ASX Small Caps Lunch Wrap: Is this new pizza the surest sign yet we are doomed as a species?

News

News

Local markets are marginally higher this morning and performing reasonably well.

Except for InfoTech, which is having a comparatively rough morning, tracking Wall Street’s Nasdaq lower after a mixed session overnight that saw market giant Apple lose even more value off the back of a second rating downgrade this week.

There’s obviously more than that happening, but first there’s news out of Italy that is going to be a little hard for some of you to digest.

Let’s face it – 2024 isn’t really off to a great start. There are two massive conflicts raging in disparate parts of the world, Japan has opened its new year with a deadly earthquake/plane crash combo and I’ve been locked in a pitched battle with my meth-head neighbour Kevin, who is accusing me of “stealing his Christmas tree” – the very same one that I watched him unceremoniously dump in my front yard on New Year’s Eve.

I confronted him at the time, and he patiently explained at a 1,000-mile-an-hour sustained bellow that it had become “a fire hazard”, before warning me that I might also be “a fire hazard” if anything happens to “his” tree.

So, it’s fairly safe to say that this year is trending fairly low – a civilisational slide that is set to continue as humanity takes another giant step towards self-obliteration, thanks to a fella called Gino Sorbillo, a pizzaiolo (pizza maestro) from Naples who has committed the country’s cardinal culinary sin.

He’s putting pineapple on pizza, and Italy is losing its mind.

Sorbillo has told global media empire CNN that he has concocted this abomination in an effort to “combat food prejudice”, which might have lost some meaning in translation, but even with the benefit of the doubt, is kitchen gibberish of the highest order.

Sorbillo’s oven-baked outrage is, according to CNN, “not your average Hawaiian” – which is obvious, because Hawaiians are, to the best of my knowledge, people.

“It is a pizza bianca, denuded of its tomato layer, sprinkled with no fewer than three types of cheese, with the pineapple cooked twice for a caramelised feel,” CNN says, cheerfully omitting to mention that it probably tastes like the crying soul of a recently-evicted sentient cartoon sponge, with cheese on top.

So, if you’re in Naples anytime soon and wish to contribute to the accelerating decline of the human race, stop by Sorbillo’s, where for the low, low price of 7 euros (roughly AUD$9,000) you can ruin your entire life.

I look forward to your angry, pineapple-flavoured emails.

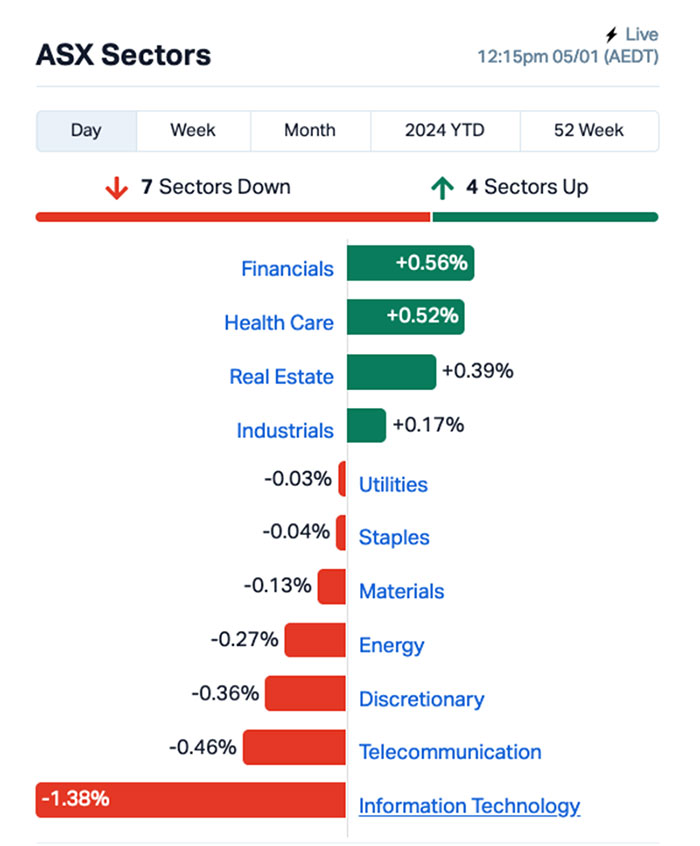

Local markets are up, but only just, this morning with the ASX 200 benchmark struggling to maintain its 0.12% gain, thanks to an ominously weighty InfoTech sector that is really dragging today.

It follows a similar looking landscape on Wall Street overnight – which I’ll get to in a moment – but the end result for the morning at this end of business is four sectors in the green, led by Financials and Health Care on about +0.50% apiece.

