ASX Small Caps Lunch Wrap: Did everyone get the memo that we’re not to kiss the turtles today?

News

News

Local markets are flat this morning, as in 0.00% flat… or is that 100% flat?

Could be both, really, depending on whether you’re a “glass half full” person, or more of a “I ordered a martini, and this is clearly urine” type.

That’s not to say that things haven’t been happening this morning (because, spoiler alert, they have), but before I get into all the smoking hot ASX action that’s led us absolutely nowhere today, there’s news from America that needs reporting.

The US Centres for Disease Control and Prevention (aka the CDA) has put out an urgent alert in the wake of an outbreak of salmonella, a potentially deadly bacteria that causes fever, stomach cramps and horrifying diarrhoea, which can potentially spread within the body, get into your spinal fluid, resulting in horrifying diarrhoea of the brain.

Eleven US states have reported cases of salmonella, with the bulk of the infections traced back to small turtles, which are popular pets in America for some reason.

“Pet turtles of any size can carry Salmonella germs in their droppings even if they look healthy and clean,” the CDC said, clearly in denial about the fact that there has never been a blurt of turtle poo that looks “clean”. For real… that gear is rancid at best.

“These germs can easily spread to their bodies, tank water, and anything in the area where they live and roam,” the CDC continued, undeterred.

“You can get sick from touching a turtle or anything in its environment and then touching your mouth or food with unwashed hands and swallowing Salmonella germs,” the warning continued.

The best way to avoid the issue, the CDC says, is “Don’t kiss or snuggle your turtle, and don’t eat or drink around it.”

This latest slab of egregious overreach from the gubbermint-run CDC has been met with utter outrage from the turtle lobby, as well as profound shock from people who identify as “turtle lovers” across the country.

This young man who, judging by his pale appearance and sunken eyes, hasn’t been able to sleep for days since the announcement had this to say.

But perhaps the most telling response indicating the level of absolute outrage the CDC has caused with its blatantly anti-turtle propaganda comes from Kentucky Senator Mitch McConnell, who held the world record as the World’s Tallest Turtle for more than 30 years before entering public service.

At a press conference overnight, when asked if he would run for re-election in 2026, McConnell – who famously sailed aboard The Beagle with prominent anti-God activist Charles Darwin as a young reptile – clearly felt the full weight of his species’ struggle.

Mitch McConnell freezes again during a press conference.

— Pop Base (@PopBase) August 30, 2023

McConnell was apparently struck mute, incandescent with rage that “his people” were being unfairly targeted by a Biden Democrat Administration whose loathing for all turtlekind is perhaps the darkest secret of the American political world.

We’ll keep you posted if there are any further developments on this story, but in the meantime if you do happen to run into Senator McConnell, for the love of all that’s holy don’t kiss him.

After two hours of hard graft this morning, the ASX 200 benchmark is flat.

Not up or down a few .01s of a per cent, but 100% bang-on flat as flat could be, with the index showing 0.00%.

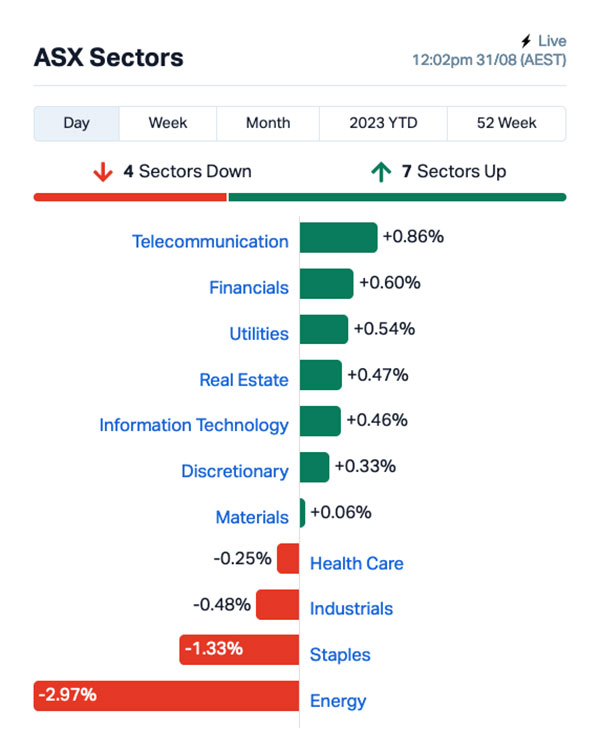

The sectors are mostly unremarkable today, with the exception of the Energy sector, which is the subject of a concerted sell-off this morning and showing an indecent -2.97% loss, probably because the The Australian Energy Market Operator (AEMO) has released its 2023 Electricity Statement of Opportunities (ESOO) report, a 10-year reliability outlook that signals development needs for each state in the National Electricity Market.

