valor Resources Ltd 0.003 -14% 1,210,000 $15,976,047 SHE Stonehorse Energy Lt 0.013 -13% 120,000 $10,266,526