However, InfoTech has nosedived this morning, falling nearly 1.4% thanks to local tech bigwigs Wisetech and Xero shedding 2.2% and 2.4% respectively, and the bulk of rest of the sector just being a bit crap in general.

The Materials sector is taking on water slowly this morning as well, with the banner headline news from that sector coming via Core Lithium (ASX:CXO).

Core dropped a “strategic review” announcement on the market this morning, outlining that it is “strategically” mothballing its operation in the Northern Territory, because of how badly the price of lithium has tanked over the course of the past year. Strategically.

For those of you who haven’t been keeping an eye on it, you’ll no doubt be shocked to learn that spodumene concentrate – once the absolute commodity market darling – has slumped more than 85% since the start of 2023, including a 50% freefall since the end of October.

Investors have taken Core’s strategic decision as something of a bad sign, and stormed the exits, leaving the company down more than 9.5% so far today.

The action on Wall Street was a tad mercurial overnight, leaving the S&P 500 down 0.34%, and the tech-heavy Nasdaq down even further, shedding 0.56% thanks in no small part to Apple, which fell for the fourth straight session.

Last night’s fall has been blamed on a rating downgrade by Piper Sandler, which let about 1.4% of the air out of Apple’s tyres and pushed its price down to $US181.60 a pop – mainly because of rumblings that demand for Apple’s iPhone might be wavering.

There’s also the fact that Apple isn’t allowed to sell its iWatch in the US because of a patent dispute, and the common knowledge that the company insists on selling slightly-above-average laptops at massively-above-average prices.

The Nasdaq’s slide overnight takes its losses since December 28 to more than 500 points, which is causing no end of consternation for CNBC’s in-house Screaming Stock Skeleton, Jim Cramer, who responded by tweeting out a short video of his best tech stock analyst hard at work behind the scenes.

Mag 7 action pic.twitter.com/aG99wpvOoJ

— Jim Cramer (@jimcramer) January 4, 2024

In other US stock news, Exxonmobil dropped -1%, tracking oil declines following a reported dive in gasoline demand via the latest EIA report.

And the yield on the US 10-year Treasury note was 9 basis points higher to 3.99%, with New York following suggestions of strength in the labour market, as reported by Earlybird Eddy’s current stunt-double, Christian “Chedward” Edwards this morning.

In Asian market news, Japan is making headway in tough times today, with the Nikkei up 0.39% so far on news that Tokyo’s famous 400-year-old Kanda Myojin Shinto shrine has finally taken a step into the enlightened robotic era.

At the end of December, the temple holds its annual Susuosame Ceremony – a traditional “spring cleaning” of soot, that signifies a fresh start for the new year ahead, and an easing of hayfever and asthma symptoms among both the priests and the miko (shrine maidens).

But the most recent Susuosame featured a little help from some small robotic pals, as a pack of wild Roombas took over some of the cleaning duties, because “Japan”.

The next step is to tie sticks to the top of the Roombas and start building an unstoppable army of high-tech warrior priests – but that’s likely to be at least 5-6 years away, so there’s no need to panic just yet.

In China, things are a little mixed as well – Shanghai markets are up 0.19% but Hong Kong’s Hang Seng is down 0.42%, much to everyone’s disappointment.

Here are the best performing ASX small cap stocks for 05 January [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap CE1 Calima Energy 0.1075 65% 17,109,276 $40,671,850 M4M Macro Metals Limited 0.003 50% 1,000,000 $4,934,156 AUH Austchina Holdings 0.004 33% 115,523 $6,233,651 PXX Polarx Limited 0.009 29% 1,811,555 $11,477,317 RCR Rincon 0.043 26% 12,269,782 $6,040,538 BBT Bluebet Holdings Ltd 0.245 26% 719,649 $39,214,262 AMN Agrimin Ltd 0.25 25% 249,483 $61,937,164 BDG Black Dragon Gold 0.045 25% 300,082 $7,224,122 HCD Hydrocarbon Dynamic 0.005 25% 100,000 $3,078,664 SI6 SI6 Metals Limited 0.005 25% 2,931,122 $7,975,438 KZR Kalamazoo Resources 0.135 23% 287,751 $18,850,642 LPE Locality Planning 0.042 20% 213,000 $6,307,154 LYN Lycaon Resources 0.19 19% 170,875 $7,049,000 IPT Impact Minerals 0.013 18% 5,381,339 $31,511,743 PUA Peak Minerals Ltd 0.0035 17% 100,000 $3,124,130 RC1 Redcastle Resources 0.014 17% 150,540 $3,939,410 ENV Enova Mining Limited 0.022 16% 20,711,519 $12,177,657 DYM Dynamic Metals 0.19 15% 10,057 $5,775,000 BM8 Battery Age Minerals 0.23 15% 338,425 $17,827,378 NPM Newpeak Metals 0.023 15% 108,303 $1,999,035 AW1 American West Metals 0.155 15% 1,071,664 $58,925,557 RAS Ragusa Minerals Ltd 0.04 14% 61,833 $4,990,958 TOU Tlou Energy Ltd 0.033 14% 115,018 $30,275,488 MTM MTM Critical Metals 0.125 14% 24,027,044 $10,938,079 SRX Sierra Rutile 0.1475 13% 1,954,538 $55,150,738