I’ll save you the bother of wading through it all – it basically says this:

“In the next 10 years, electricity consumption and peak demand are predicted to grow due to population growth and economic activity, but also the electrification (fuel switching) across all sectors of the economy, including transportation and residential heating and cooking.”

And this: “Over the 10-year outlook, we continue to forecast reliability gaps, which are mostly due to the expectation that 62% of today’s coal fleet will retire by 2033.”

Whitehaven Coal (ASX:WHC) dropped more than 9.0%, Woodside (ASX:WDS) fell more than 4.0%, New Hope (ASX:NHC) shed more than 2.2% and pretty much the entire sector now looks like the switch from coal to “burning dumpsters” might be happening sooner than the energy market expected.

While that’s all happening, several Australian states – particularly South Australia and Victoria – are on notice that when this coming summer starts to heat up, there’s a solid chance there won’t be enough power to go round.

Also up the rich end of town, Qantas (ASX:QAN) is in trouble again, this time thanks to a lawsuit from the ACCC alleging that the airline has been sprung selling tickets to flights that had already been cancelled.

That comes on the heels of outgoing Qantas CEO Alan Joyce’s comically poor appearance before the Senate Select Committee on Cost of Living on Monday, where he was given quite the send-off by the senators involved.

I have neither the time nor the inclination to rehash everything Qantas is carrying in terms of the Bad PR burden it’s been lumbered with, but I will extend something of a gesture of goodwill – a free marketing slogan that should help get the Flying Kangaroo back on its feet.

“QANTAS: Proudly taking Australian taxpayers for a ride, since 1920”.

Or they can have “QANTAS: Surely none of this is illegal… right?” for free as well.

US stocks closed modestly higher in New York overnight for a fourth-straight day of gains, with the S&P 500 up +0.38%, blue chips Dow Jones up by +0.11%, and the tech-heavy Nasdaq climbing +0.54% over the course of the session.

Earlybird Eddy reported this morning that Wall Street reacted to some weak data releases, including US GDP data which showed the economy grew 2.1% in Q2 compared with an official estimate of 2.4%.

Meanwhile the ADP payroll employment rose by 177,000 in August, vs survey of +195,000 – another data point that proves the US economy is slowing.

“Weaker data makes possible a scenario where additional interest rate hikes will be limited or perhaps even nonexistent,” said Daniel Jones of Crude Value Insights.

In US stock news, Apple and Nvidia led the gains in megacaps, rising by 1-2% each, after Apple announced that it was testing the use of 3D printers to produce the steel chassis used to make some of its upcoming smartwatches, potentially putting tens of thousands of tiny little blacksmiths out a job.

Visa and Mastercard rose on plans to increase the fees that merchants pay when accepting customers’ credit and debit cards, which is a polite way of telling us all that everything’s about to get more expensive for consumers, and the minimum spend at your local convenience store will be increased to $42,000 per transaction.

In Japan, the Nikkei is up 0.51% in early trade, as the furore developing over the release of “100% totally safe, no doubt about it” radioactive waste water into the ocean has taken another turn.

In the wake of China’s decision to ban Japanese seafood – and a sustained campaign of *checks notes* crank phone calls – Japanese officials were essentially forced into taking decisive action.

By that, I mean Japanese Prime Minister Fumio Kishida and three of his Cabinet ministers did a spot of political stunting, sitting down to a meal of locally-sourced fish to prove that it’s safe to consume, by eating it himself.

I have managed to get my hands on some footage from the press conference, which was apparently held at the home of a local buffoon.

In response, China allowed its factory activity to shrink for a fifth straight month, probably because the nation’s factory workers have been redeployed to massive call centres for the Japanese harassment campaign.

But also because China’s economy is in deep, deep trouble. Mustn’t forget that part.

Shanghai markets are, predictably, down as a result, falling 0.21% while in Hong Kong, the Hang Seng is up a relatively slim 0.47%.

Here are the best performing ASX small cap stocks for 02 August [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap HLA Healthia Limited 1.74 78% 1,609,497 $136,687,178 CLE Cyclone Metals 0.0015 50% 772,986 $10,264,505 LNU Linius Tech Limited 0.003 50% 125,352 $8,459,581 TD1 Tali Digital Limited 0.0015 50% 591,654 $3,295,156 DRE Dreadnought Resources Ltd 0.058 41% 83,090,695 $137,135,907 AD1 AD1 Holdings Limited 0.009 29% 100,000 $5,757,983 BFC Beston Global Ltd 0.01 25% 10,822,434 $15,976,375 ICN Icon Energy Limited 0.005 25% 2,000,000 $3,072,055 OLI Oliver'S Real Food 0.02 25% 271,331 $7,051,711 RML Resolution Minerals 0.005 25% 1,500,000 $5,029,167 NOU Noumi Limited 0.18 24% 763,236 $40,180,851 RNX Renegade Exploration 0.011 22% 3,490,263 $8,578,114 29M 29Metals 0.88 20% 5,797,476 $352,522,346 JYC Joyce Corporation 3.15 20% 35,557 $74,417,477 APC Aust Potash Ltd 0.006 20% 1,779,445 $5,193,447 TKL Traka Resources 0.006 20% 1,018,880 $4,356,646 EOF Ecofibre Limited 0.2 18% 480,755 $59,366,474 CDX Cardiex Limited 0.17 17% 89,916 $20,834,111 NMR Native Mineral Res 0.0515 17% 546,772 $7,406,459 WSP Whispir Limited 0.42 17% 184,355 $42,550,427 WYX Western Yilgarn NL 0.175 17% 211,266 $7,448,626 AQD Ausquest Limited 0.014 17% 91,407 $9,901,791 IEC Intra Energy Corp 0.007 17% 2,300,000 $9,724,690 PRX Prodigy Gold NL 0.007 17% 228,428 $10,506,647 TMX Terrain Minerals 0.007 17% 50,194 $6,499,196

In top spot among Small Caps this morning, Healthia (ASX:HLA) has piled on a spectacular 78.5% gain, on news that it has entered into a Scheme Implementation Deed with Harold BidCo, an entity owned by funds advised by Pacific Equity Partners, to acquire 100% of the fully diluted share capital in Healthia by way of a scheme of arrangement.

Harold BidCo says its prepared to stump up either $1.80 cash per Healthia share, unlisted scrip consideration or a combination of cash and unlisted scrip consideration for every shareholder, representing a whopping premium of 84.6% to the last closing price of $0.975 per share and 72.8% to the 3-month volume weighted average price up to and including 30 August 2023.

At the time of writing, HLA’s price has been hovering around the $1.74 mark for a while, and the proposed deal is subject to shareholder approval, and reliant on no better offer turning up in the short term.

In second place, Dreadnought Resources (ASX:DRE) has popped up outta nowhere before lunch to pile on more than 41%, after telling the market this morning that it’s bitten into massive and disseminated Ni-Cu sulphides at the Bookathanna North prospect.

The intercept announced today comes from the 45km long Money Intrusion part of the Mangaroon Ni-Cu-PGE Project, located in the Gascoyne Region of Western Australia, where Dreadnought is in an earn-in agreement with its partner on the project, First Quantum Minerals.

On-site inspection shows ~14m of Ni-Cu sulphide mineralisation from 37m, including 2m of massive sulphides and 12m of disseminated sulphides. The sample’s been sent for assays, and further drilling at the site is set to take place.

Noumi (ASX:NOU) – formerly Freedom Foods Group – is up nearly 21% this morning on no particular news, and Joyce Corporation (ASX:JYC) has delivered a more than 20% gain this morning after the homewares and bedding and other stuff company banked a solid earnings report.

Joyce says it’s boosted revenue 12% to $144.7 million, driving a group NPAT of $17.7 million and is set to deliver a final divvy of $0.175 per share. Neato.

Here are the most-worst performing ASX small cap stocks for 31 August [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap AVW Avira Resources Ltd 0.001 -33% 10 3,200,685 KEY KEY Petroleum 0.001 -33% 350,000 2,951,892 PEN Peninsula Energy Ltd 0.088 -27% 43,293,431 150,846,000 MYX Mayne Pharma Ltd 3.75 -21% 420,275 404,102,868 LEG Legend Mining 0.03 -21% 6,511,757 110,256,133 NSM Northstaw 0.048 -20% 79,900 7,207,620 BTE Botala Energyltd 0.1 -20% 130,000 6,664,583 RNO Rhinomed Ltd 0.06 -20% 307,811 21,428,977 OPN Oppen Negotiation 0.008 -20% 625,000 11,166,796 TML Timah Resources Ltd 0.032 -20% 89,903 3,550,390 GMN Gold Mountain Ltd 0.007 -18% 35,305,958 19,287,168 RCL Readcloud 0.05 -17% 86,976 7,310,237 MXC MGC Pharmaceuticals 0.0025 -17% 18,888,199 11,677,079 CGO CPT Global Limited 0.18 -16% 168,525 9,007,933 NXS Next Science Limited 0.545 -16% 602,122 139,613,587 REM Remsense Technologies 0.061 -15% 637,204 3,600,398 4DS 4Ds Memory Limited 0.14 -15% 40,767,345 276,605,306 ENV Enova Mining Limited 0.006 -14% 336,005 2,736,505 NES Nelson Resources 0.006 -14% 2,058,872 4,295,160 SKN Skin Elements Ltd 0.006 -14% 205,781 3,986,403 YPB YPB Group Ltd 0.003 -14% 20,000 2,602,115 LNR Lanthanein Resources 0.013 -13% 39,600,167 16,823,634 14D 1414 Degrees Limited 0.033 -13% 171,651 9,050,404 SOR Strategic Elements 0.08 -13% 2,150,411 41,117,876 AOA Ausmon Resorces 0.0035 -13% 57,000 3,877,157