The morning’s big winner is Calima Energy (ASX:CE1), which has popped a very healthy 61.5% gain this morning on news that it has executed definitive agreements for the sale of of 100% of its wholly-owned Canadian subsidiary Blackspur Oil Corp to Astara Energy, for the princely sum of C$75 million – roughly 83.3 million of our puny Australian dollarydoos.

Which is, of course, big news – but the major reason why Calima’s gone absolutely gangbusters this morning is this little nugget in the announcement:

“It is the Company’s objective to distribute no less than 85% of the funds received from the Blackspur Sale to Calima shareholders in the most tax effective form and the Company will seek an ATO ruling on this matter in a timely fashion.”

Calima is currently trading at $0.105, which comes with a free hit at a slice of just under $71 million, depending on how the ATO decides to rule on the offer.

International bookie Michael Sullivan’s Bluebet (ASX:BBT) is up more than 25% this morning, after releasing a boilerplate non-denial of media speculation about a possible merger between it and rival Matt Tripp’s BetR.

“BlueBet is regularly involved in discussions with third parties regarding strategic initiatives, including Betr, aimed at maximising value for its shareholders,” the company said.

So that’s a very firm “possibly”, which was enough to get the more punt-friendly investors away from the pokies for a few minutes this morning.

And MTM Critical Metals (ASX:MTM) is still making the most of its recent news about rare earth element (REE) and niobium (Nb) mineralisation over broad intervals in previously untested parts of the Pomme carbonatite complex – the same news that saw the company shed 27% to $0.07 the day it dropped has since seen the company’s price climb 85.7% to $0.13.

What a time to be alive.

Here are the most-worst performing ASX small cap stocks for 05 January [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap LNU Linius Tech Limited 0.002 -33% 5,000 $14,817,722 JAV Javelin Minerals Ltd 0.0015 -25% 35,000 $2,176,231 NWF Newfield Resources 0.13 -21% 79,713 $149,031,700 NTM NT Minerals Limited 0.008 -20% 453,465 $8,599,029 MDX Mindax Limited 0.051 -18% 5,000 $126,824,644 AL8 Alderan Resource Ltd 0.005 -17% 2,193,627 $6,641,168 AMD Arrow Minerals 0.005 -17% 3,518,805 $20,842,591 IS3 I Synergy Group Ltd 0.005 -17% 11,764 $1,824,482 RDS Redstone Resources 0.005 -17% 121,500 $5,528,271 PAM Pan Asia Metals 0.18 -16% 240,055 $36,080,607 LRD Lord Resources 0.055 -15% 826,359 $2,413,588 WWG Wise Way Group 0.042 -14% 191,676 $8,197,400 PRX Prodigy Gold NL 0.006 -14% 50,000 $12,257,755 VML Vital Metals Limited 0.006 -14% 1,384,266 $41,265,469 OCN Oceana Lithium 0.1 -13% 415,895 $6,103,798 EMT Emetals Limited 0.007 -13% 4,300 $6,800,000 DTZ Dotz Nano Ltd 0.145 -12% 145,406 $84,791,005 RNO Rhinomed Ltd 0.03 -12% 33,954 $9,714,470 GRL Godolphin Resources 0.04 -11% 5,000 $7,615,891 AUR Auris Minerals Ltd 0.008 -11% 446,332 $4,289,634 PUR Pursuit Minerals 0.008 -11% 632,500 $26,495,743 TX3 Trinex Minerals Ltd 0.008 -11% 816,000 $13,383,222 IXU IXUP Limited 0.033 -11% 161,290 $40,238,817 ATH Alterity Therapeutics 0.0045 -10% 23,304,635 $14,011,802 BMG BMG Resources Ltd 0.009 -10% 7,700 $6,337,972